Prepare Profit and Loss Account for the year ended 31st March, 2025 from the following particulars Advertisement ₹ 30,000

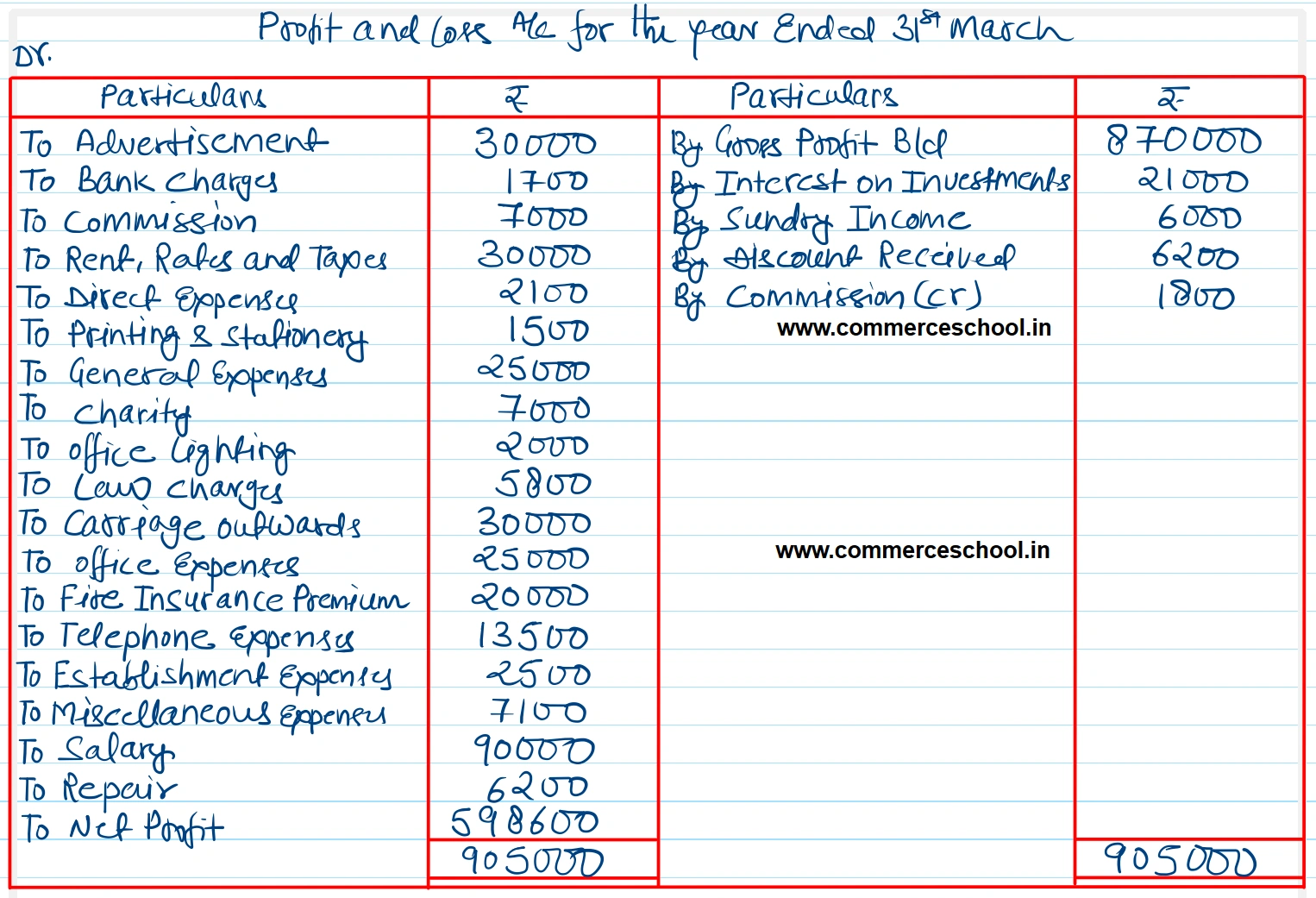

Prepare Profit and Loss Account for the year ended 31st March, 2025 from the following particulars:-

[Ans. Net Profit – ₹ 5,98,600.]

| Particulars | ₹ | Particulars | ₹ |

| Advertisement | 30,000 | Gross Profit | 8,70,000 |

| Bank Charges | 1,700 | Carriage Outwards | 30,000 |

| Commission | 7,000 | Office Expenses | 25,000 |

| Rent, Rates and Taxes | 30,000 | Fire Insurance Premium | 20,000 |

| Interest on Investments | 21,000 | Telephone Expenses | 13,500 |

| Sundry Income | 6,000 | Establishment Expenses | 2,500 |

| Direct Expenses | 5,000 | Miscellaneous Expenses | 7,100 |

| Indirect Expenses | 2,100 | Discount Received | 6,200 |

| Printing and Stationery | 1,500 | Wages | 75,000 |

| Gnereal Expenses | 25,000 | Salary | 90,000 |

| Charity | 7,000 | Repair | 6,200 |

| Factory Lighting | 20,000 | Commission (Cr.) | 1,800 |

| Office Lighting | 2,000 | ||

| Law Charges | 5,800 |

Anurag Pathak Answered question