On 31st March 2022, the Balance Sheet of A and B, who were sharing profits in the ratio of 3 : 2 was as follows:

On 31st March 2022, the Balance Sheet of A and B, who were sharing profits in the ratio of 3 : 2 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 2,50,000 | Cash at Bank | 1,30,000 |

| Investment Fluctuation Reserve | 50,000 |

Sundry Debtors 7,50,000 Less: Provision 30,000 |

7,20,000 |

|

Capitals: A B |

10,00,000 8,00,000 | Stock | 4,50,000 |

| Investments | 2,00,000 | ||

| Plant and Machinery | 6,00,000 | ||

| 21,00,000 | 21,00,000 |

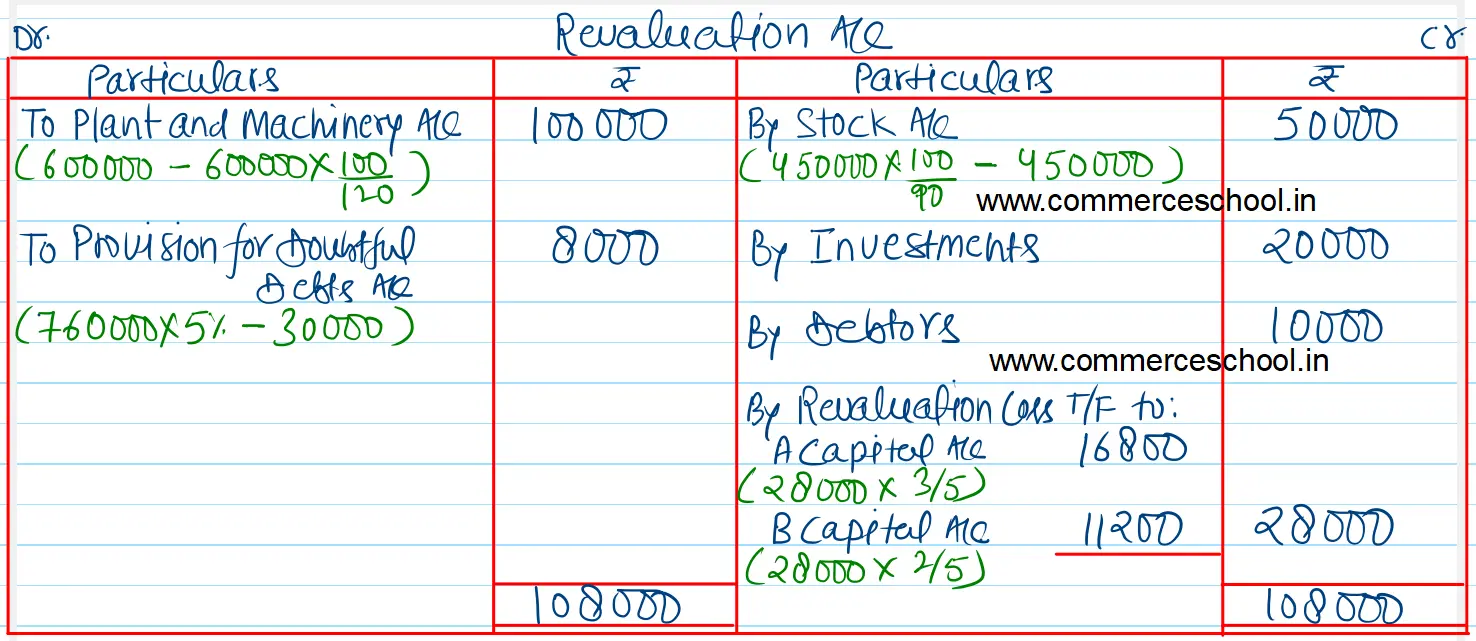

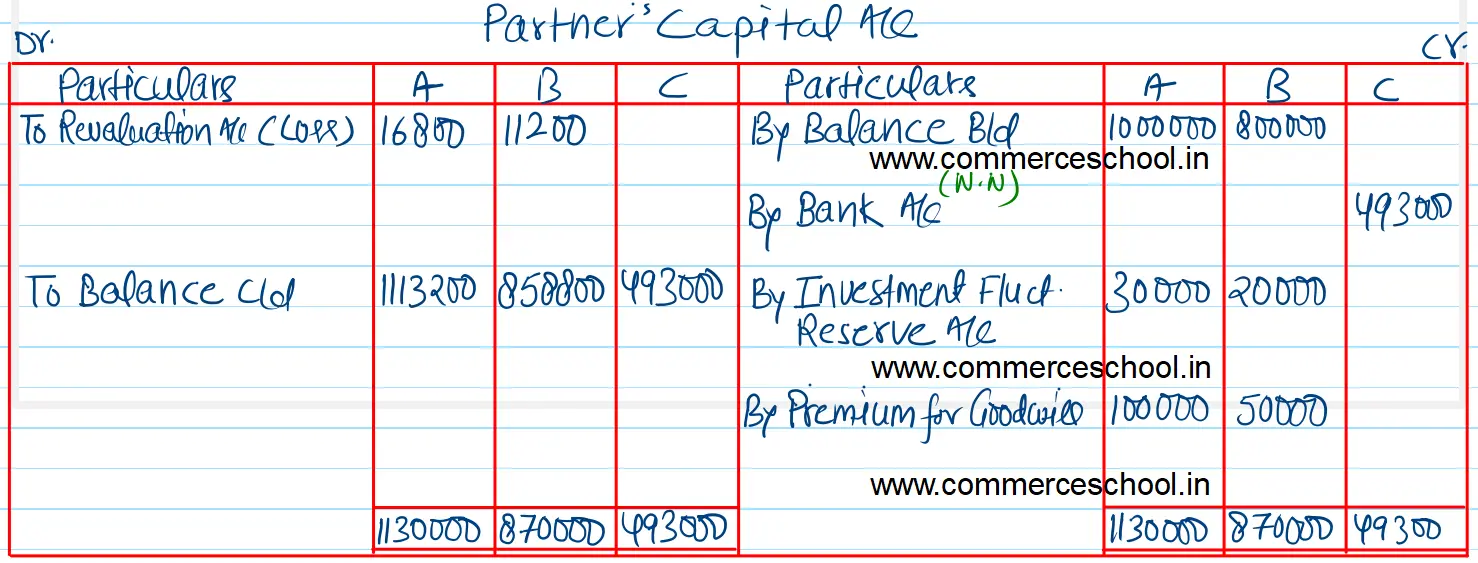

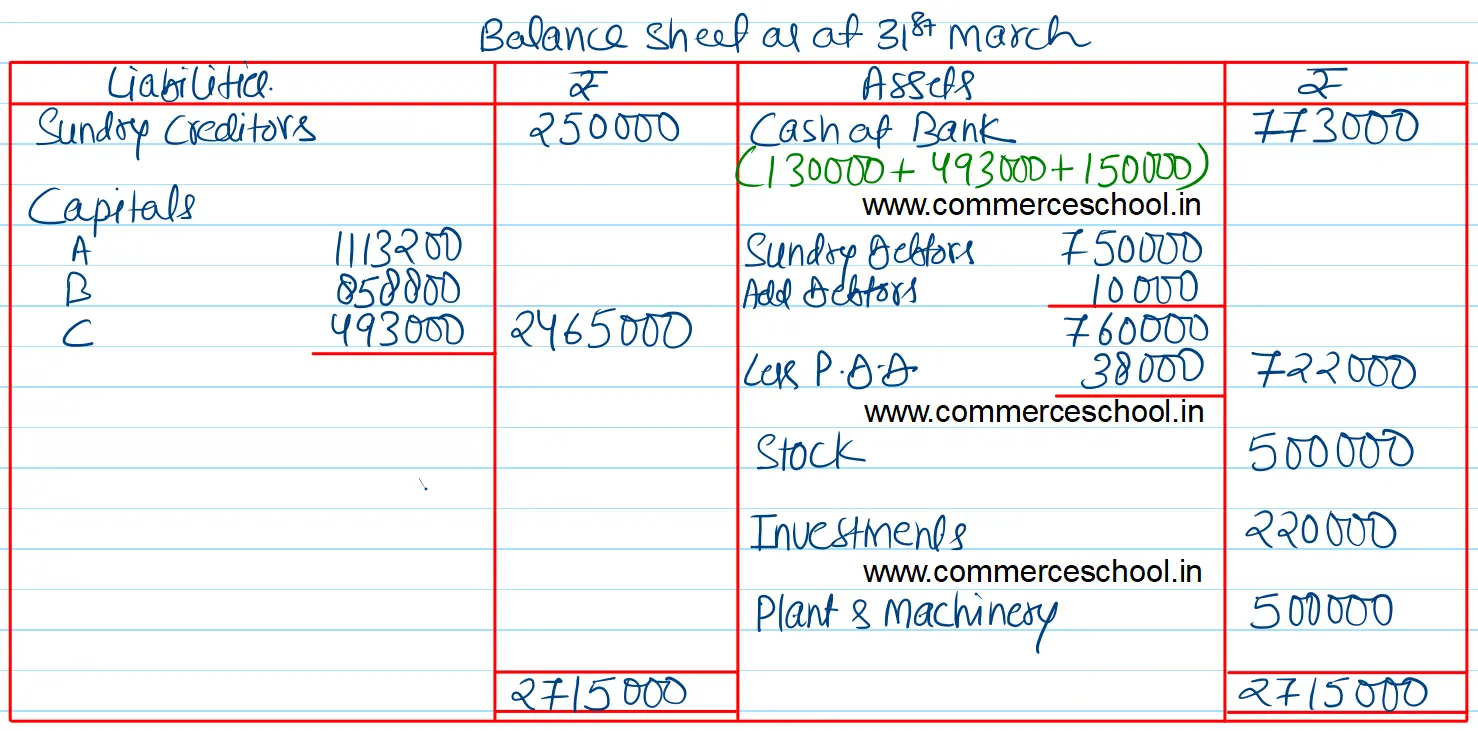

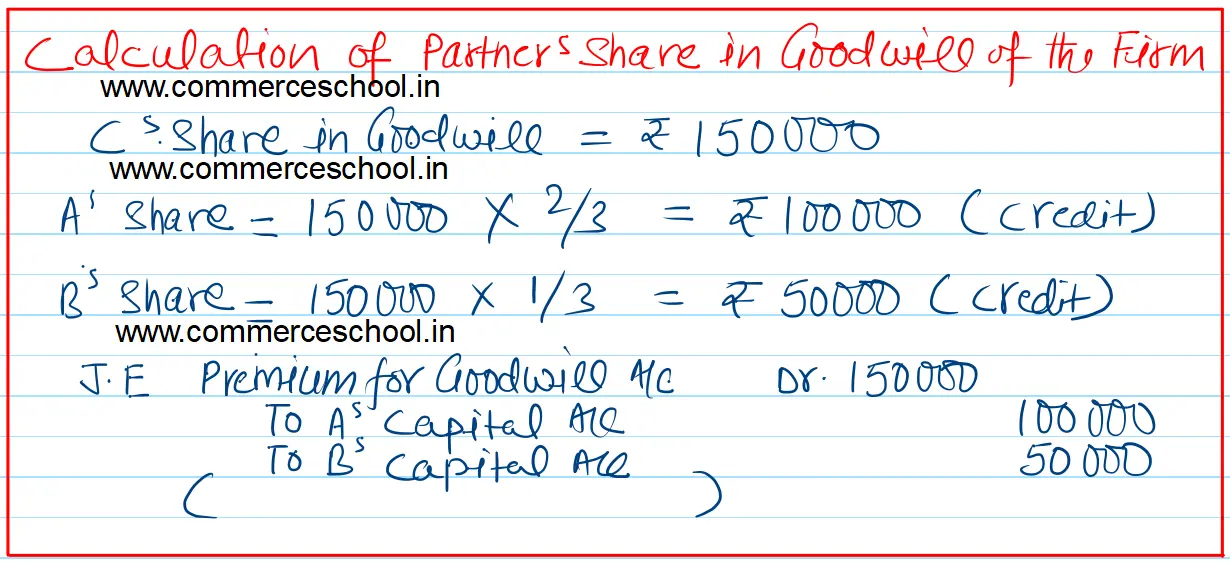

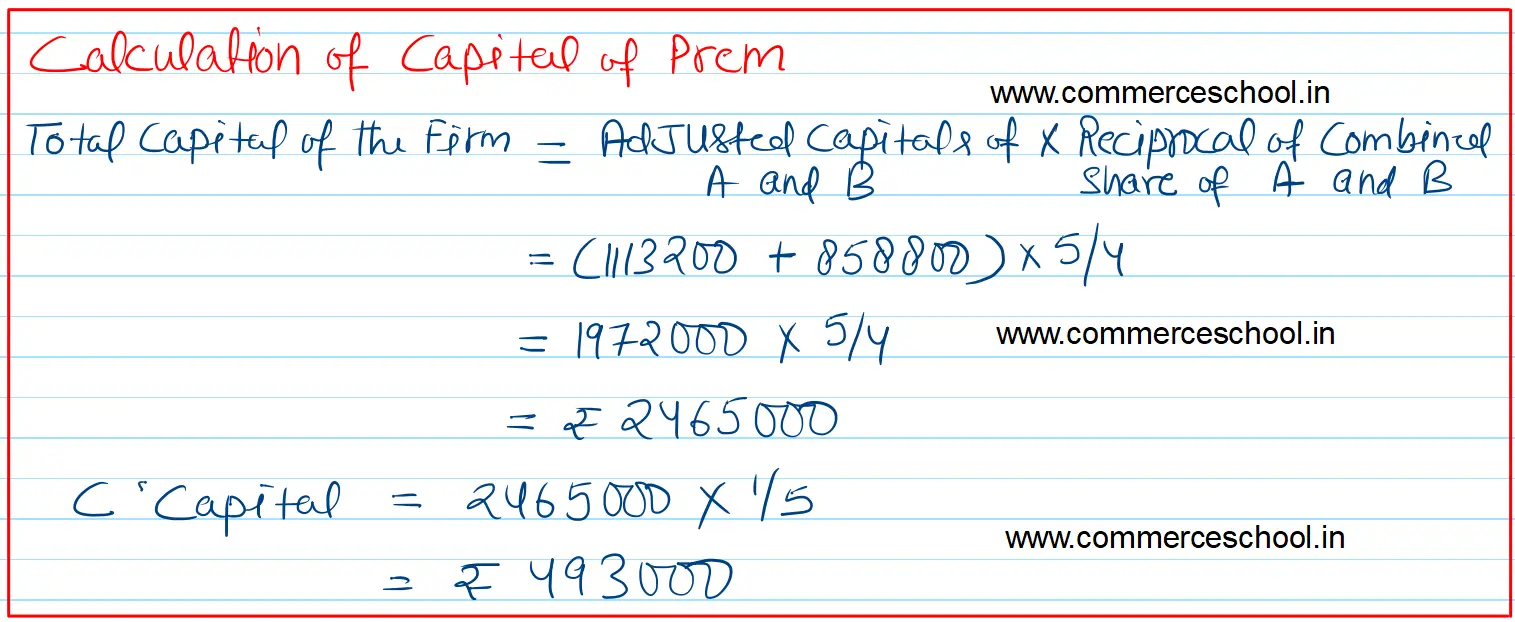

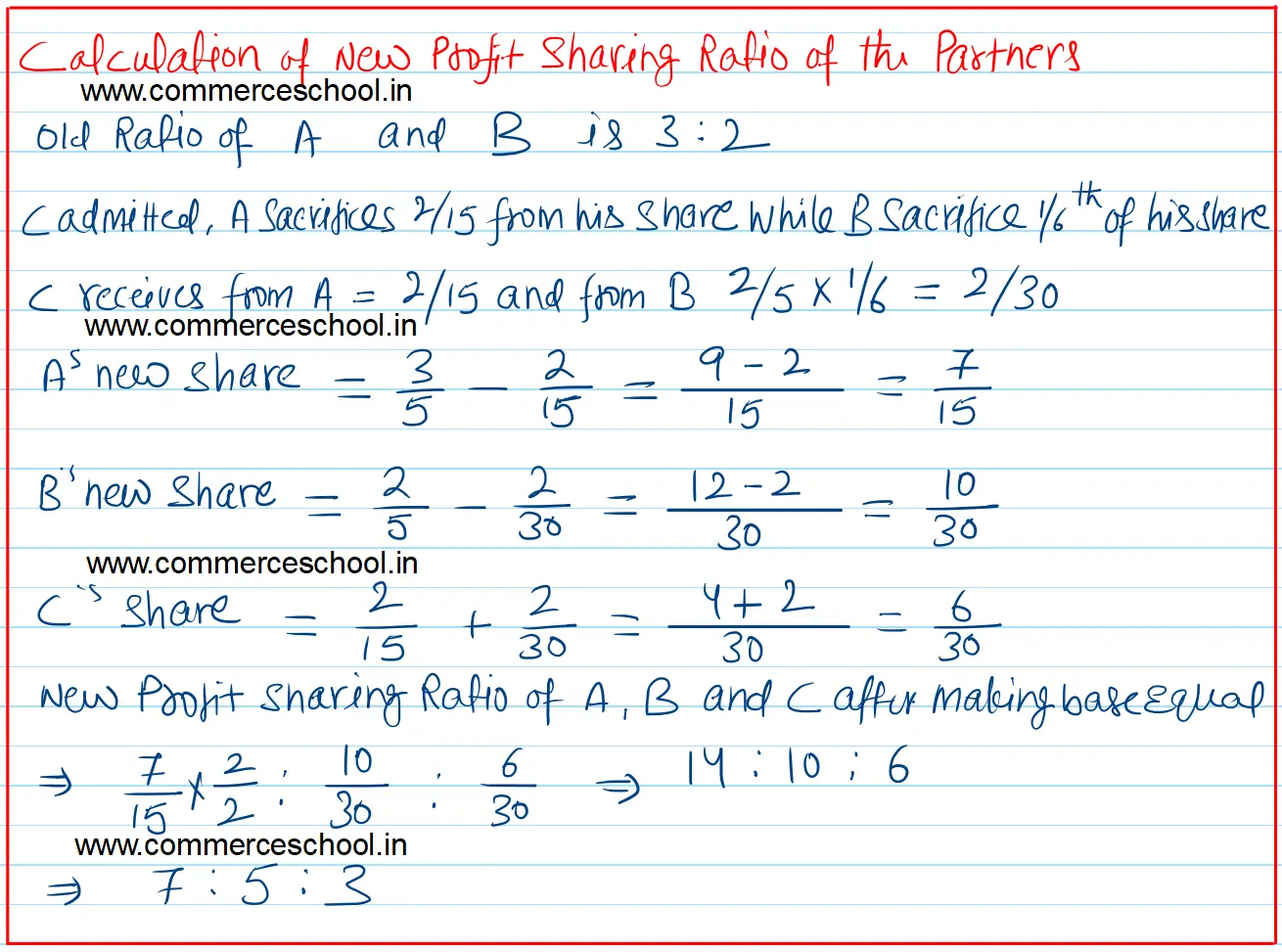

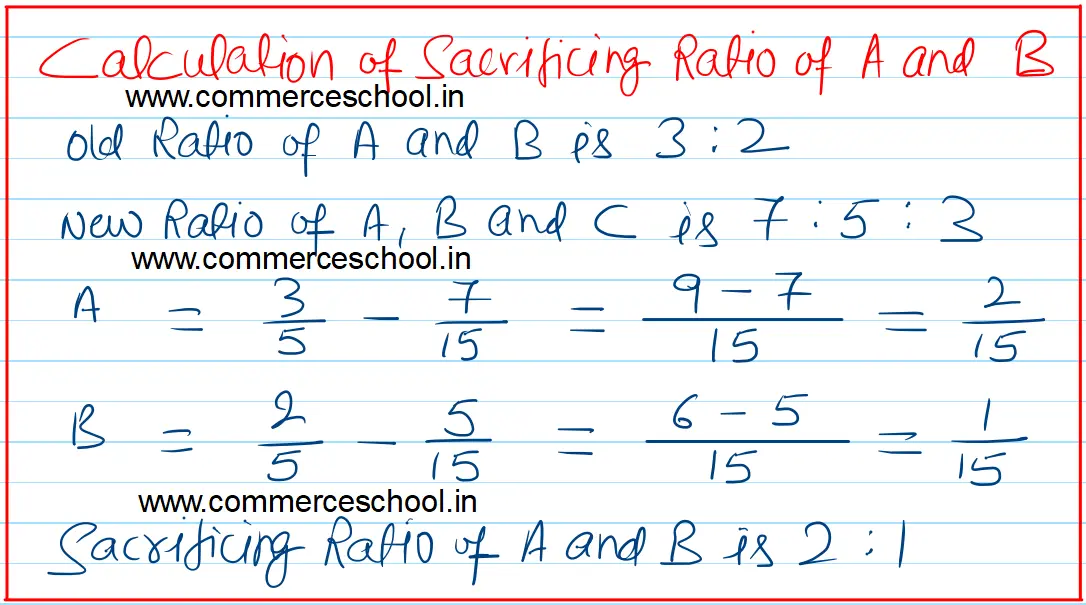

They decide to admit C as a partner. A sacrifices 2/15 from his share while B sacrifices 1/6th of his share in favour of C. The following adjustments were agreed upon: (i) C shall bring ₹ 1,50,000 as his share of goodwill premium and shall bring in proportionate capital. (ii) Stock was undervalued by 10% and Plant and Machinery was overvalued by 20%. (iii) Market value of investments is ₹ 2,20,000. (iv) Debtors the the extent of ₹ 10,000 were unrecorded. (v) 5% Provision for doubtful debts is required on sundry debtors. Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm. [Ans. Loss on Revaluation ₹ 28,000; Capital Accounts A ₹ 11,13,200; B ₹ 8,58,800 and C ₹ 4,93,000; Balance Sheet Total ₹ 27,15,000.]