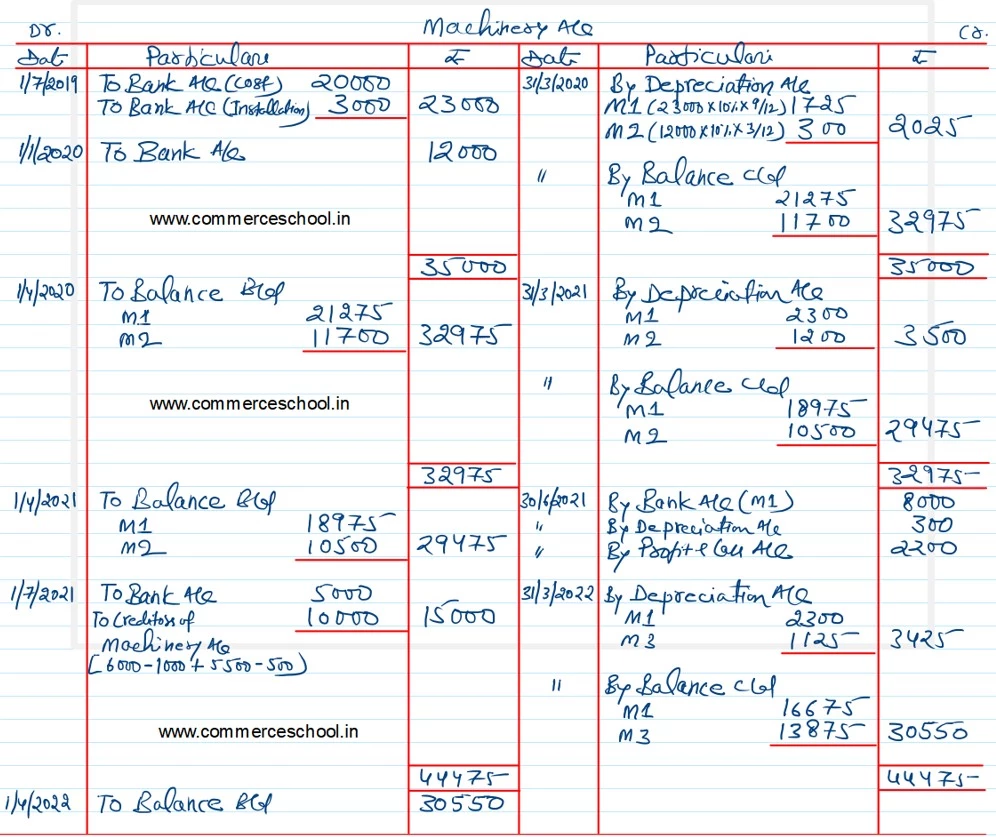

On 1st July, 2019, OM Ltd. purchases second-hand machinery for ₹ 20,000 and spends ₹ 3,000 on reconditioning and installing it. On 1st January 2020, the firm purchases new machinery worth ₹ 12,000.

On 1st July, 2019, OM Ltd. purchases second-hand machinery for ₹ 20,000 and spends ₹ 3,000 on reconditioning and installing it. On 1st January 2020, the firm purchases new machinery worth ₹ 12,000. On 30th June 2021, the machinery purchased on 1st January 2020, was sold for ₹ 8,000 and on 1st July, 2021, a fresh plant was installed.

Payments for this plant was to be made as follows:

Payments in 2022 and 2023 include interest of ₹ 1,000 and ₹ 500 respectively.

The company writes off 10% p.a. on the original cost. The accounts are closed every year on 31st March. Show the Machinery Account for the year ended 31st March, 2022.

[Balance in Machinery A/c – ₹ 30,550.]

| 1st July, 2021 | ₹ 5,000 |

| 30th June, 2022 | ₹ 6,000 |

| 30th June, 2023 | ₹ 5,500 |

Anurag Pathak Changed status to publish