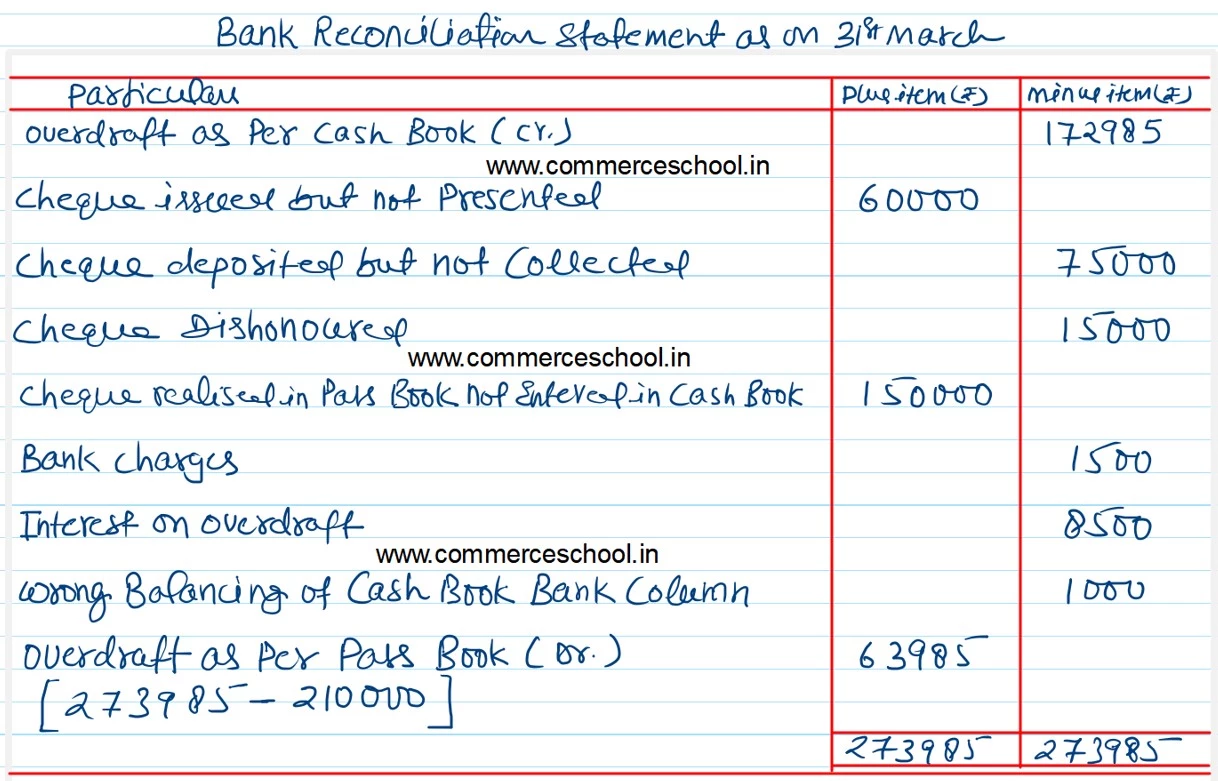

On 31st March, 2023, Cash Book of a merchant showed bank overdraft of ₹ 1,72,985. On comparing the Cash Book with Bank Statement, following discrepancies were noted:

On 31st March, 2023, Cash Book of a merchant showed bank overdraft of ₹ 1,72,985. On comparing the Cash Book with Bank Statement, following discrepancies were noted:

(i) Cheques issued for ₹ 60,000 were not presented in the bank till 7th April, 2023.

(ii) Cheques amounting to ₹ 75,000 were deposited in the bank but were not collected.

(iii) A cheque of ₹ 15,000 received from Mahesh Chand and deposited in the bank was dishonoured but the non-payment advice was not received from the bank till 1st April, 2023.

(iv) ₹ 1,50,000 entered in Pass Book for cheque realised but not in the Cash Book.

(v) Bank Charges ₹ 1,500 and interest on overdraft ₹ 8,500 appeared inteh Pass Book but not in the Cash Book.

(vi) Overdraft balance as per Cash Book of ₹ 500 on 28th February, 2023 was wrongly carried forward as debit balance. The error was noted at the time of preparing the Bank Reconciliation Statement as on 31st March, 2023.

Prepare Bank Reconciliation Statement

[Overdraft as per Pass Book – ₹ 63,985.]