On 31st March, 2023 the following Trial Balance Was extracted from the books of Sh. Ghanshyam Das

On 31st March, 2023 the following Trial Balance Was extracted from the books of Sh. Ghanshyam Das:-

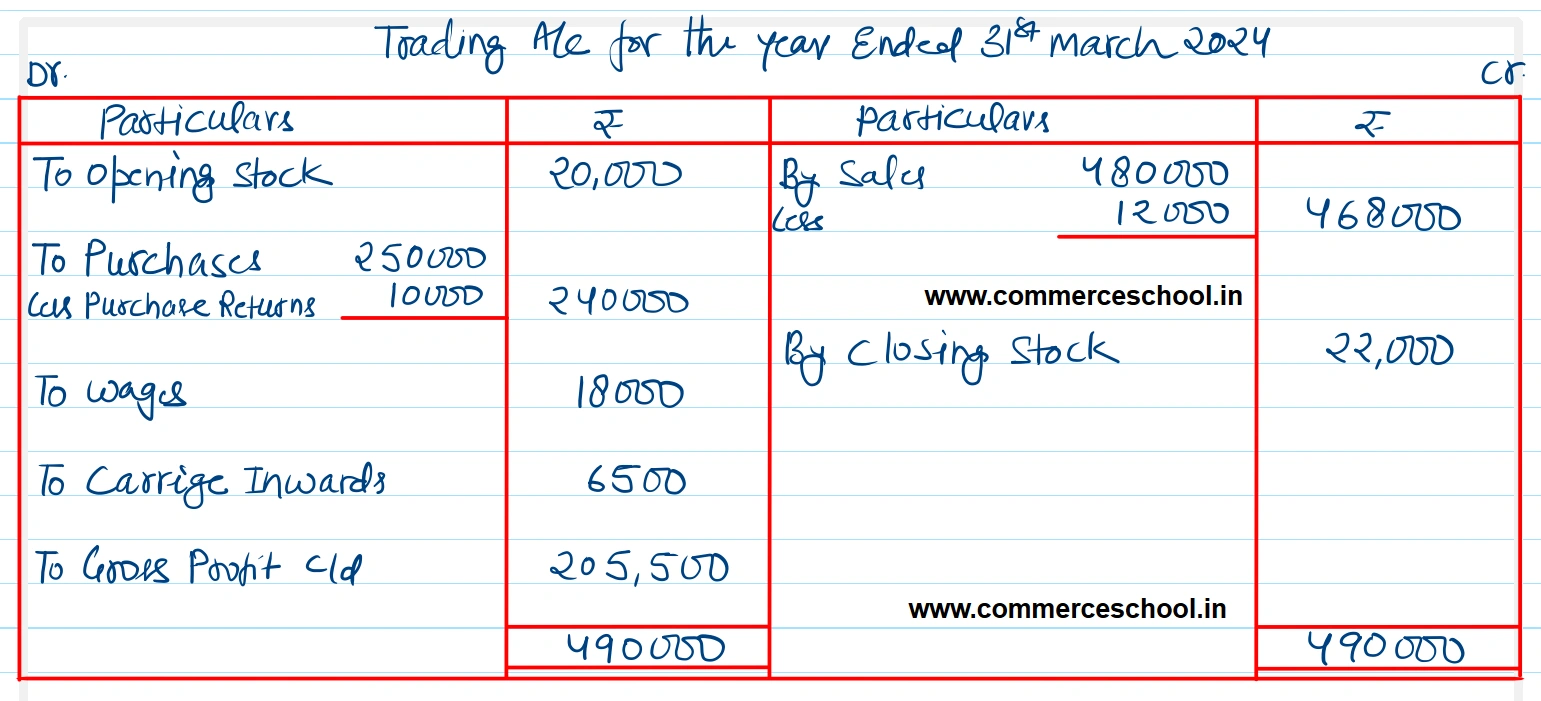

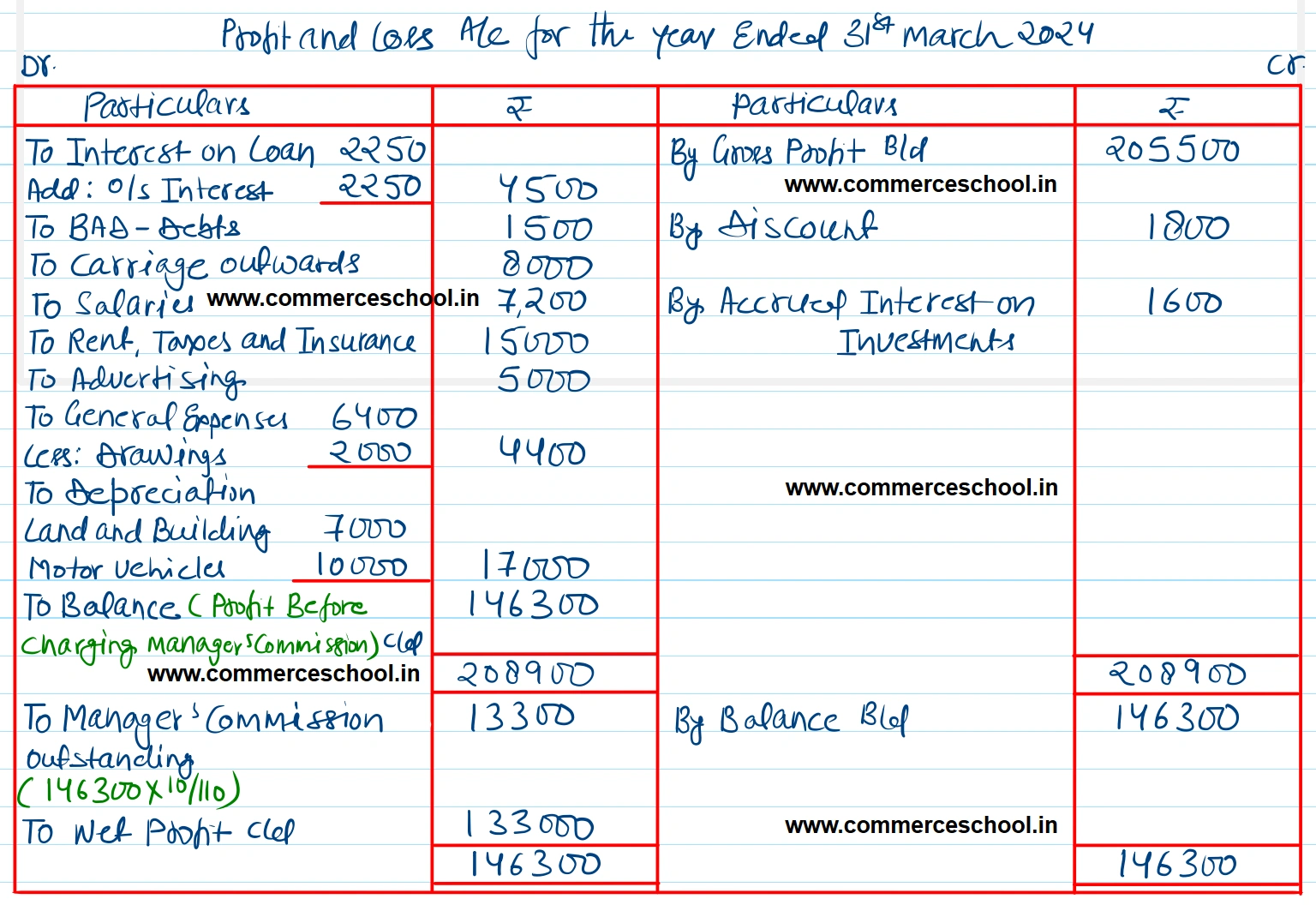

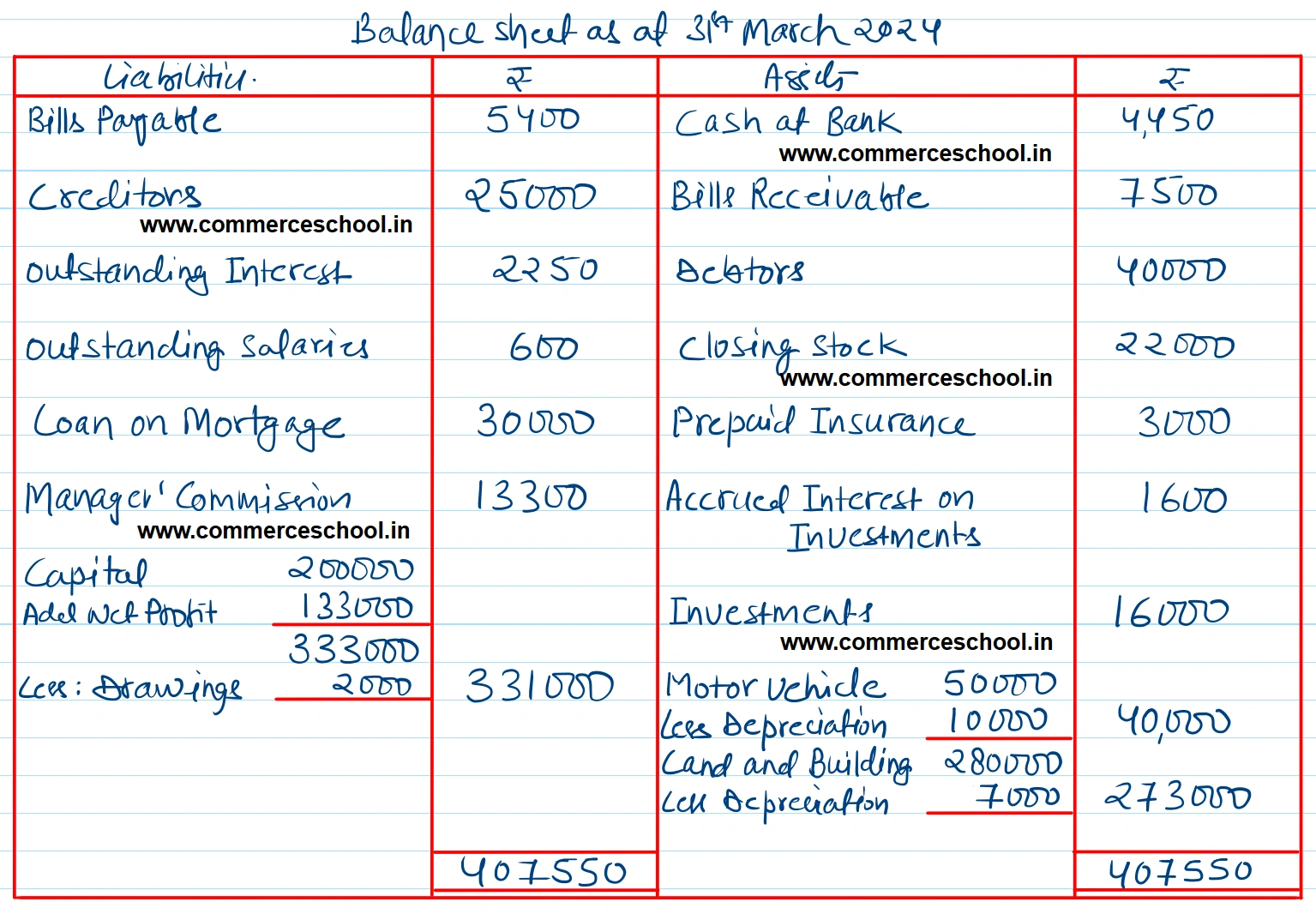

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date, after making adjustments for the following matters:

(1) Depreciate Land and Building at 2.5% and Motor Vehicles at 20%.

(2) Interest on Loan at 15% p.a. is unpaid for six months.

(3) Ghanshyam Das withdrew ₹ 2,000 for his private use. The amount was included in general expenses.

(4) Interest on Investments is receivable for full year @ 10%.

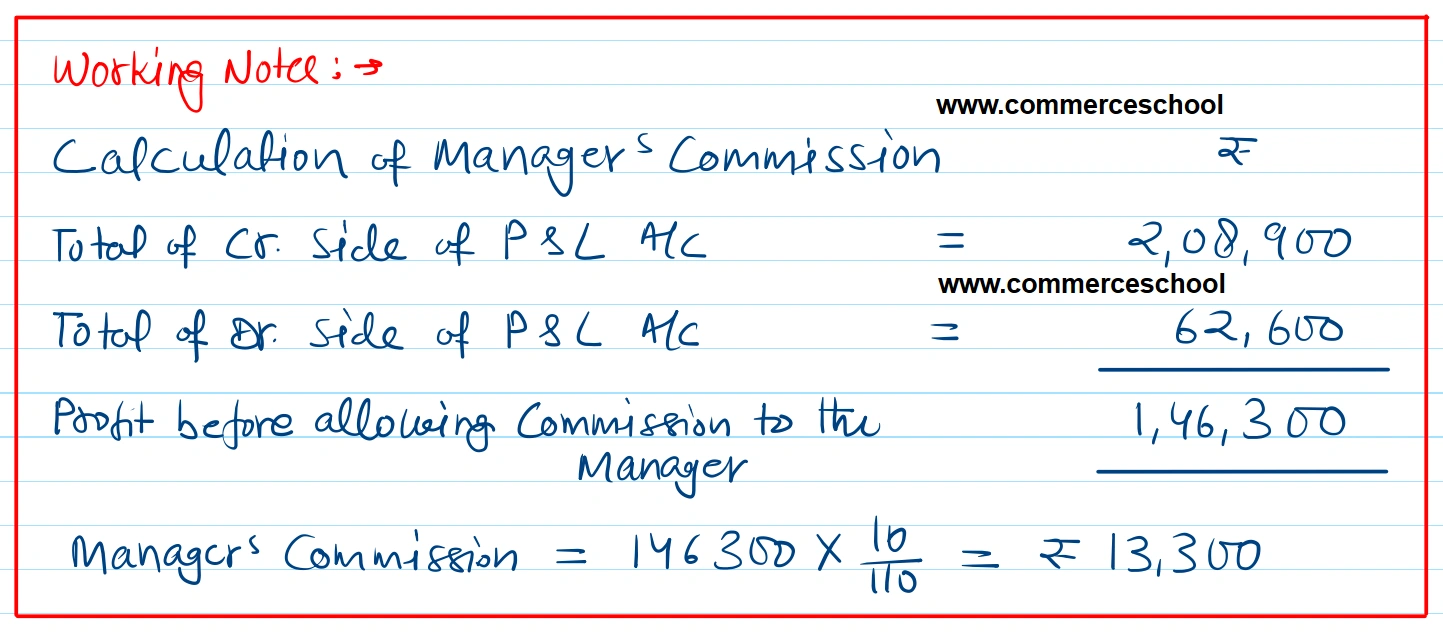

(5) Provide for Manager’s Commission at 10% on Net Profit after charing such commission.

(6) Stock in hand on 31st March, 2023 was valued at ₹ 25,000 (Realisable Value ₹ 22,000).

[Ans. G.P ₹ 2,05,500; N.P. ₹ 1,33,000; B/S Total ₹ 4,07,550.]

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital Account | 2,00,000 | |

| Debtors and Creditors | 40,000 | 25,000 |

| Loan on Mortgage | 30,000 | |

| Interest on Loan | 2,250 | |

| Discount | 1,800 | |

| Stock on 1st April, 2022 | 20,000 | |

| Motor Vehicle | 50,000 | |

| Cash at Bank | 4,450 | |

| Investments | 16,000 | |

| Wages | 18,000 | |

| Land and Building | 2,80,000 | |

| Bad-debts | 1,500 | |

| Purchases and Sales | 2,50,000 | 4,80,000 |

| Purchases and Sales Return | 12,000 | 10,000 |

| Carriage Outward | 8,000 | |

| Carriage Inward | 6,500 | |

| Salaries | 7,200 | |

| Outstanding Salaries | 600 | |

| Rates, Taxes and Insurance | 15,000 | |

| Advertising | 5,000 | |

| General Expenses | 6,400 | |

| Bills Receivable and Payable | 7,500 | 5,400 |

| Prepaid Insurance | 3,000 | |

| 7,52,800 | 7,52,800 |

Anurag Pathak Answered question