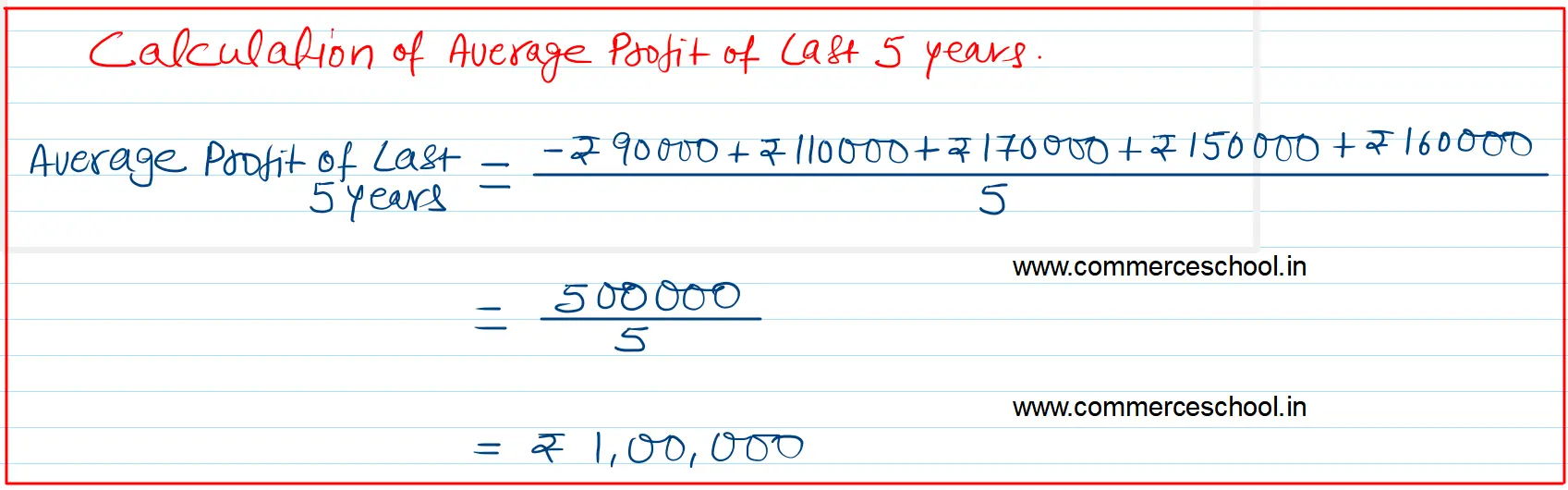

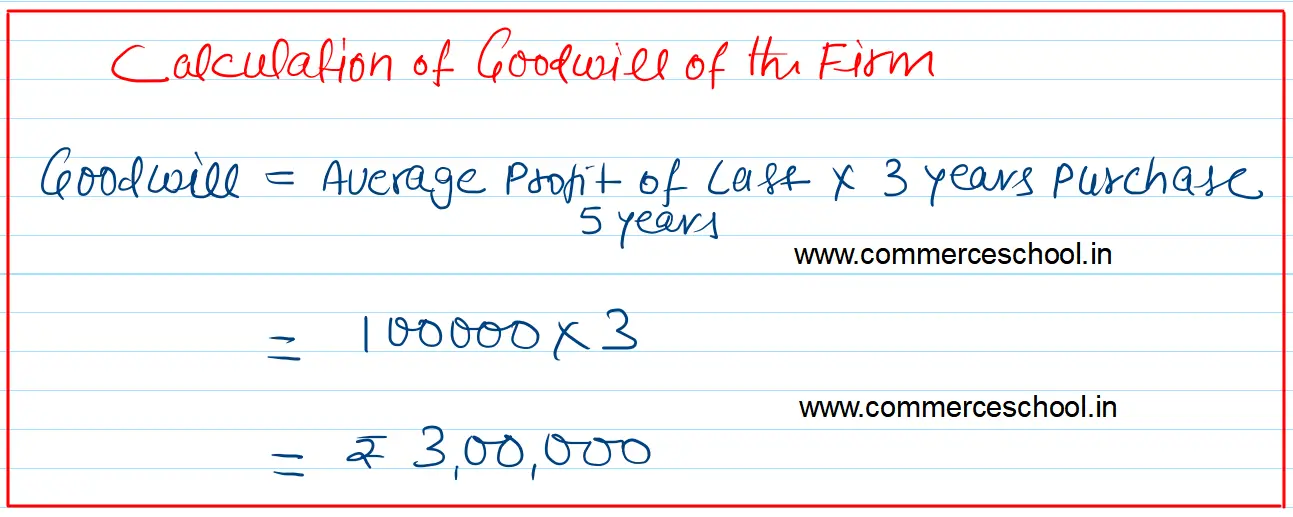

Parul and Rahul are partners in a firm. They admit Param into partnership for equal share. It was agreed that goodwill will be valued at three year’s purchase of average profit of last five years. profits for the last five years were:

Parul and Rahul are partners in a firm. They admit Param into partnership for equal share. It was agreed that goodwill will be valued at three year’s purchase of average profit of last five years. profits for the last five years were:

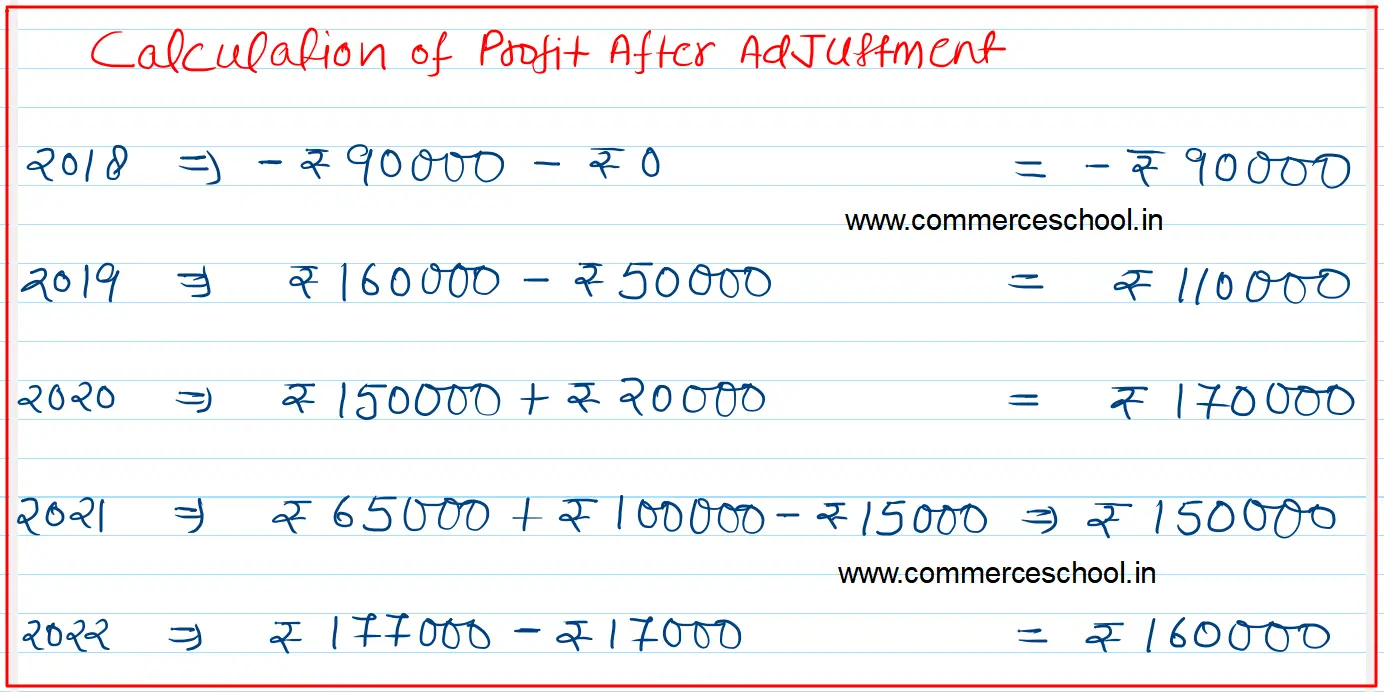

| Year Ended | Profits (₹) |

| 31st March, 2019 | 90,000 (Loss) |

| 31st March, 20120 | 1,60,000 |

| 31st March, 2021 | 1,50,000 |

| 31st March, 2022 | 65,000 |

| 31st March, 2023 | 1,77,,000 |

Books of Account of the firm revealed that:

i) The firm had gain (profit) of ₹ 50,000 from sale of machinery sold in the year ended 31st March, 2020. The gain (profit) on sale of machinery was credited to Profit & Loss Account.

ii) There was an abnormal loss of ₹ 20,000 incurred in the year ended 31st March, 2021 because of a machine becoming obsolete in accident.

iii) Overhauling cost of second hand machinery purchased on 1st July, 2021 of ₹ 1,00,000 was debited to Repairs Account. Depreciation is charged @ 20% p.a. on Written Down Value Method.

Calculate the value of goodwill.