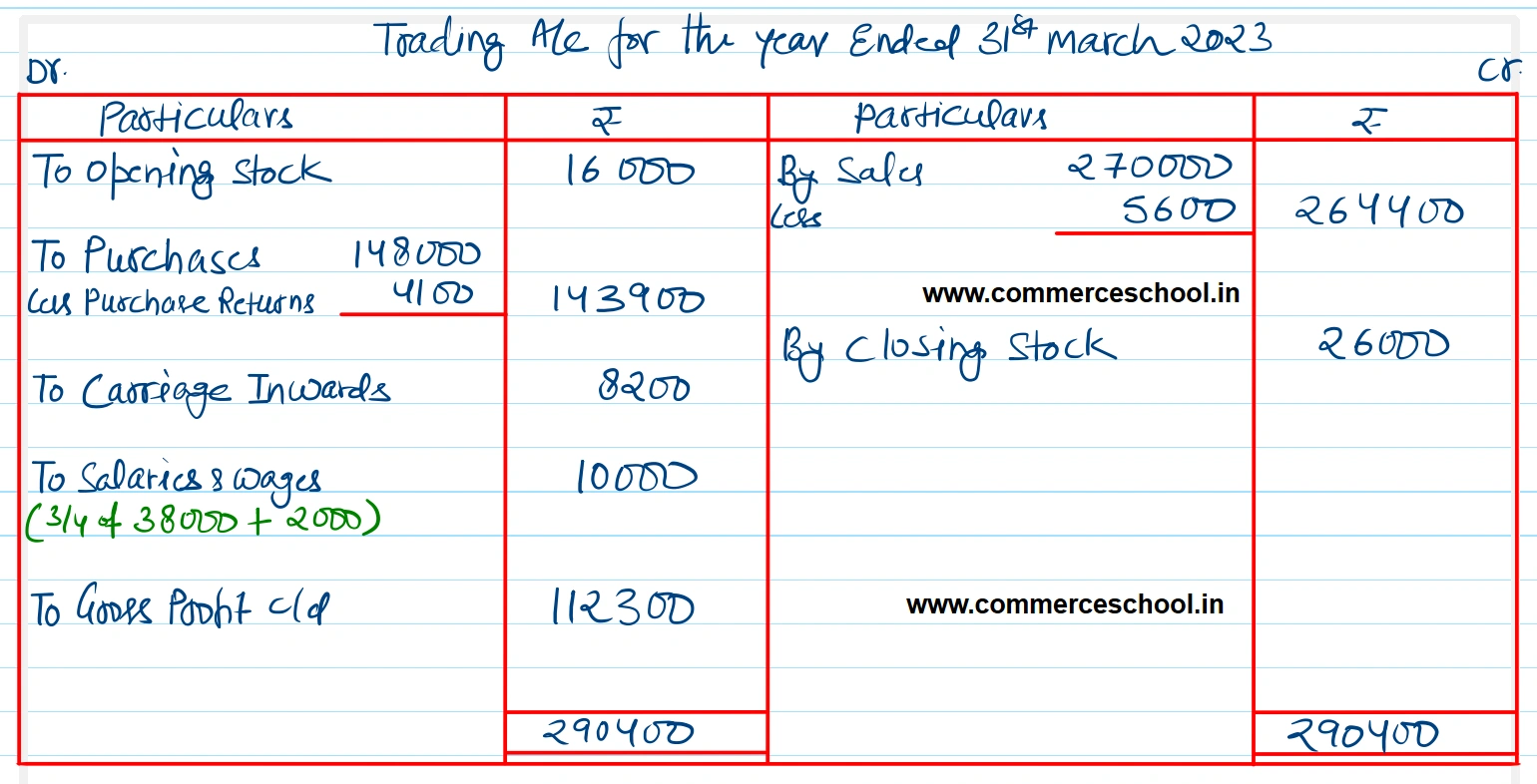

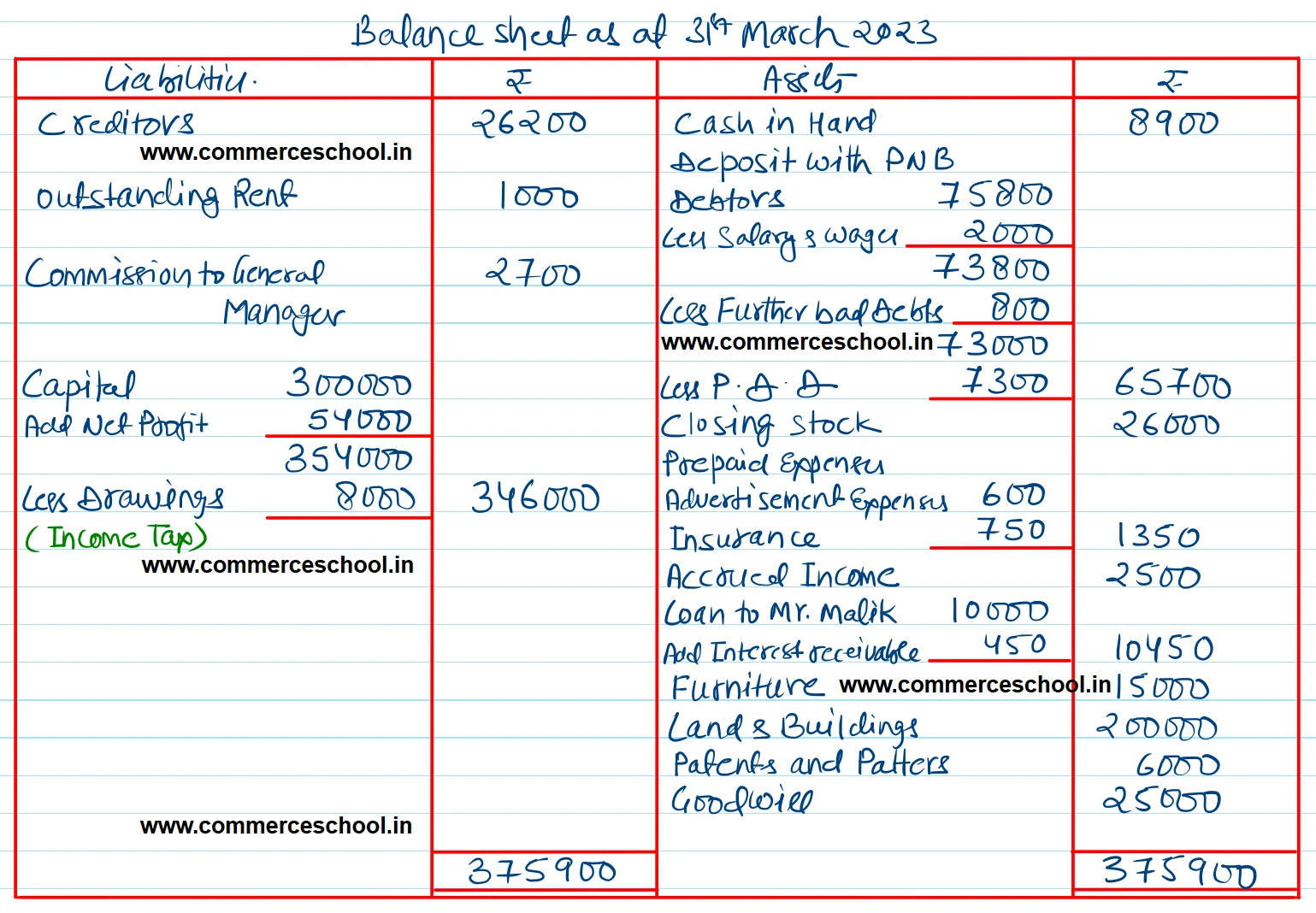

On 31st March, 2023 the following Trial Balance of Sh. Ajay Oswal was taken out. Prepare Trading and Profit & Loss Account for the year and Balance Sheet at that date after making the following adjustments:-

On 31st March, 2023 the following Trial Balance of Sh. Ajay Oswal was taken out. Prepare Trading and Profit & Loss Account for the year and Balance Sheet at that date after making the following adjustments:-

(i) Stock on 31st March, 2023 was valued ₹ 26,000.

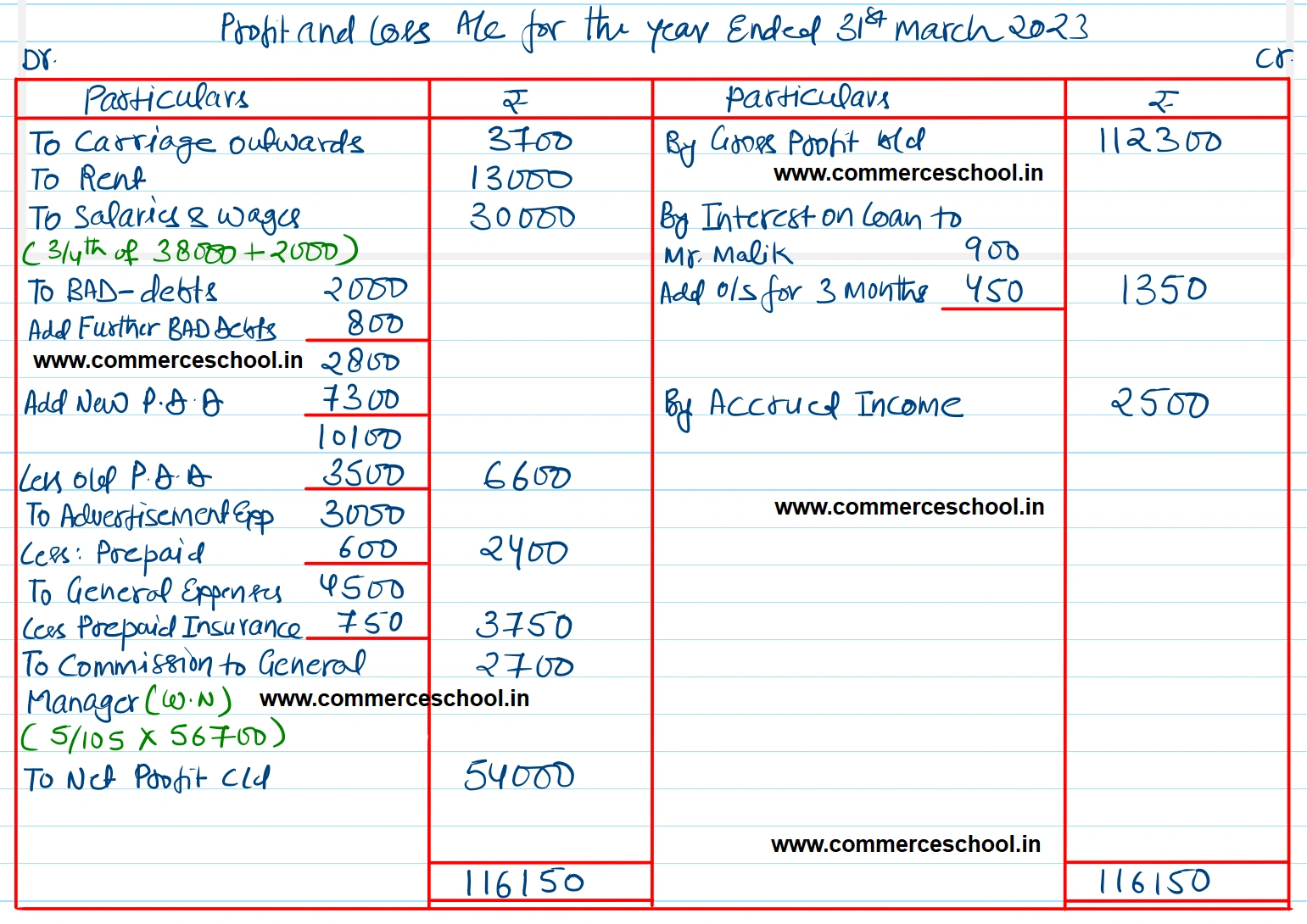

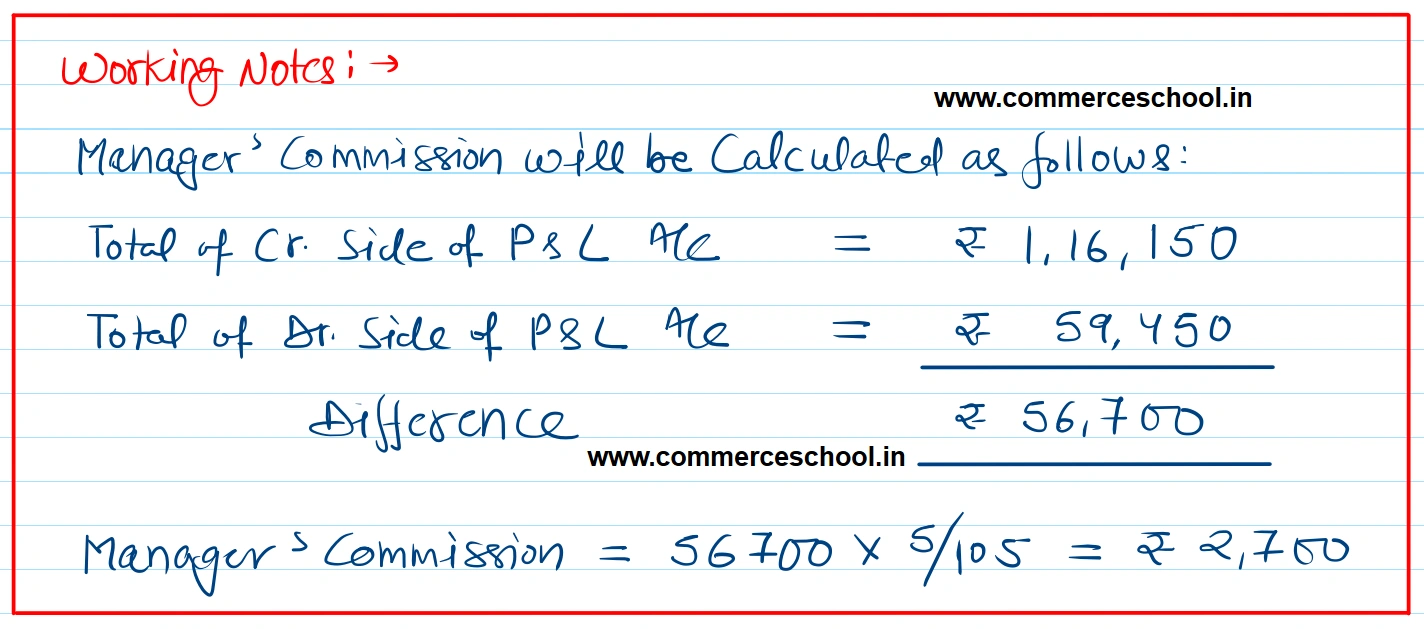

(ii) General Manager is entitled to a Commission of 5% on Net Profits after charging such Commission.

(iii) ₹ 2,000 paid for Salary & Wages have been included in Sundry Debtors.

(iv) Increase Bad-debts by ₹ 800 and create provision for Doubtful Debts at 10%.

(v) General Expenses include insurance premium paid up to 30th June, 2023 @ ₹ 3,000 per annum.

(vi) ₹ 600 out of the Advertisement Expenses are to be carried forward to the next year.

(vii) Charge one-fourth of ‘Salaries and Wages’ to Trading A/c.

(viii) Accrued Income ₹ 2,500.

| Dr. (₹) | Cr. (₹) | |

| Capital | 3,00,000 | |

| Income Tax | 8,000 | |

| Stock on 1-4-2022 | 16,000 | |

| Return Inwards | 5,600 | |

| Carriage Inwards | 8,200 | |

| Deposit with PNB | 15,000 | |

| Return Outwards | 4,100 | |

| Carriage Outwards | 3,700 | |

| Loan to Mar. Malik @ 18% p.a. given on 1-7-2022 | 10,000 | |

| Interest on the above | 900 | |

| Rent | 13,000 | |

| Outstanding Rent | 1,000 | |

| Purchases | 1,48,000 | |

| Debtors | 75,800 | |

| Goodwill | 25,000 | |

| Land and Buildings | 2,00,000 | |

| Furniture | 15,000 | |

| Salaries and Wages | 38,000 | |

| Creditors | 26,200 | |

| Advertisement Expenses | 3,000 | |

| Provision for Doubtful Debts | 3,500 | |

| Bad-Debts | 2,000 | |

| Patents and Patterns | 6,000 | |

| Cash in Hand | 8,900 | |

| Sales | 2,70,000 | |

| General Expenses | 4,500 | |

| 6,05,700 | 6,05,700 |

[Ans. G.P ₹ 1,12,300; N.P. ₹ 54,000; B/s Total ₹ 3,75,900.]