P, Q and R were partners in a firm sharing profits in the ratio of 5 : 6 : 9. On 31.3.2023, their Balance Sheet was as follows:

P, Q and R were partners in a firm sharing profits in the ratio of 5 : 6 : 9. On 31.3.2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 30,000 | Cash | 10,000 |

| Bills Payable | 40,000 | Bank | 80,000 |

| General Reserve | 60,000 | Stock | 40,000 |

| Capitals: P Q R | 1,30,000 2,00,000 4,00,000 | Debtors | 70,000 |

| Building | 2,00,000 | ||

| Land | 3,00,000 | ||

| Profit and Loss A/c | 1,60,000 | ||

| 8,60,000 | 8,60,000 |

R died on 30th April, 2023. The partnership deed provided for the following on the death of a partner:

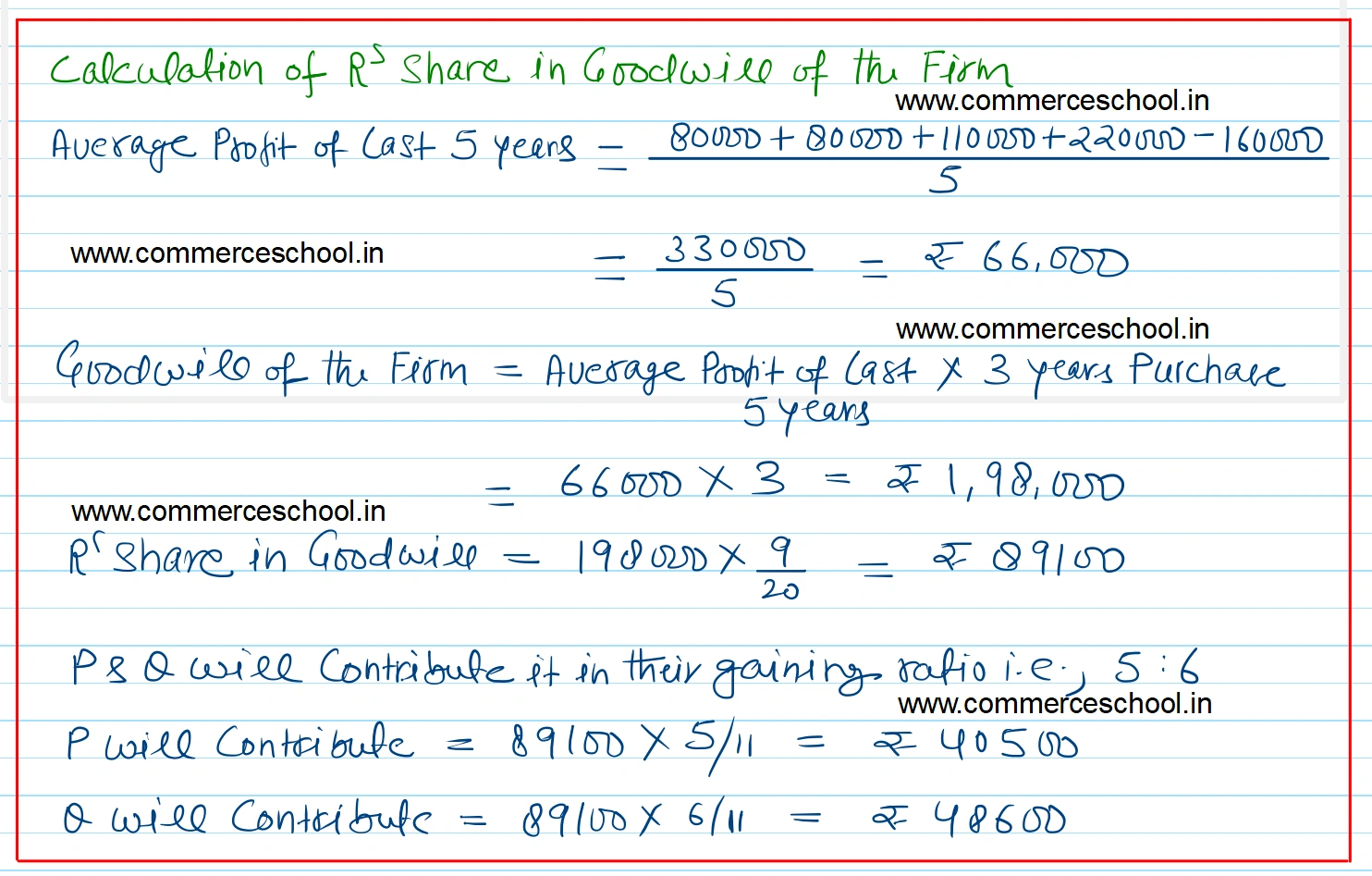

(i) Goodwill of the firm was to be valued at 3 year’s purchase of the average profits of the last 5 years. The profits for the years ending 31-3-2022, 31-3-2021, 31-3-2020 and 31-3-2019 were ₹ 80,000; ₹ 80,000; ₹ 1,10,000 and ₹ 2,20,000 respectively.

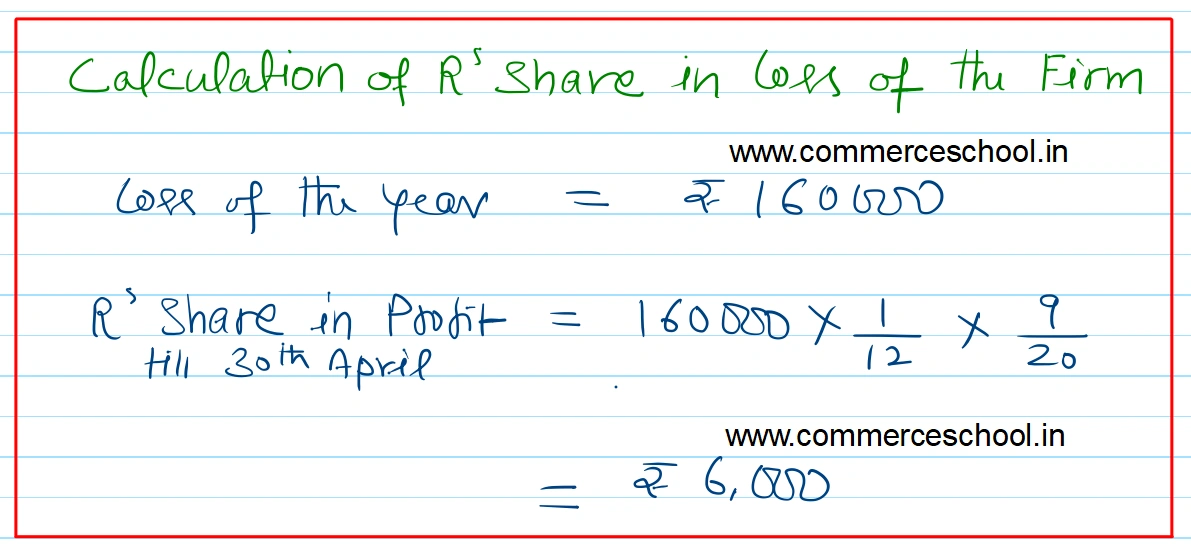

(ii) R’s share of profit or loss till the date of his death was to be calculated on the basis of the profit or loss for the year ending 31-3-2023.

You are required to calculate the following:

(i) Goodwill of the firm and R’s share of goodwill at the time of his death.

(ii) R’s share in the profit or loss of the firm till the date of his death.

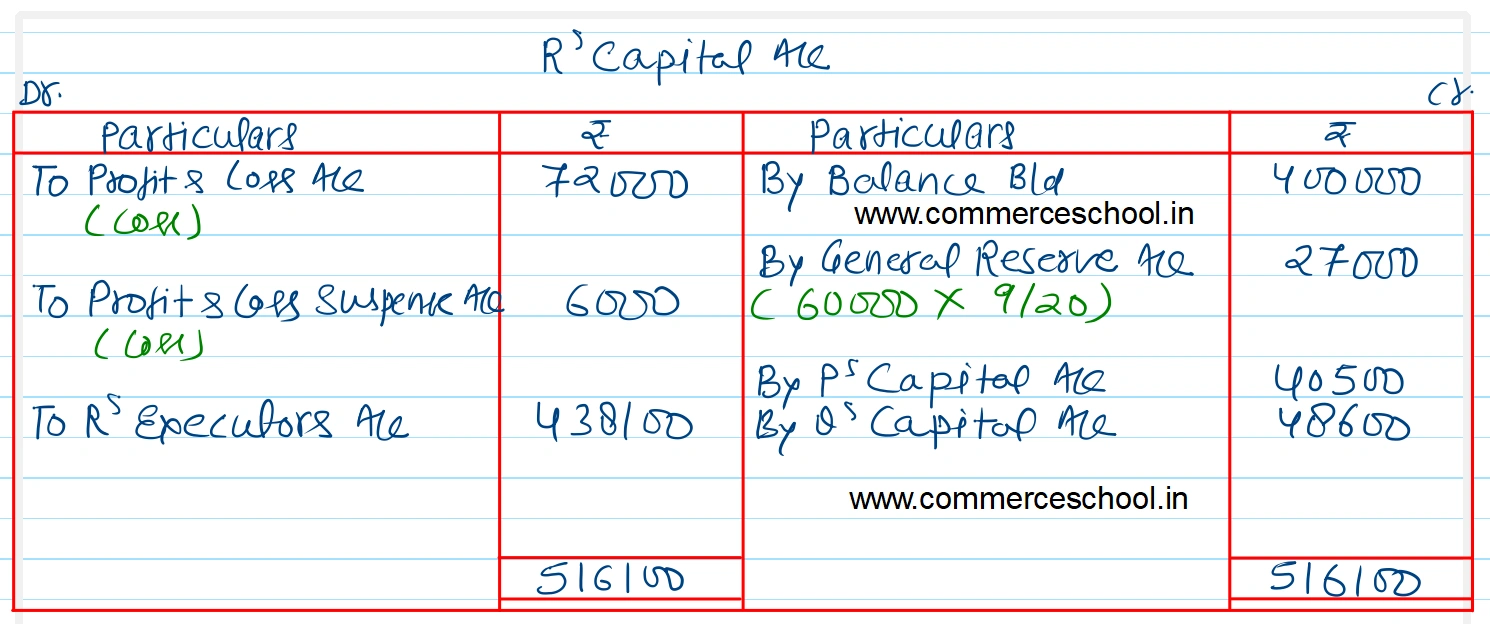

Prepare R’s Capital Account also at the time of his death to be presented to his executors.

[Ans. R’s share of goodwill ₹ 89,100; R’s share in loss (for one month) ₹ 6,000; Amount due ot R’s Executors ₹ 4,38,100.]