Prepare a Trading and Profit & Loss account for the year ending March 31, 2023, from the balances extracted of M/s Rahul Sons. Also prepare a balance sheet as at that date.

Prepare a Trading and Profit & Loss account for the year ending March 31, 2023, from the balances extracted of M/s Rahul Sons. Also prepare a balance sheet as at that date.

Adjustments:-

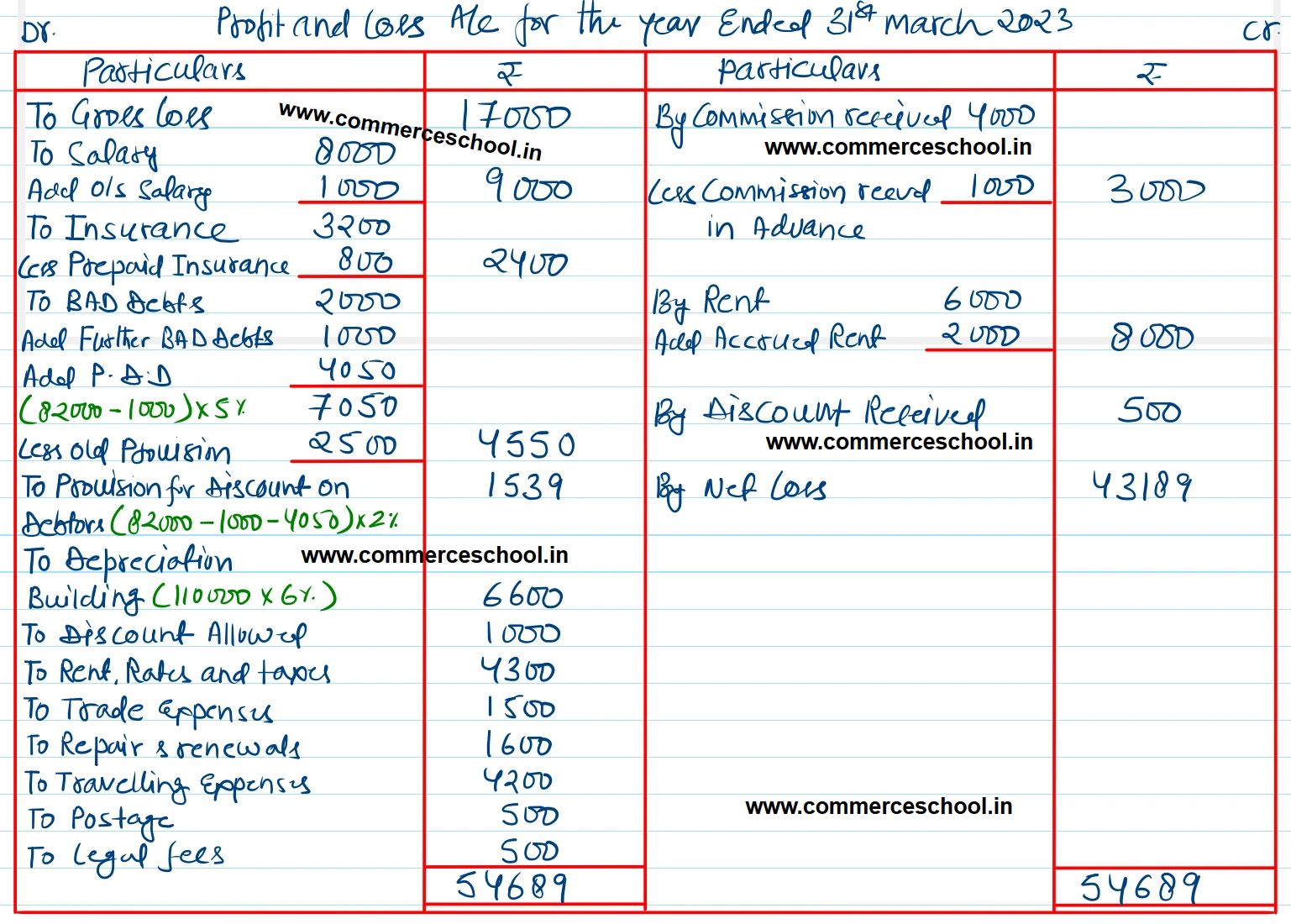

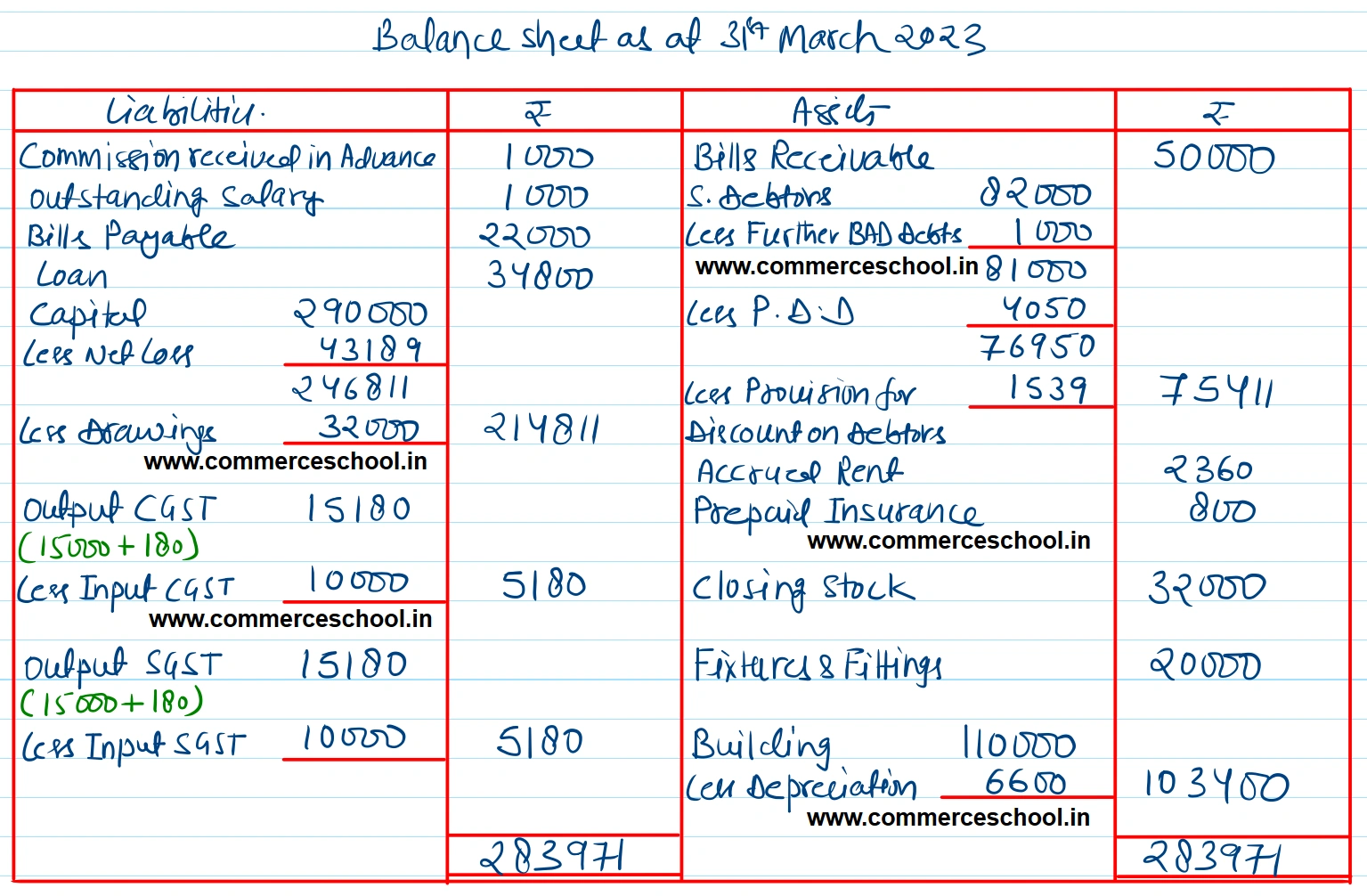

(i) Commission received in advance ₹ 1,000.

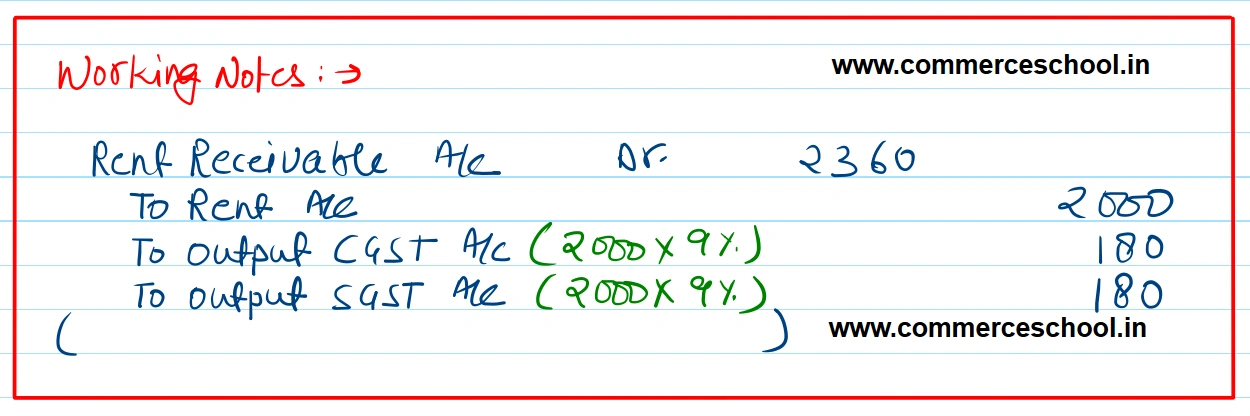

(ii) Rent receivable ₹ 2,000, subject to levy of CGST and SGST @ 9% each.

(iii) Salary outstanding ₹ 1,000 and insurance prepaid ₹ 800.

(iv) Further Bad-debts ₹ 1,000 and provision for Bad-debts @ 5% on debtors and provision for discount on debtors @ 2%.

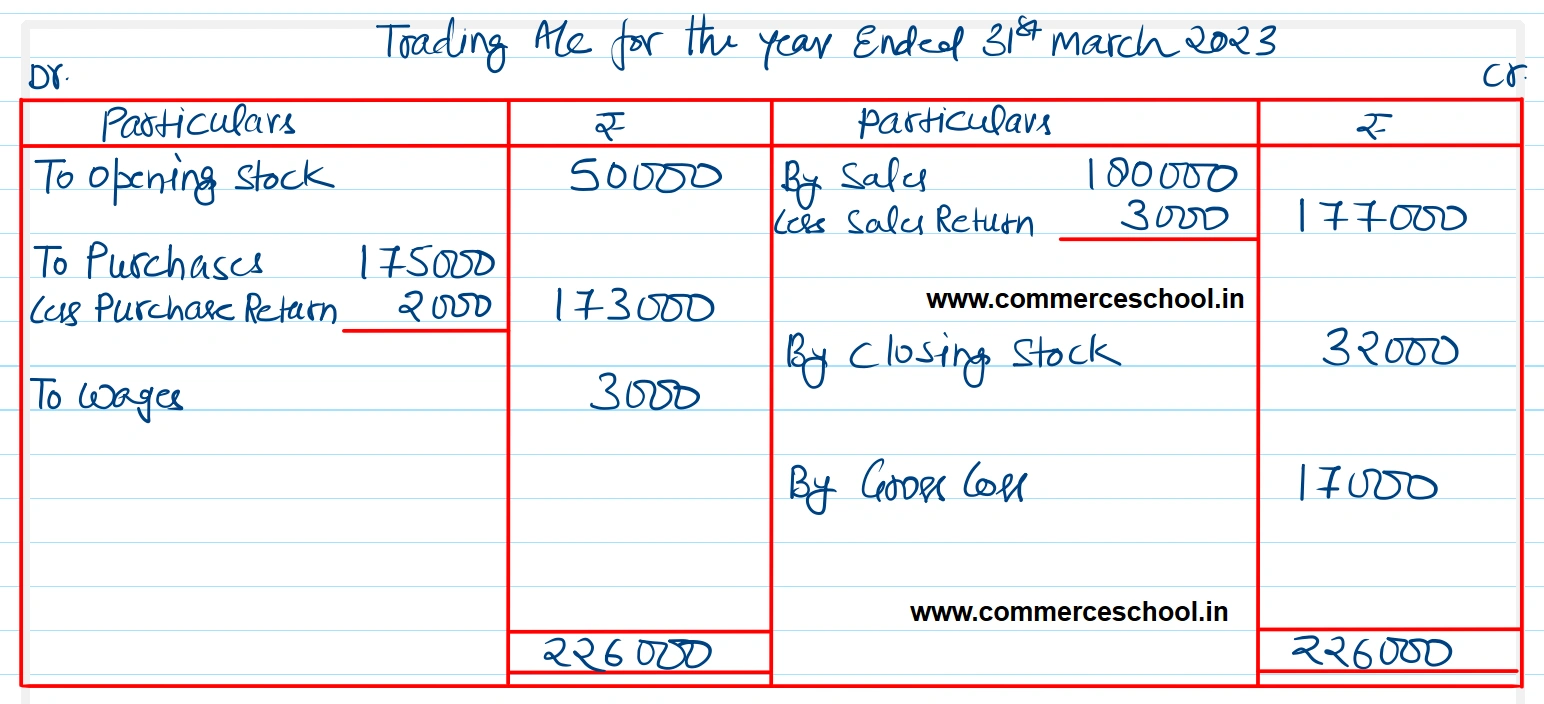

(v) Closing Stock ₹ 32,000.

(vi) Depreciation on Building @ 6% p.a.

[Ans. Gross Loss ₹ 17,000; Net Loss ₹ 43,189 and Balance Sheet Total ₹ 2,83,971.]

| Debit Balances | ₹ | Credit Balances | ₹ |

| Opening Stock | 50,000 | Sales | 1,80,000 |

| Wages | 3,000 | Purchase return | 2,000 |

| Salary | 8,000 | Discount received | 500 |

| Purchases | 1,75,000 | Provision for bad debts | 2,500 |

| Sales Return | 3,000 | Capital | 2,90,000 |

| S. Debtors | 82,000 | Bills Payable | 22,000 |

| Discount allowed | 1,000 | Commission received | 4,000 |

| Insurance | 3,200 | Rent | 6,000 |

| Rent, rates and taxes | 4,300 | Loan | 34,800 |

| Fixtures and fittings | 20,000 | Output CGST | 15,000 |

| Trade Expenses | 1,500 | Output SGST | 15,000 |

| Bad debts | 2,000 | ||

| Drawings | 32,000 | ||

| Repair and revewals | 1,600 | ||

| Travelling expenses | 4,200 | ||

| Postage | 500 | ||

| Legal fees | 500 | ||

| Bills Reveivable | 50,000 | ||

| Building | 1,10,000 | ||

| Input CGST | 10,000 | ||

| Input SGST | 10,000 | ||

| 5,71,800 | 5,71,800 |

Anurag Pathak Answered question