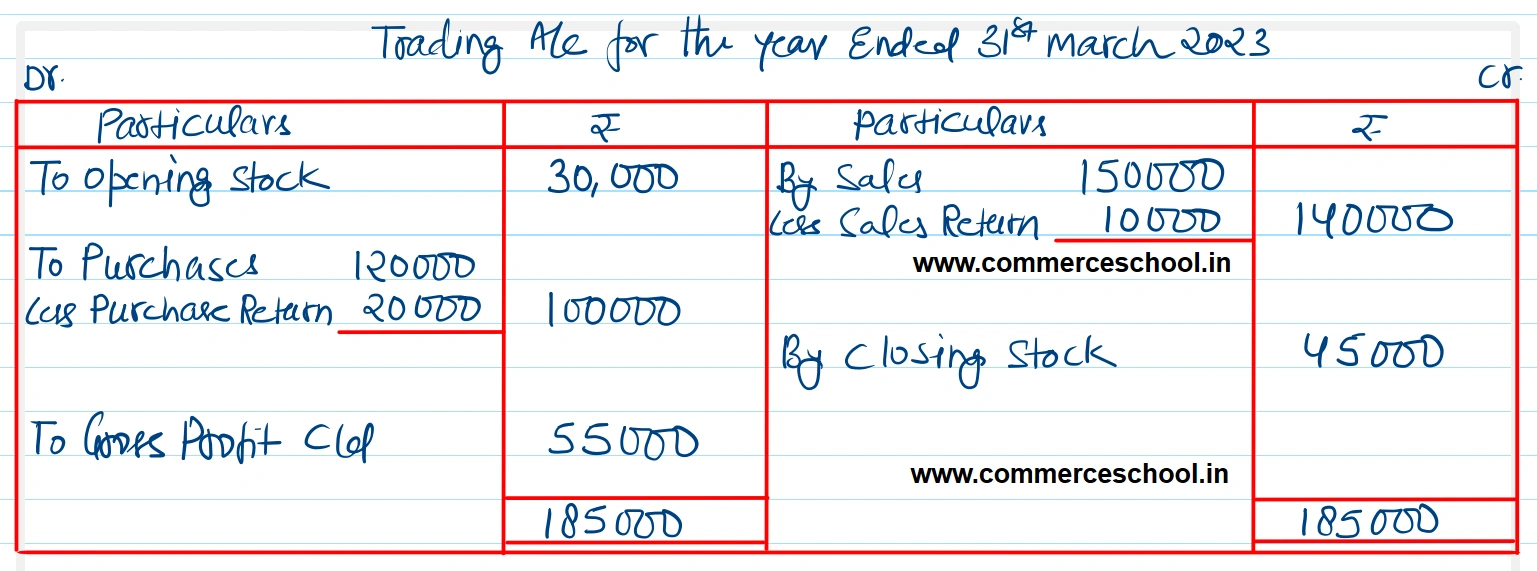

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance:-

Adjustments:-

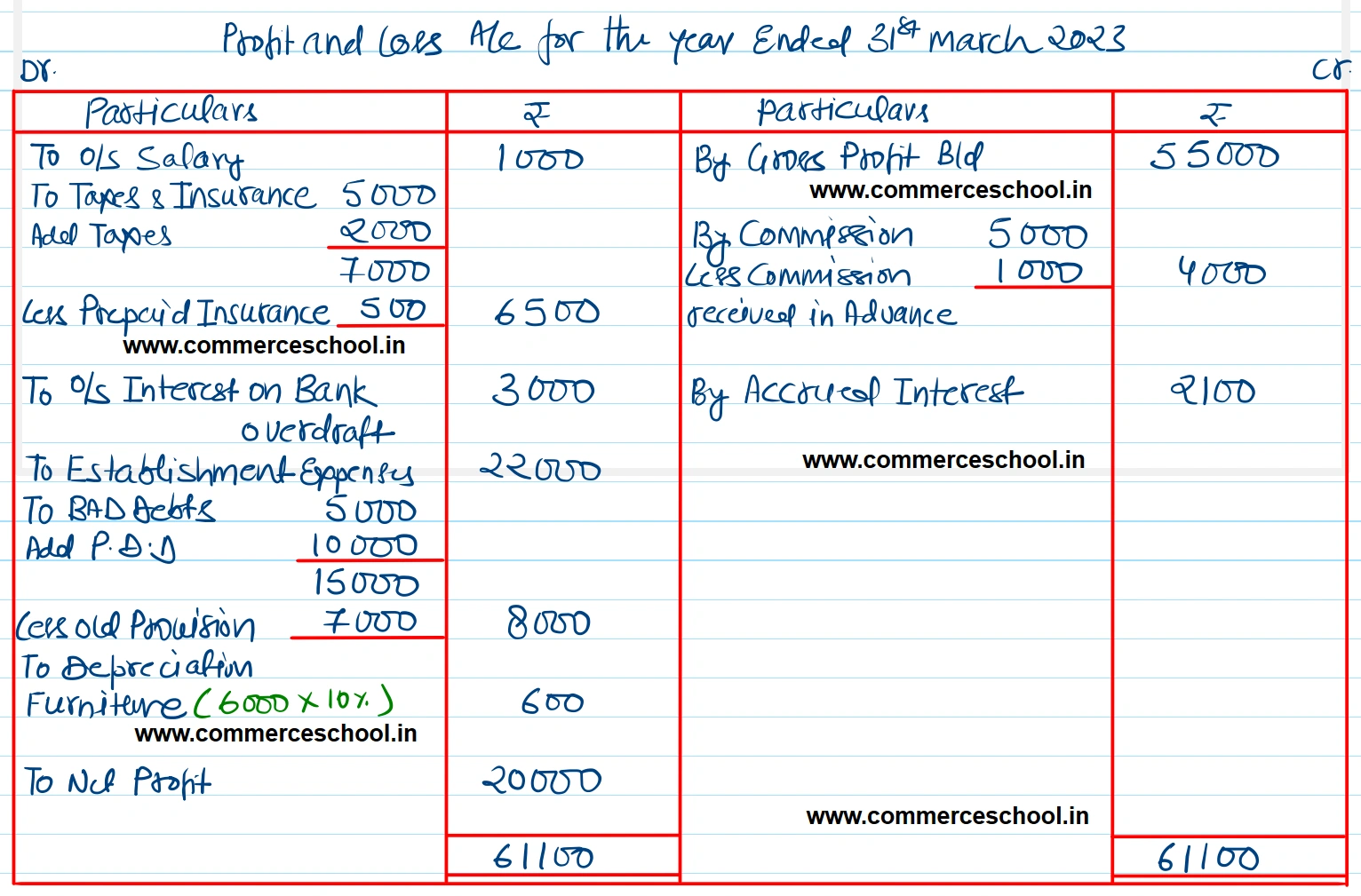

1. Salaries ₹ 1,000 and taxes ₹ 2,000 are outstanding but insurance ₹ 500 is prepaid.

2. Commission ₹ 1,000 is received in advance for next year.

3. Interest ₹ 2,100 is to be received on Deposits and Interest on Bank Overdraft ₹ 3,000 is to be paid.

4. Bad-debts provision is to be maintained at ₹ 10,000 on Debtors.

5. Depreciate Furniture by 10%.

6. Stock on 31st March, 2023 was valued at ₹ 45,000.

[Ans. G.P. ₹ 55,000; N.P. ₹ 20,000, and

| Particulars | Dr. (₹) | Cr. (₹) |

| Capital | 1,00,000 | |

| Cash | 15,000 | |

| Bank Overdraft | 20,000 | |

| Purchases and Sales | 1,20,000 | 1,50,000 |

| Returns | 10,000 | 20,000 |

| Establishment Expenses | 22,000 | |

| Taxes and Insurance | 5,000 | |

| Bad-debts and Bad-debt Provision | 5,000 | 7,000 |

| Debtors and Creditors | 50,000 | 20,000 |

| Commission | 5,000 | |

| Deposits | 40,000 | |

| Opening Stock | 30,000 | |

| Drawings | 14,000 | |

| Furniture | 6,000 | |

| B/R and B/P | 30,000 | 25,000 |

| 3,47,000 | 3,47,000 |

Anurag Pathak Answered question