On 31st March, 2022 the Balance Sheet of M/s A, B and C sharing profits and losses in proportion to their fixed Capitals stood as follows:

On 31st March, 2022 the Balance Sheet of M/s A, B and C sharing profits and losses in proportion to their fixed Capitals stood as follows:

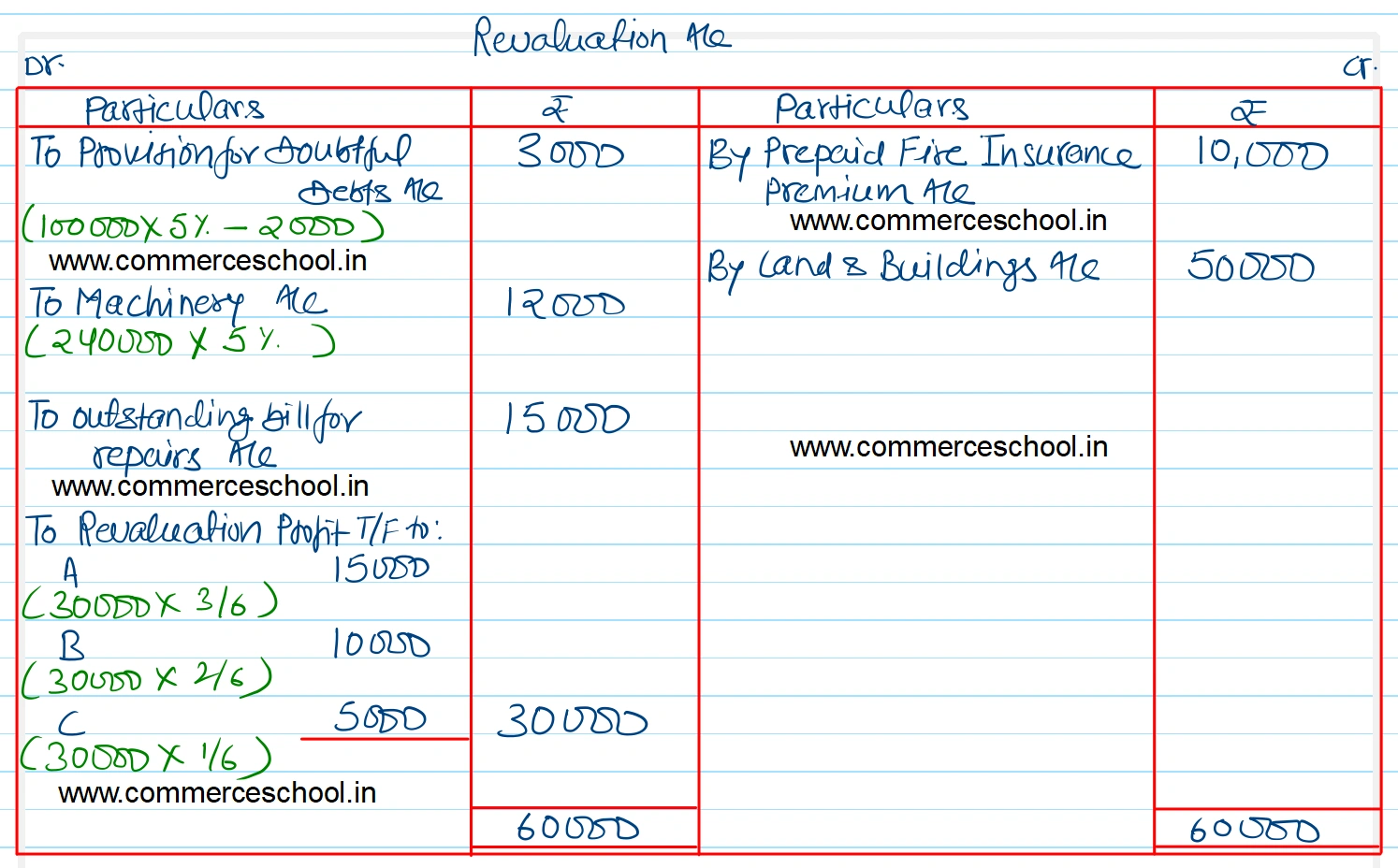

On 1st April, 2022, B wants to retire from the firm and the remaining partners decide to carry on. The following re-adjustments of assets and liabilities have been agreed upon before the ascertainment of the amount payable to B:

(i) that, out of the Fire Insurance Premium paid during 2021-22, ₹ 10,000 be carried forward as unexpired.

(ii) that the land and Buildings be appreciated by 10%.

(iii) that provision for doubtful debts be brought up to 5% on debtors.

(iv) that the machinery be depreciated by 5%.

(v) that a provision for ₹ 15,000 be made in respect of an outstanding bill for repairs.

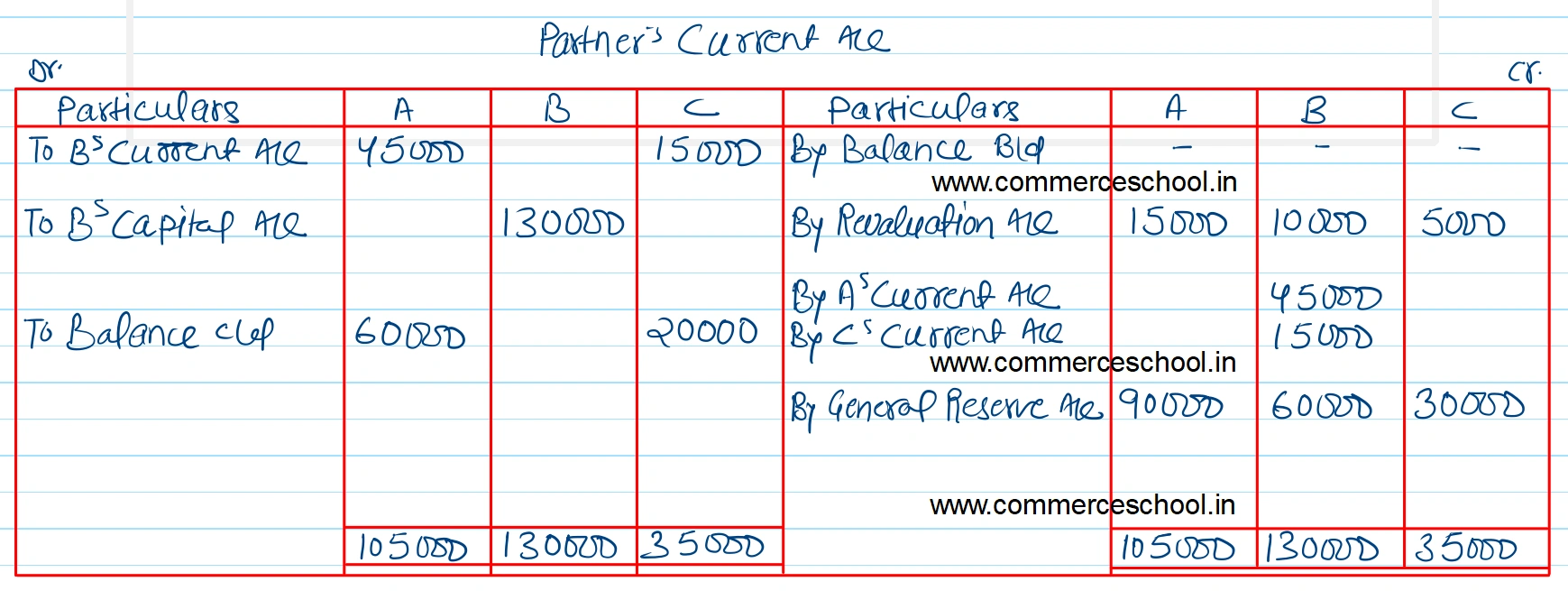

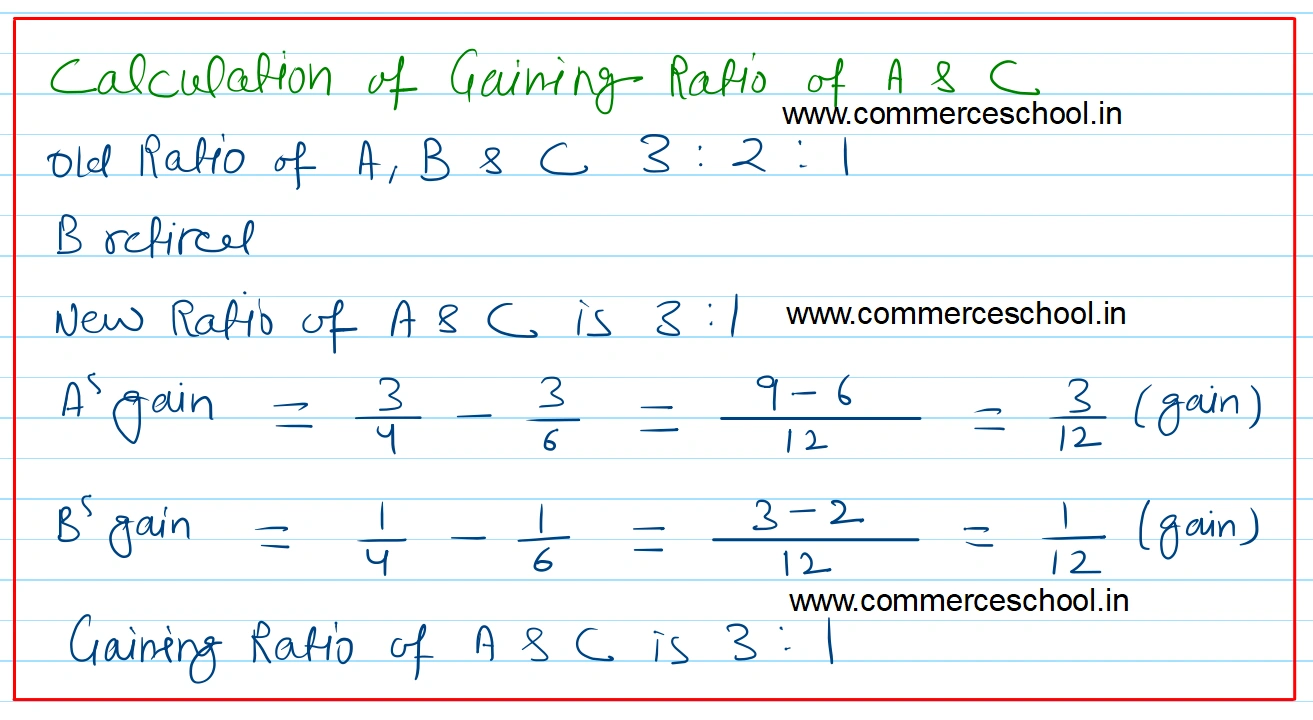

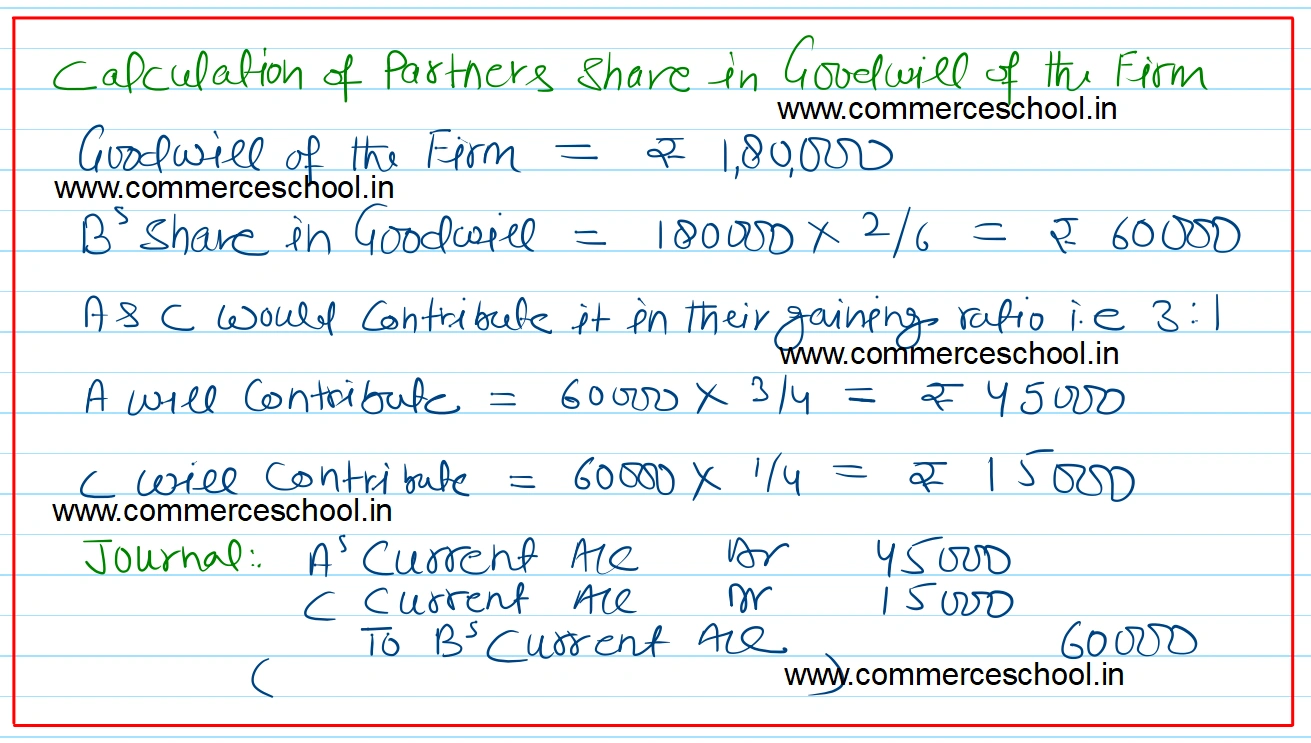

(vi) that the goodwill of the entire firm be at ₹ 1,80,000 and B’s share of the same adjusted in the A/cs of A and C who share future profits in the proportion of 3/4th and 1/4th respectively; and

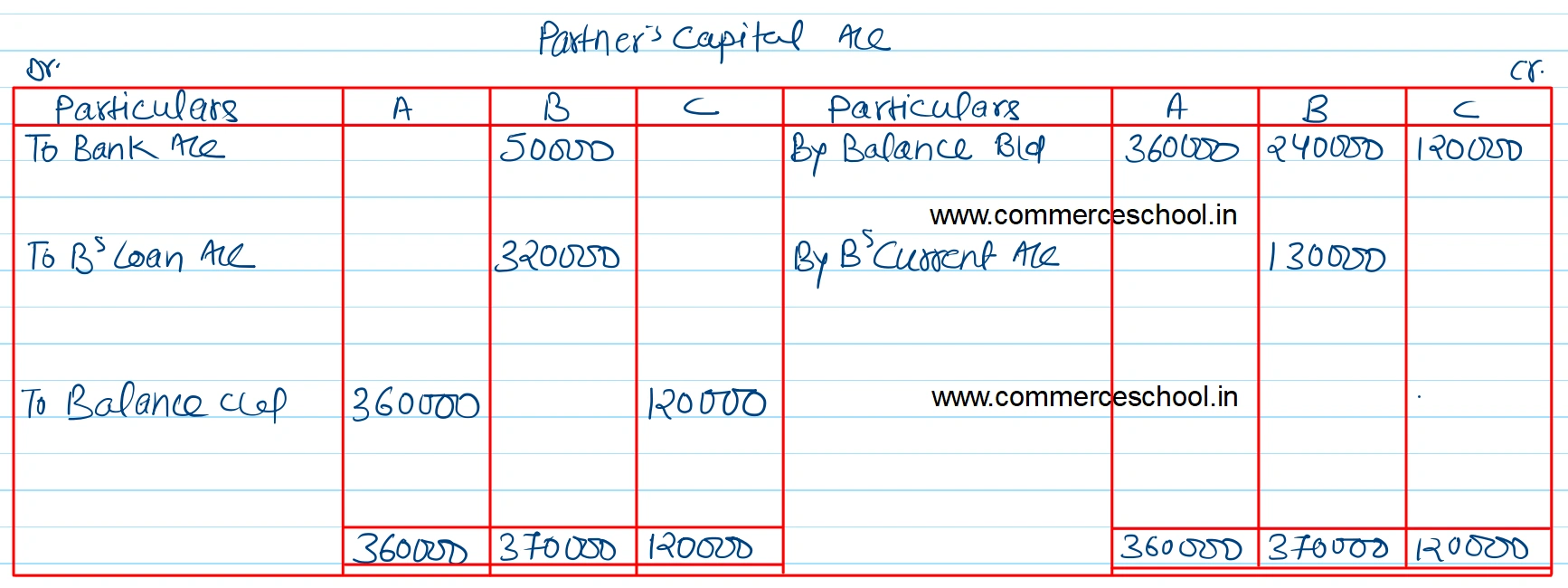

(vii) that B be paid ₹ 50,000 in cash and the balance be transferred to his Loan A/c.

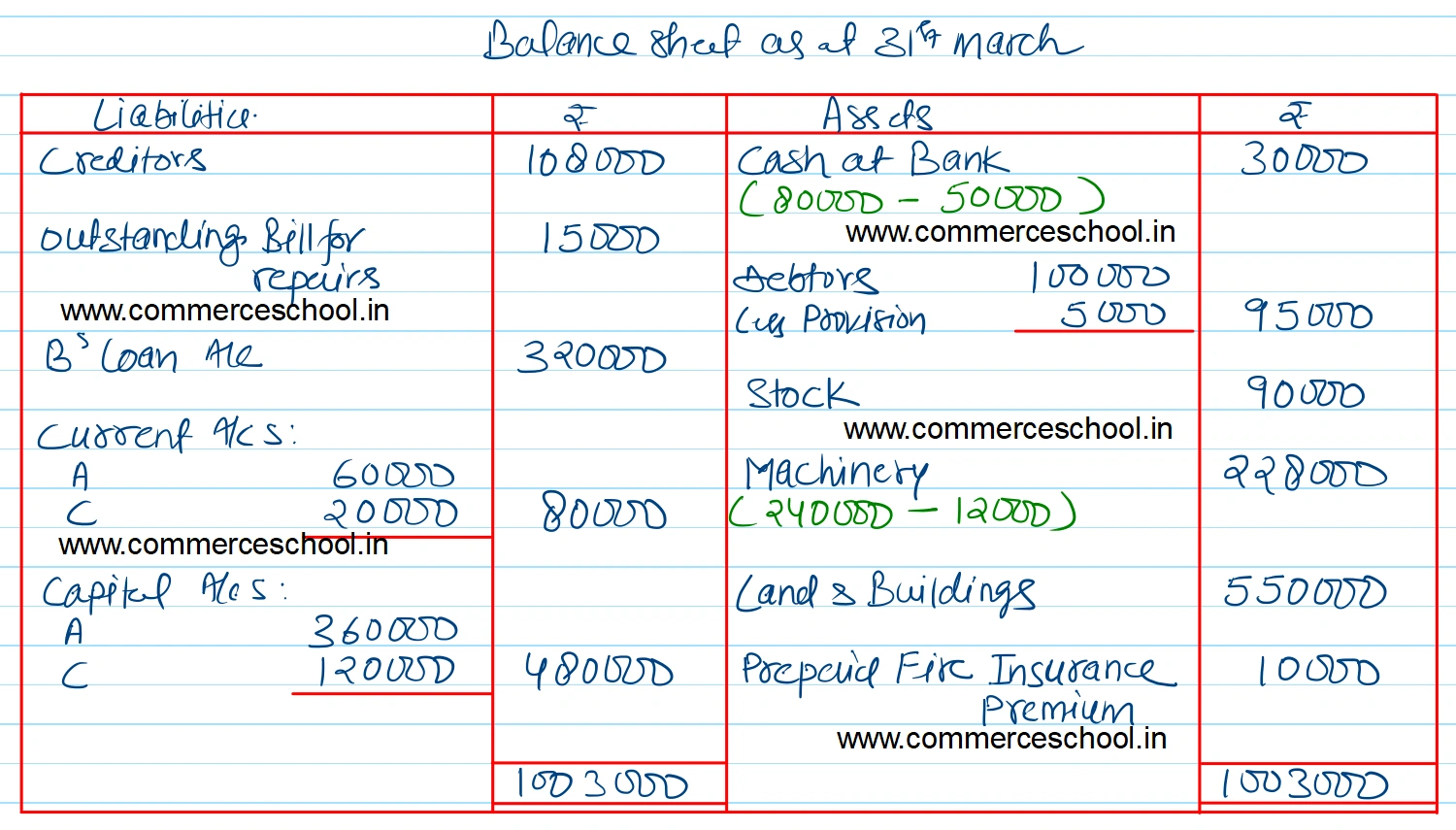

Prepare Revaluation A/c, Partner’s Current Accounts, Capital Accounts and the Balance sheet of the firm of A and C.

[Ans. Gain on Revaluation ₹ 30,000; B’s Loan A/c ₹ 3,20,000; Current Accounts: A ₹ 60,000 (Cr.) and C ₹ 20,000 (Cr.); Capital : A ₹ 3,60,000; C ₹ 1,20,000; B/S Total ₹ 10,03,000]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,08,000 | Cash at Bank | 80,000 |

| General Reserve | 1,80,000 | Debtors 1,00,000 Less: Provision 2,000 | 98,000 |

| Capital A/cs: A B C | 3,60,000 2,40,000 1,20,000 | Stock | 90,000 |

| Machinery | 2,40,000 | ||

| Land and Buildings | 5,00,000 | ||

| 10,08,000 | 10,08,000 |

Anurag Pathak Answered question