Prashant and Rajesh are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was:

Prashant and Rajesh are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was:

| Liabilities | ₹ | Assets | ₹ | |

| Bank Overdraft

General Reserve Investments Fluctuation Reserve Loan by Prashant Capital A/c: Prashant |

30,000 56,000 20,000 34,000 50,000 |

Cash in Hand

Bank Balance Sundry Debtors Investments Stock Furniture Building Rajesh’s Capital |

26,000

|

6,000 10,000 24,000 40,000 10,000 10,000 60,000 30,000 |

| 1,90,000 | 1,90,000 |

On that date, the partners decide to dissolve the firm. Prashant took investments at an agreed value of ₹ 35,000. Other assets were realised as follows:

Sundry Debtors: Full amount. The firm could realise Stock at 15% less and Building was sold at ₹ 1,00,000.

Compensation to employees paid by the firm was ₹ 10,000. This liability was not provided for in the above Balance Sheet.

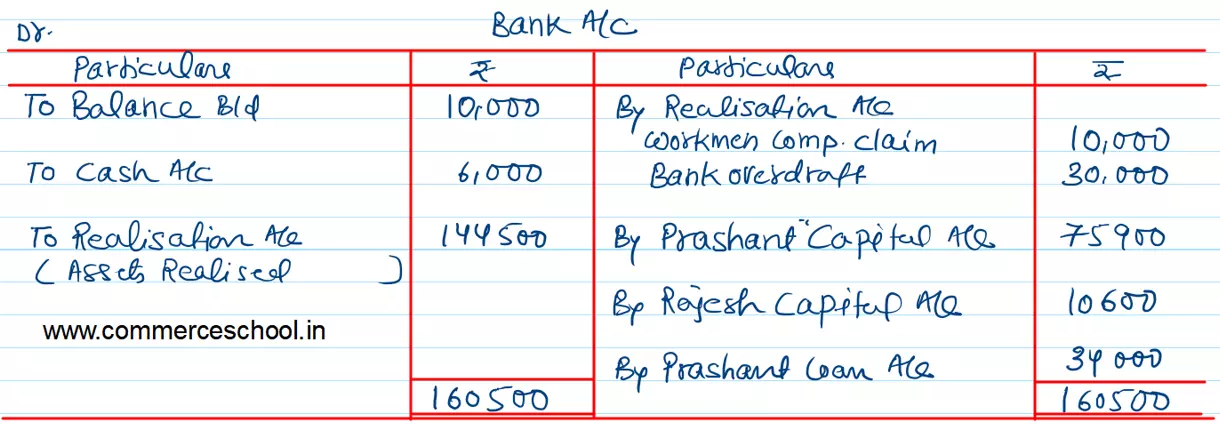

You are rquired to close the books of the firm by preparing Realisation Account, Partner’s Capital Accounts and Bank Account.

[Ans.: Gain (profit) on Realistion – ₹ 45,500; Payment to Prashant – ₹ 75,900; Rajesh – ₹ 10,600; Total of Bank Account – ₹ 1,60,500.]