On 1st January, 2020, A Ltd. Purchased a machine for ₹ 2,40,000 and spent ₹ 10,000 on its erection. On 1st July, 2020 an additional machinery costing ₹ 1,00,000 was purchased

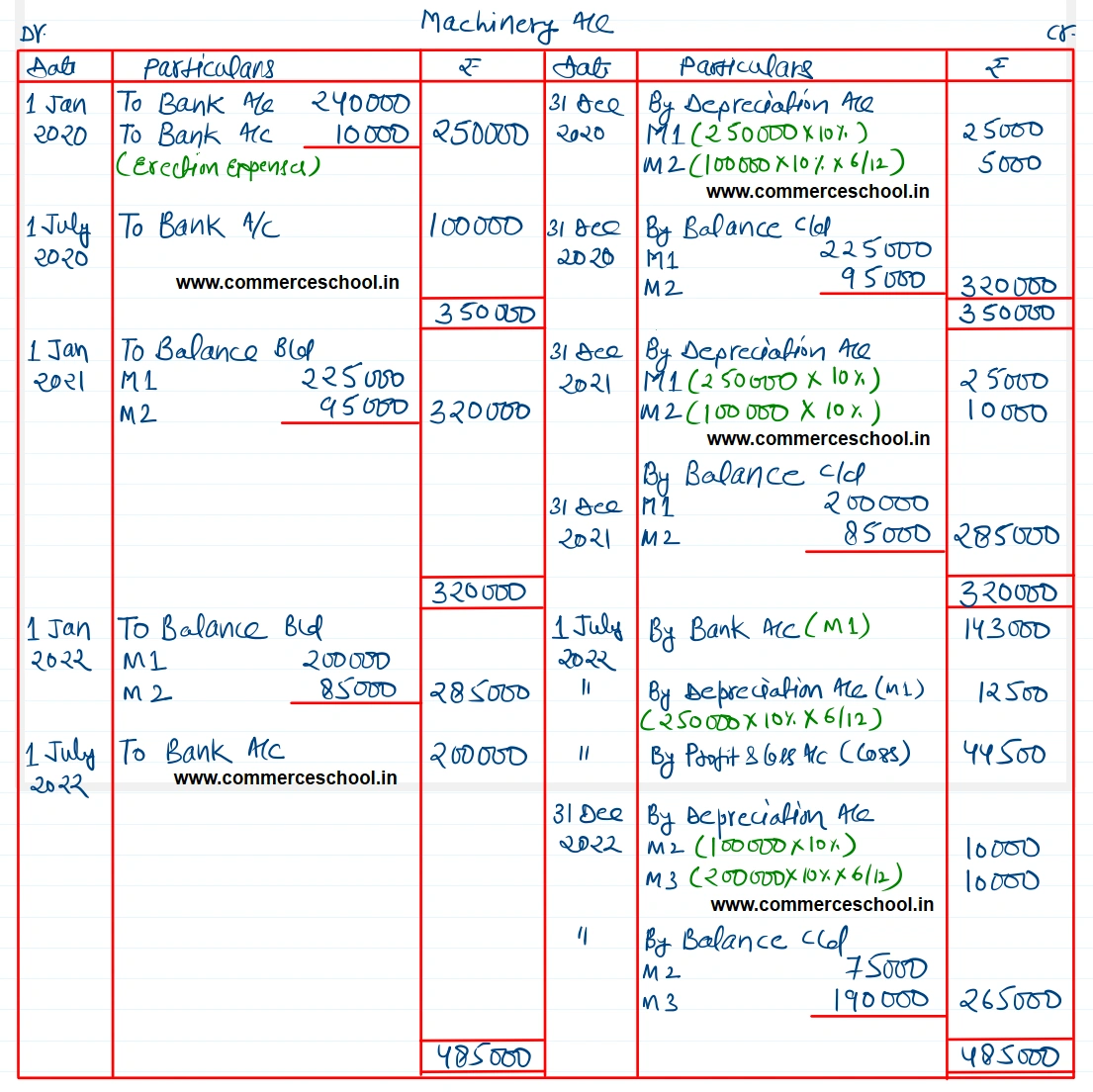

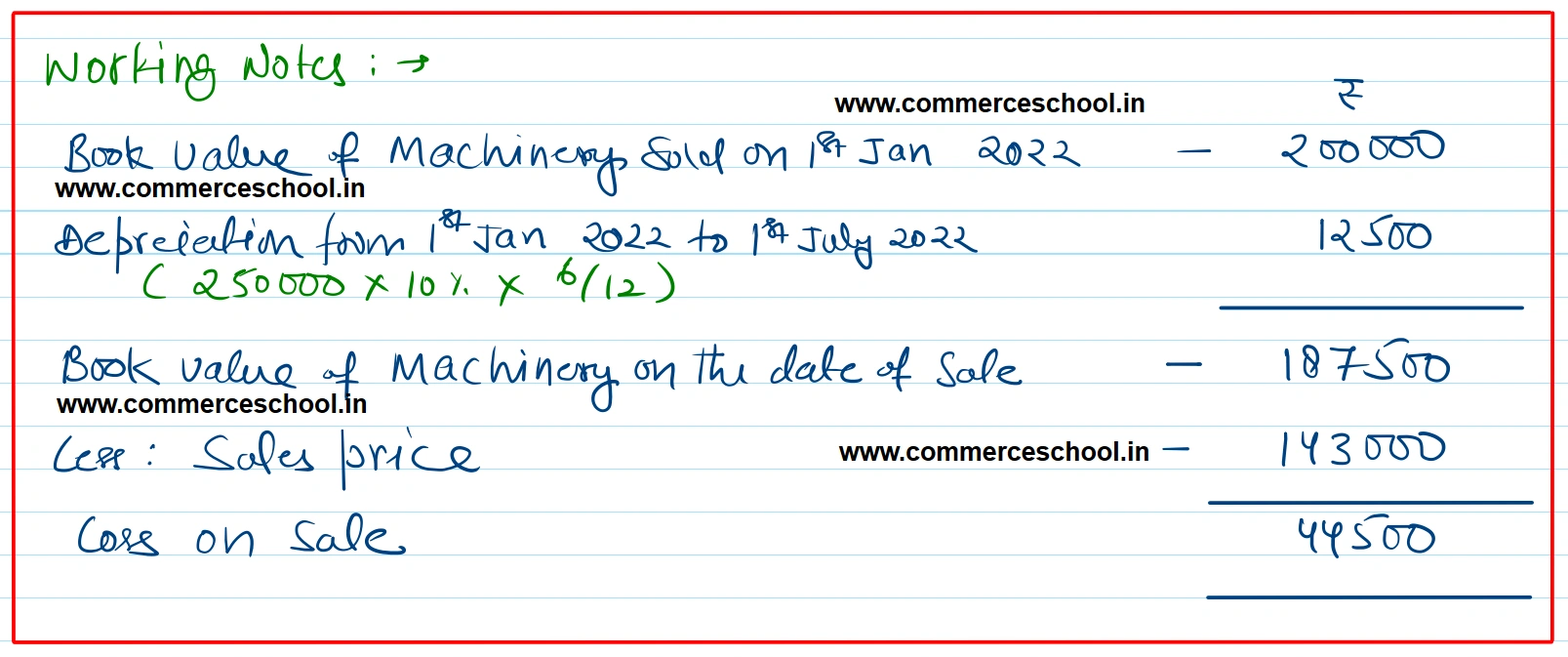

On 1st January, 2020, A Ltd. Purchased a machine for ₹ 2,40,000 and spent ₹ 10,000 on its erection. On 1st July, 2020 an additional machinery costing ₹ 1,00,000 was purchased. On 1st July, 2022 the machine purchased on 1st January, 2020 was sold for ₹ 1,43,000 and on the same date, a new machine was purchased at a cost of ₹ 2,00,000.

Show the Machinery Account for the first three calendar years after charging depreciation at 10% p.a. by the Straight Line Method.

[Ans. Loss on Sale of Machinery ₹ 44,500; Balance of Machinery Account ₹ 2,65,000.]

Anurag Pathak Answered question