P, Q and R are in partnership sharing profits and losses in the ratio of 5 : 4 : 3. On 31st March 2023, their balance sheet was as follows:

P, Q and R are in partnership sharing profits and losses in the ratio of 5 : 4 : 3. On 31st March 2023, their balance sheet was as follows:

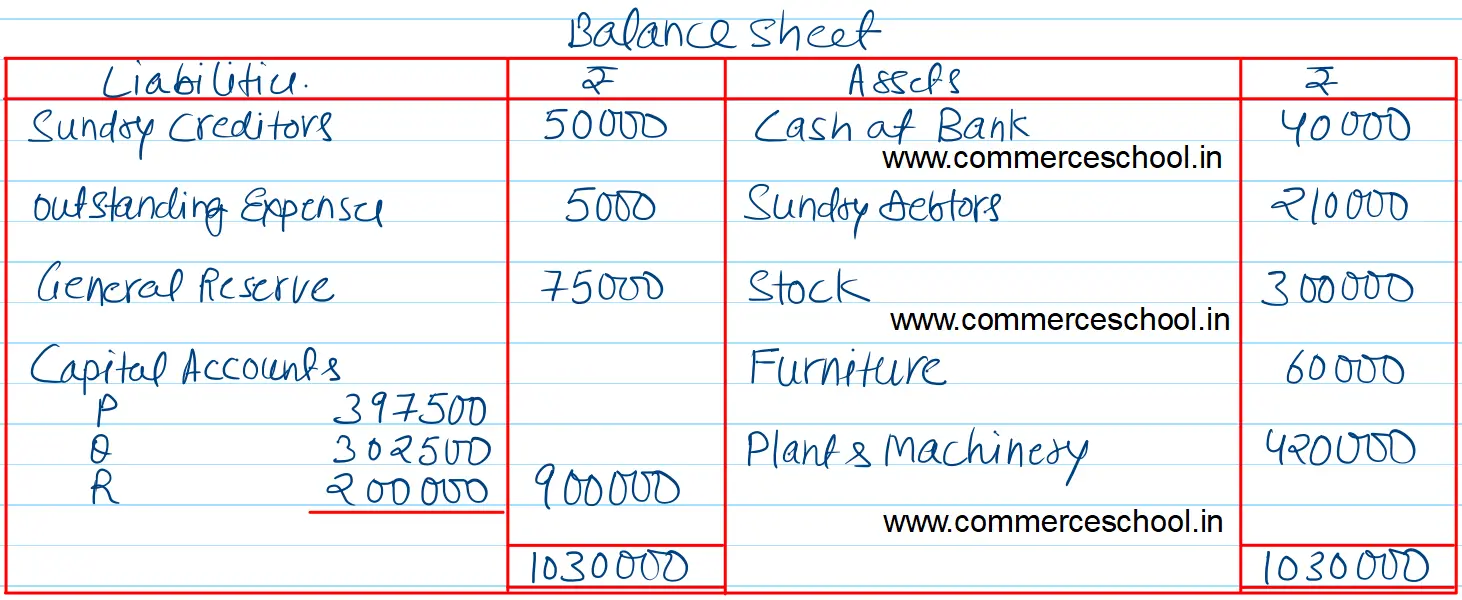

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 50,000 | Cash at Bank | 40,000 |

| Outstanding Expenses | 5,000 | Sundry Debtors | 2,10,000 |

| General Reserve | 75,000 | Stock | 3,00,000 |

| Capital Accounts: P Q R | 4,00,000 3,00,000 2,00,000 | Furniture | 60,000 |

| Plant & Machinery | 4,20,000 | ||

| 10,30,000 | 10,30,000 |

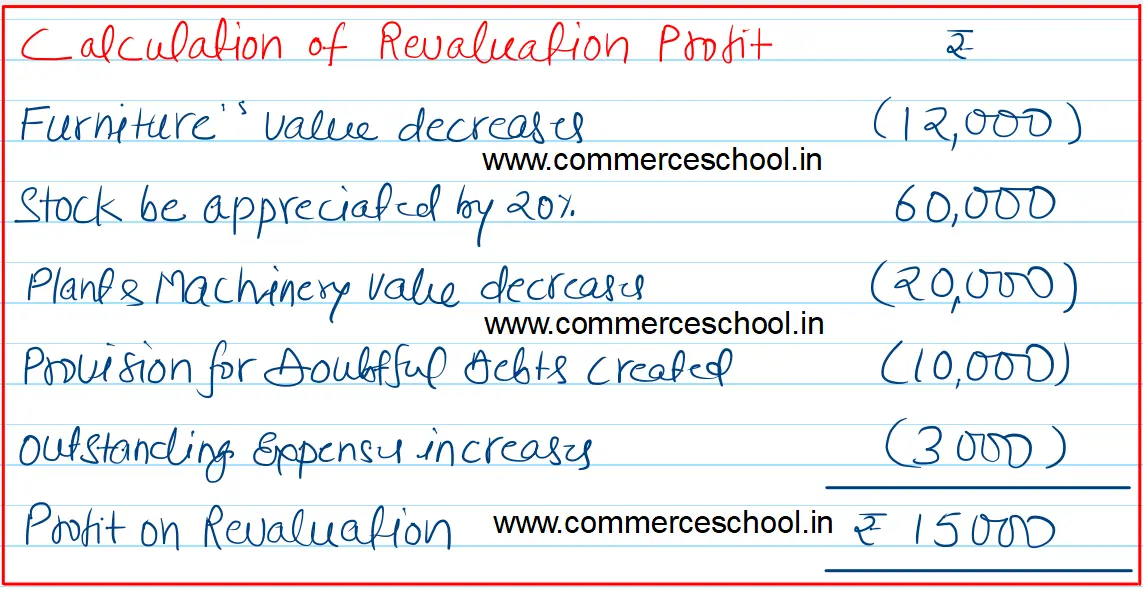

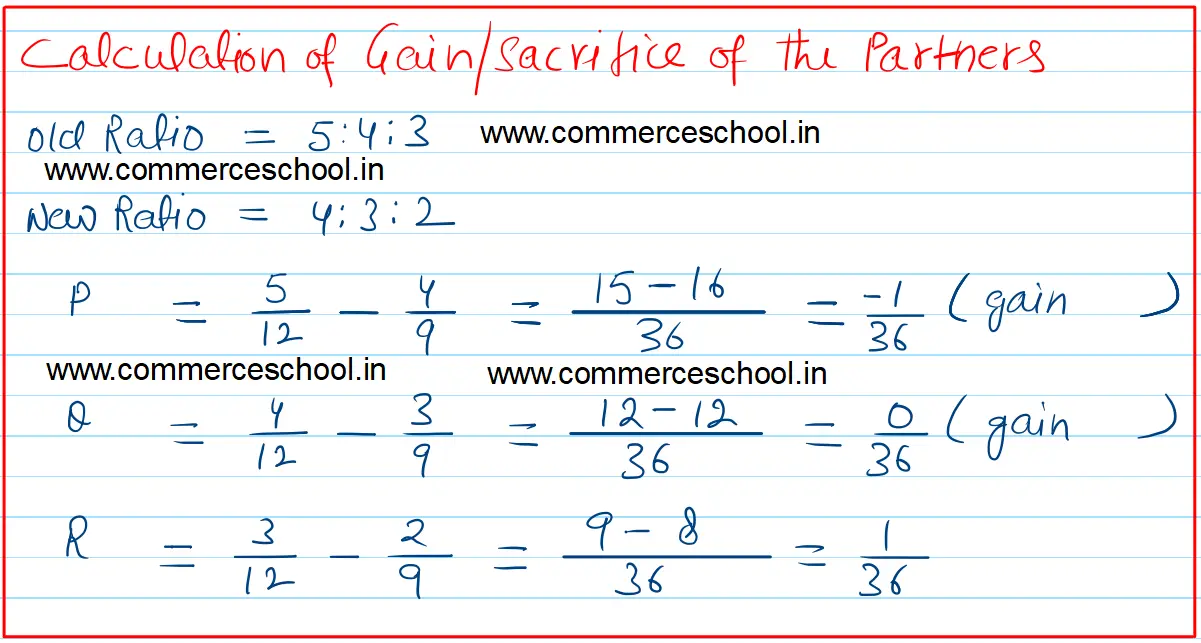

It was decided that with effect from 1st April 2023, the profit sharing ratio will be 4 : 3 : 2. For this purpose the following revaluation were made:

(i) Furniture be taken at 80% of its value.

(ii) Stock be appreciated by 20%.

(iii) Plant & Machinery be valued at ₹ 4,00,000.

(iv) Create provision for doubtful debts for ₹ 10,000 on debtors.

(v) Outstanding expenses be increased by ₹ 3,000.

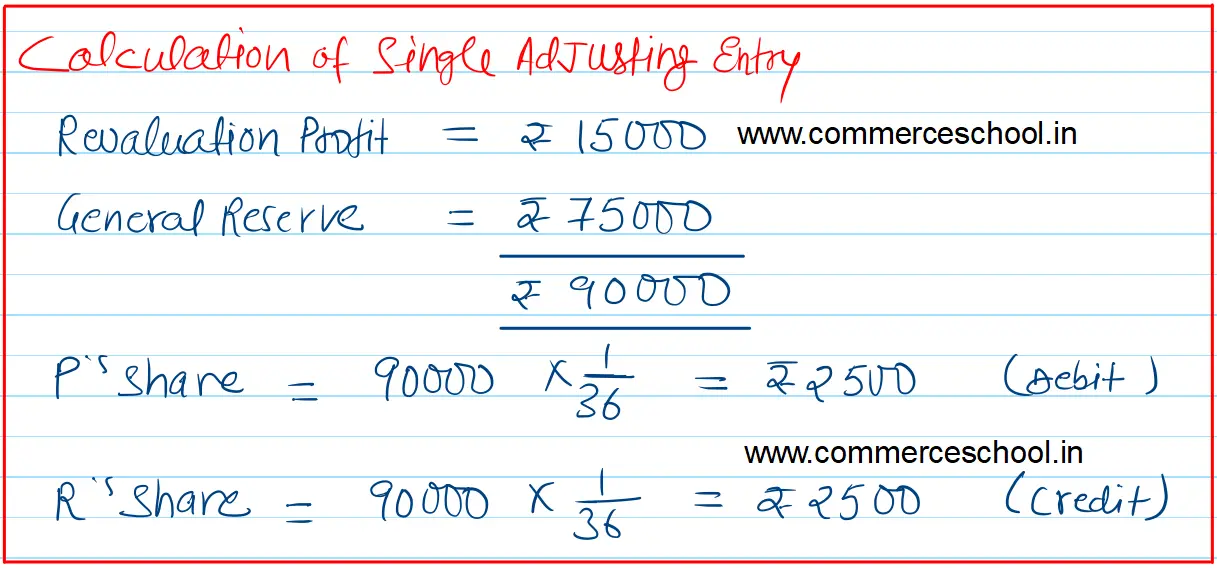

Partners agreed that altered values are not to be recorded in the books and they also do not want to distribute the general reserve.

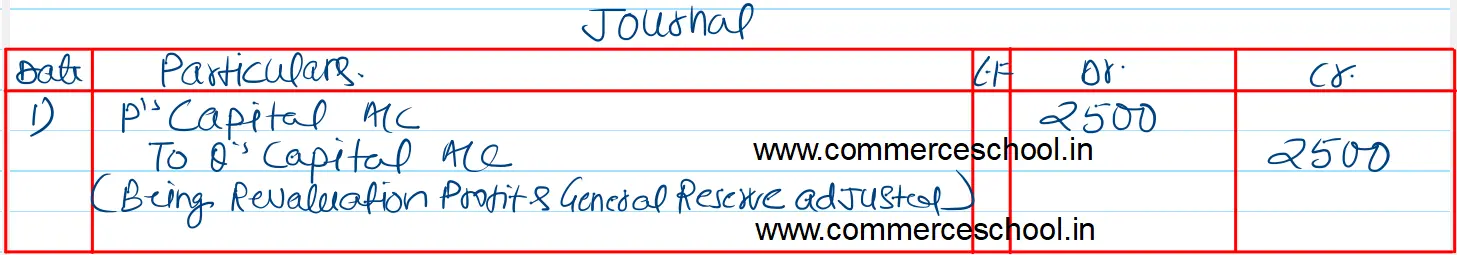

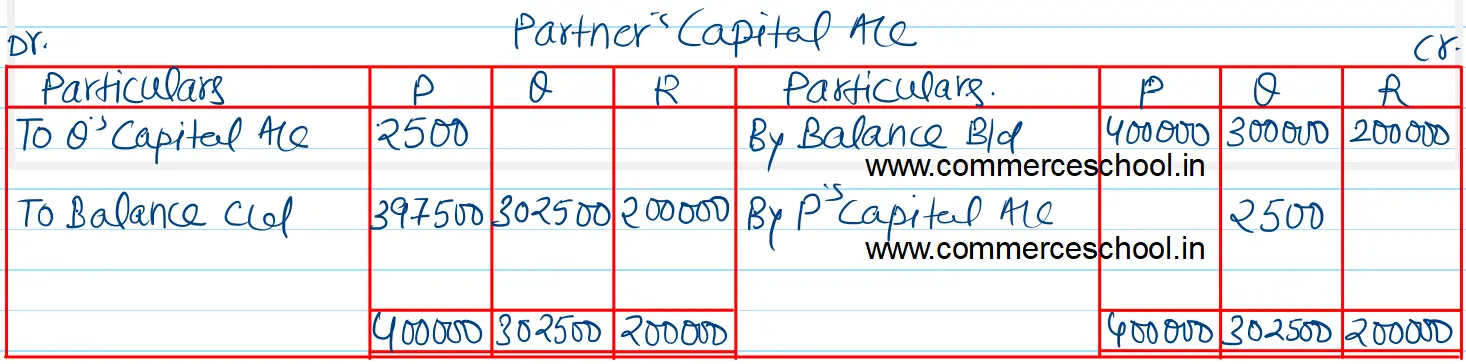

You are required to post a single journal entry to give effect to the above. Also prepare the revised Balance Sheet.

[Ans. Profit on Revaluation ₹ 15,000. Adjustment for Revaluation and General Reserve : Debit P by ₹ 2,500 and Credit R by ₹ 2,500. Balance Sheet Total ₹ 10,30,000.]