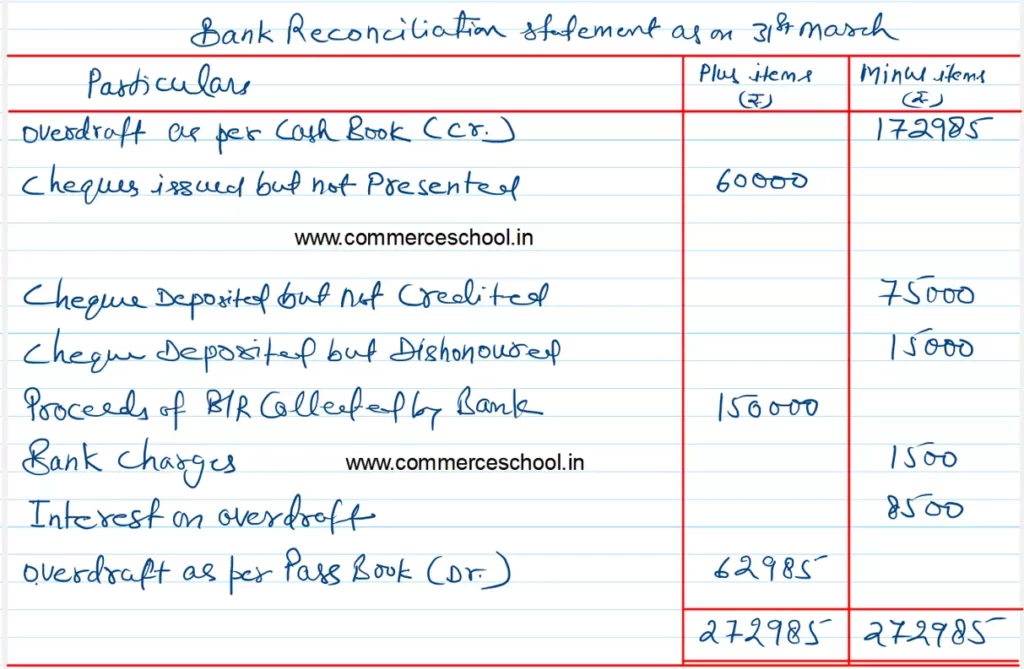

On 31st March, 2023, the Cash Book of a Merchant showed a bank overdraft of ₹ 1,72,985. On comparing the Cash Book with the Bank Pass Book the following discrepancies were noted

On 31st March, 2023, the Cash Book of a Merchant showed a bank overdraft of ₹ 1,72,985. On comparing the Cash Book with the Bank Pass Book the following discrepancies were noted:

(i) Cheques issued for ₹ 60,000 were not presented in the bank till 7th April, 2023.

(ii) Cheques of ₹ 75,000 were deposited in the bank but were not collected.

(iii) A cheque of ₹ 15,000 received from Mahesh and deposited in the bank was dishonoured but the non-payment advice was not received from the bank till 1st April, 2023.

(iv) ₹ 1,50,000 being the proceeds of a bill receivable collected showed in the Bank Pass Book but not in the Cash Book.

(v) Bank Charges ₹ 1,500 and interest on overdraft ₹ 8,500 were charged by the Bank Pass Book but were not recorded in the Cash Book.

Prepare Bank Reconciliation Statement as on 31st March, 2023 and what does the balance of Bank Pass Book indicate.