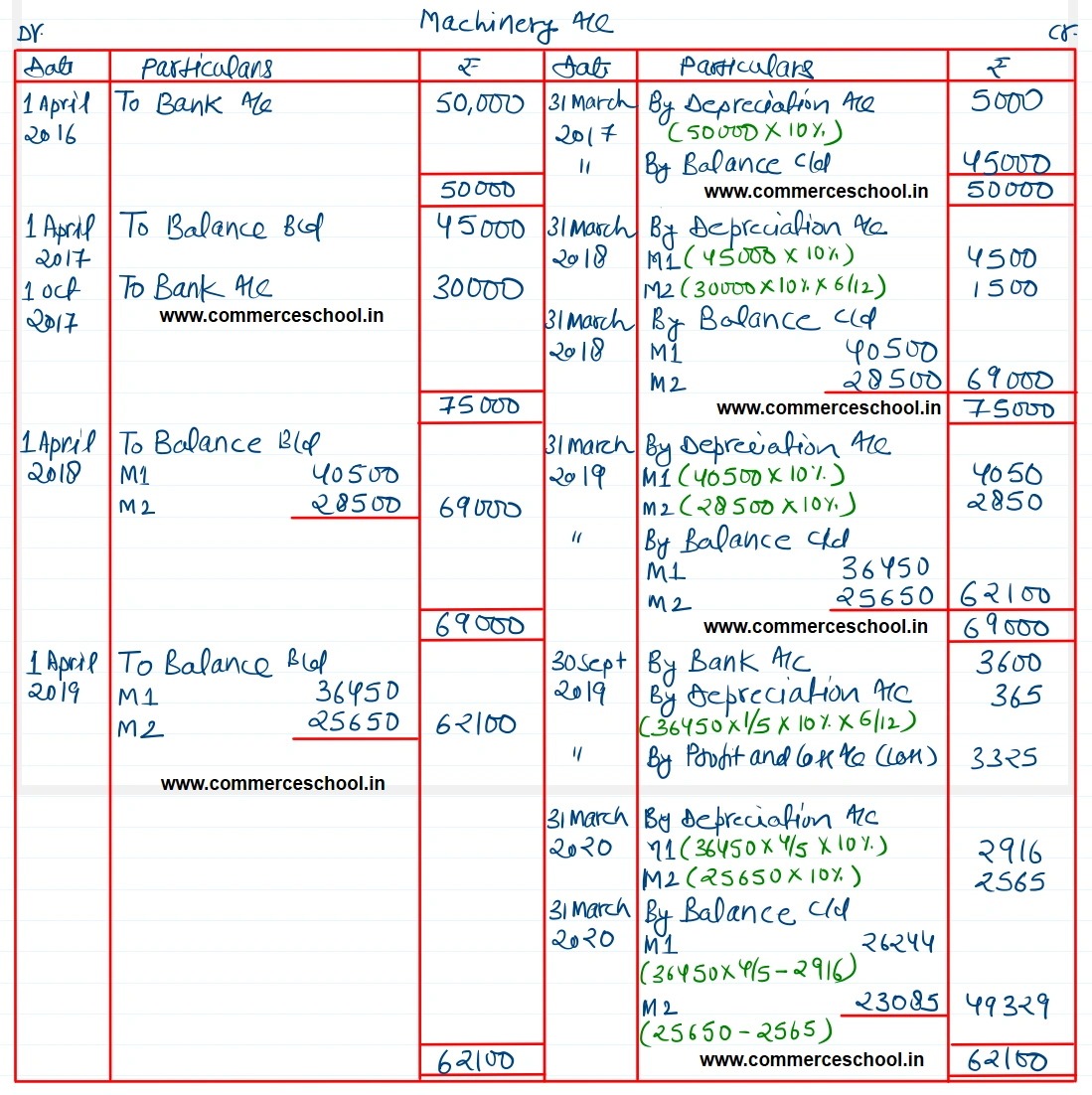

Raja Textiles Co. which closes its books on 31st March, purchased a machine on 1-4-2016 for ₹ 50,000. On 1-10-2017, it purchased an additional machine for ₹ 30,000

Raja Textiles Co. which closes its books on 31st March, purchased a machine on 1-4-2016 for ₹ 50,000. On 1-10-2017, it purchased an additional machine for ₹ 30,000. Estimated scrap value were ₹ 1,500 and ₹ 1,000 respectively.

The part of the machine which was purchased on 1-4-2016 costing ₹ 10,000 was sold for ₹ 3,600 on 30th Sept., 2019. Prepare the Machine Account for four years, if the depreciation is provided at the rate of 10% p.a. on Diminishing Balance Method.

[Ans. Loss on sale of Machinery ₹ 3,325; Balance of Machinery A/c on 31st March, 2020, ₹ 49,329.]

Anurag Pathak Answered question