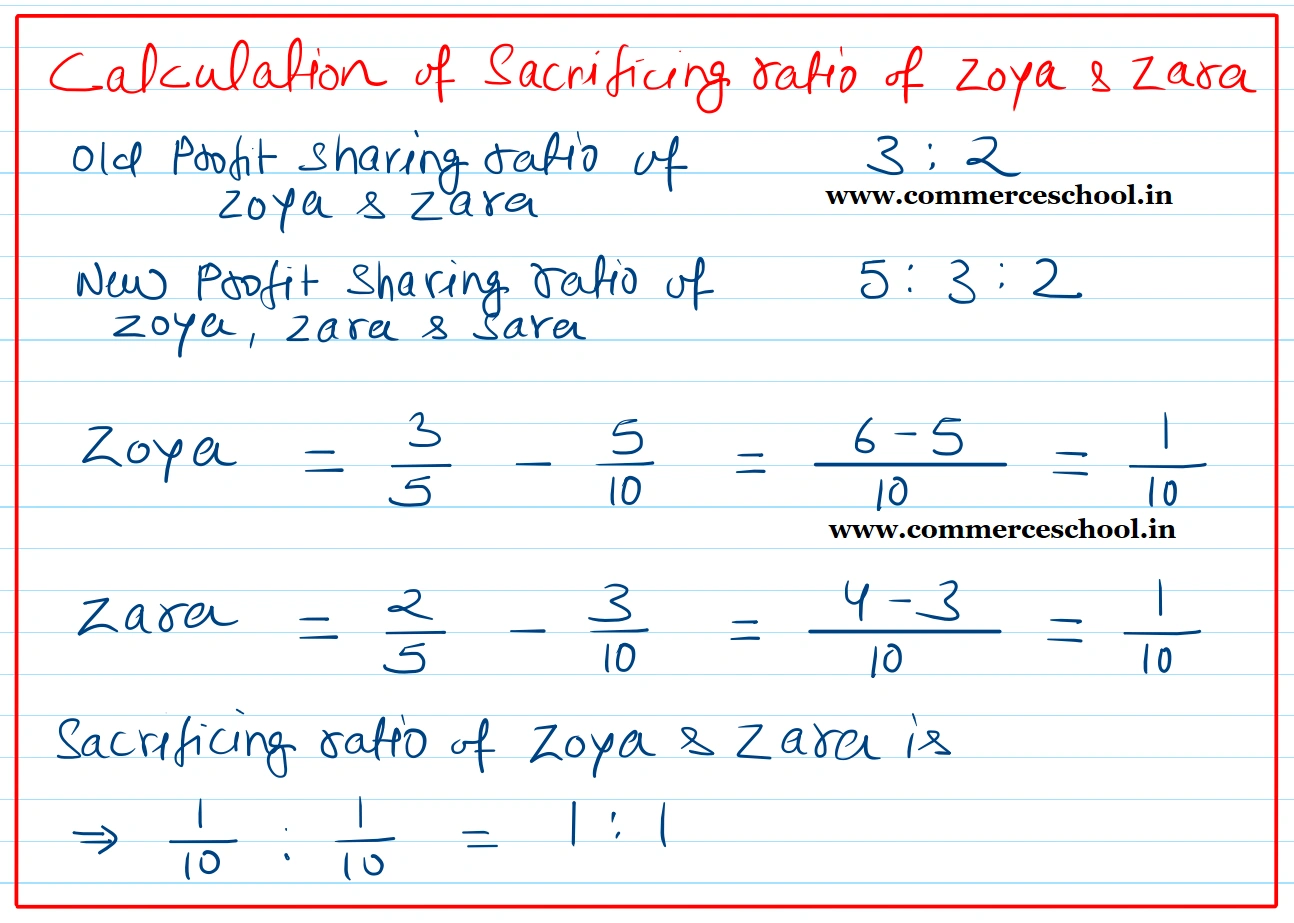

On 31st March 2023, the Balance Sheet of Zoya and Zara who were sharing profits and losses in the ratio of 3 : 2 was as follows:

On 31st March 2023, the Balance Sheet of Zoya and Zara who were sharing profits and losses in the ratio of 3 : 2 was as follows:

They decided to admit Sara for 1/5th share on 1st April, 2023 in the firm on the following terms:

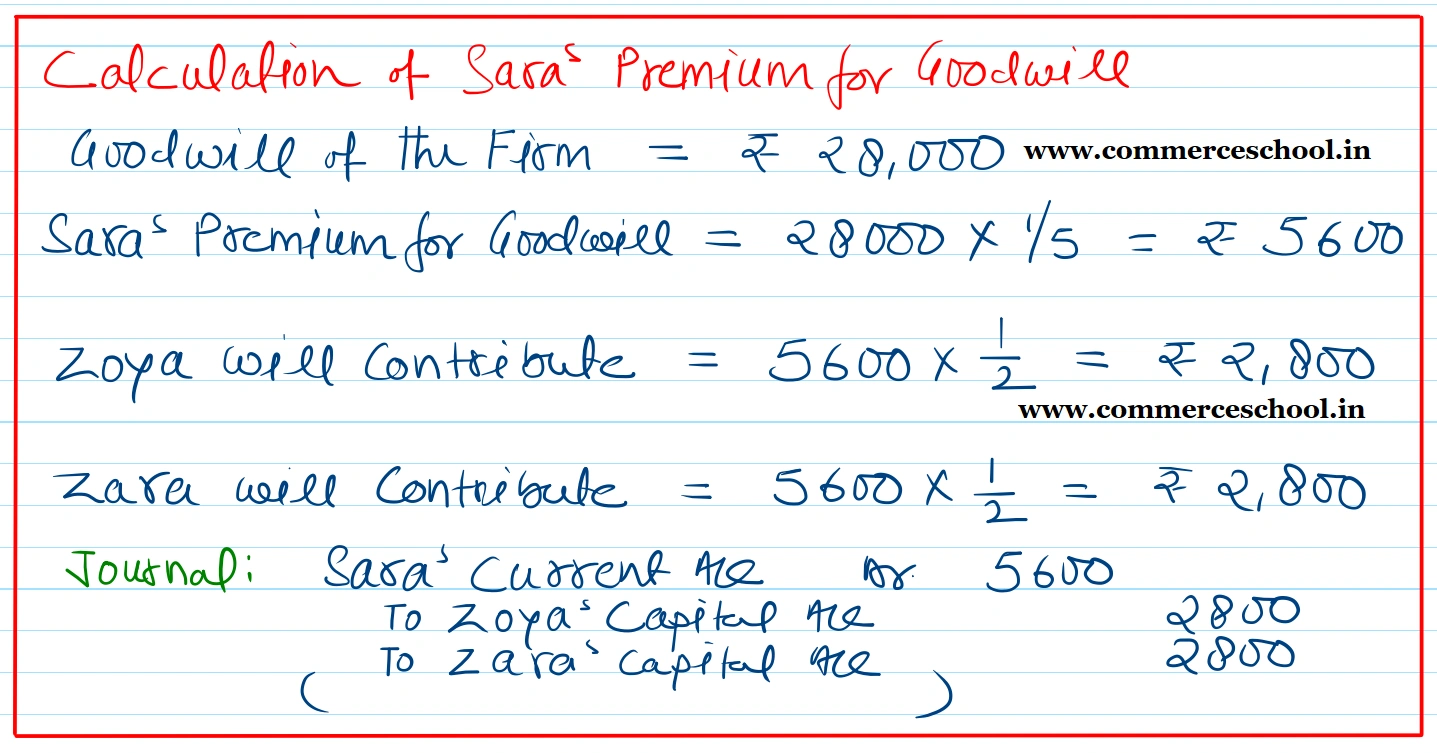

(a) Goodwill of the firm is valued at ₹ 28,000.

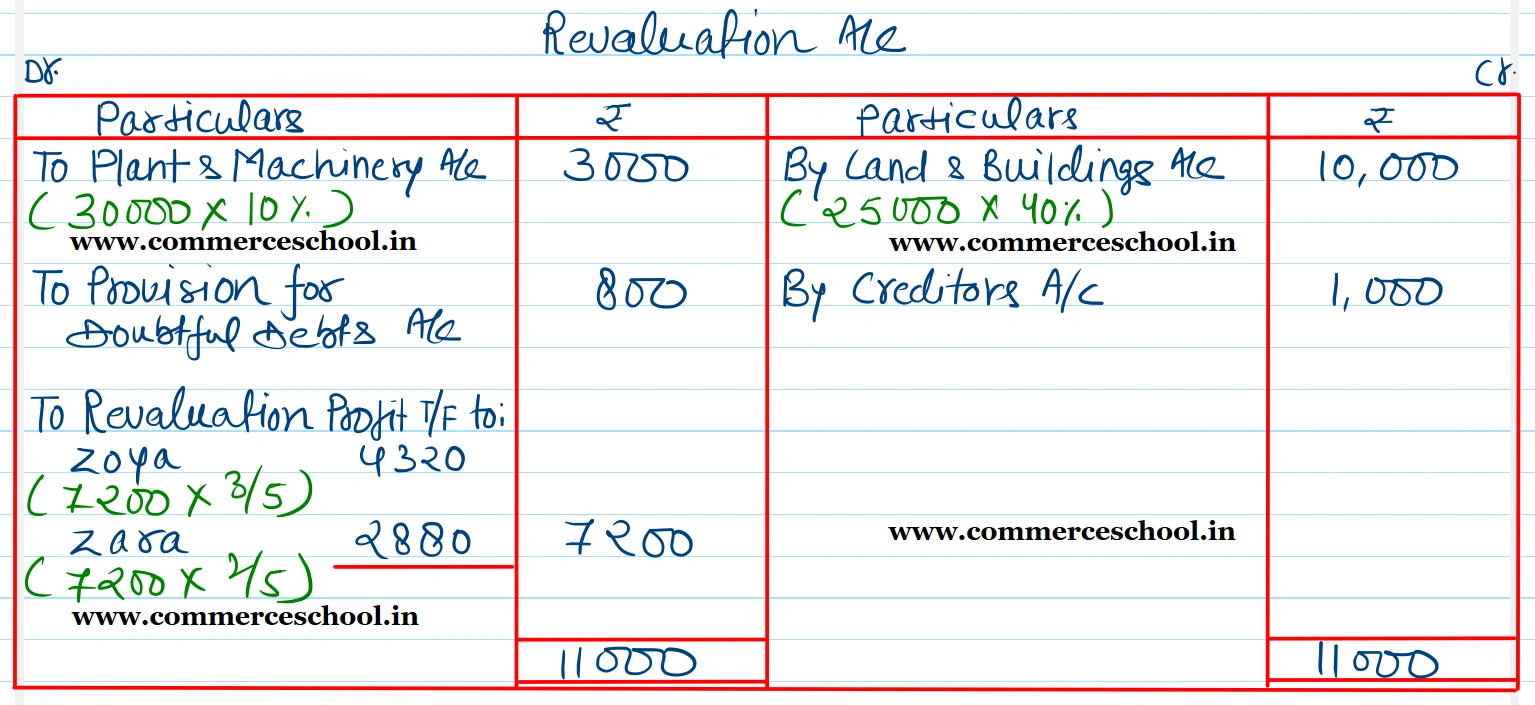

(b) Depreciate Plant and Machinery by 10%, appreciate Land and Building by 40%.

(c) The provision for doubful debts was to be increased by ₹ 800.

(d) A liability of ₹ 1,000 included in the creditors is not likely to arise.

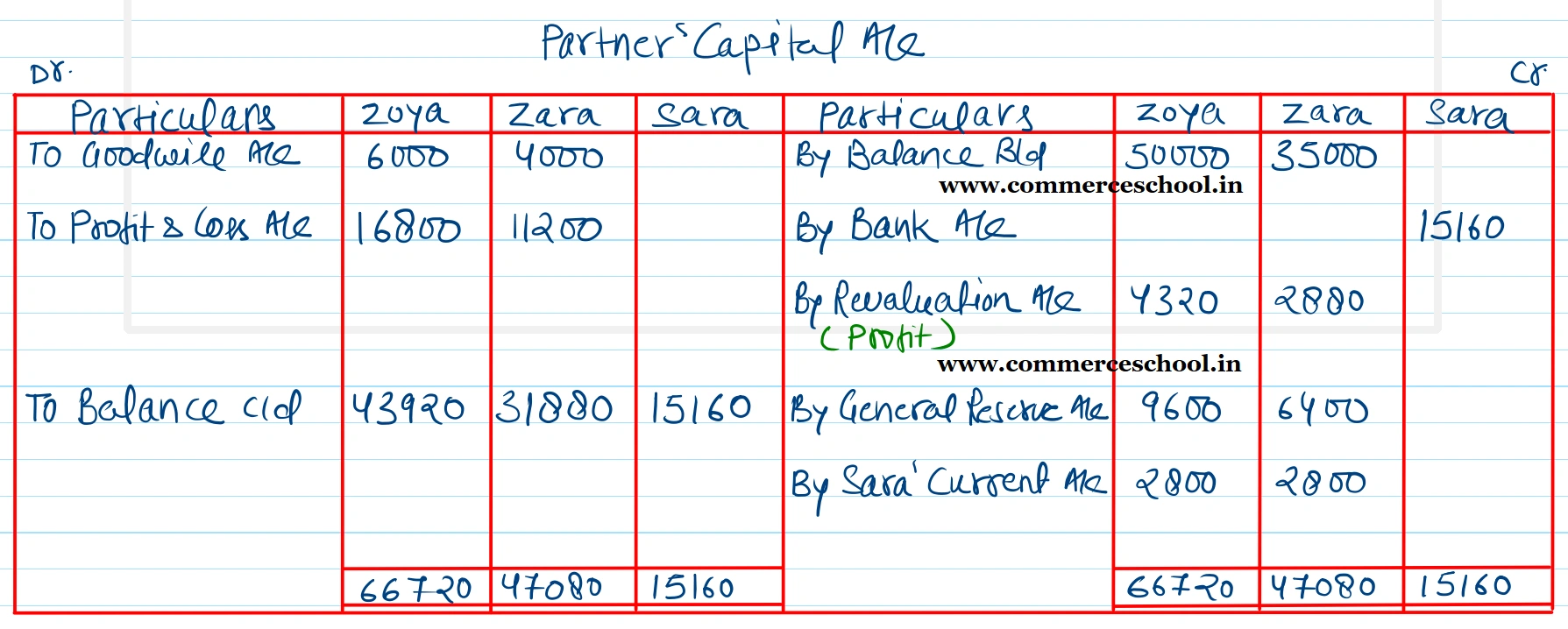

(e) New profit sharing ratio between Zoya, Zara and Sara shall be 5 : 3 : 2 respectively.

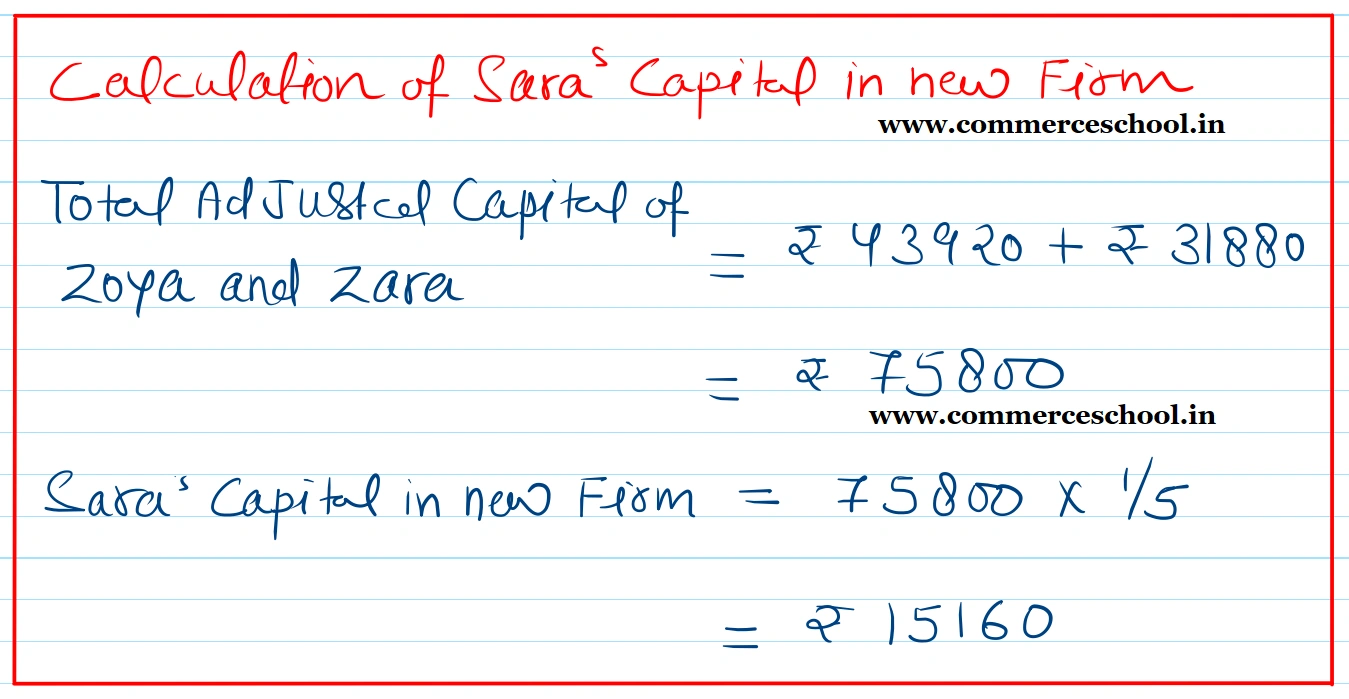

(f) Sara was to contribue capital equal to 1/5th of the total capital of Zoya and Zara after all adjustments.

You are required to prepare Revaluation Account and Partner’s Capital Accounts

[Ans. Gail on Revaluation ₹ 2,700; Capital Account balances : Zoya ₹ 43,920; Zara ₹ 31,880 and Sara ₹ 15,160.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 29,000 | Cash at Bank | 9,000 |

| Bills Payable | 6,000 | Debtors 20,000 Less PDD 1,000 | 19,000 |

| General Reserve | 16,000 | Stock | 15,000 |

| Capitals: Zoya 50,000 Zara 35,000 | 85,000 | Land and Building | 25,000 |

| Plant and Machinery | 30,000 | ||

| Goodwill | 10,000 | ||

| Profit and Loss Account | 28,000 | ||

| 1,36,000 | 1,36,000 |

Anurag Pathak Answered question