On 1st June, 2017, Kedarnath Ltd. purchased a machinery for ₹ 27,00,000. Depreciation is provided @ 10% p.a. on diminishing balance method and the books are closed on 31st March each year

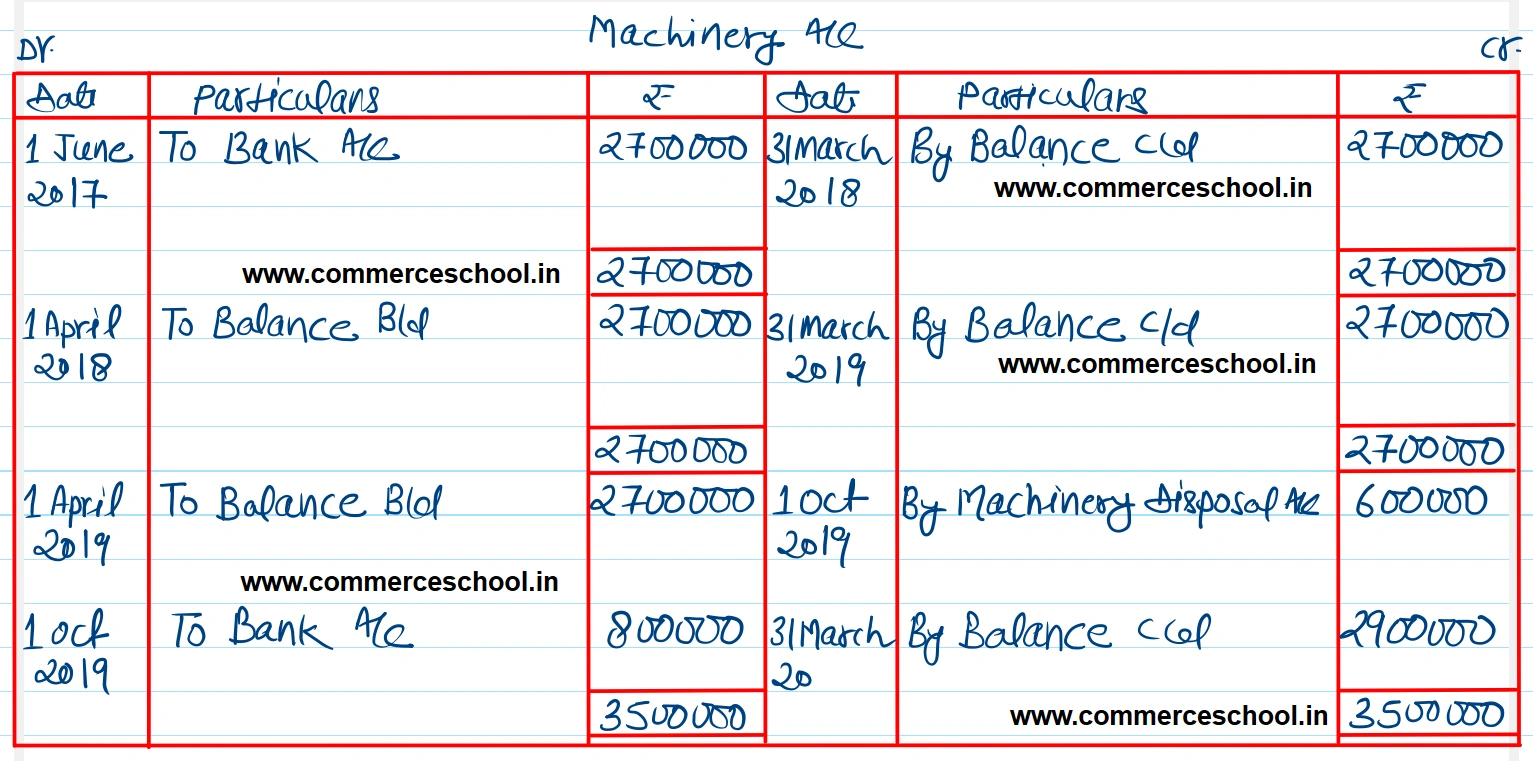

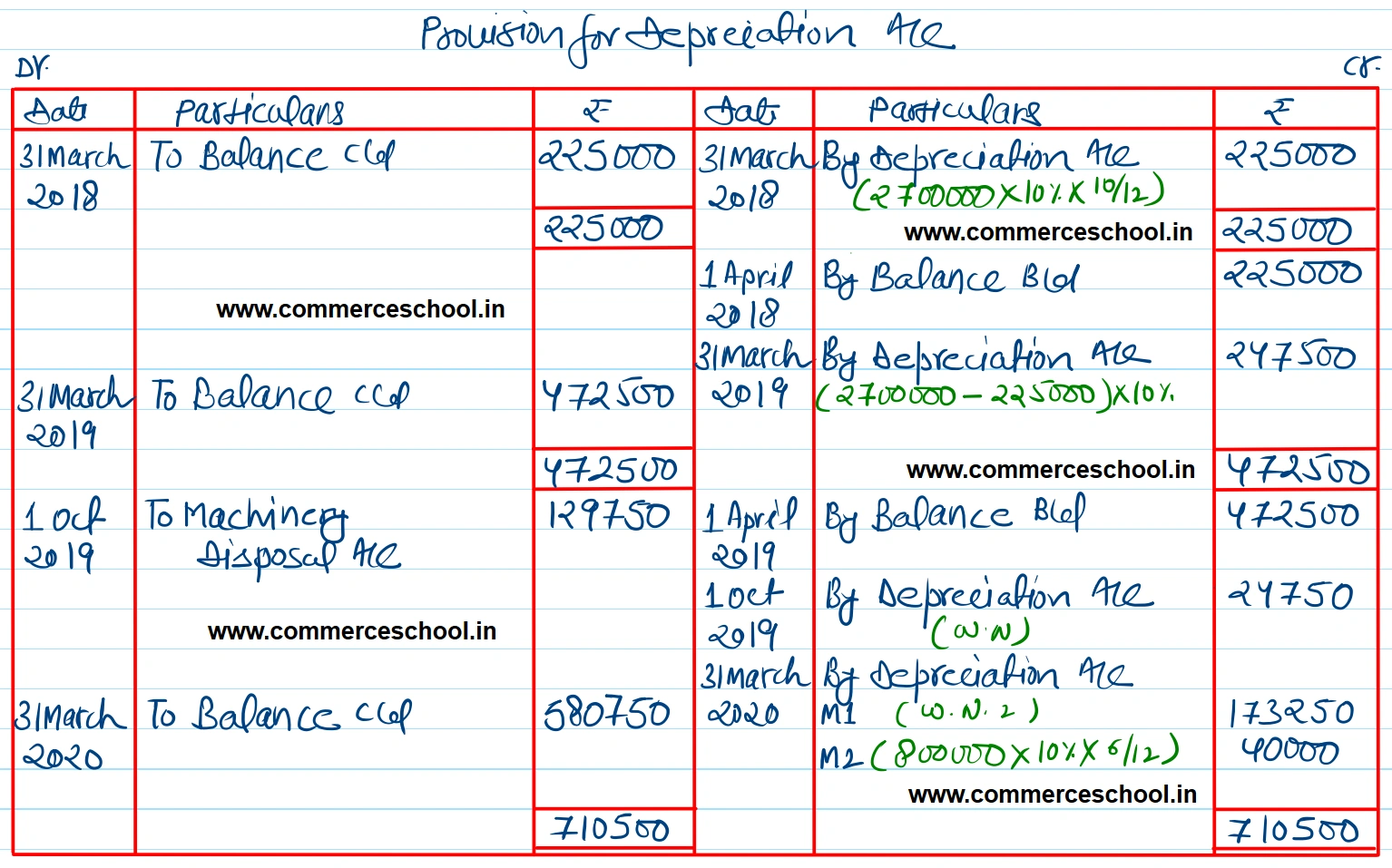

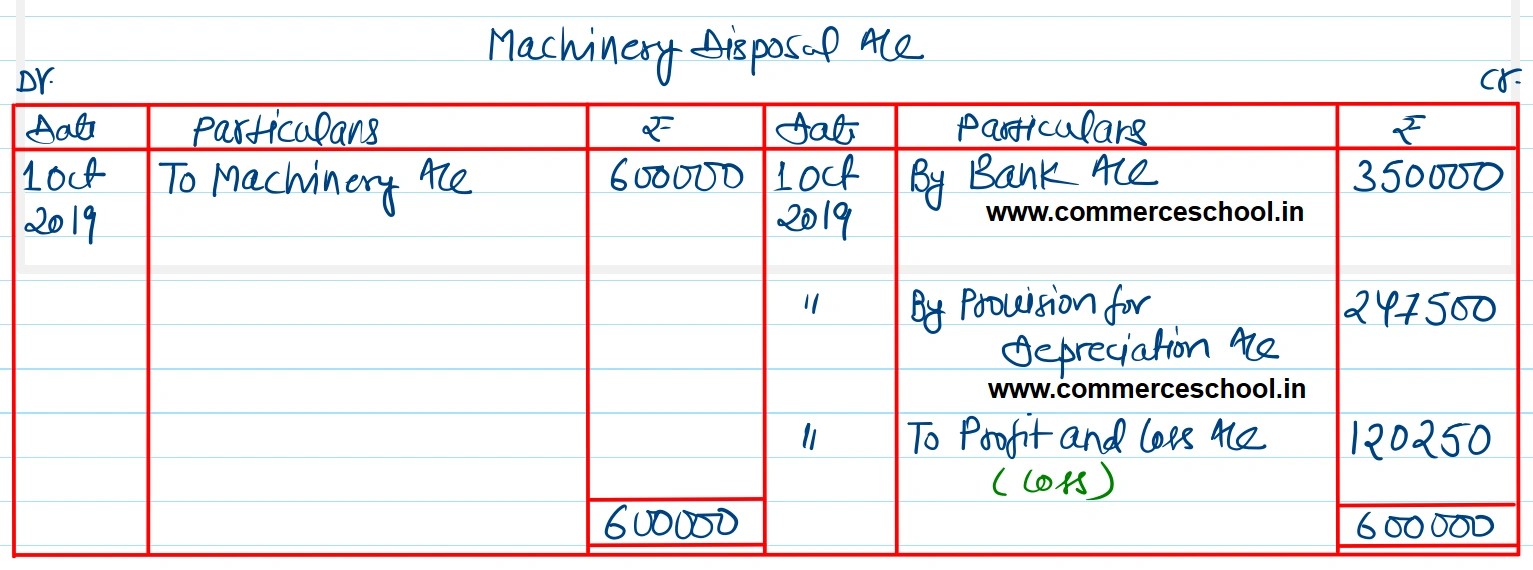

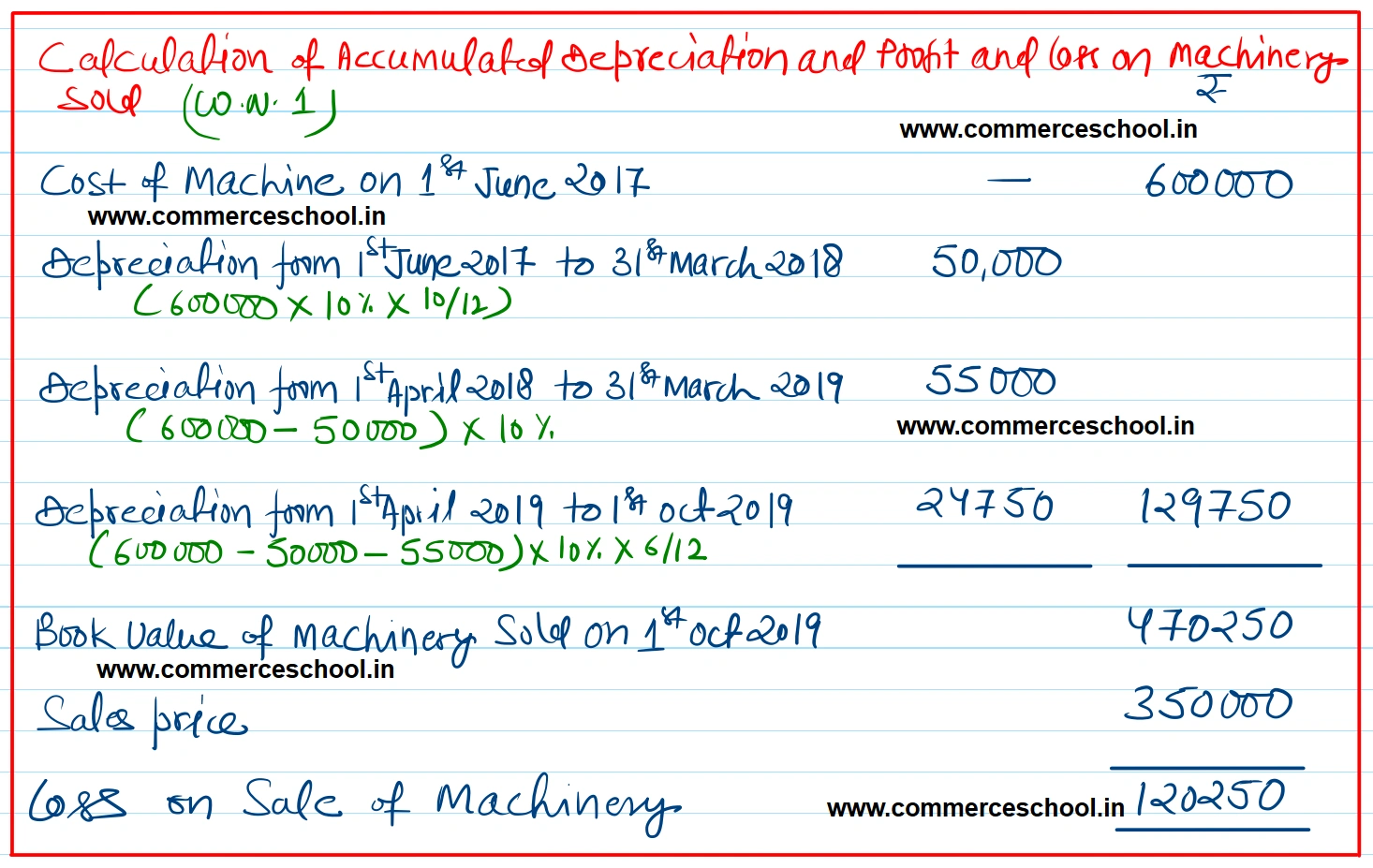

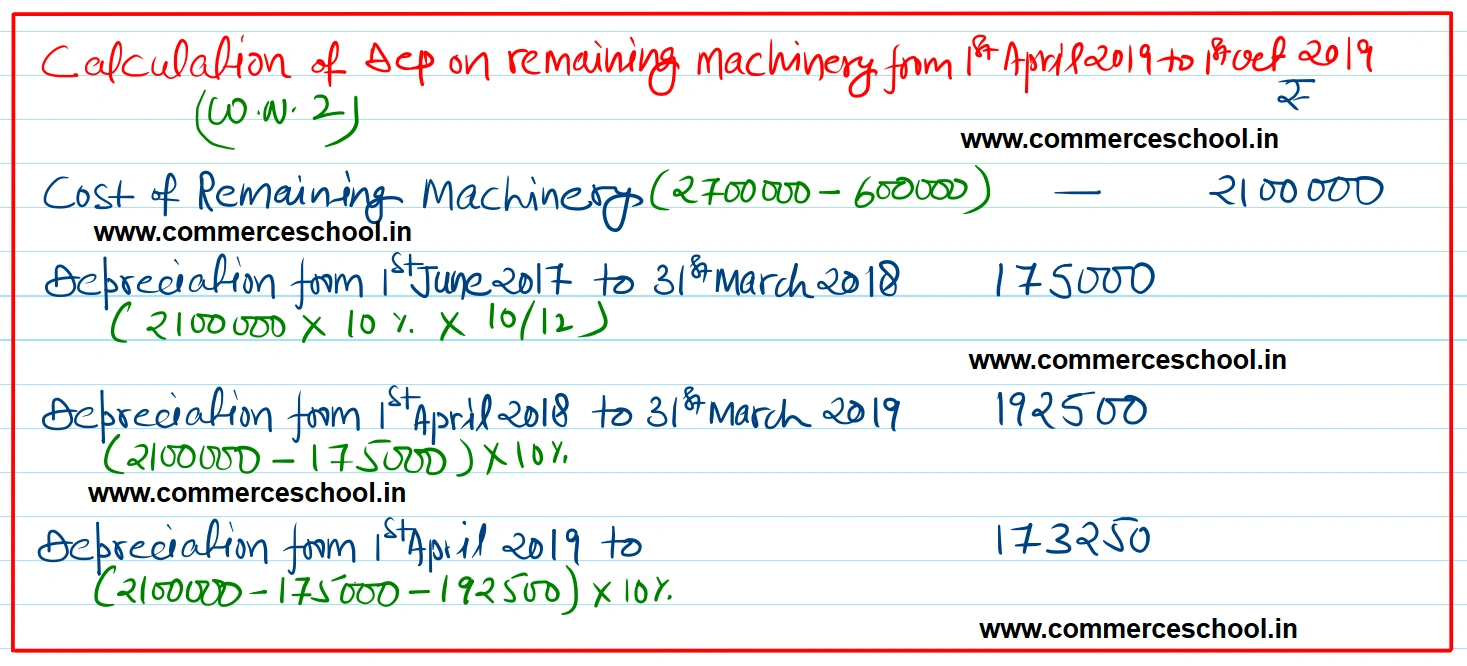

On 1st June, 2017, Kedarnath Ltd. purchased a machinery for ₹ 27,00,000. Depreciation is provided @ 10% p.a. on diminishing balance method and the books are closed on 31st March each year. On 1st October, 2019, a part of the machinery purchased on 1st June, 2017 for ₹ 6,00,000 was sold for ₹ 3,50,000 and on the same date another machinery was purchased for ₹ 8,00,000. You are required to show (i) Machinery A/c, (ii) Provision for Dep. A/c, and (iii) Machinery Disposal A/c.

[Ans. Balance of Machinery A/c on 31st March, 2020 ₹ 29,00,000; Balance of Provision for Dep. A/c on 31st March, 2020 ₹ 5,80,750; Loss on sale of Machinery ₹ 1,20,250.]

Anurag Pathak Answered question