Prepare Trading and Profit & Loss Account and Balance Sheet as at 31st March, 2023, from the following balances: Capital A/c ₹ 5,00,000 ₹ Drawings A/c ₹ 36,000

Prepare Trading and Profit & Loss Account and Balance Sheet as at 31st March, 2023, from the following balances:

Adjustments:-

(1) Stock on hand on 31st March, 2023 was ₹ 80,000.

(2) Further Bad-debts writeen off ₹ 2,000 and Create a provision of 5% on Sundry Debtors.

(3) Rent has been paid up to 31st May, 2023.

(4) Manufacturing wages include ₹ 10,000 of a new Machinery purchased on 1st October, 2022.

(5) Depreciate Plant and Machinery by 10% p.a. and Fixtures and Fittings by 20% p.a.

(6) Commission earned but not received ₹ 1,000.

(7) Interest on Loan for the last two months is not paid.

(8) Goods worth ₹ 4,000 were distributed as free samples.

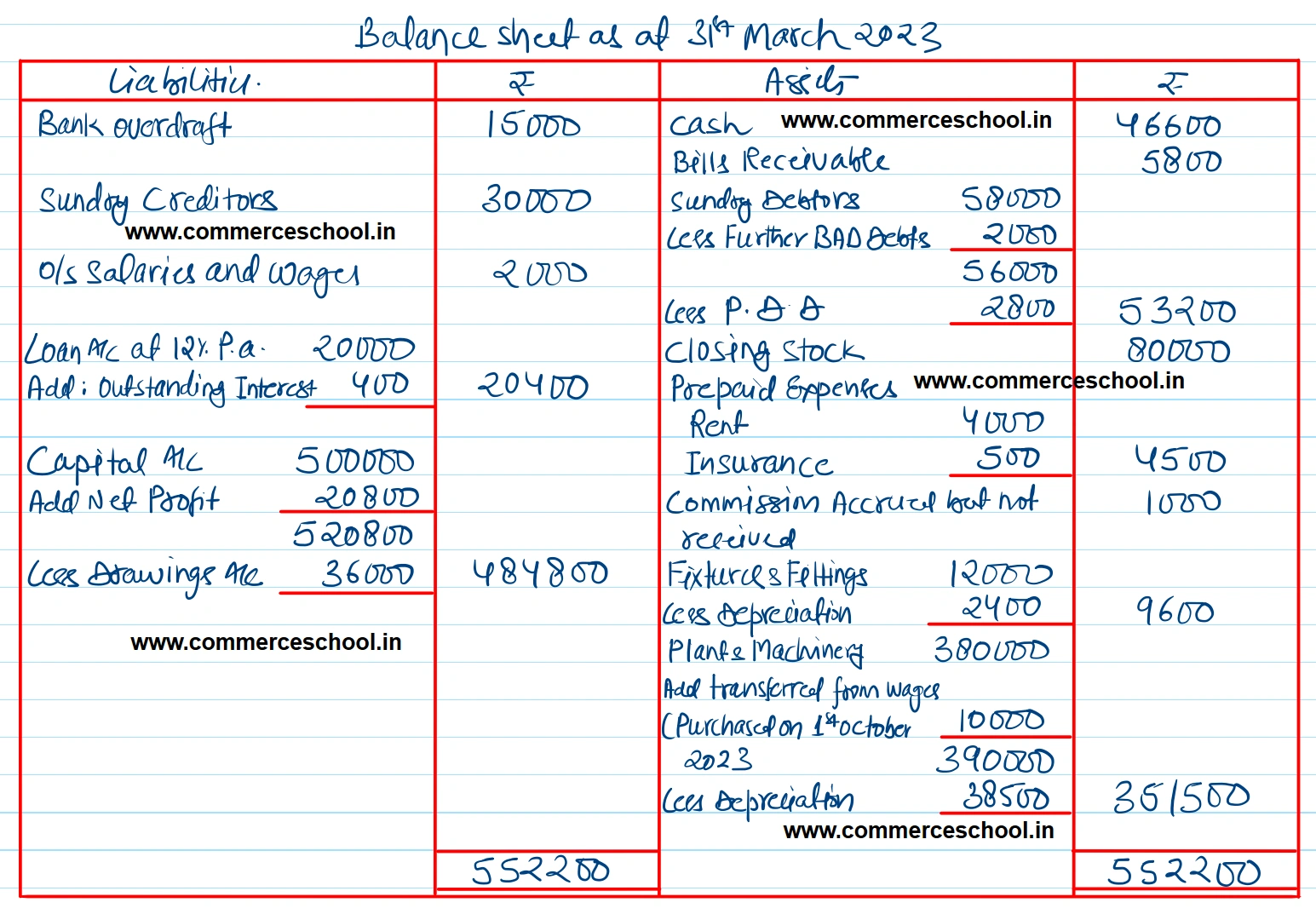

[Ans. G.P. ₹ 1,24,000; N.P. ₹ 20,800; B/S Total ₹ 5,52,200.]

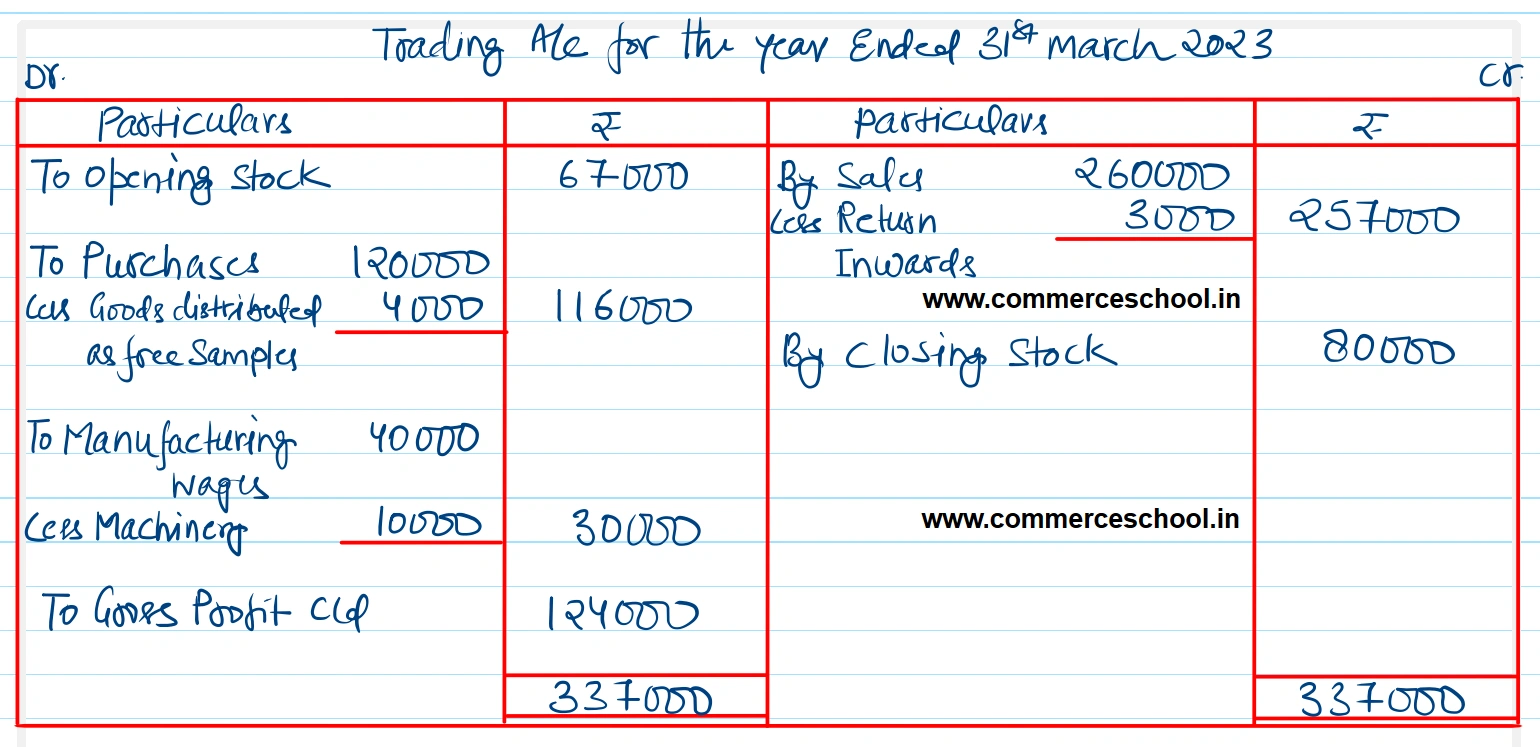

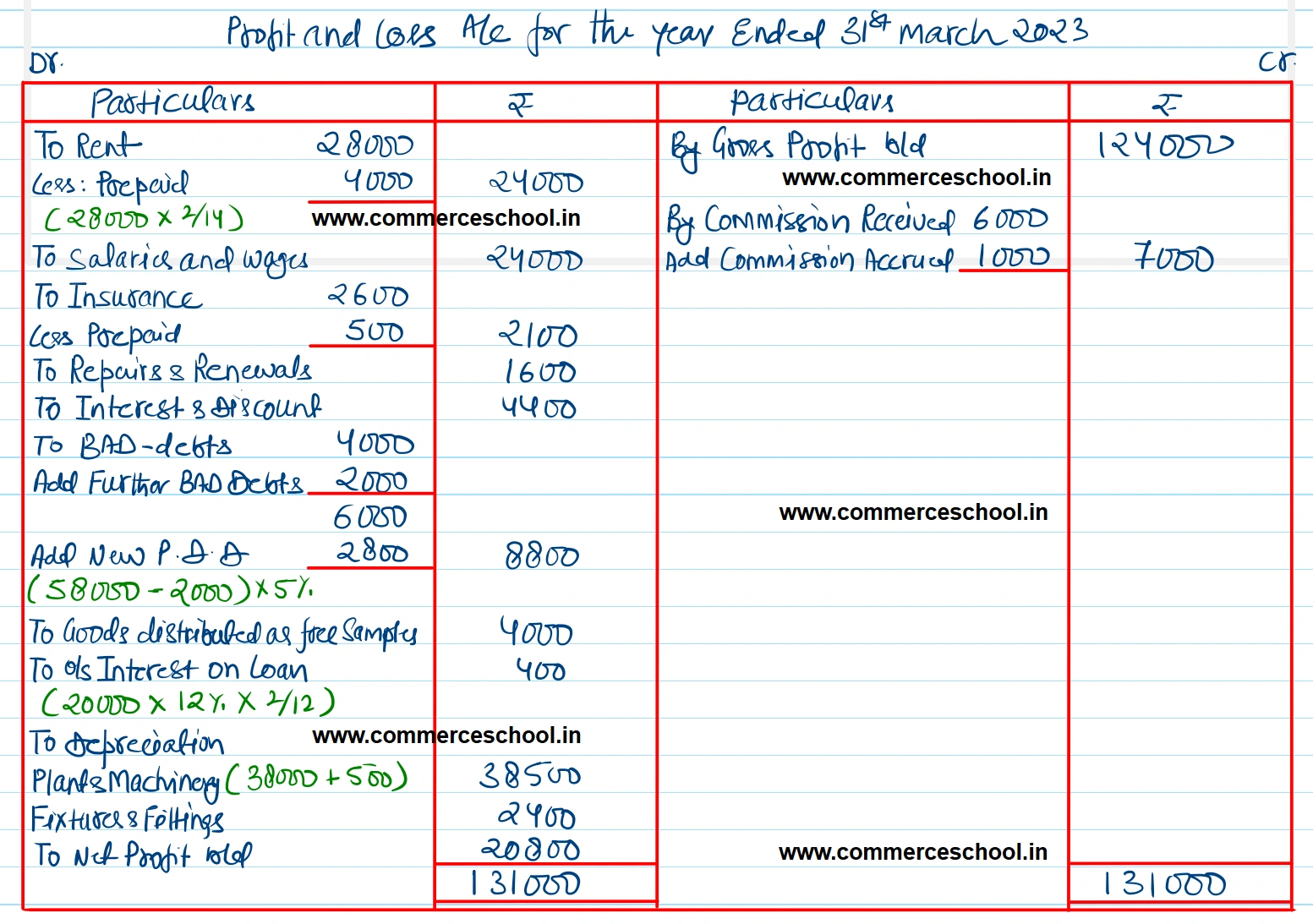

Solution:-

| Particulars | ₹ | Particulars | ₹ |

| Capital A/c | 5,00,000 | Stock on 1.4.2022 | 67,000 |

| Drawings A/c | 36,000 | Salaries & Wages | 24,000 |

| Bills Receivable | 5,800 | Outstanding Salaries and Wages | 2,000 |

| Plant & Machinery | 3,80,000 | Insurance (including premium of ₹ 1,000 per annum paid upto 30.9,2023) | 2,600 |

| Sundry Debtors | 58,000 | Cash | 46,600 |

| Loan A/c (Cr.) at 12% p.a. | 20,000 | Bank Overdraft | 15,000 |

| Manufacturing Wages | 40,000 | Repairs & Renewals | 1,600 |

| Returns Inwards | 3,000 | Interest & Discount (Dr.) | 4,400 |

| Purchases | 1,20,000 | Bad-debts | 4,000 |

| Sales | 2,60,000 | Sundry Creditors | 30,000 |

| Rent | 28,000 | Fixtures & Fittings | 12,000 |

| Commission Received | 6,000 |

Anurag Pathak Answered question