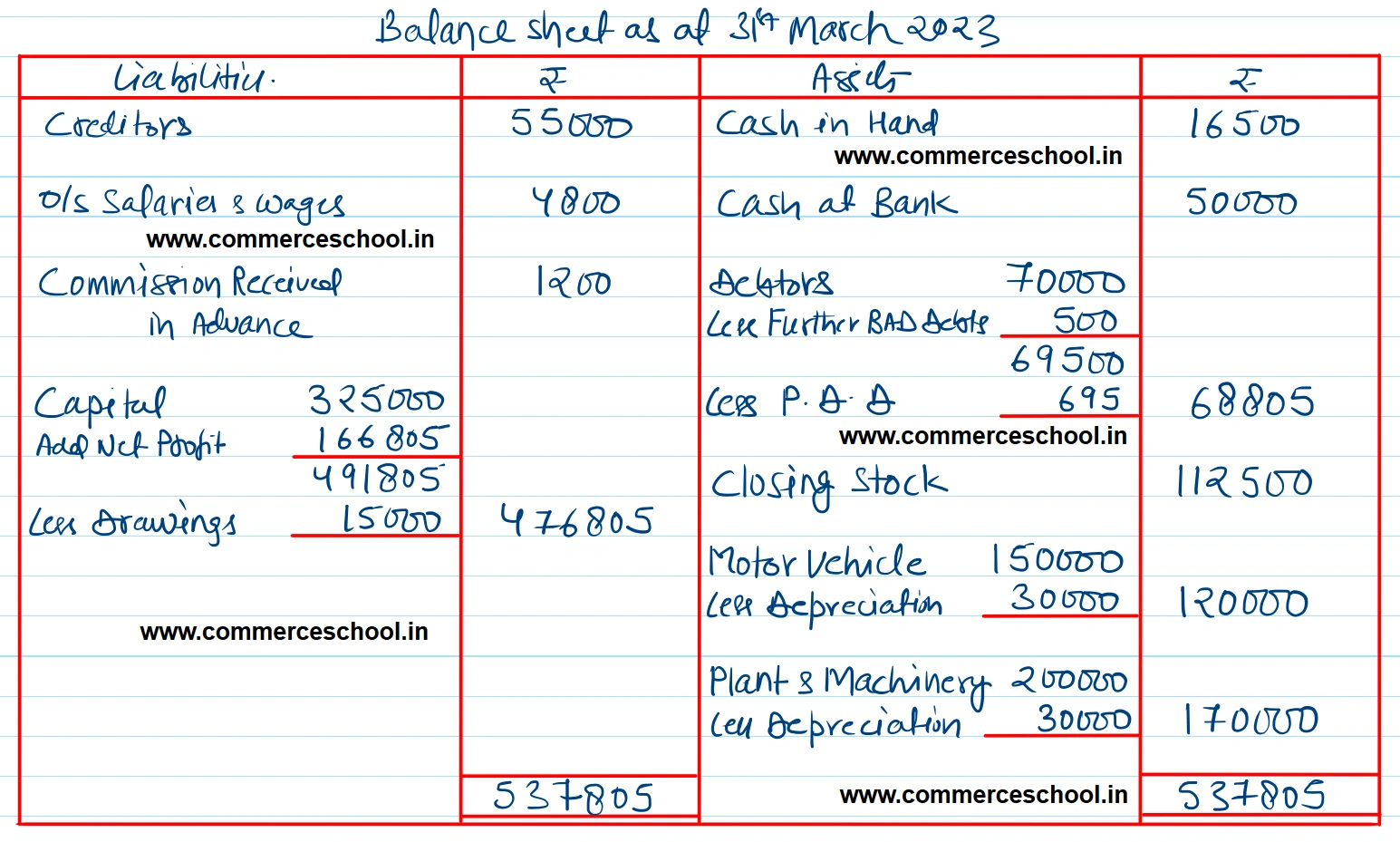

Prepare Trading and Profit and Loss Account and Balance Sheet from the following Trial Balance and information as on 31st March, 2023 Drawings and Capital ₹ 15,000 ₹ 3,25,000

Prepare Trading and Profit and Loss Account and Balance Sheet from the following Trial Balance and information as on 31st March, 2023:

Adjustments:

(i) Closing Stock was valued at ₹ 1,12,500.

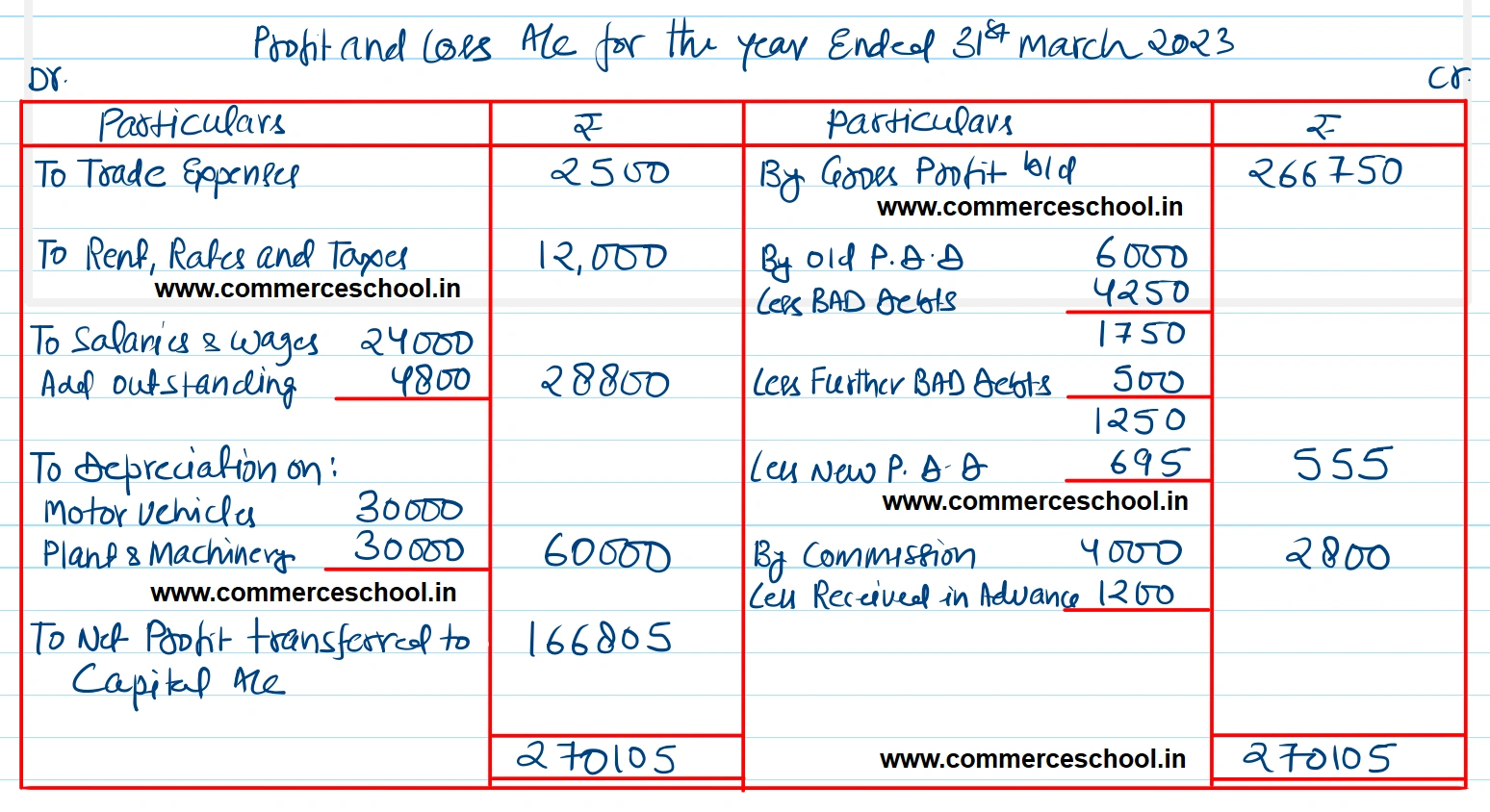

(ii) Commission include ₹ 1,200 being commission received in advance.

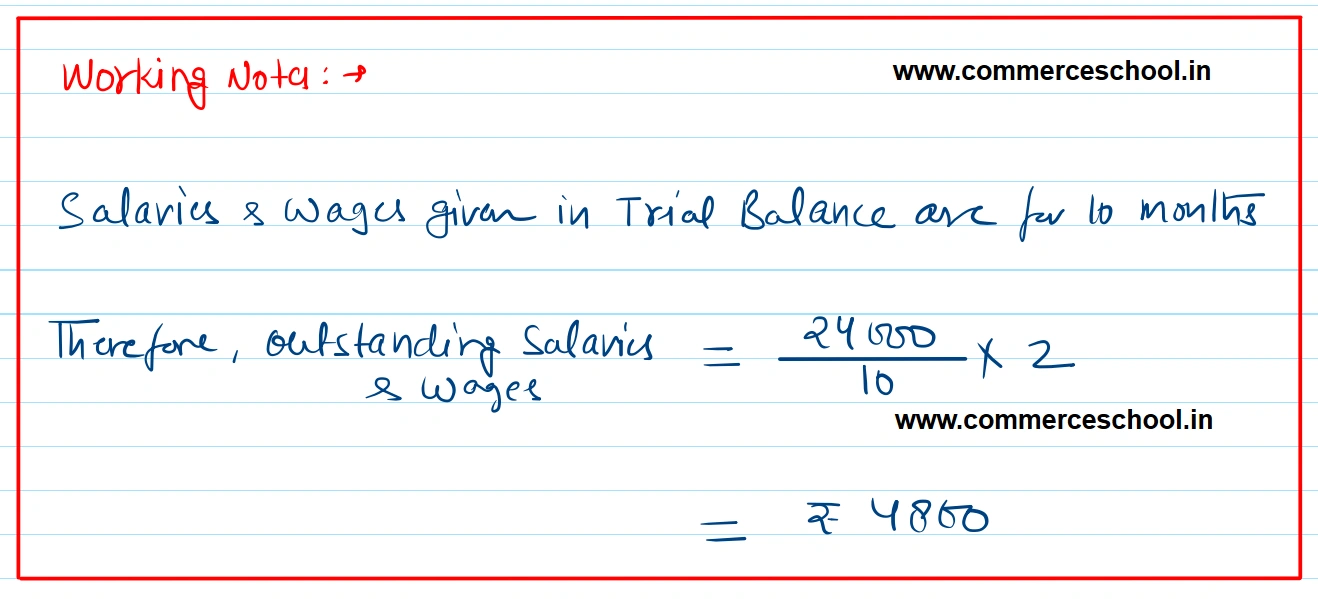

(iii) Salaries and wages is outstanding for the month of Feb. & March, 2023.

(iv) Depreciate Plant and Machinery by 15% and Motor Vehicle by 20%.

(v) Write off ₹ 500 as further Bad Debts and maintain provision for doubtful debts at 1% on debtors.

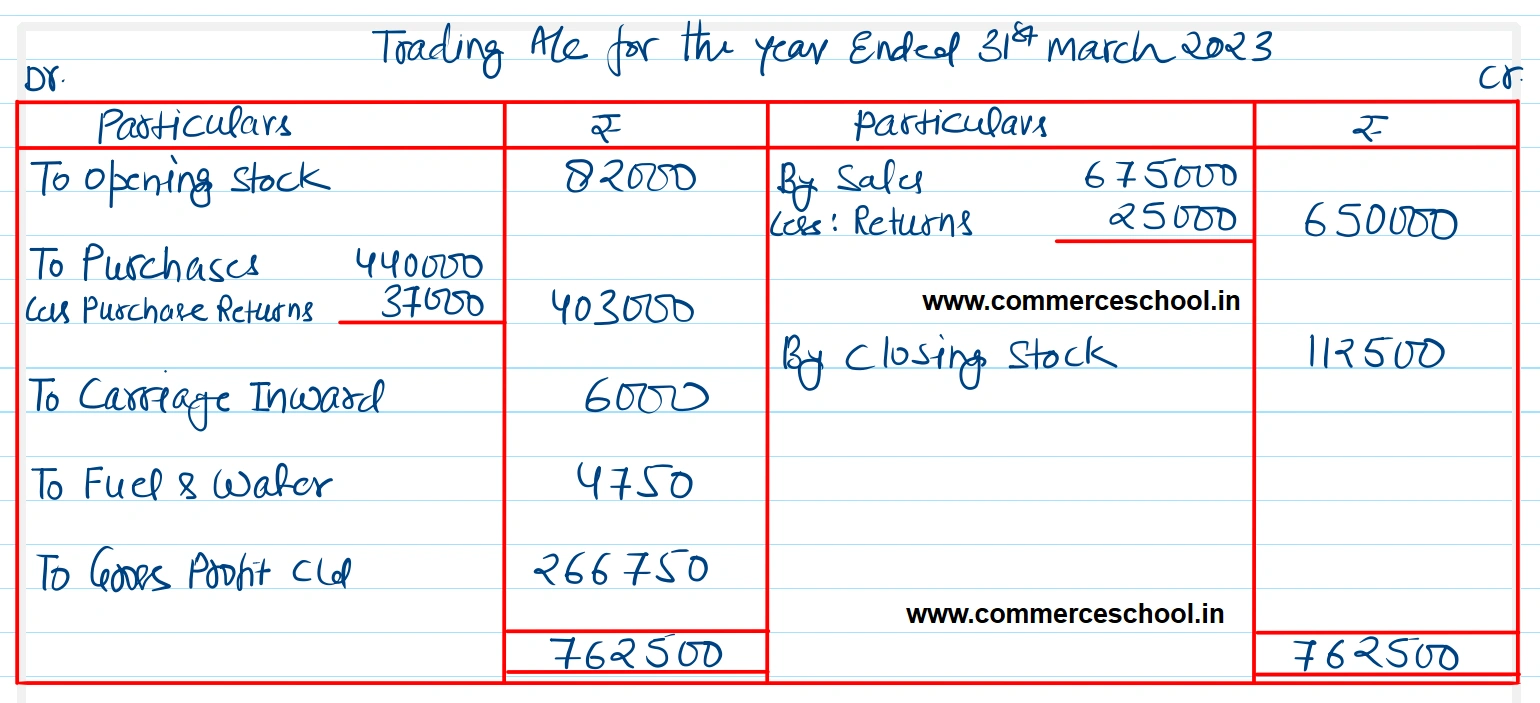

[Ans. Gross Profit ₹ 2,66,750; Net Profit ₹

1,66,805; Balance Sheet Total ₹ 5,37,805.]

Solution:-

| Name of Account | Dr. (₹) | Cr. (₹) |

| Drawings and Capital | 15,000 | 3,25,000 |

| Plant and Machinery | 2,00,000 | |

| Motor Vehicle | 1,50,000 | |

| Return Inward and Outward | 25,000 | 37,000 |

| Stock on 1stApril, 2022 | 82,000 | |

| Purchases and Sales | 4,40,000 | 6,75,000 |

| Carriage Inward | 6,000 | |

| Trade Expenses | 2,500 | |

| Bad Debts | 4,250 | |

| Provision for Doubtful Debts | 6,000 | |

| Commission | – | 4,000 |

| Rent, Rates and Taxes | 12,000 | |

| Salaries and Wages | 24,000 | |

| Debtors and Creditors | 70,000 | 55,000 |

| Fuel and Water | 4,750 | |

| Cash in Hand | 16,500 | |

| Cash at Bank | 50,000 | |

| 11,02,000 | 11,02,000 |

Anurag Pathak Answered question