Pass rectifying entries: ₹ 5,000, being the cost of a Radio purchased for the personal use of the proprietor has been debited to Radio account in the ledger.

Pass rectifying entries:-

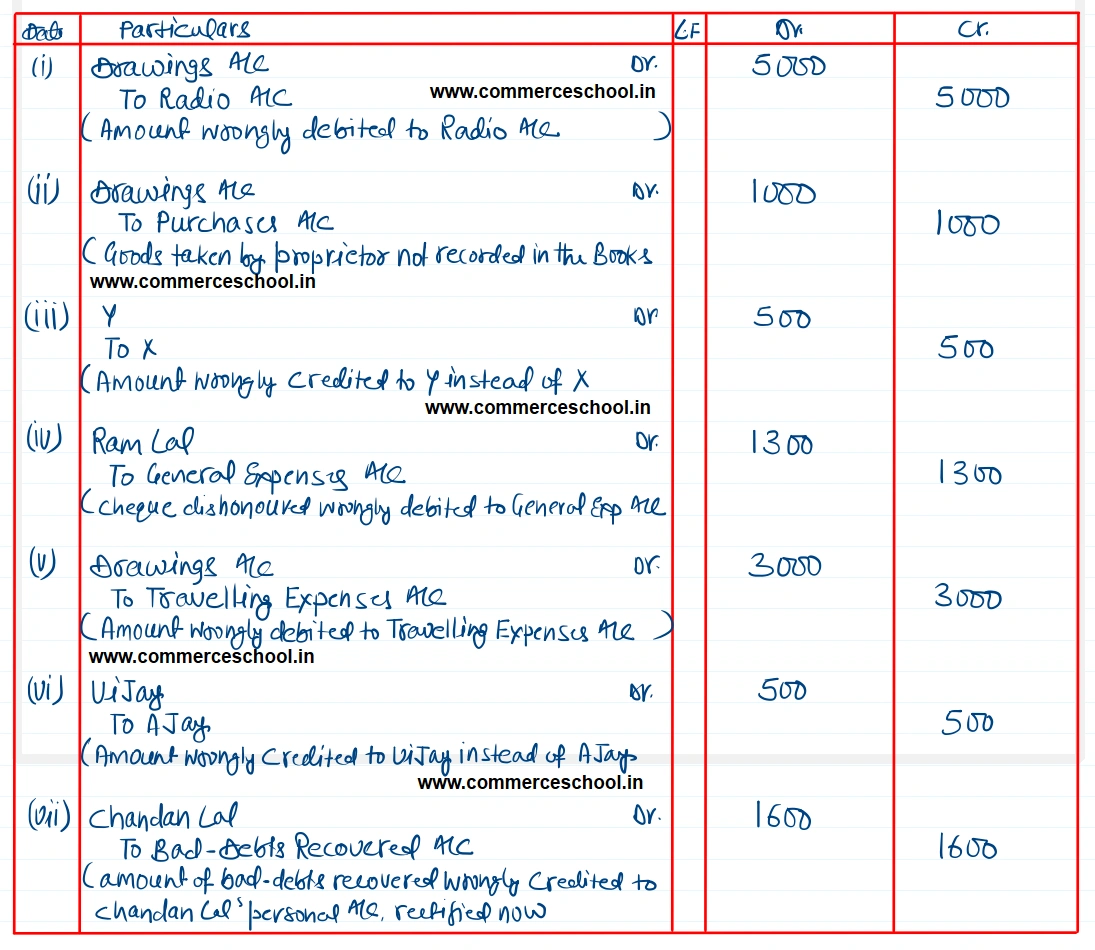

(i) ₹ 5,000, being the cost of a Radio purchased for the personal use of the proprietor has been debited to Radio account in the ledger.

(ii) Goods taken by the proprietor for ₹ 1,000 has not been entered in the books at all.

(iii) A cheque of ₹ 500 received from X was credited to the account of Y and debited to Cash instead of Bank A/c

(iv) A cheque of ₹ 1,300 received from Ram Lal was dishonoured and debited to ‘General Expenses’ A/c.

(v) A sum of ₹ 3,000 drawn by the proprietor for his private travel was debited to ‘Travelling Expenses A/c’.

(vi) Credit purchase of ₹ 500 from Ajay were posted to the credit of Vijay A/c

(vii) An amount of ₹ 1,600 due from Chandan Lal was written off as ‘Bad-debt’ in previous year, was unexpectedly received this year, and has been credited to the account of Chandan Lal.

Solution:-