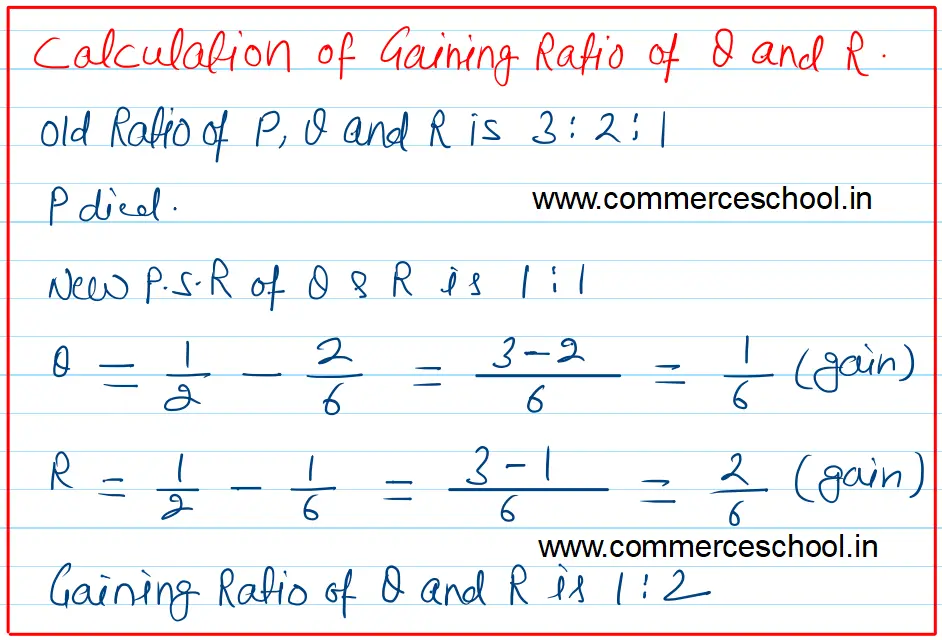

P, Q and R were partners in a firm sharing profits in the ratio of 3 : 2 : 1. P dies and the new profit sharing ratio of Q and R was agreed to be equal

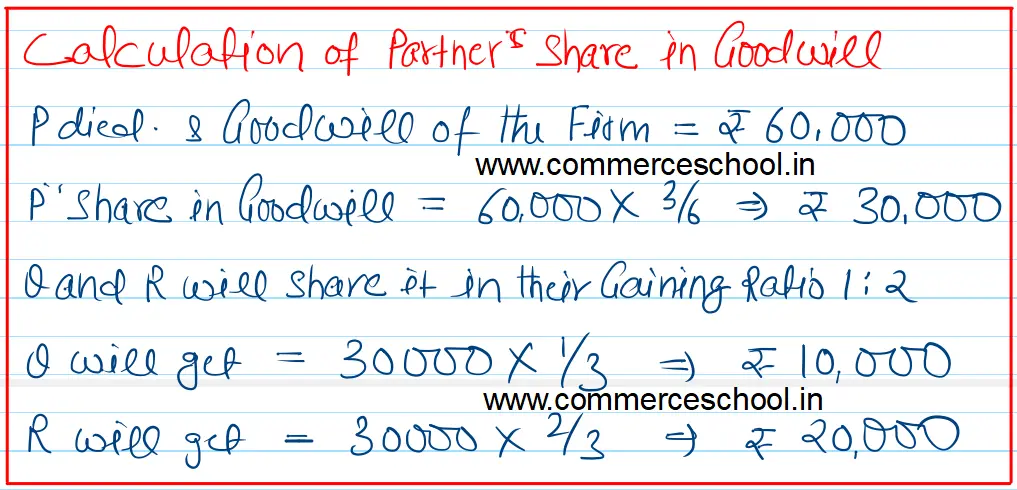

P, Q and R were partners in a firm sharing profits in the ratio of 3 : 2 : 1. P dies and the new profit sharing ratio of Q and R was agreed to be equal. On P’s death, goodwill of the firm was valued at ₹ 60,000.

Pass the necessary entries for the treatment of goodwill under the following conditions:

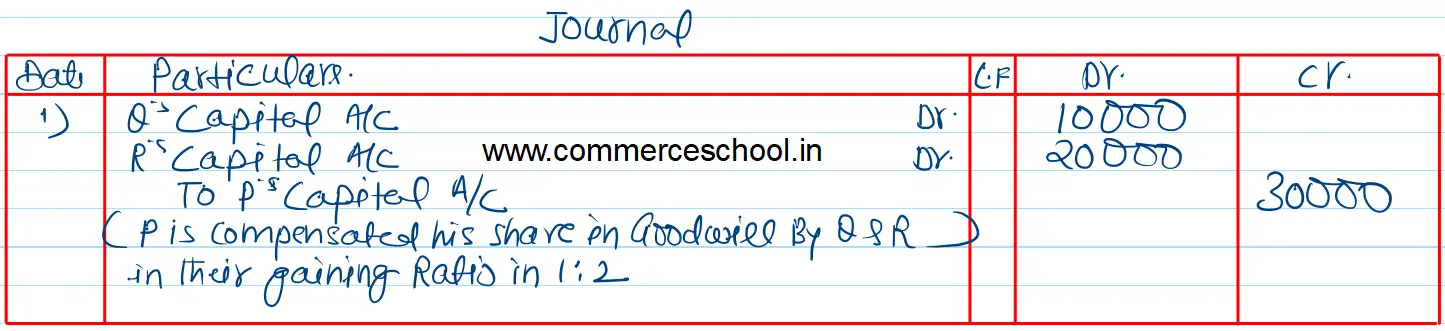

(a) When Goodwill does not exist in the books of account; and

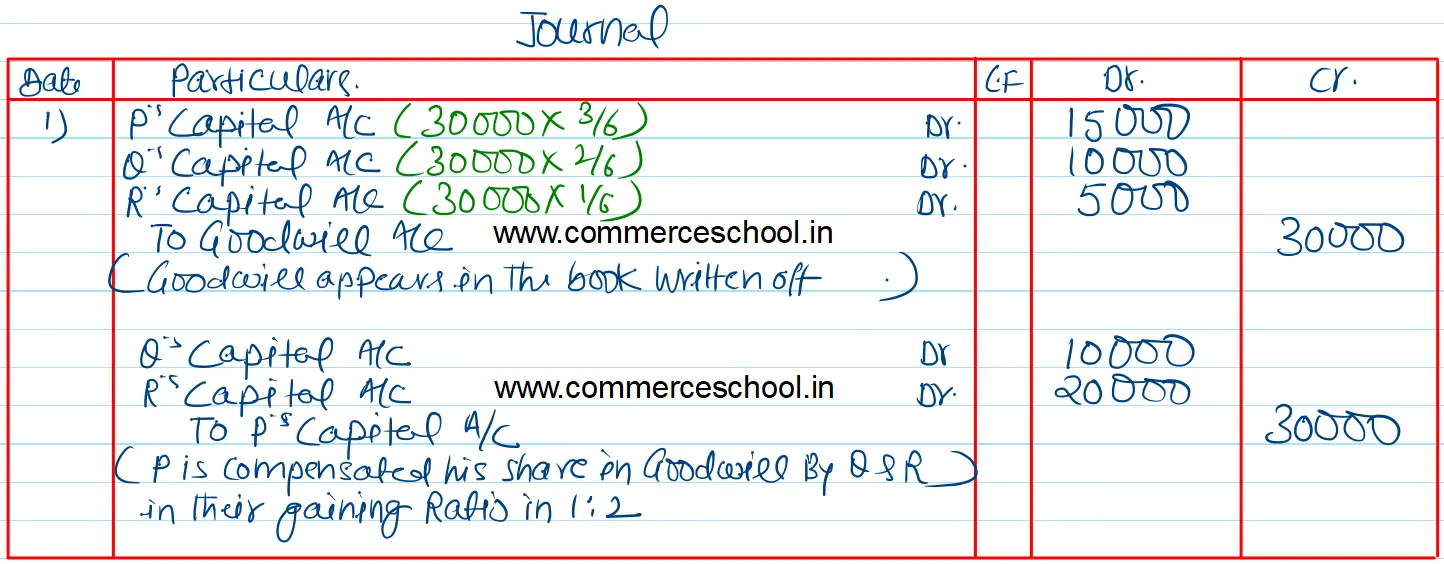

(b) When Goodwill exists in the books of account at ₹ 30,000.

[Ans.: (a) Dr. Q’s Capital A/c by ₹ 10,000; R’s Capital A/c by ₹ 20,000 and Cr. P’s Capital A/c by ₹ 30,000;

(b) (I) Dr. P’s Capital A/c by ₹ 15,000; Q’s Capital A/c by ₹ 10,000; and R’s Capital A/c by ₹ 5,000; Cr. Goodwill A/c by ₹ 30,000;

(ii) Dr. Q’s Capital A/c by ₹ 10,000; R’s Capital A/c by ₹ 20,000 and Cr. P’s Capital A/c by ₹ 30,000.]