Radha, Manas and Arnav were partners in a firm sharing profits and losses in the ratio of 3 : 1 : 1. Their Balance Sheet as at 31st March, 2019 was as follows:

Radha, Manas and Arnav were partners in a firm sharing profits and losses in the ratio of 3 : 1 : 1. Their Balance Sheet as at 31st March, 2019 was as follows:

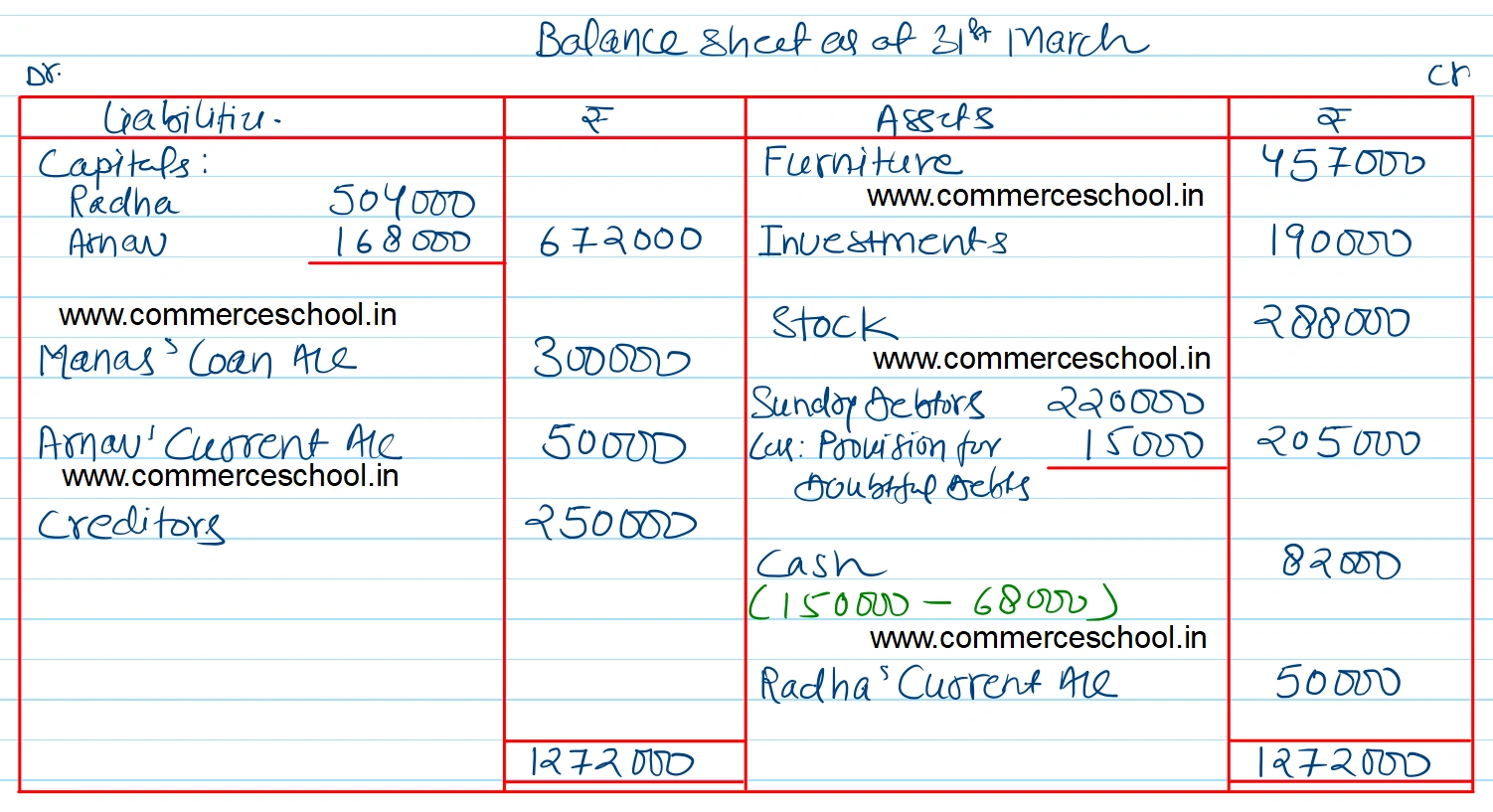

Balance Sheet of Radha, Manas and Arnav as at 31st March, 2019

| Liabilities | ₹ | Assets | ₹ |

|

Capitals: Radha Manas Arnav |

4,00,000 3,00,000 2,00,000 |

Furniture | 4,60,000 |

| Investment Fluctuation Fund | 1,10,000 | Investments | 2,00,000 |

| Creditors | 2,50,000 | Stock | 2,40,000 |

|

Sundry Debtors 2,20,000 Less: Provision for Doubtful Debts 10,000 |

2,10,000 | ||

| Cash | 1,50,000 | ||

| 12,60,000 | 12,60,000 |

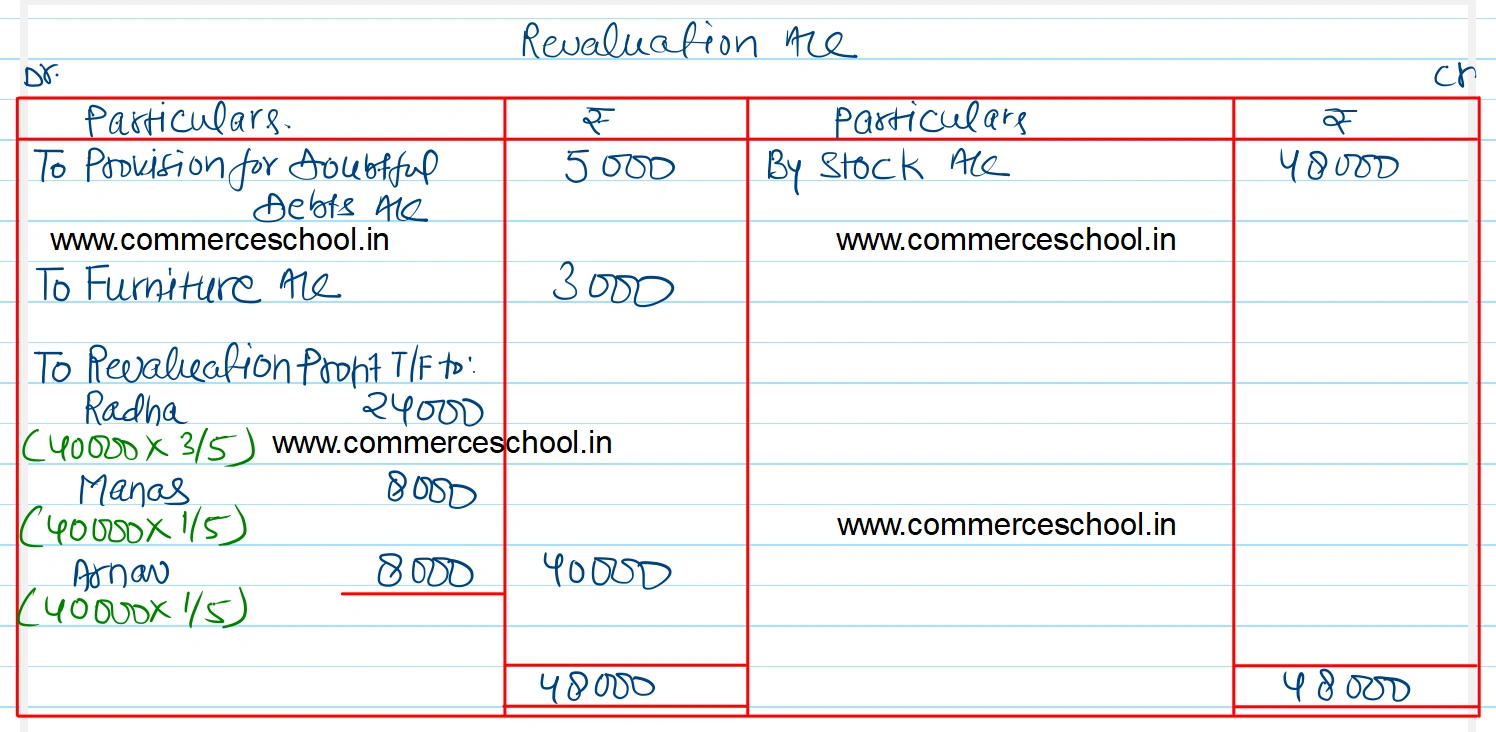

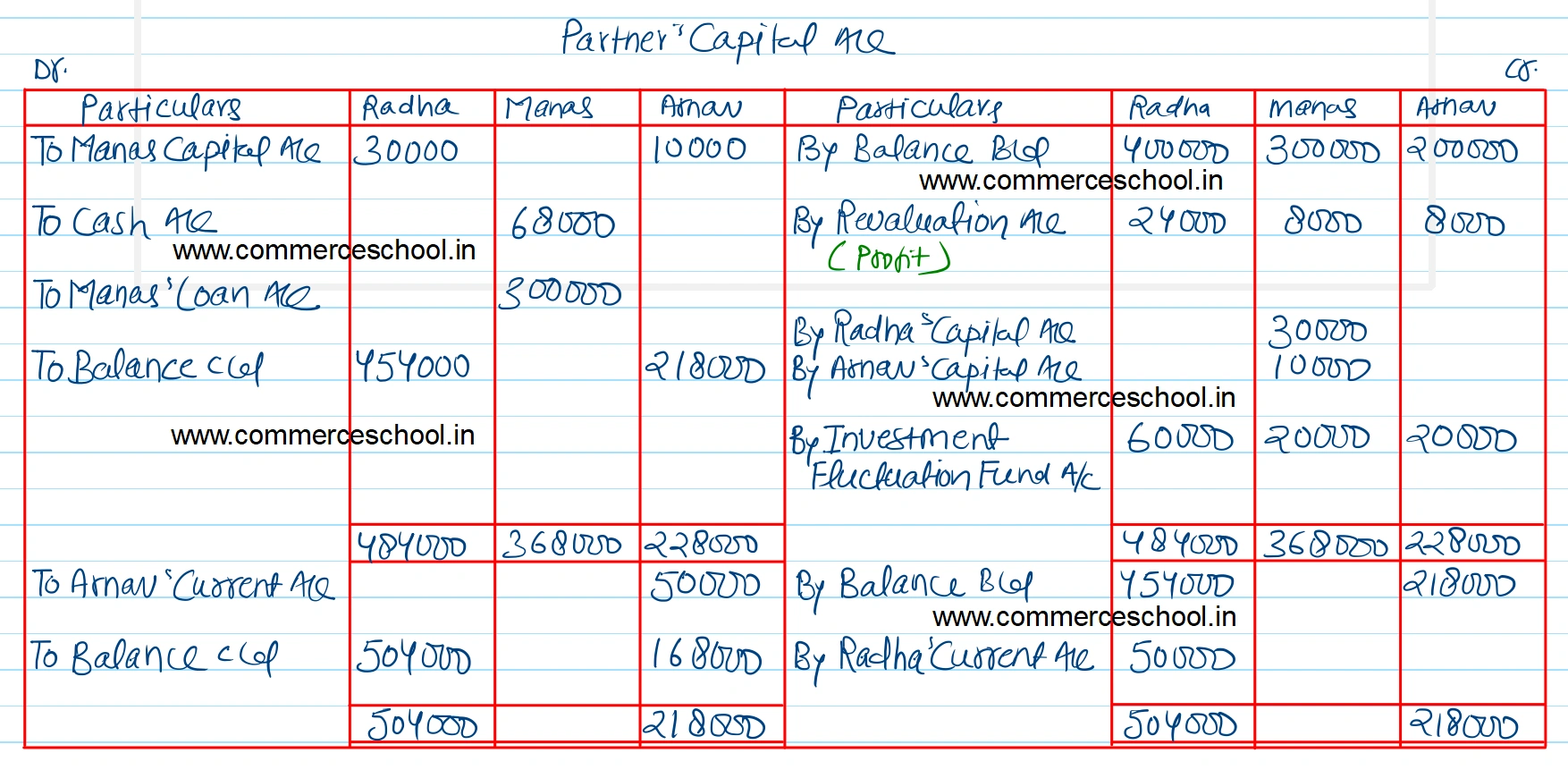

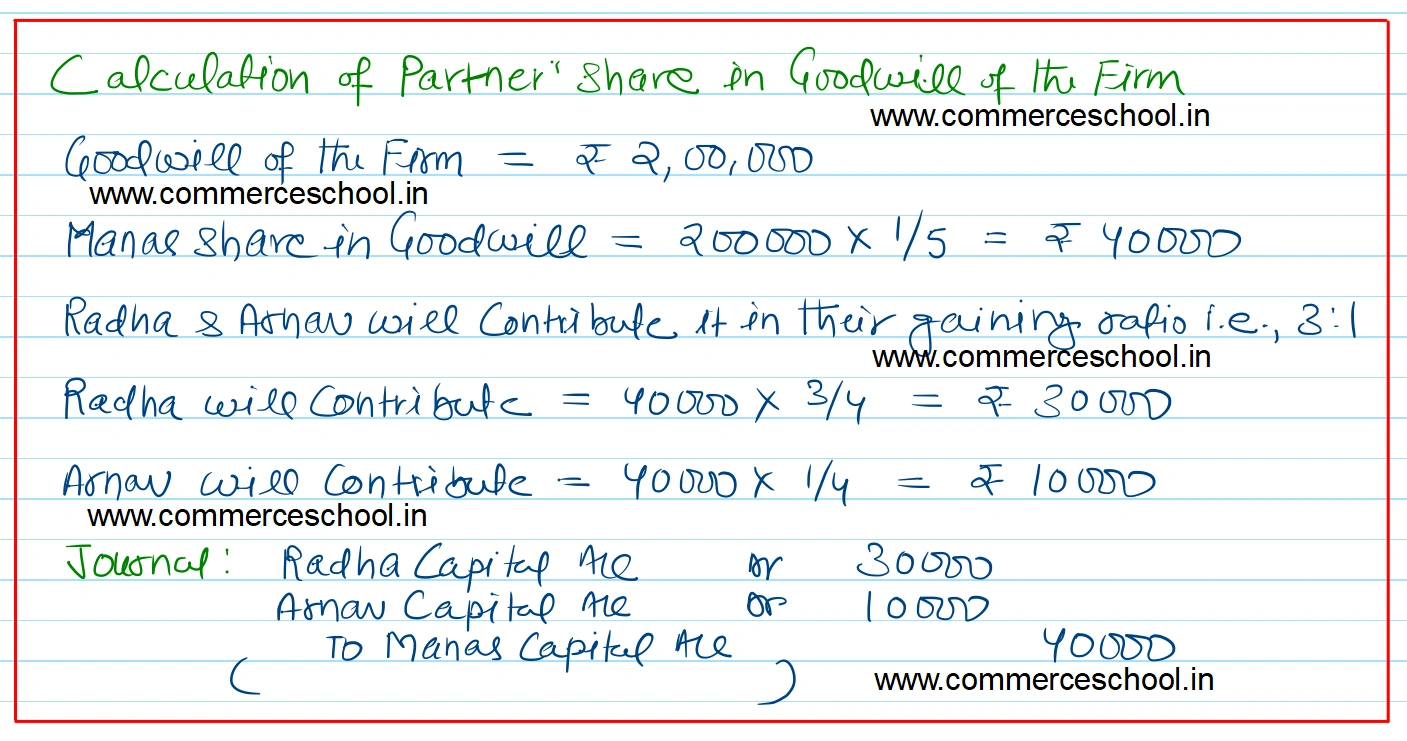

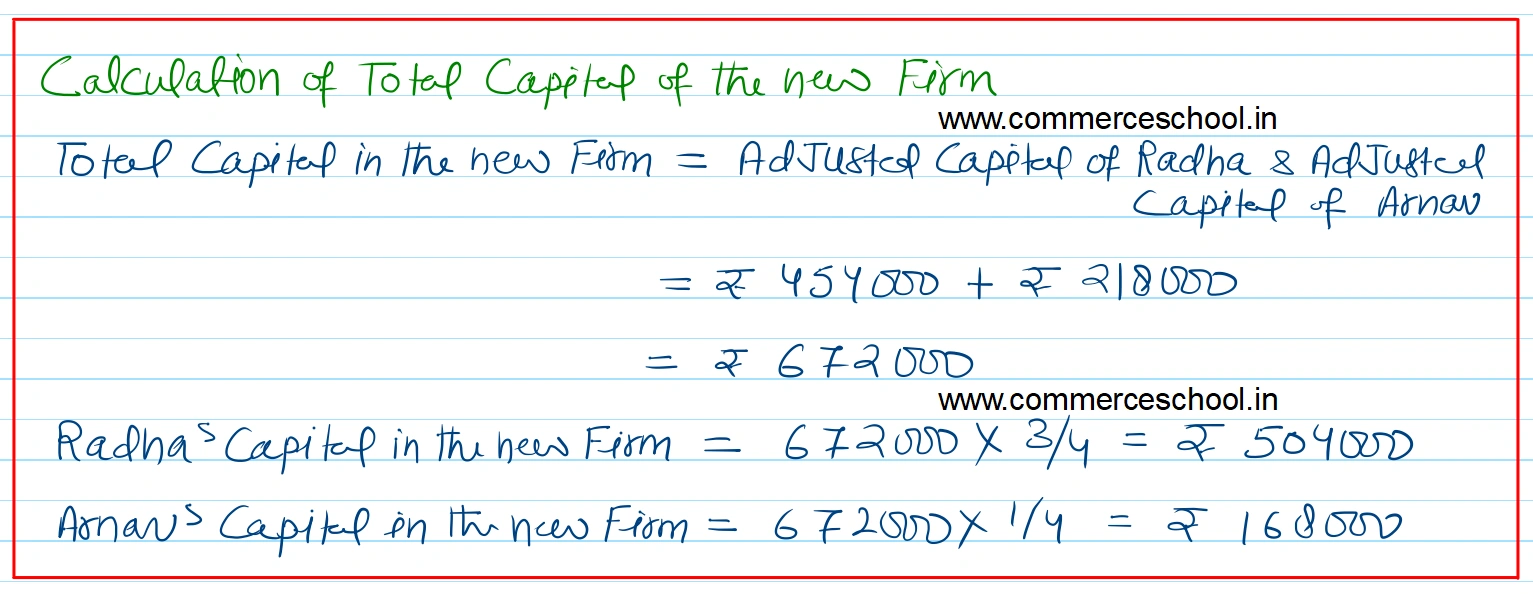

Manas retired on 1st April, 2019. It was agreed that: (I) Stock was to be appreciated by 20%. (ii) Provision for doubtful debts was to be increased to ₹ 15,000. (iii) Value of furniture was to be reduced by ₹ 3,000. (iv) Market value of investments was ₹ 1,90,000. (v) Goodwill for the firm was valued at ₹ 2,00,000 and Manas’s share was adjusted in the accounts of Radha and Arnav. (vi) Manas was paid ₹ 68,000 in cash and the balance was transferred to his loan account. (vii) Capitals of Radha and Arnav were to be in proportion to their new profit sharing ratio. Surplus/deficit, if any, in their capital accounts was to be adjusted through current accounts. Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm. [Ans. Gain on Revaluation ₹ 40,000; Manas Loan A/c ₹ 3,00,000; Capital A/cs: Radha ₹ 5,04,000 and Arnav ₹ 1,68,000; Current A/cs: Radha ₹ 50,000 (Dr.), Arnav ₹ 50,000 (Cr.); Balance Sheet Total ₹ 12,72,000.]