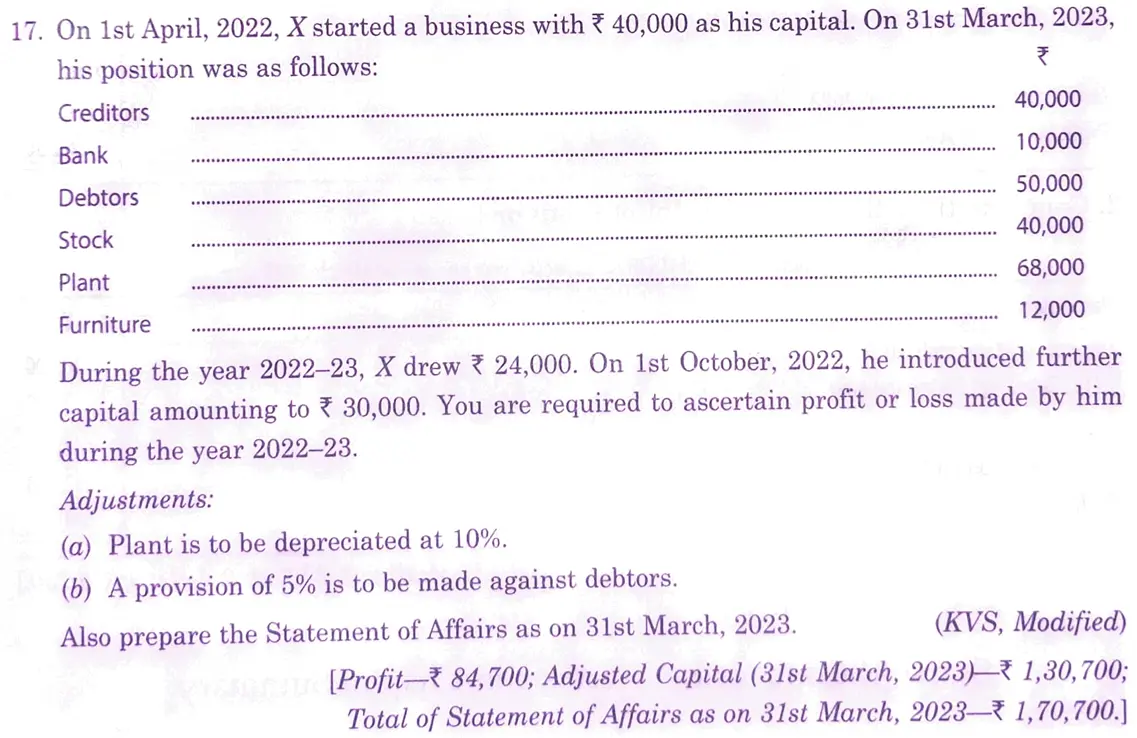

On 1st April, 2022, X started a business with ₹ 40,000 as his capital. On 31st March, 2023, his position was as follows:

On 1st April, 2022, X started a business with ₹ 40,000 as his capital. On 31st March, 2023, his position was as follows:

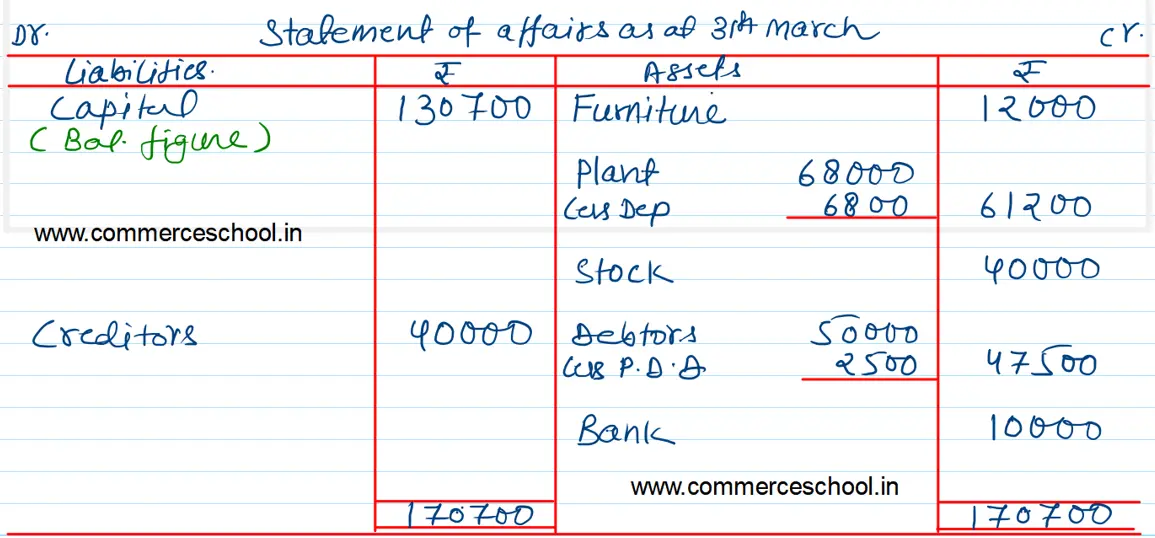

| Creditors | 40,000 |

| Bank | 10,000 |

| Debtors | 50,000 |

| Stock | 40,000 |

| Plant | 68,000 |

| Furniture | 12,000 |

During the year 2022-23, X drew ₹ 24,000. On 1st october, 2022, he introduced further capital amounting to ₹ 30,000. You are required to ascertain profit or loss made by him during the year 2022-23.

Adjustments:

(a) Plant is to be depreciated at 10%.

(b) A provision of 5% is to be made against debtors.

Also prepare the Statement of Affairs as on 31st March, 2023.

[Profit – ₹ 84,700; Adjusted Capital (31st March 2023) – ₹ 1,30,700; Total of Statement of Affairs as on 31st March, 2023 – ₹ 1,70,700.]

Anurag Pathak Changed status to publish