P, Q and R are partners in a firm. Q retires and his claim including his capital and his share of goodwill is ₹ 8,00,000. There was an unrecorded furniture valued at ₹ 60,000

P, Q and R are partners in a firm. Q retires and his claim including his capital and his share of goodwill is ₹ 8,00,000. There was an unrecorded furniture valued at ₹ 60,000, three-fourth of which was given to an unrecorded creditor of ₹ 1,00,000 in settlement of his claim of ₹ 70,000 and remaining one-fourth was given to Q at ₹ 12,000 in part settlement of his claim. Balance of Q’s claim was discharged by cheque.

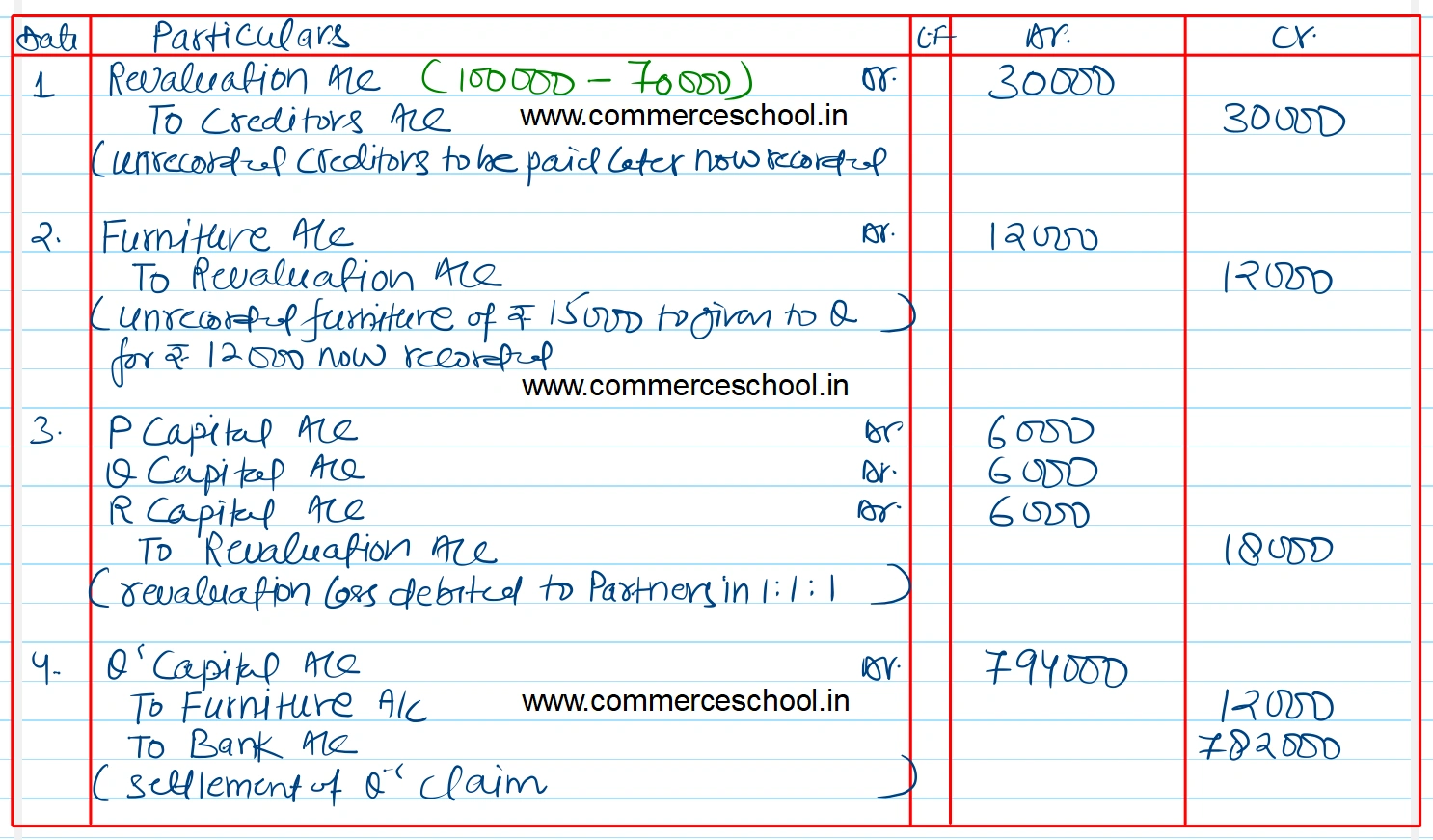

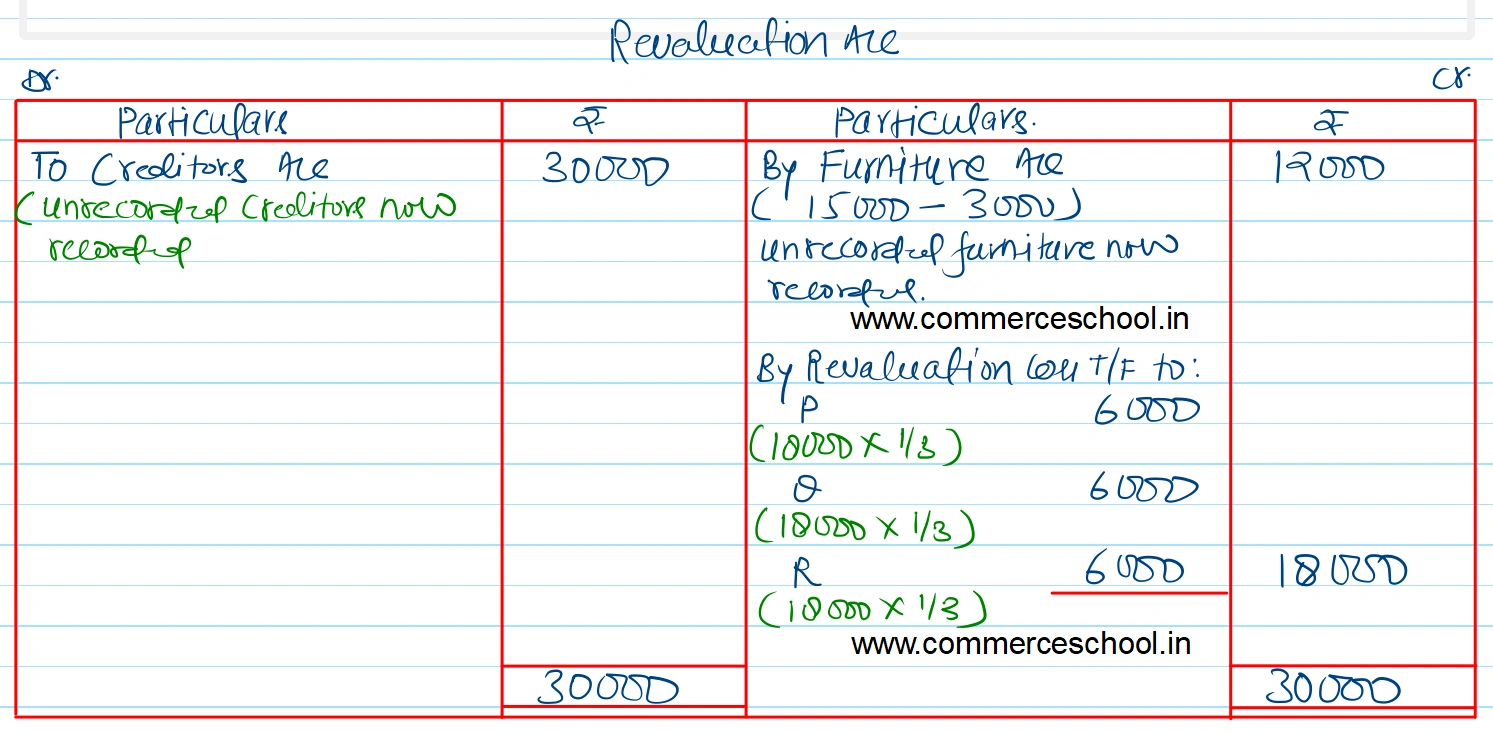

[Ans. Loss on Revaluation ₹ 18,000; For payment to Q;

Q’s Capital A/c Dr. 7,94,000

To Furniture A/c 12,000

To Bank A/c 7,82,000

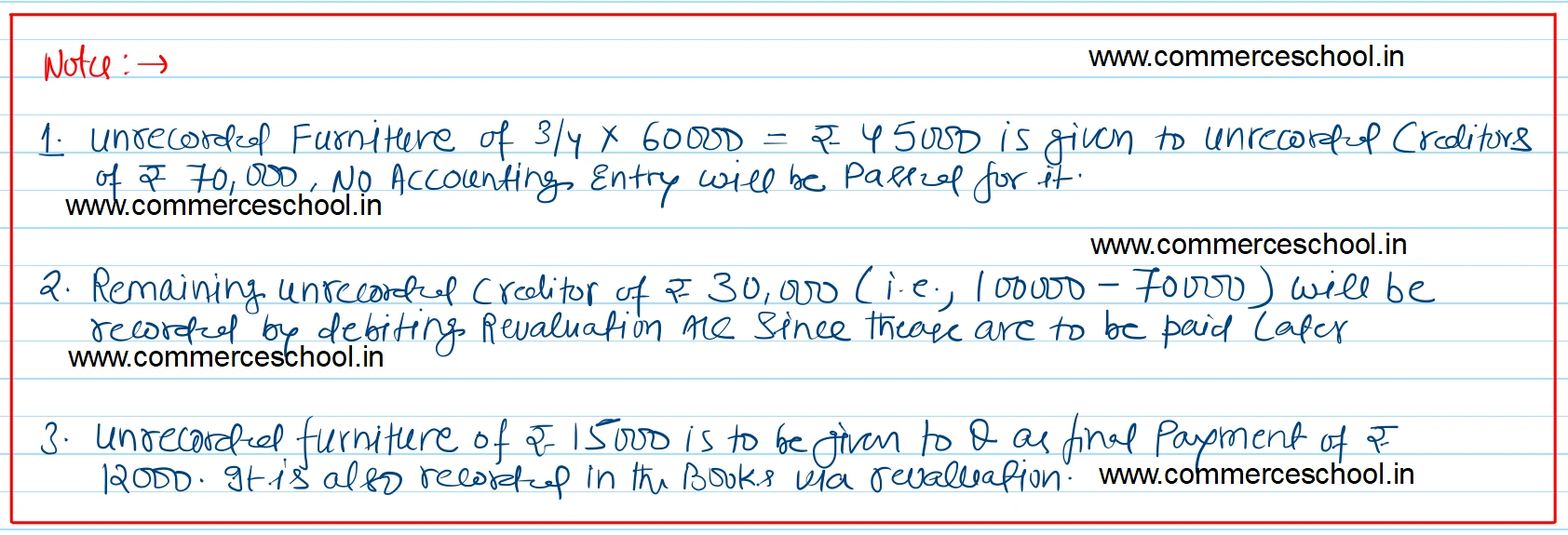

Hints:

(i) Unrecorded furniture of ₹ 45,000 is given to unrecorded creditor of ₹ 70,000. No accounting entry will be passed for it.

(ii) Unrecorded creditors of ₹ 30,000 will be recorded by debiting Revaluation A/c