P, Q and R share profits in the ratio of 5 : 3 : 2. S was admitted into partnership. S brings in ₹ 30,000 as his capital. S is entitled for 1/5th share in profits which he acquires equally from P, Q and R. Goodwill of the firm is to be valued at three year’s purchase of last four years’ average profits

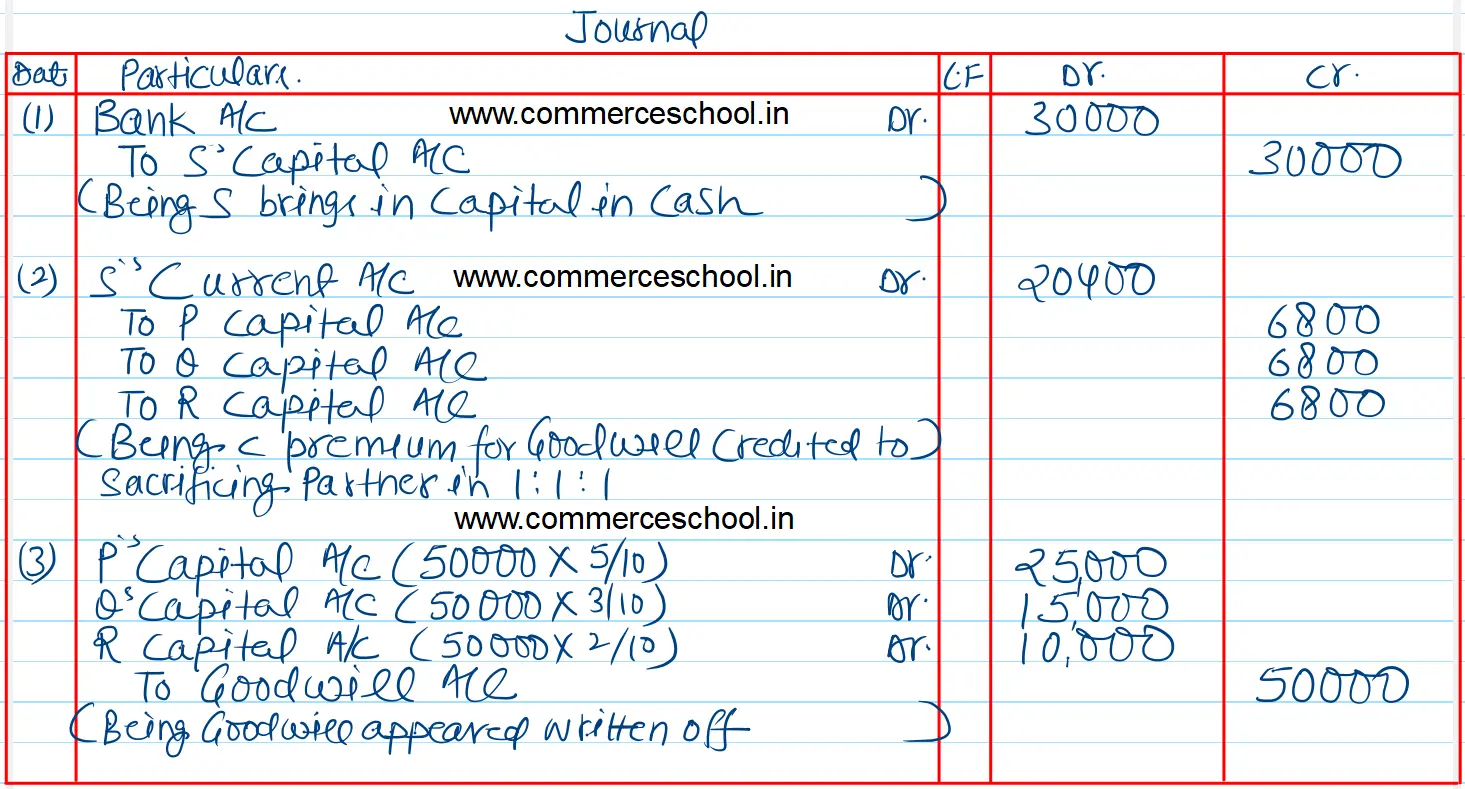

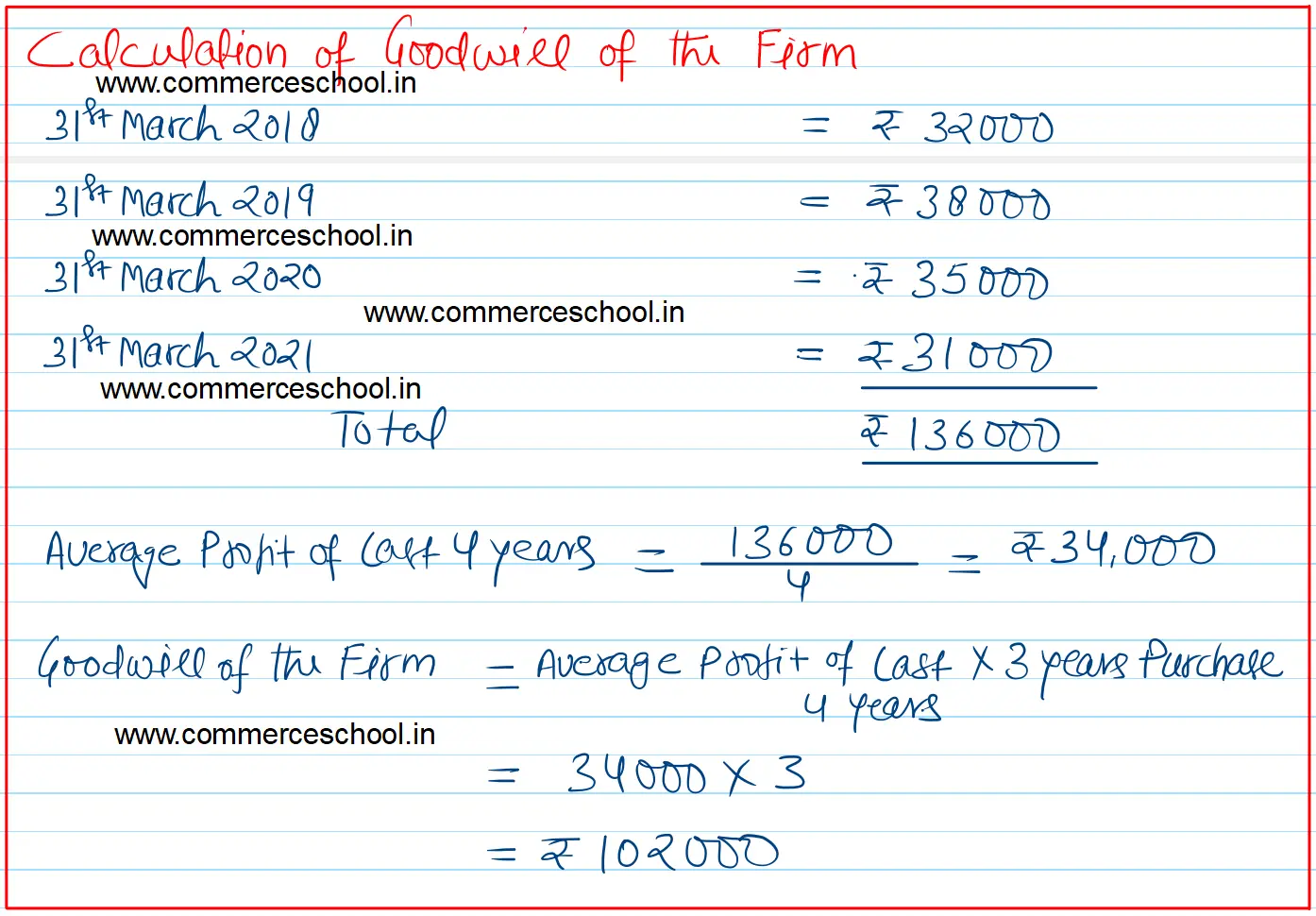

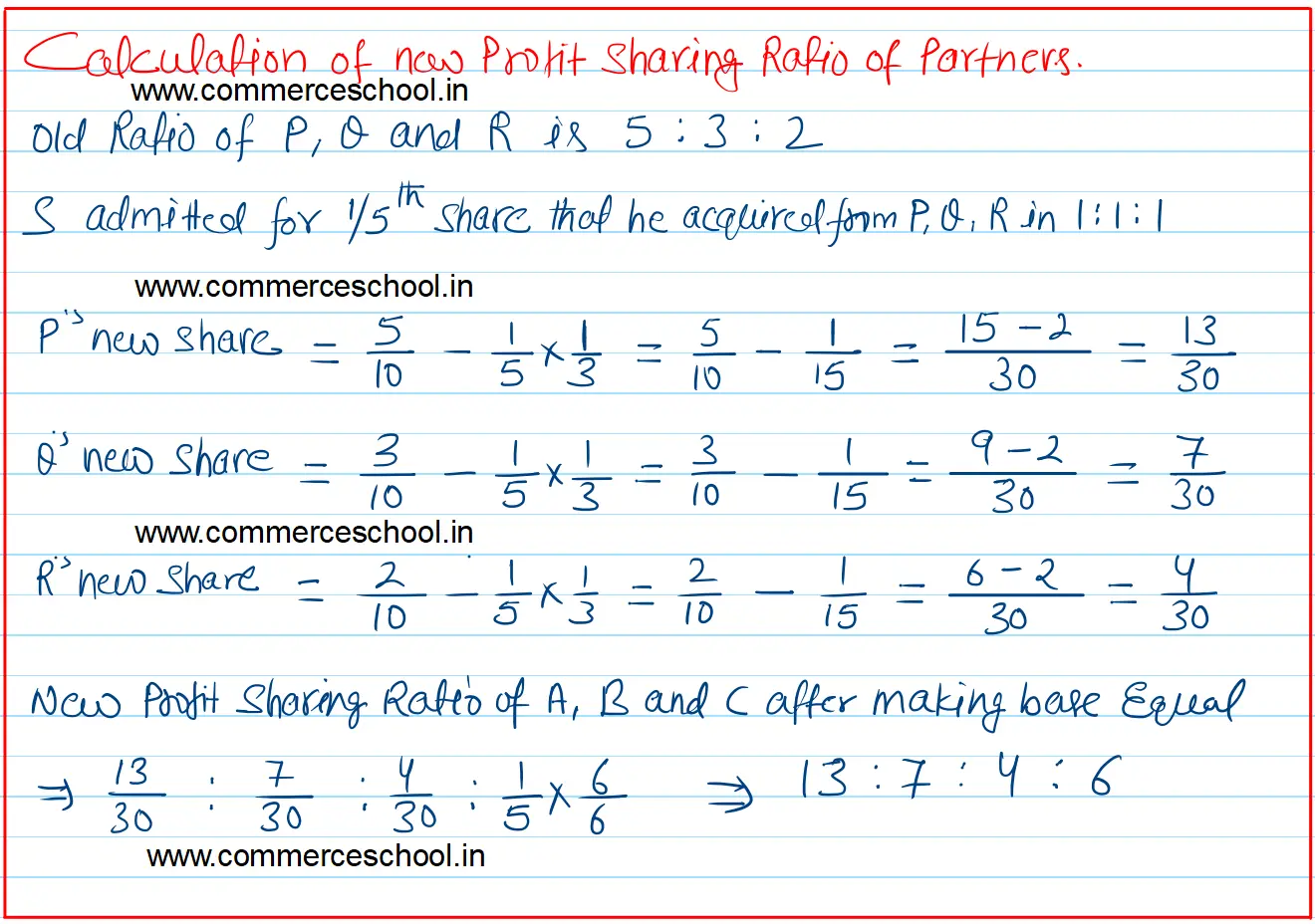

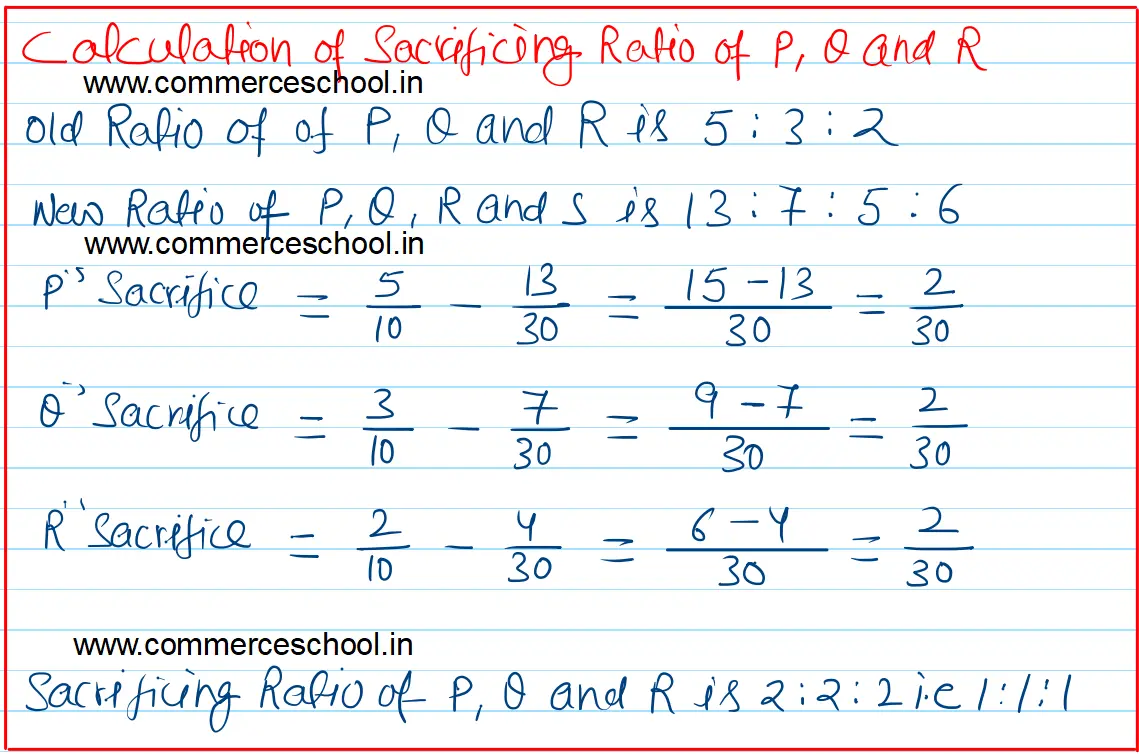

P, Q and R share profits in the ratio of 5 : 3 : 2. S was admitted into partnership. S brings in ₹ 30,000 as his capital. S is entitled for 1/5th share in profits which he acquires equally from P, Q and R. Goodwill of the firm is to be valued at three year’s purchase of last four years’ average profits. The profits of the last four year’s are ₹ 32,000, ₹ 38,000, ₹ 35,000 and ₹ 31,000 respectively. S can not bring goodwill in cash. Goodwill already appears in the books at ₹ 50,000. Give Journal entries.

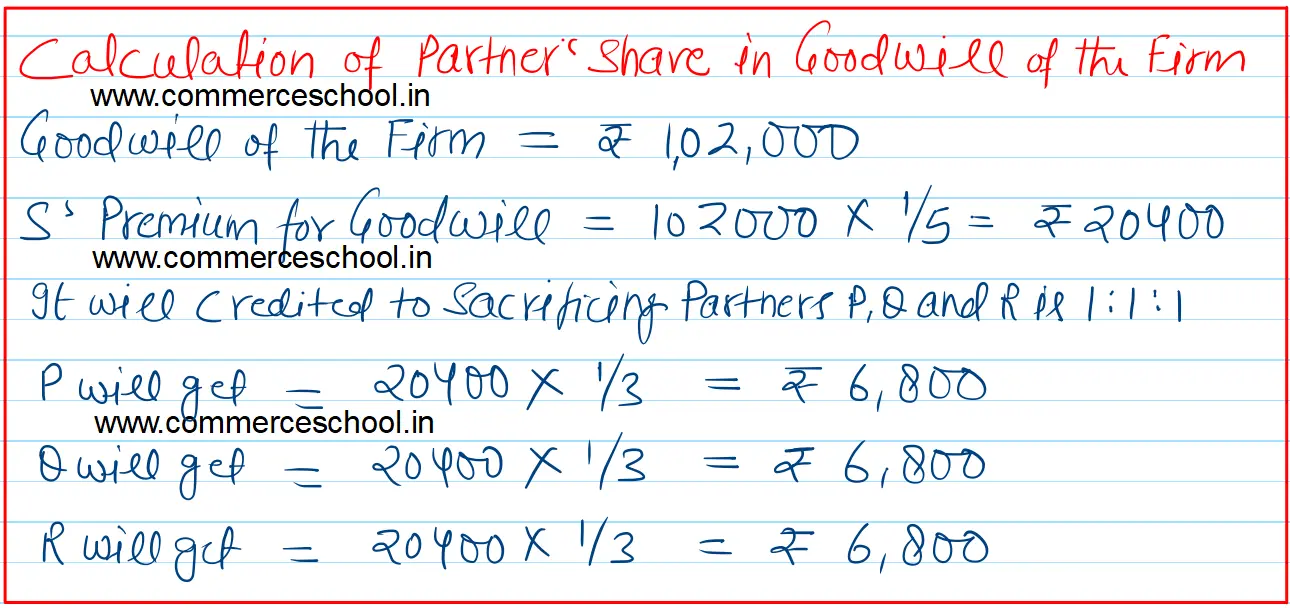

[Ans. Existing Goodwill of ₹ 50,000 will be written off among P, Q and R in 5 : 3 : 2. Current A/c of S will be debited by his share of goodwill ₹ 20,400 and Capital Accounts of P, Q and R will be credited in equal proportion.]