P, Q and R were partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. As at 31st March, 2022 the Balance Sheet of the firm stood as follows:

P, Q and R were partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. As at 31st March, 2022 the Balance Sheet of the firm stood as follows:

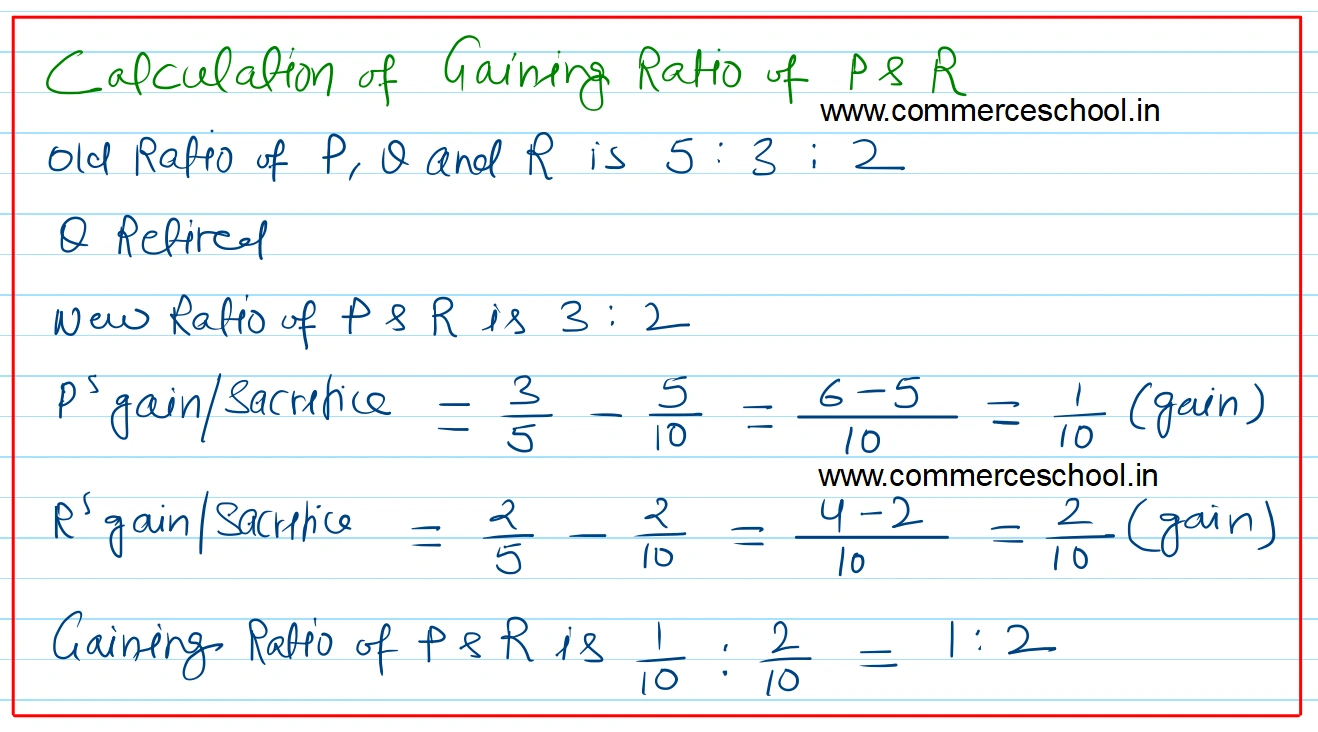

On this date Q decided to retire and for this purpose:

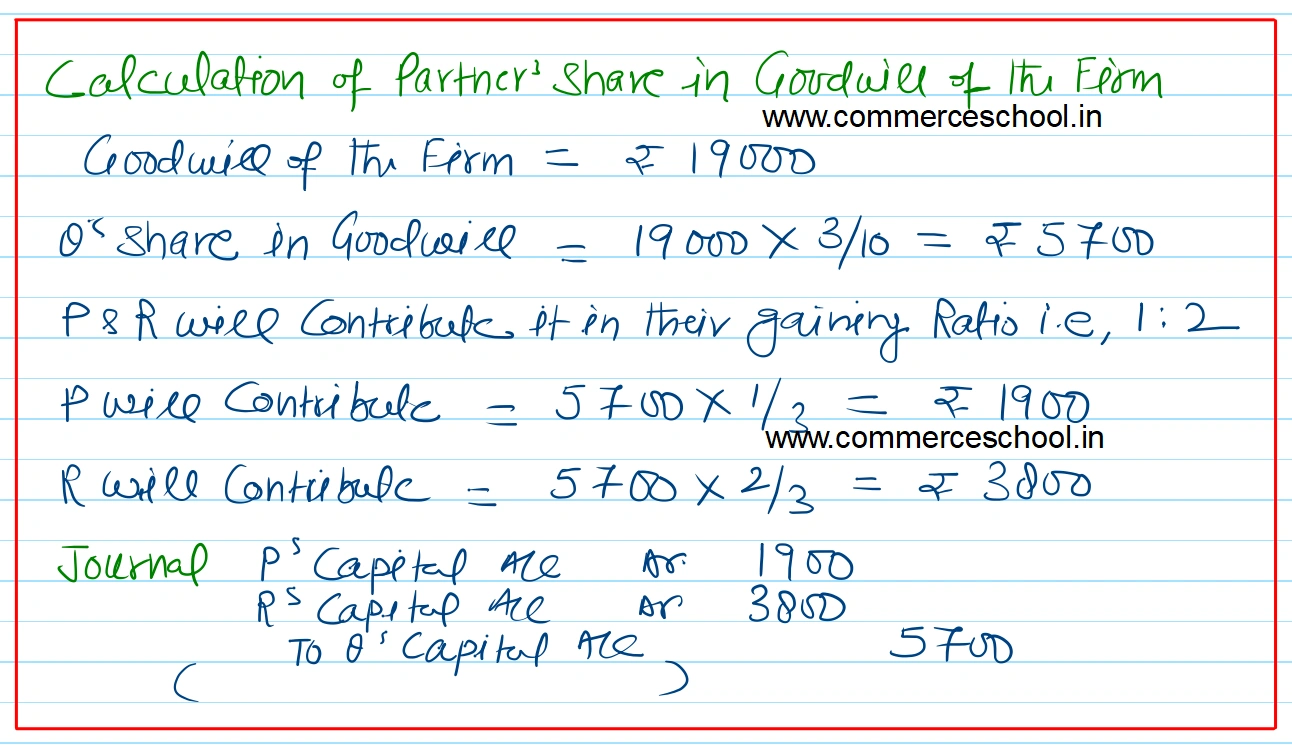

(a) Goodwil was valued at ₹ 19,000.

(b) Fixed Assets were valued at ₹ 30,000;

(c) Stock was considered as worth ₹ 10,000.

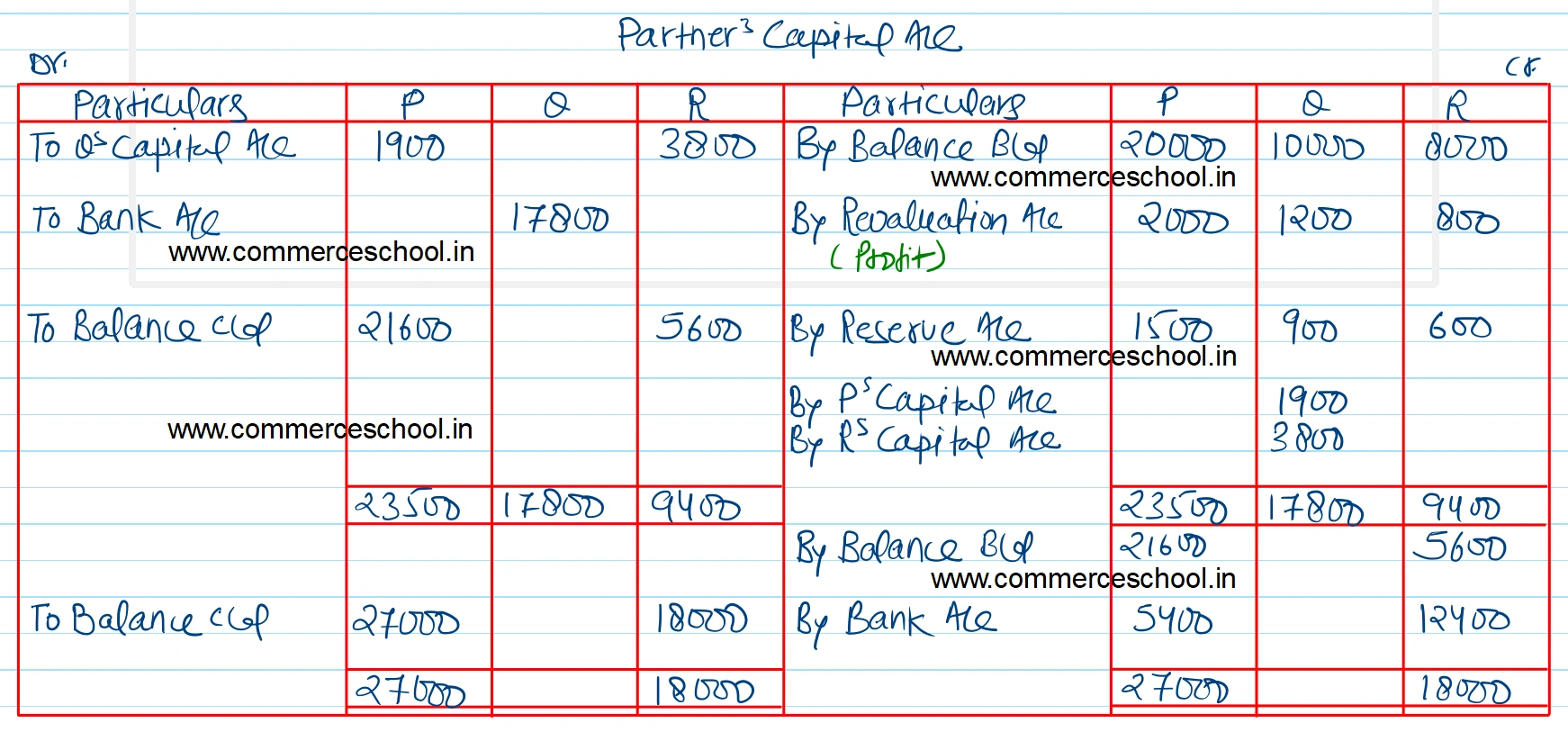

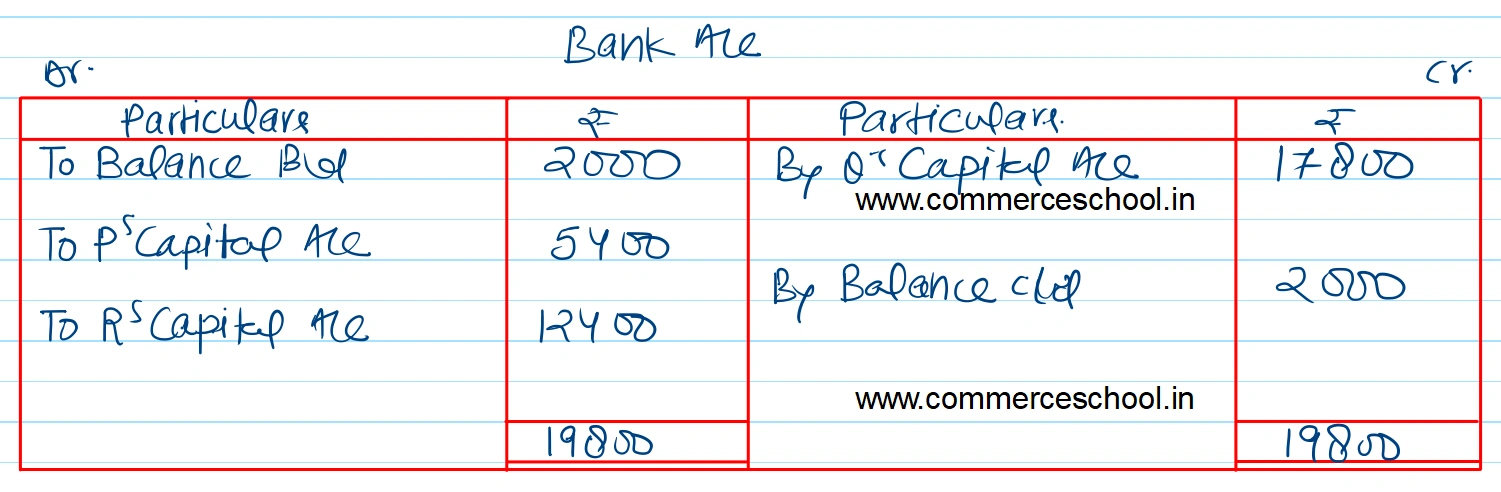

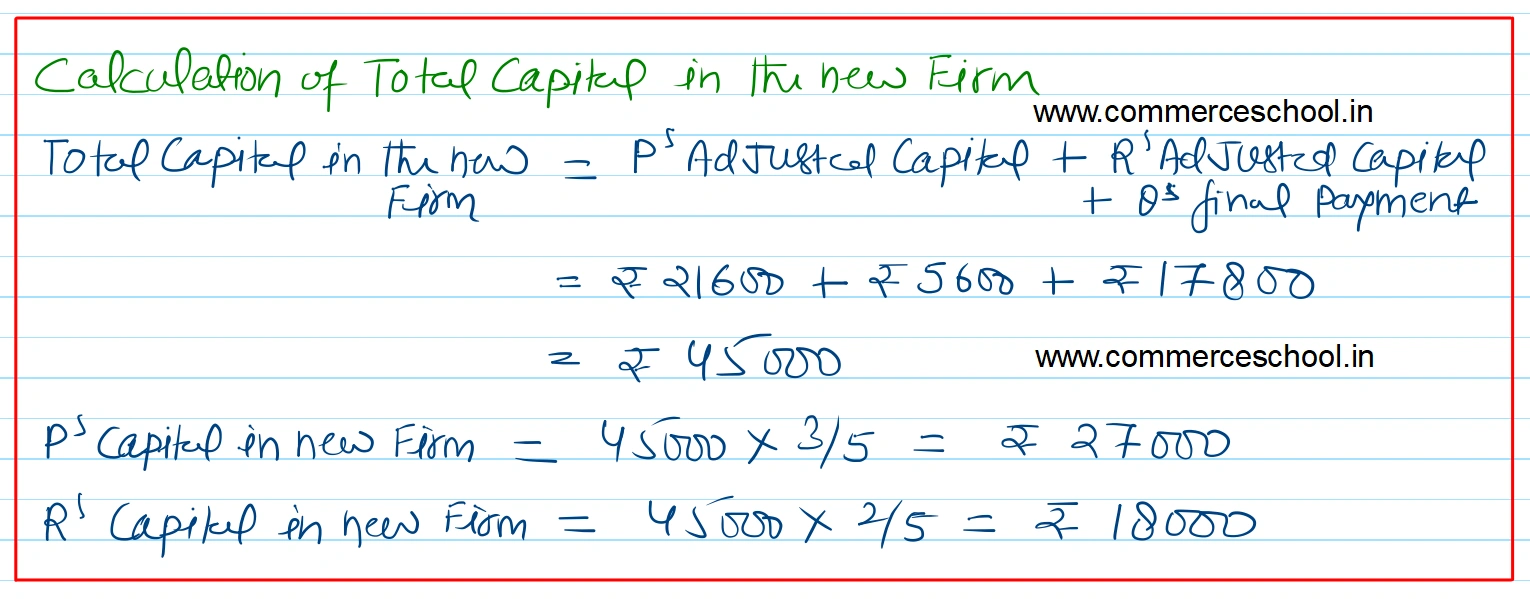

Q was to be paid through cash, brought in by P and R, in such a way as to make their capitals proportionate to their new profit sharing ratio which was to be P 3/5 and R 2/5.

Record these matters in the journal of the firm and prepare the resultant Balance Sheet.

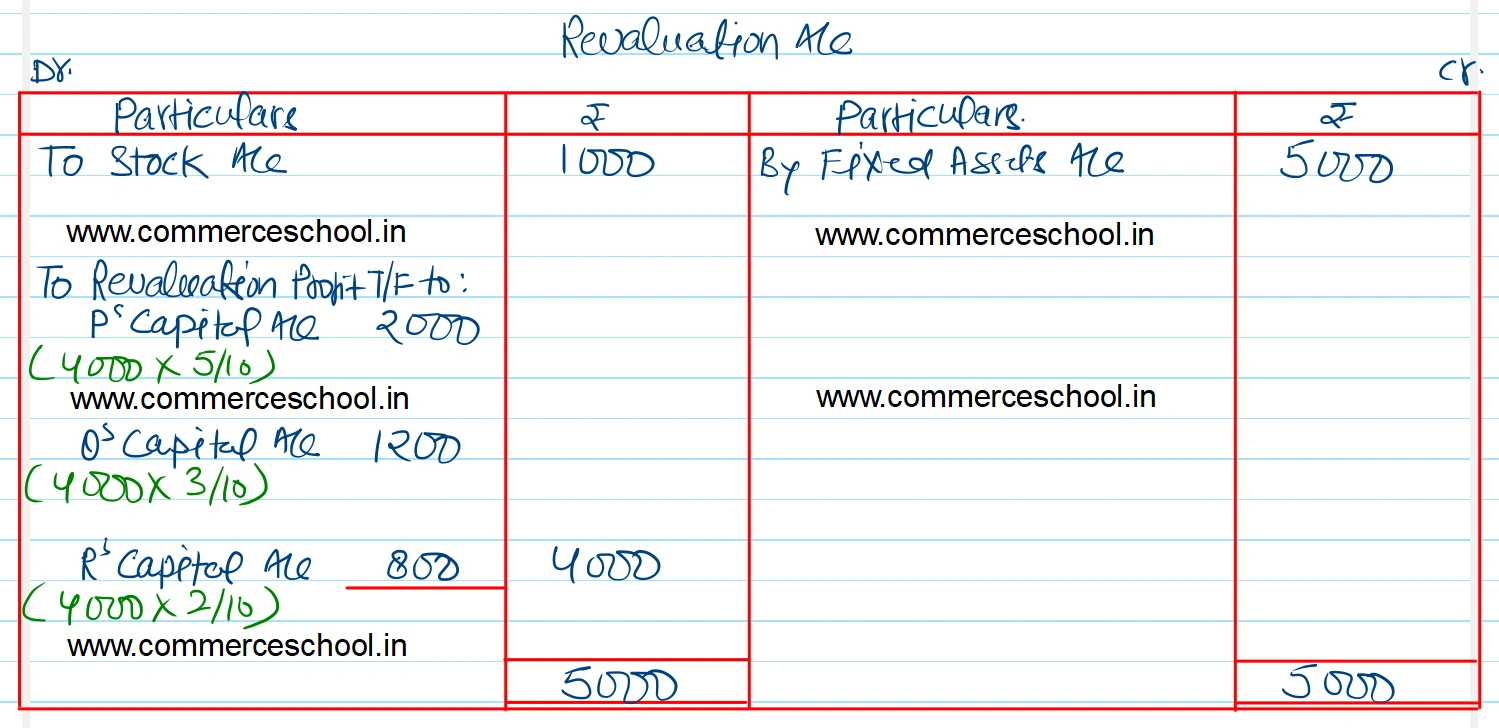

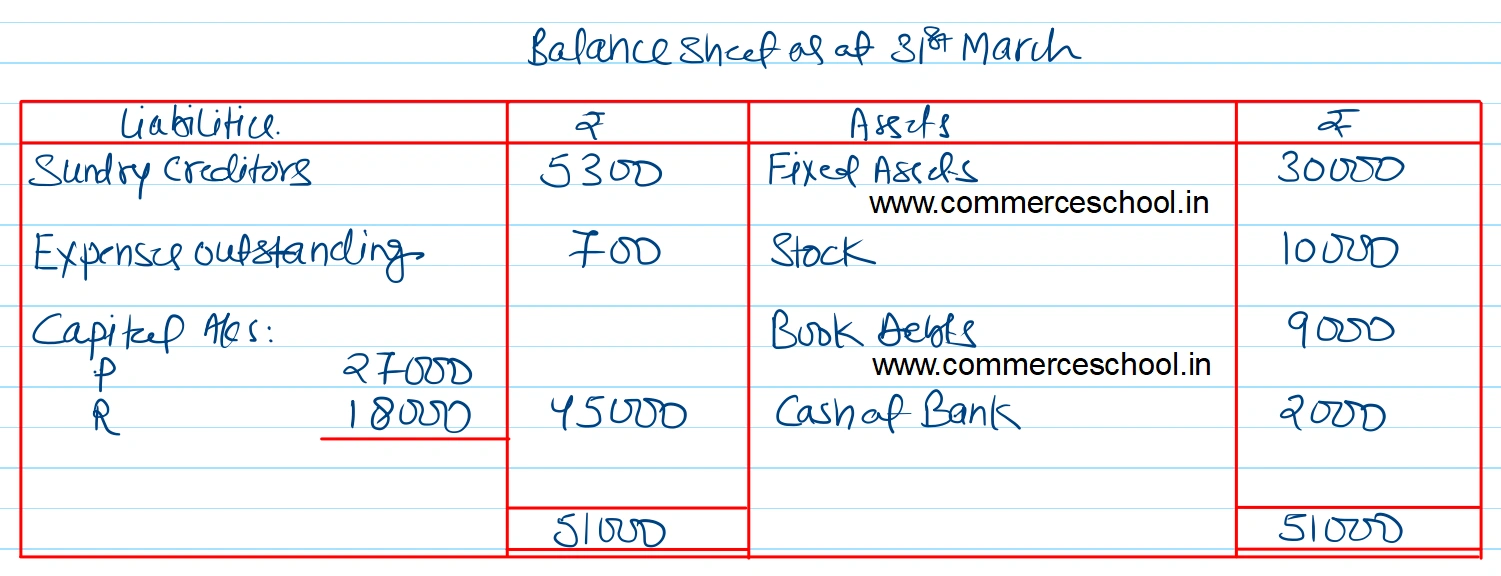

[Ans. Gain on revaluation ₹ 4,000; Amount paid to Q ₹ 17,800; Capital A/cs P ₹ 27,000, R ₹ 18,000 and Balance Sheet total ₹ 51,000; Gaining Ratio 1 : 2.]

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 5,300 | Fixed Assets | 25,000 |

| Expenses Outstanding | 700 | Stock | 11,000 |

| Reserve | 3,000 | Book Debts | 9,000 |

| Capitals: P Q R | 20,000 10,000 8,000 | Cash at Bank | 2,000 |

| 47,000 | 47,000 |

Anurag Pathak Answered question