Prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2023 from the following Balances of Mr. Sardari Lal:

Prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2023 from the following Balances of Mr. Sardari Lal:

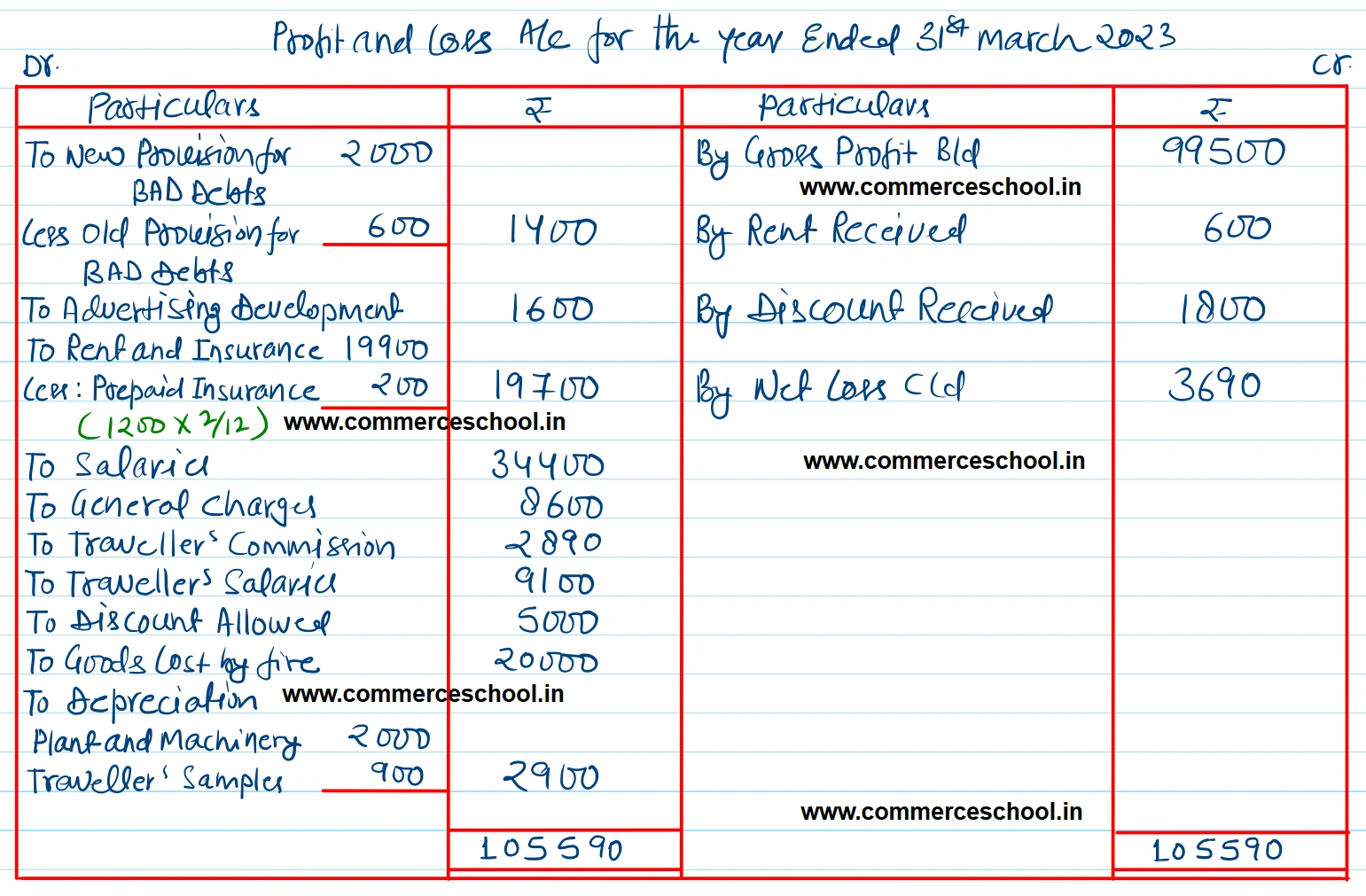

Adjustments:- The Closing stock was ₹ 23,000 but there has been a loss by fire on 20th March, 2023, to the extent of ₹ 20,000, not covered by insurance. Depreciate Plant and Machinery by 10% and Traveller’s Samples by 331/3%. Increase the Bad-debts Provision to ₹ 2,000. Write 20% off Advertising Development Account. Annual premium on insurance expiring 1st June, 2023 was ₹ 1,200. Provide for Manager’s commission @ 5% on Net Profits after charging such Commission.

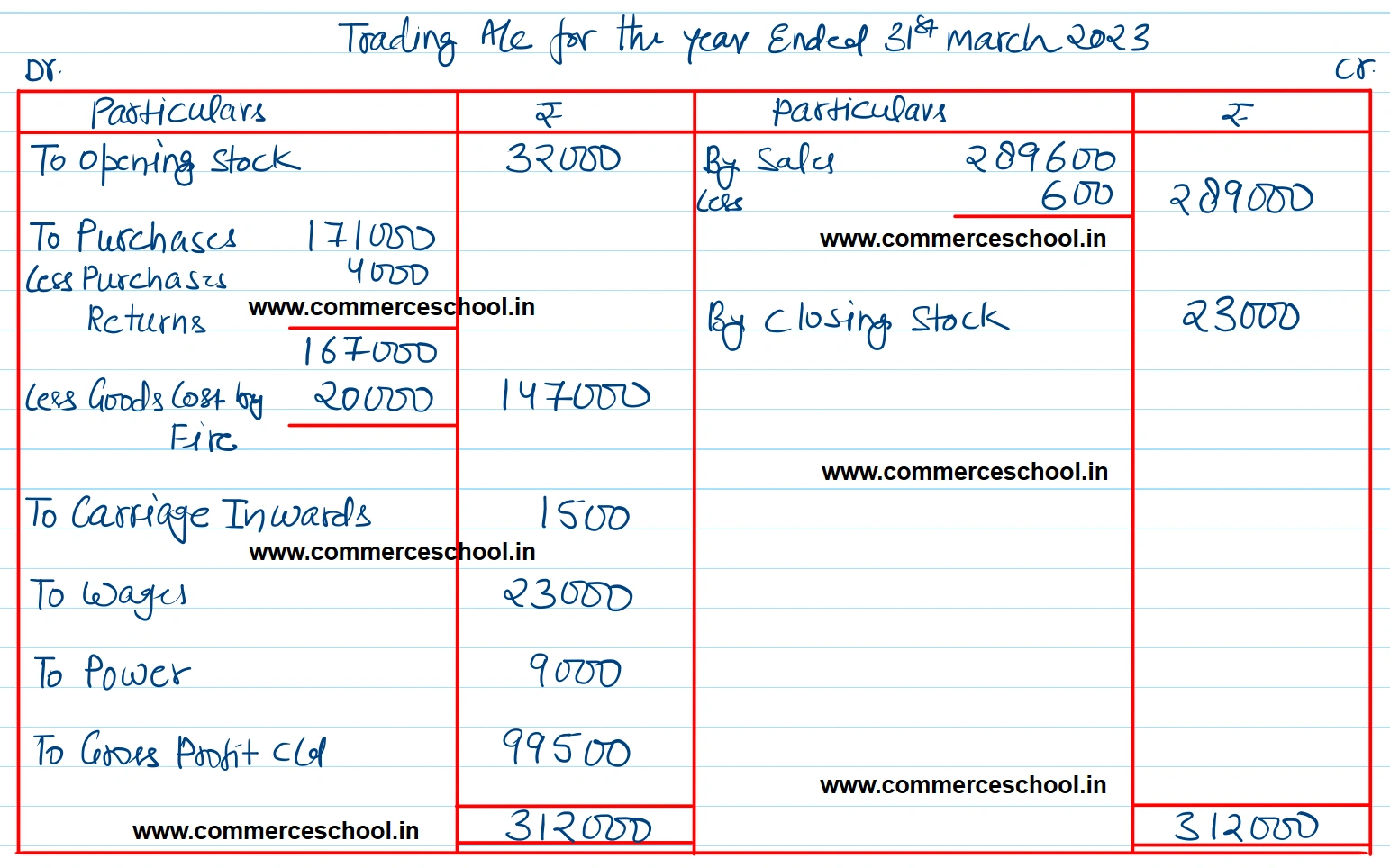

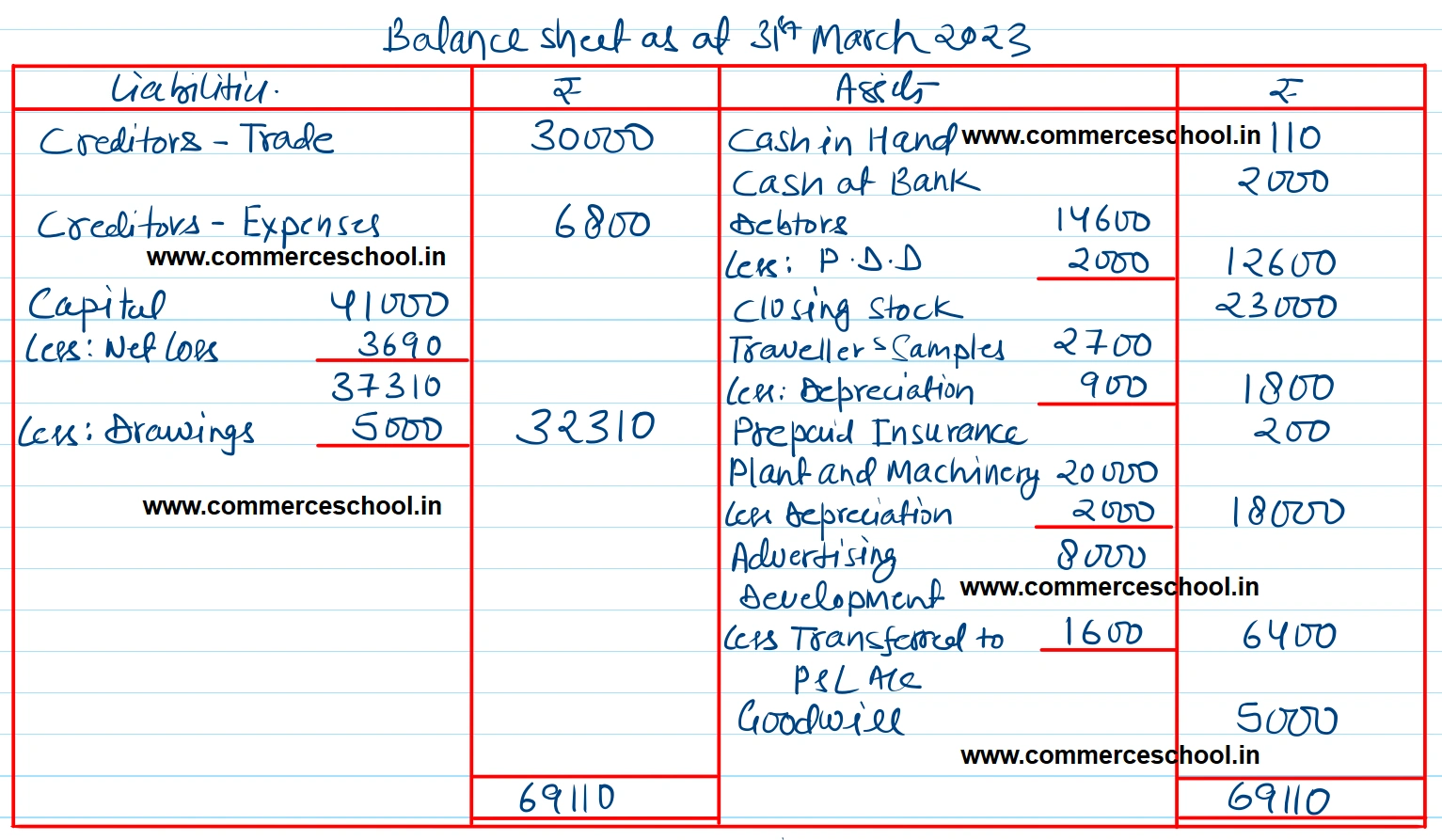

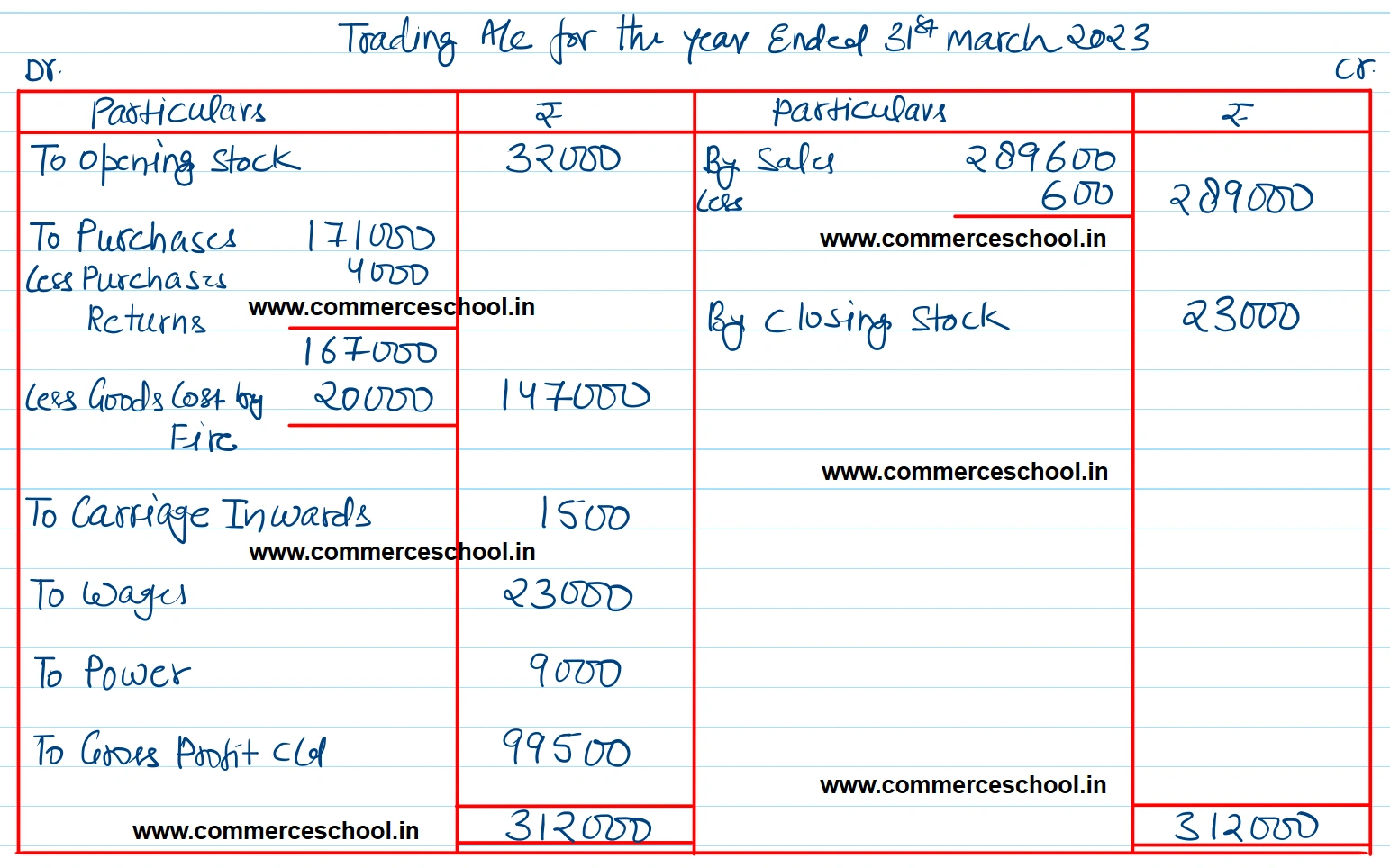

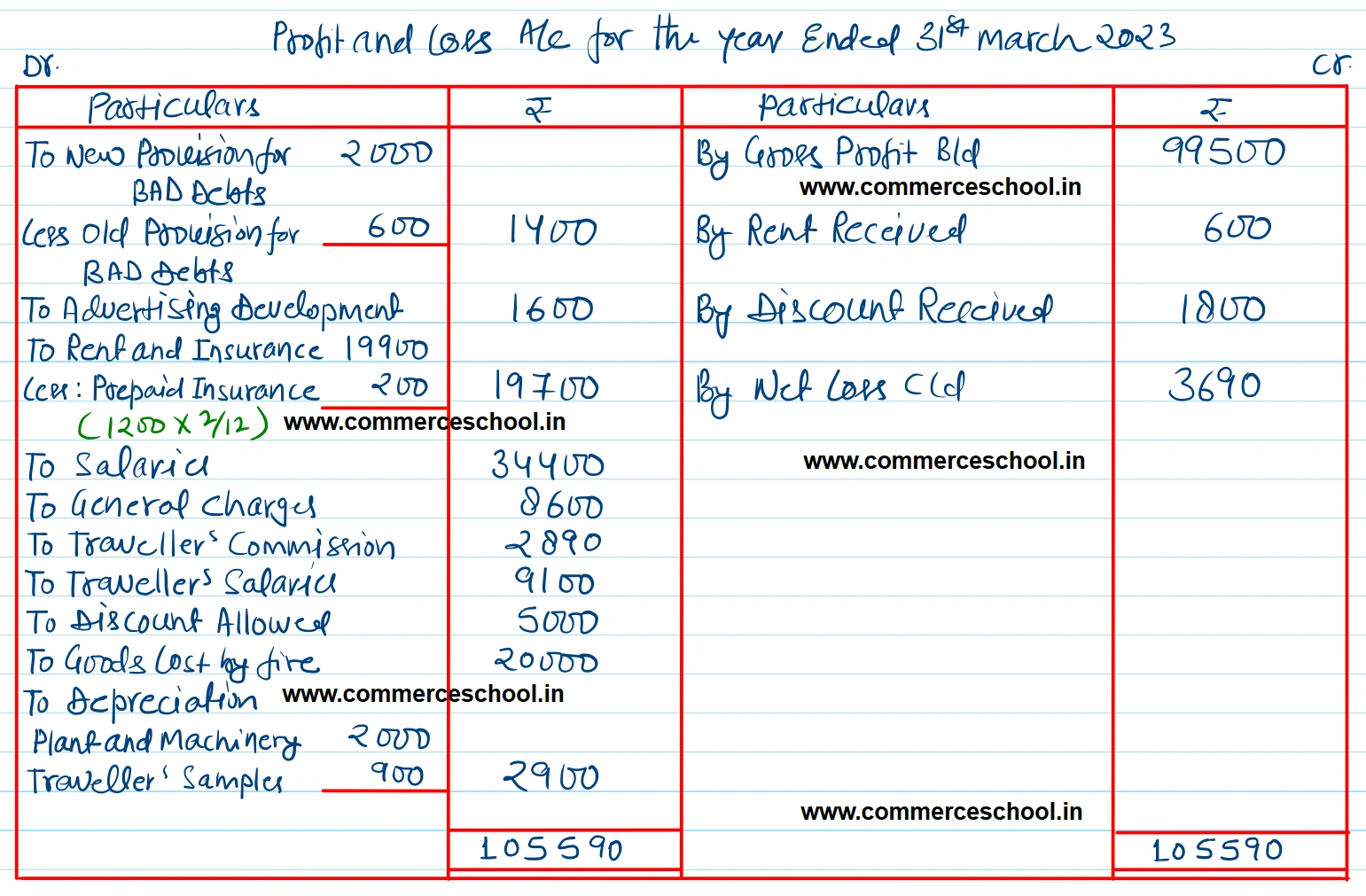

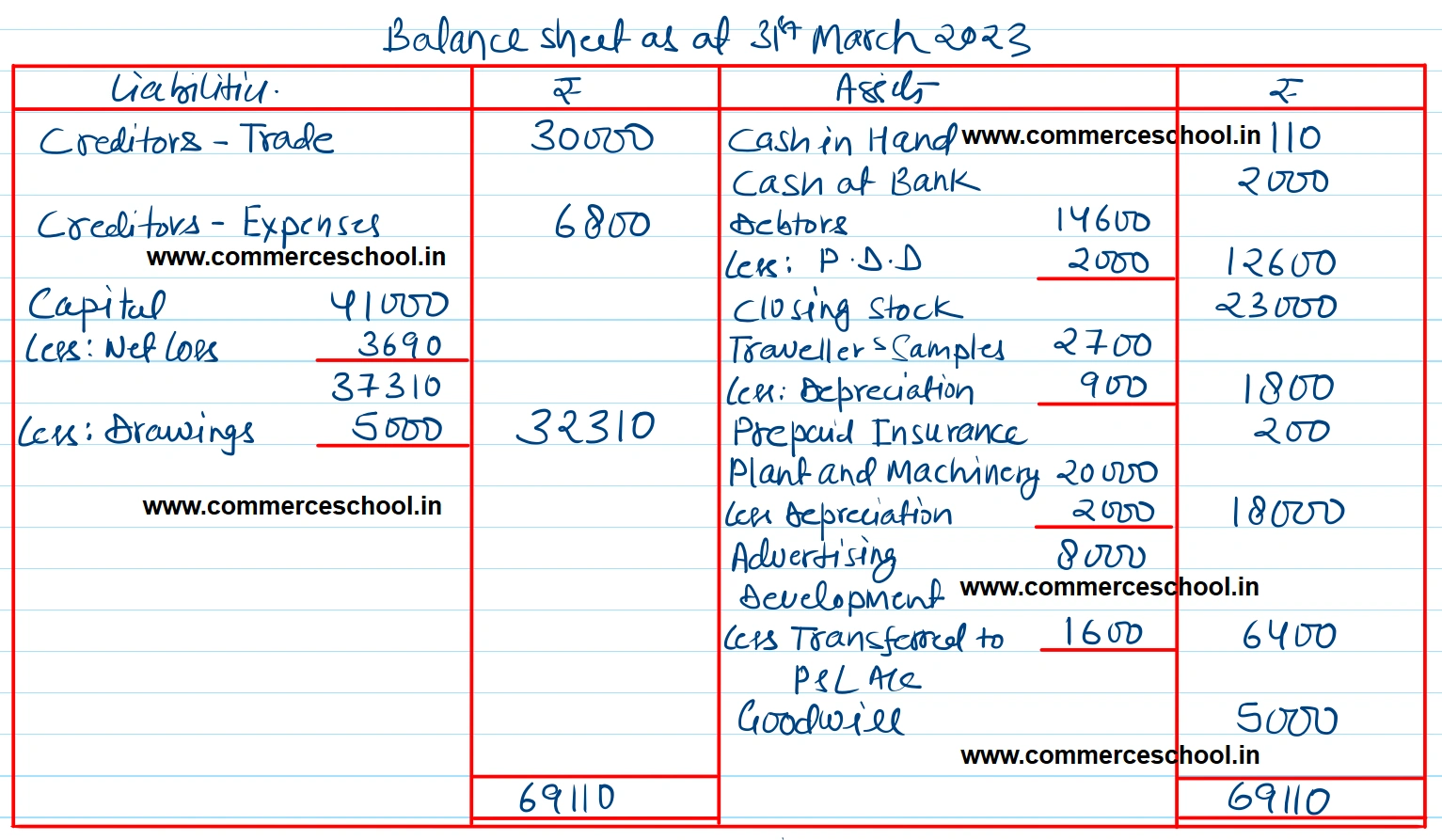

[Ans. G.P. ₹ 99,500, Net Loss ₹ 3,690, B/S Total ₹ 69,110.]

| Particulars | ₹ | Particulars | ₹ |

| Capital Account | 41,000 | Drawings | 5,000 |

| Creditors – Trade | 30,000 | Purchases | 1,71,000 |

| Creditors – Expenses | 6,800 | Carriage Inwards | 1,500 |

| Rent Received | 600 | Wages | 23,000 |

| Purchases Returns | 4,000 | Power | 9,000 |

| Sales | 2,89,600 | Rent and Insurance | 19,900 |

| Bad-debts Provision on 1s April, 2022 | 600 | Salaries | 34,400 |

| Advertising Development | 8,000 | Discount Received | 1,800 |

| Goodwill | 5,000 | General Charges | 8,600 |

| Plant and Machinery | 20,000 | Sales Returns | 600 |

| Traveller’s Samples | 2,700 | Traveller’s Commission | 2,890 |

| Stock on 1-4-2022 | 32,000 | Traveller’s Salaries | 9,100 |

| Debtors | 14,600 | Discount Allowed | 5,000 |

| Cash at Bank | 2,000 | ||

| Cash in Hand | 110 |

Anurag Pathak Answered question

Solution:-

Hints:-

(1) Creditors Trade and Creditors Expenses, both will be shown on the Liabilities side.

(2) Insurance is prepaid for the two months of April and May. As such, the Prepaid Insurance will be ₹ 1,200 x 2/12 = ₹ 200.

(3) Manager will not be entitled to any Commission because there is Net Loss instead of Net Profit in the Question.

Hints:-

(1) Creditors Trade and Creditors Expenses, both will be shown on the Liabilities side.

(2) Insurance is prepaid for the two months of April and May. As such, the Prepaid Insurance will be ₹ 1,200 x 2/12 = ₹ 200.

(3) Manager will not be entitled to any Commission because there is Net Loss instead of Net Profit in the Question.

Hints:-

(1) Creditors Trade and Creditors Expenses, both will be shown on the Liabilities side.

(2) Insurance is prepaid for the two months of April and May. As such, the Prepaid Insurance will be ₹ 1,200 x 2/12 = ₹ 200.

(3) Manager will not be entitled to any Commission because there is Net Loss instead of Net Profit in the Question.

Hints:-

(1) Creditors Trade and Creditors Expenses, both will be shown on the Liabilities side.

(2) Insurance is prepaid for the two months of April and May. As such, the Prepaid Insurance will be ₹ 1,200 x 2/12 = ₹ 200.

(3) Manager will not be entitled to any Commission because there is Net Loss instead of Net Profit in the Question.

Anurag Pathak Changed status to publish