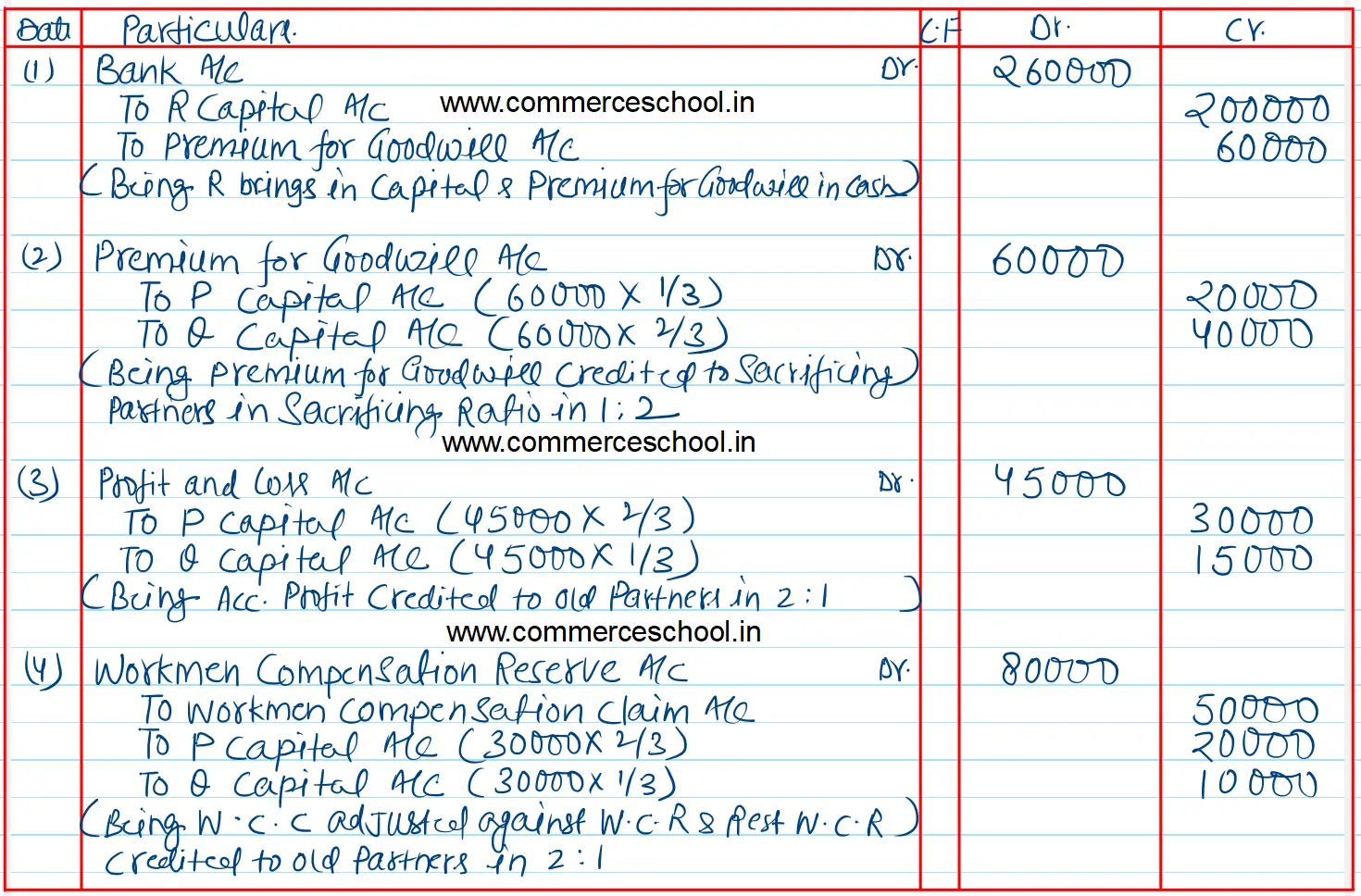

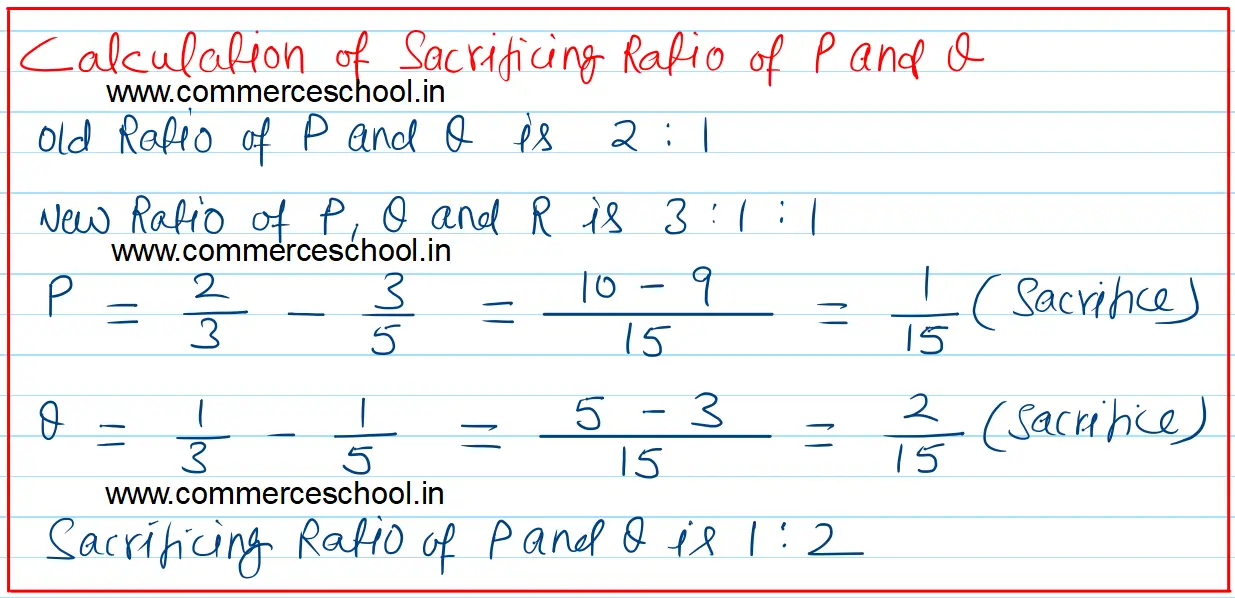

P and Q were partners sharing profits in the ratio of 2 : 1. On 1st April, 2023, they admitted R as a new partner and the new profit sharing ratio of P, Q and R is agreed at 3 : 1 : 1. R brought in ₹ 2,00,000 as his capital and ₹ 60,000 as his share of premium for goodwill

P and Q were partners sharing profits in the ratio of 2 : 1. On 1st April, 2023, they admitted R as a new partner and the new profit sharing ratio of P, Q and R is agreed at 3 : 1 : 1. R brought in ₹ 2,00,000 as his capital and ₹ 60,000 as his share of premium for goodwill.

On the date of R’s admission, the Balance Sheet of P and Q showed a credit balance of ₹ 45,000 in Profit and Loss A/c and Workmen Compensation Reserve of ₹ 80,000. It was agreed that there was a claim of Workmen Compensation for ₹ 50,000.

Pass necessary Journal entries on R’s admission.

[Ans. (i) Surplus Workmen Compensation Reserve ₹ 30,000 credited to P and Q in 2 : 1. (ii) Premium for Goodwill credited to P and Q in 1 : 2.

Anurag Pathak Answered question