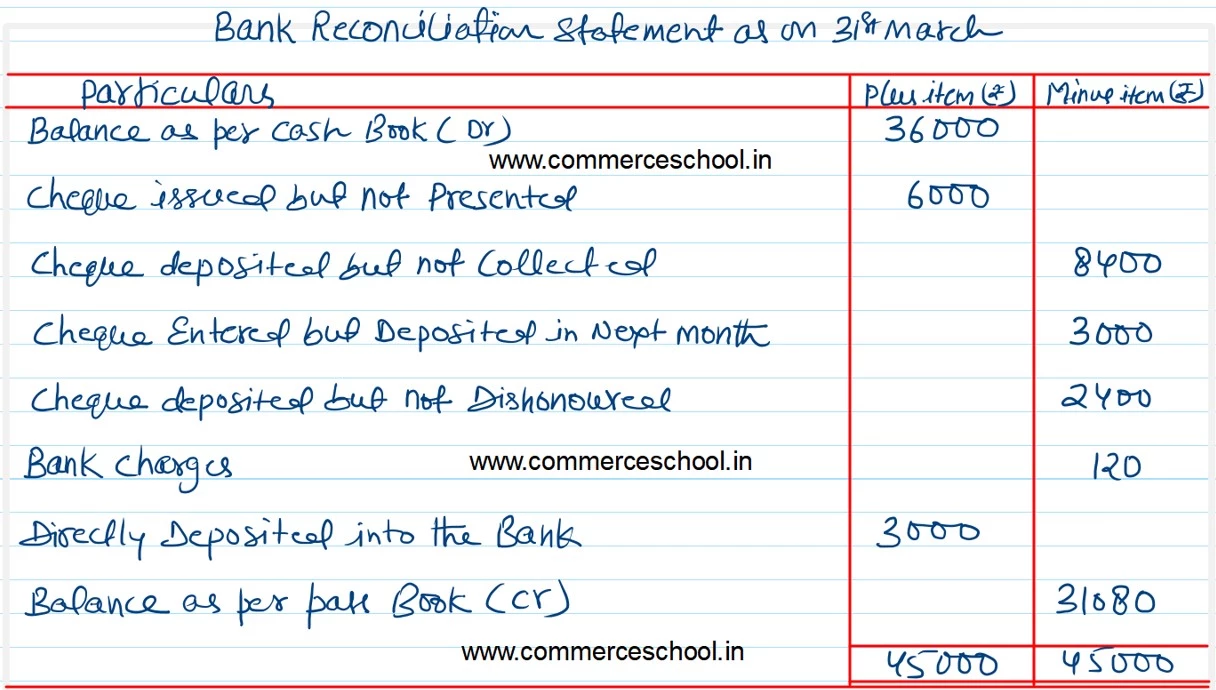

On 31st March, 2023, Cash Book of a firm showed bank balance of ₹ 36,000 (Dr.). Prepare a Bank Reconciliation Statement as on 31st March, 2023 from the following:

Prepare a Bank Reconciliation Statement as on 31st March, 2023 from the following:

(i) On 31st March, 2023, Cash Book of a firm showed bank balance of ₹ 36,000 (Dr.).

(ii) Cheques had been issued for ₹ 30,000, out of which cheques of ₹ 24,000 were presented for payment.

(iii) Cheques of ₹ 8,400 were deposited in the bank on 28th March, 2023 but has not been credited by the bank. Also, a cheque of ₹ 3,000 entered in the Cash Book on 30th March, 2023 was banked on 3rd April.

(iv) A cheque from Suresh for ₹ 2,400 was deposited in the bank on 26th March, 2023 was dishonoured, advice was received on 2nd April, 2023.

(v) Pass Book showed bank charged of ₹ 120 debited by the bank.

(vi) One of the Debtors deposited ₹ 3,000 in the bank account of the firm on 26th March, 2023, but the intimation in this respect was received from the bank on 2nd April, 2023.

[Balance as per Pass Book – ₹ 31,080.]