On 31st March, 2019, the Balance Sheet of A and B, who were sharing profits in the ratio of 3 : 2 was as follows:

On 31st March, 2019, the Balance Sheet of A and B, who were sharing profits in the ratio of 3 : 2 was as follows:

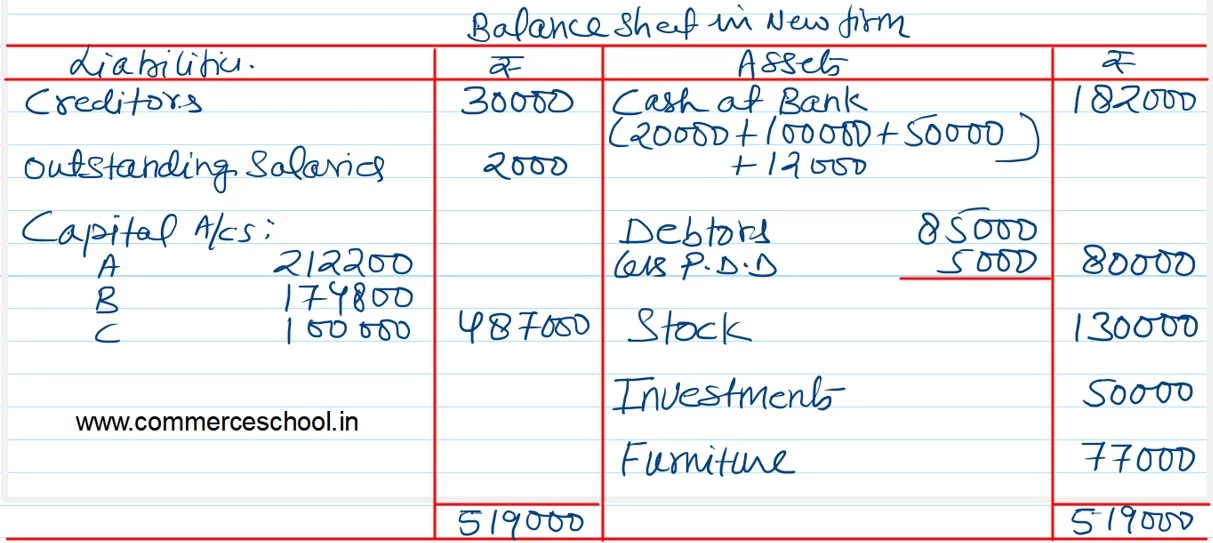

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Investment Fluctuation Fund Capital A/cs: A B |

30,000 12,000 25,000 1,60,000 1,40,000 |

Cash at Bank

Debtors Stock Investments Furniture |

85,000

|

20,000 80,000 1,30,000 60,000 77,000 |

| 3,67,000 | 3,67,000 |

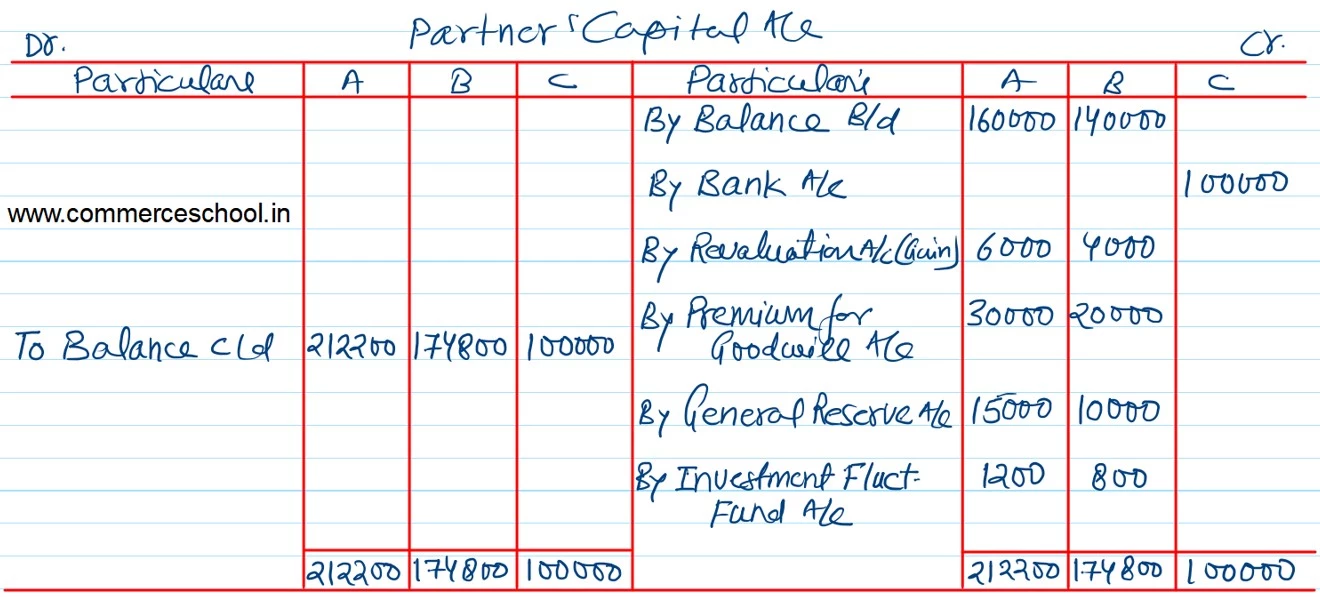

On 1st April, 2019, they decided to admit C as a new partner for 1/5th share in the profits on the following terms:

i) C brought ₹ 1,00,000 as his capital and ₹ 50,000 as his share of premium for goodwill.

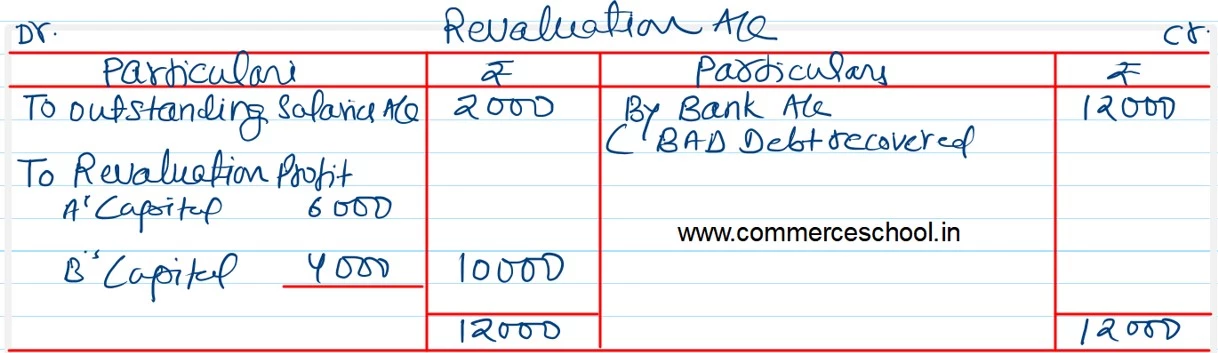

ii) Outstanding salaries of ₹ 2,000 be provided for.

iii) The market value of investments was ₹ 50,000.

iv) A debtor whose dues of ₹ 18,000 were written off as bad debts paid ₹ 12,000 in full settlement.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm.