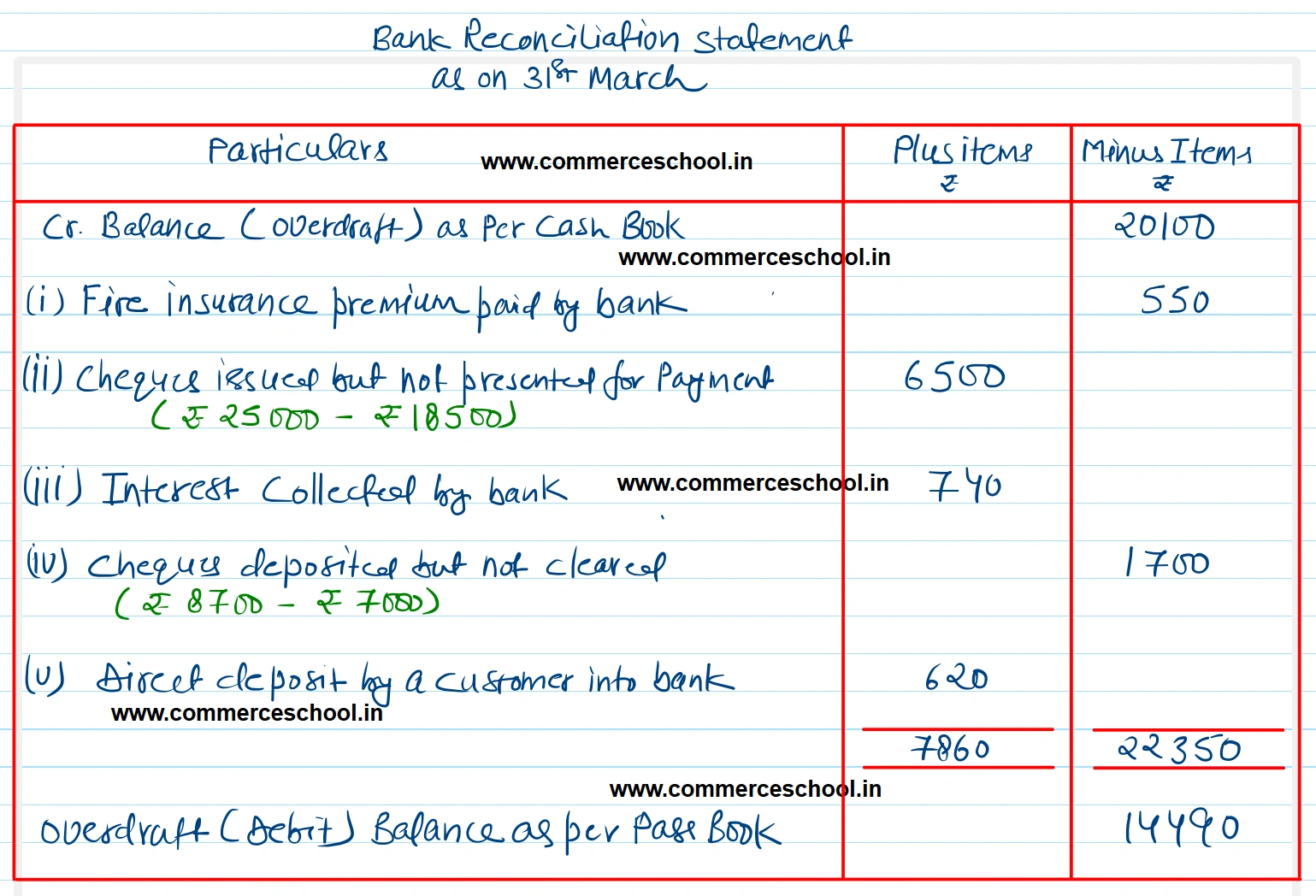

Prepare Bank Reconciliation Statement as on 31st January, 2017, if Cash Book of Mr. Sanjay showed a credit balance of ₹ 20,100

Prepare Bank Reconciliation Statement as on 31st January, 2017, if Cash Book of Mr. Sanjay showed a credit balance of ₹ 20,100.

(i) The bank had paid fire insurance premium of ₹ 550 which does not appear in the Cash Book.

(ii) Cheques for ₹ 25,000 issued during January, but cheques for only ₹ 18,500 were presented for payment.

(iii) Interest collected by bank ₹ 740.

(iv) Cheques of ₹ 8,700 were deposited into bank, but cheques for ₹ 7,000 were cleared till 31st January, 2017.

(v) A customer deposited $ 620 directly into bank without informing Mr. Sanjay.

[Ans. Overdraft (Debit) Balance as per Pass Book ₹ 14,490.]

Anurag Pathak Answered question