P, R and S are in partnership sharing profits 4/8, 3/8 and 1/8 respectively. It is provided under the partnership deed that on the death of any partner his share of goodwill is to be valued at one-half of the net profits credited to his account during the last 4 completed years

P, R and S are in partnership sharing profits 4/8, 3/8 and 1/8 respectively. It is provided under the partnership deed that on the death of any partner his share of goodwill is to be valued at one-half of the net profits credited to his account during the last 4 completed years (books of accounts are closed on 31st March).

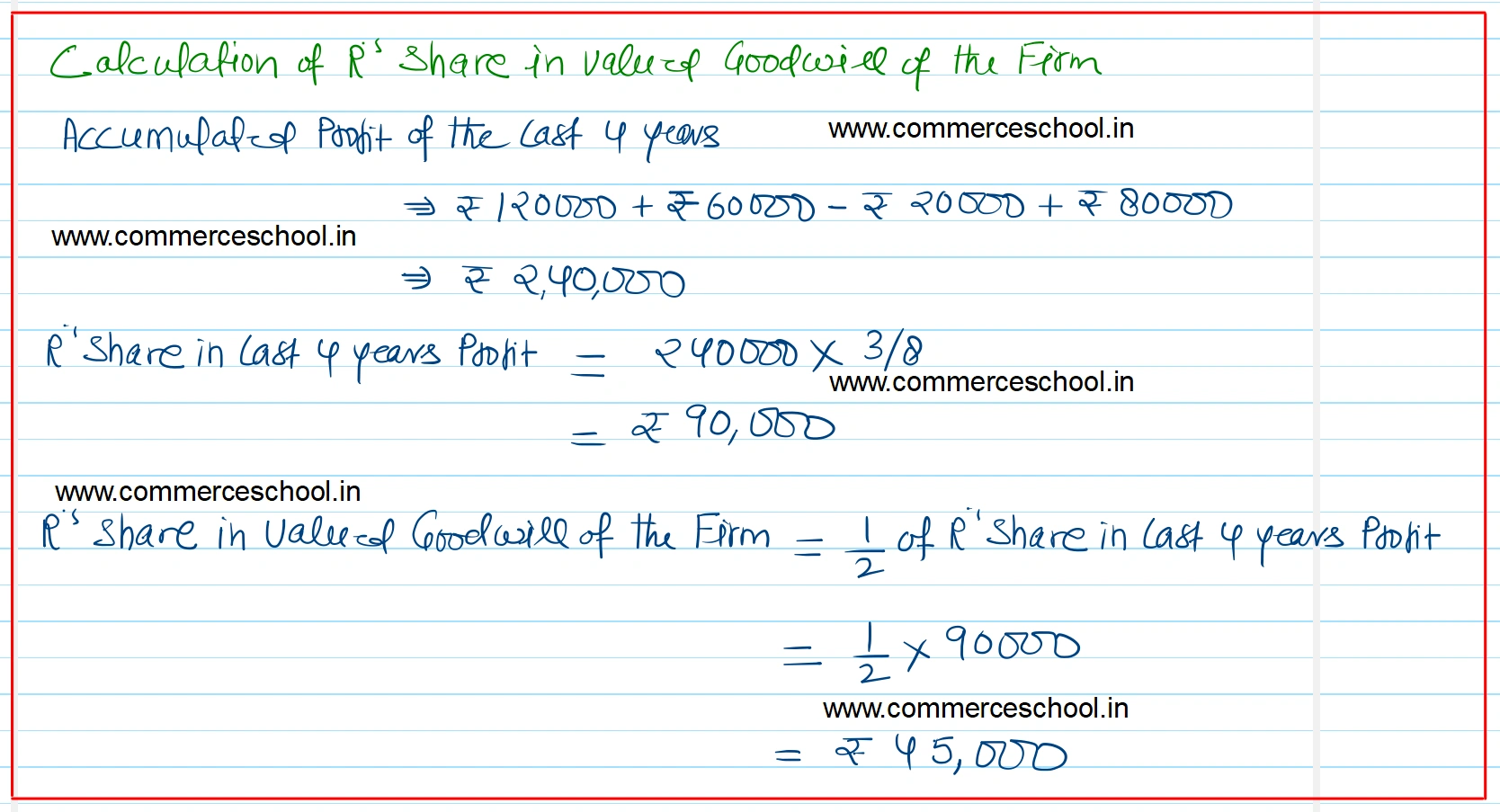

R died on 1st April, 2022. The firm’s profits for the last 4 years were as follows: 2019 (Profits ₹ 1,20,000); 2020 (Profits ₹ 60,000); 2021 (Losses ₹ 20,000) and 2022 (Profits ₹ 80,000).

1. Determine the amount that should be credited to R in respect of his share of goodwill.

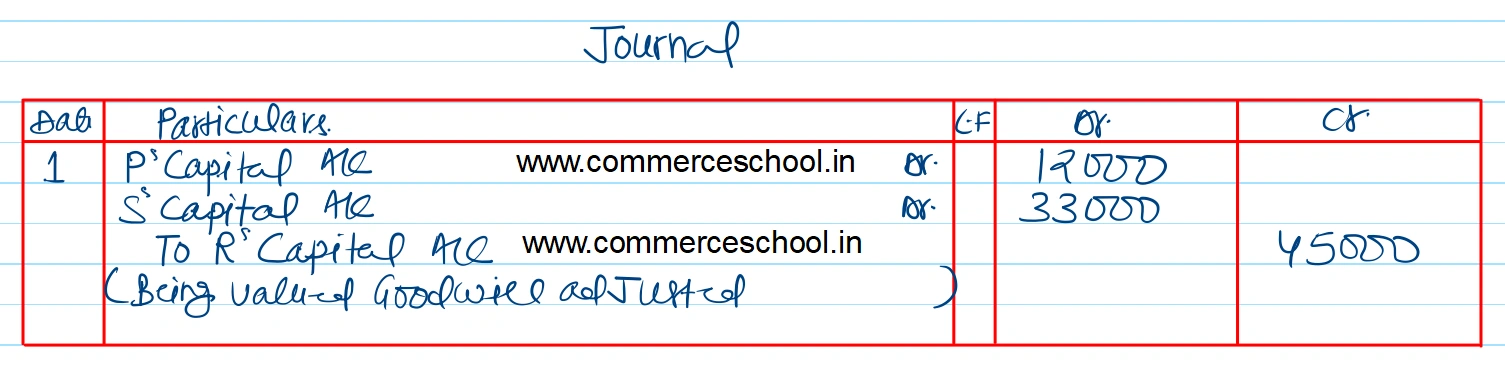

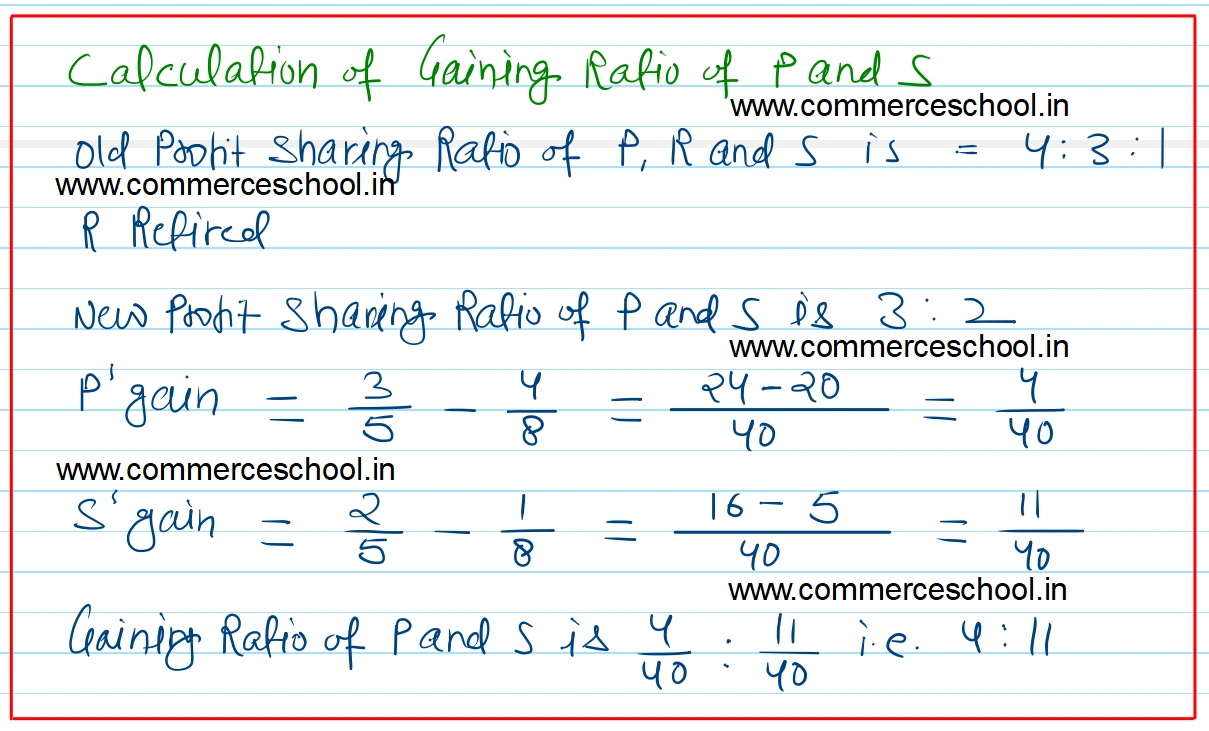

2. Pass journal entry for the adjustment of goodwill, assuming that profit sharing ratio between P and S in future will be 3 : 2. Show your working clearly.

[Ans. R’s share of goodwill ₹ 4