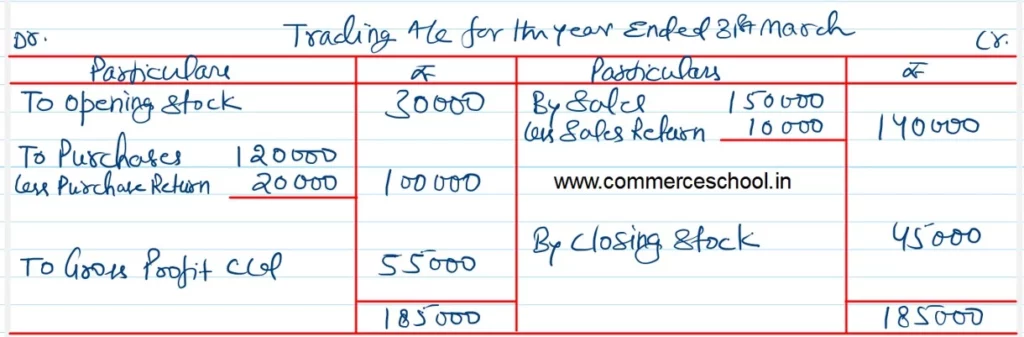

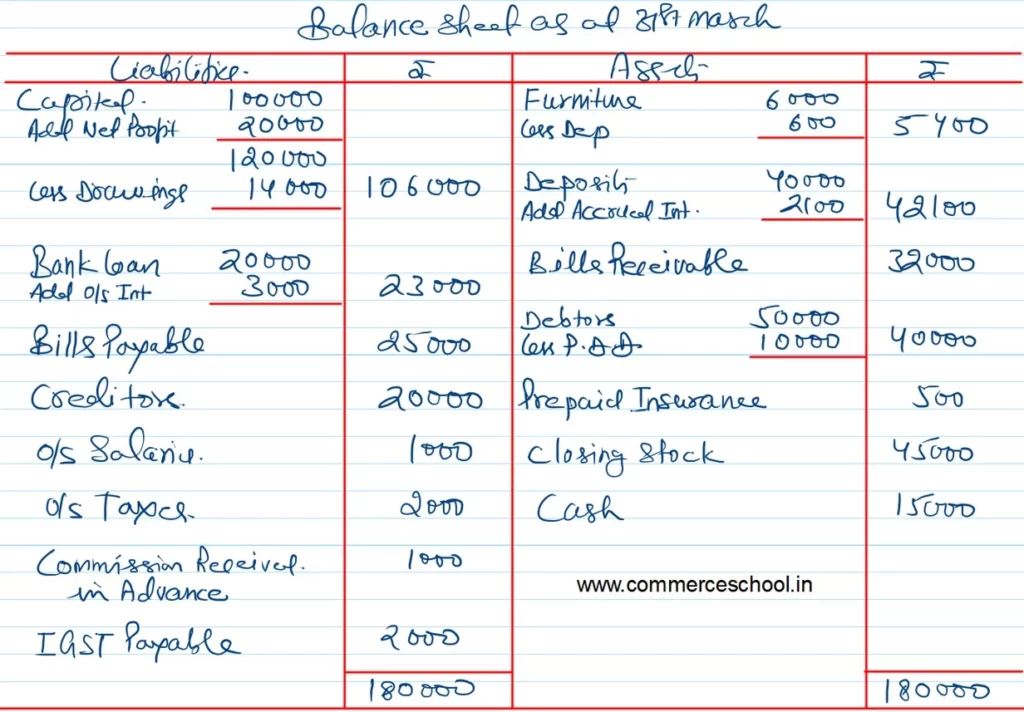

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance:

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance:

| Particulars | Dr. (₹) | Cr. (₹) |

|

Capital Cash Bank Loan Purchases Sales Sales Return Purchases Return Establishment Expenses Taxes and Insurance Bad Debts Provision for Doubtful Debts Debtors Creditors Commission Deposits Opening Stock Drawings Furniture Bills Receivable Bills Payable Input CGST Input SGST Output CGST Output SGST Output IGST |

– 15,000 1,20,000 – 10,000 – 22,000 5,000 5,000 – 50,000 – – 40,000 30,000 14,000 6,000 32,000 – 10,000 10,000 – – – |

1,00,000 – 20,000 – 1,50,000 – 20,000 – – – 7,000 – 20,000 5,000 – – – – – 25,000 – – 8,000 8,000 6,000 |

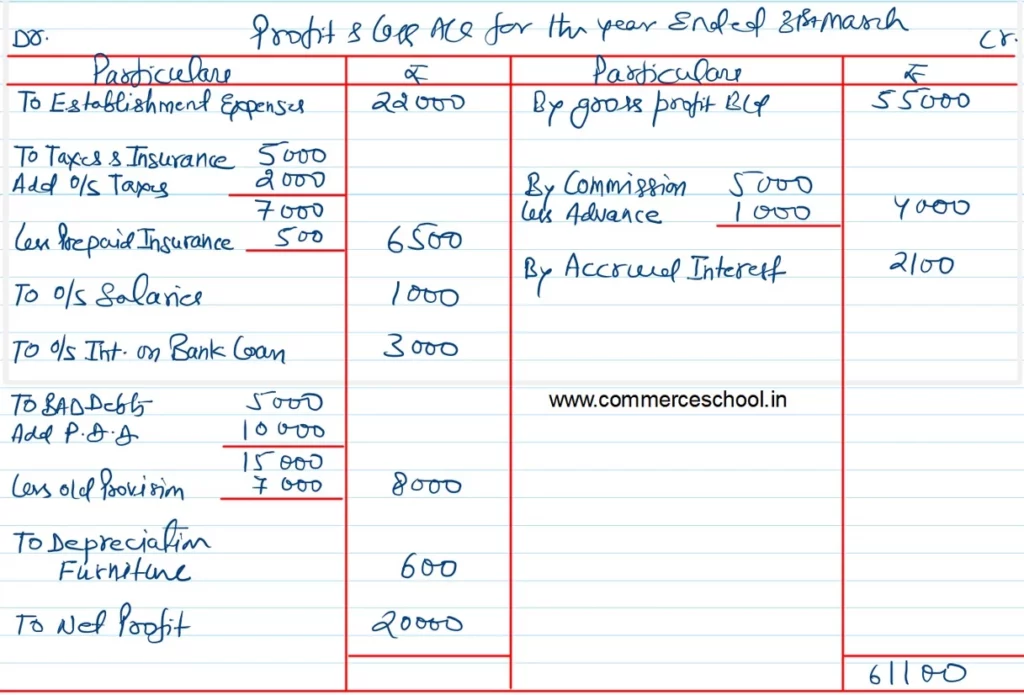

Adjustments:

(i) Salaries ₹ 1,000 and Taxes ₹ 2,000 are outstnading but insurance ₹ 5000 is prepaid.

(ii) Commission ₹ 1,000 received in advance for the next year.

(iii) Interest ₹ 2,100 is to be received on Deposits and Interest on Bank Loan ₹ 3,000 is to be paid.

(iv) Provision for Doubtful Debts to be maintained at ₹ 10,000.

(v) Depreciate Furniture by 10%.

(vi) Stock on 31st March, 2023 is ₹ 45,000.

(vii) A fire occurred on 1st April, 2023 destroying goods costing ₹ 10,000.