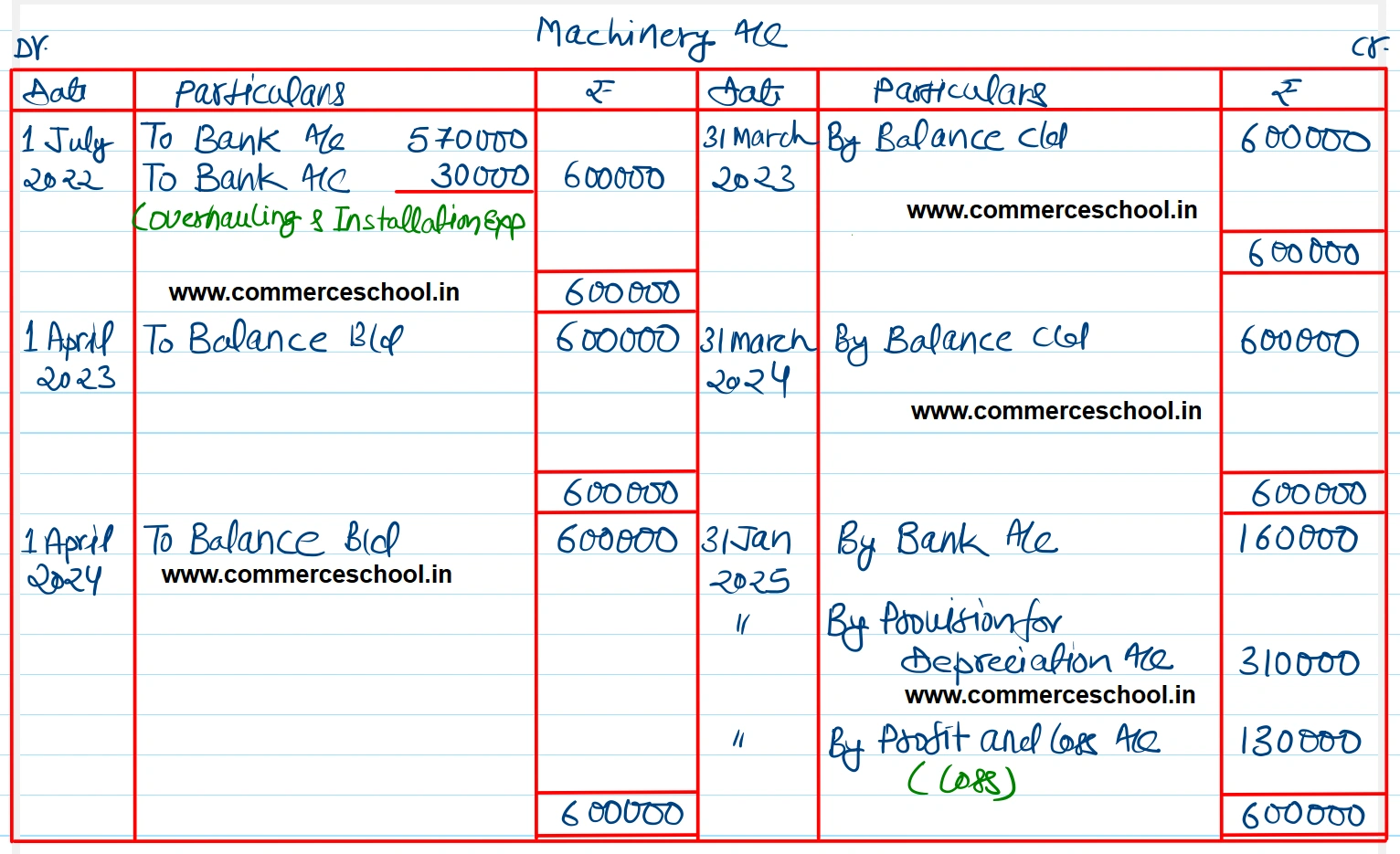

On July 1, 2022 Pushpak Ltd. purchased a machinery for ₹ 5,70,000 and paid ₹ 30,000 for its overhaluing and installation. Depreciation is provided @ 20% p.a

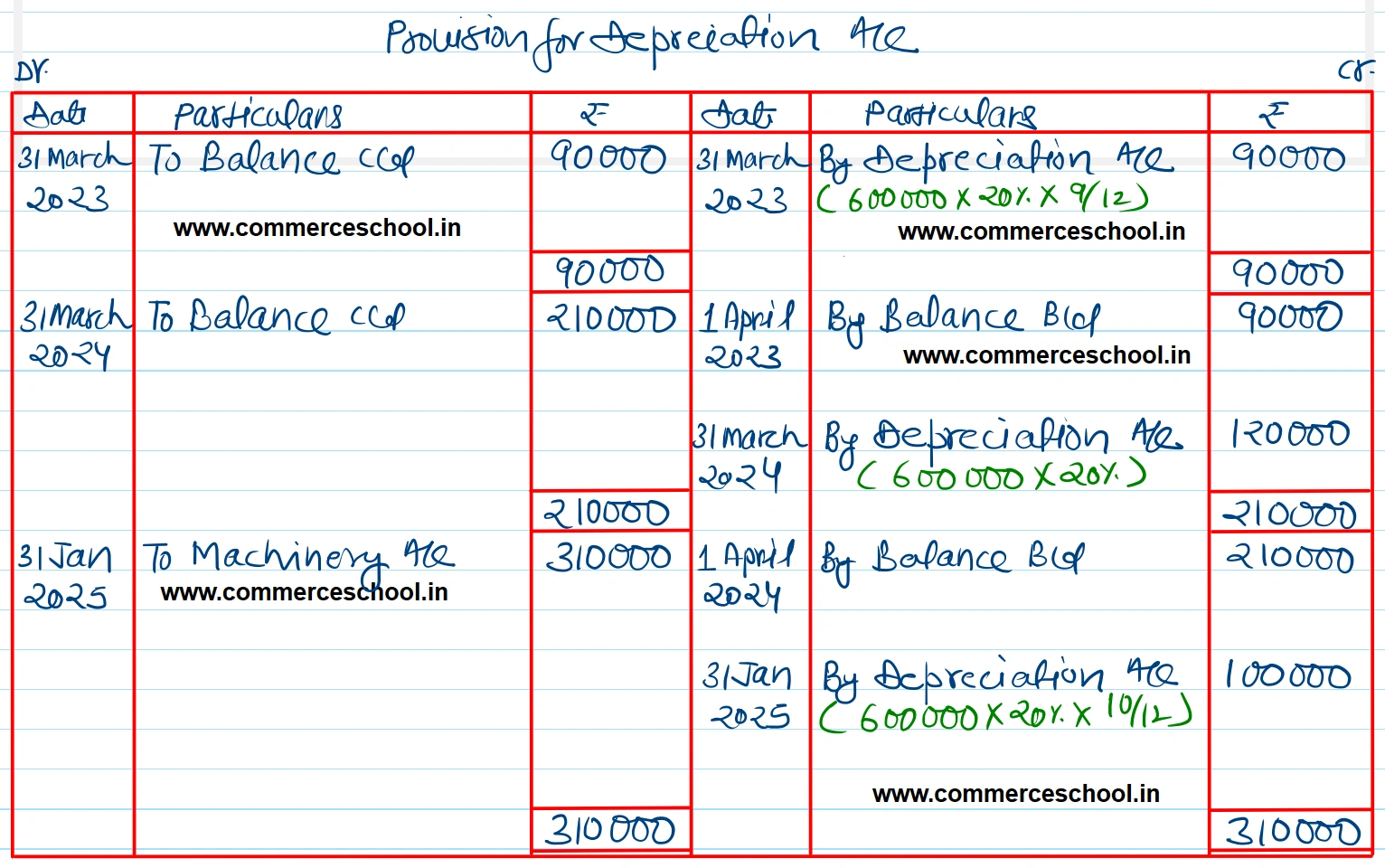

On July 1, 2022 Pushpak Ltd. purchased a machinery for ₹ 5,70,000 and paid ₹ 30,000 for its overhaluing and installation. Depreciation is provided @ 20% p.a. on Origianl Cost Method and the books are closed on 31st March every year. The machine was sold on 31st January 2025 for a sum of ₹ 1,60,000. You are required to show the Machinery Account and Provision for Depreciation Account for three years.

[Ans. Loss on sale of Machinery ₹ 1,30,000.]

Anurag Pathak Answered question