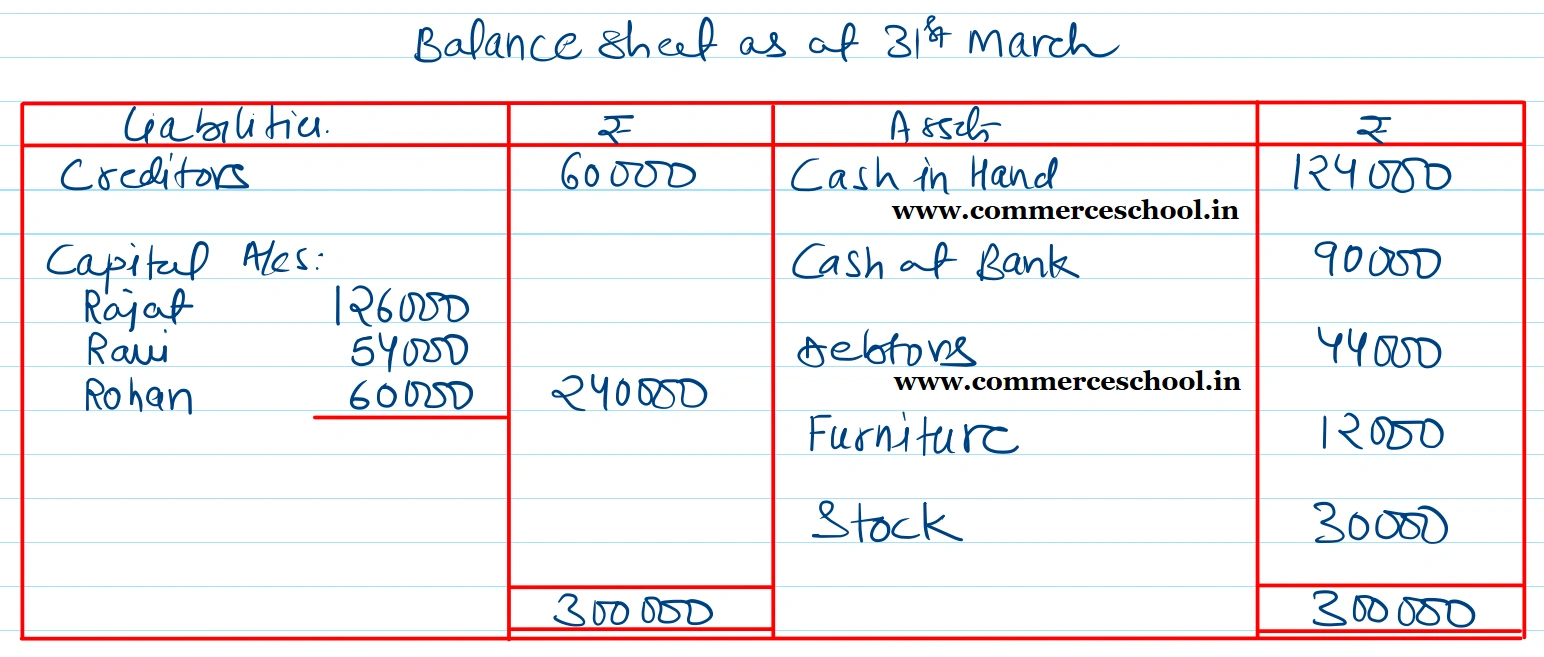

Rajat and Ravi are partners in a firm sharing profits and losses in the ratio of 7 : 3. Their Balance Sheet as at 31st March, 2024 is as follows:

Rajat and Ravi are partners in a firm sharing profits and losses in the ratio of 7 : 3. Their Balance Sheet as at 31st March, 2024 is as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 60,000 | Cash in Hand | 36,000 |

| Reserve | 10,000 | Cash at Bank | 90,000 |

|

Capital Accounts: Rajat Ravi |

1,00,000 80,000 |

Debtors | 44,000 |

| Furniture | 30,000 | ||

| Stock | 50,000 | ||

| 2,50,000 | 2,50,000 |

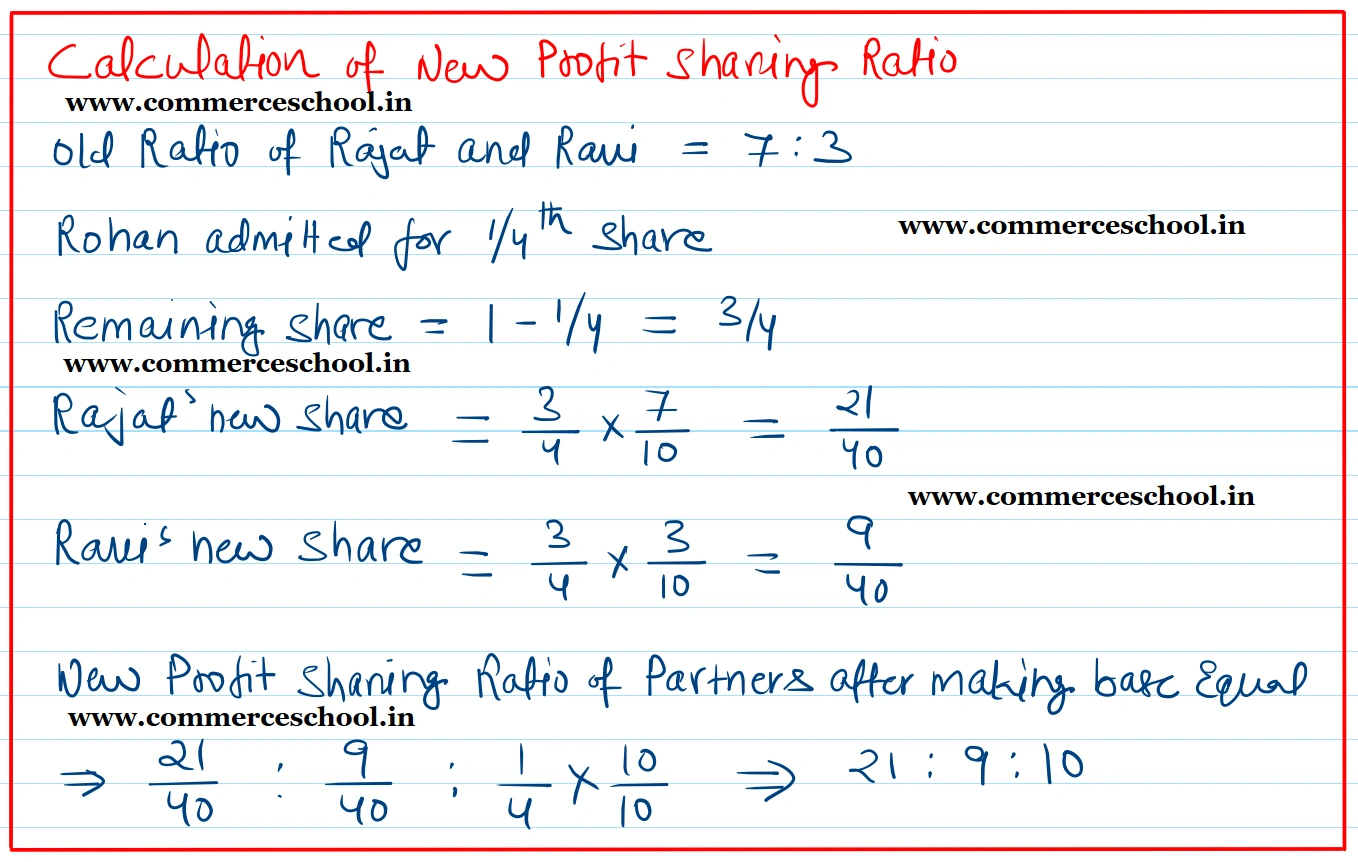

On 1st April, 2024, they admit Rohan on the following terms:

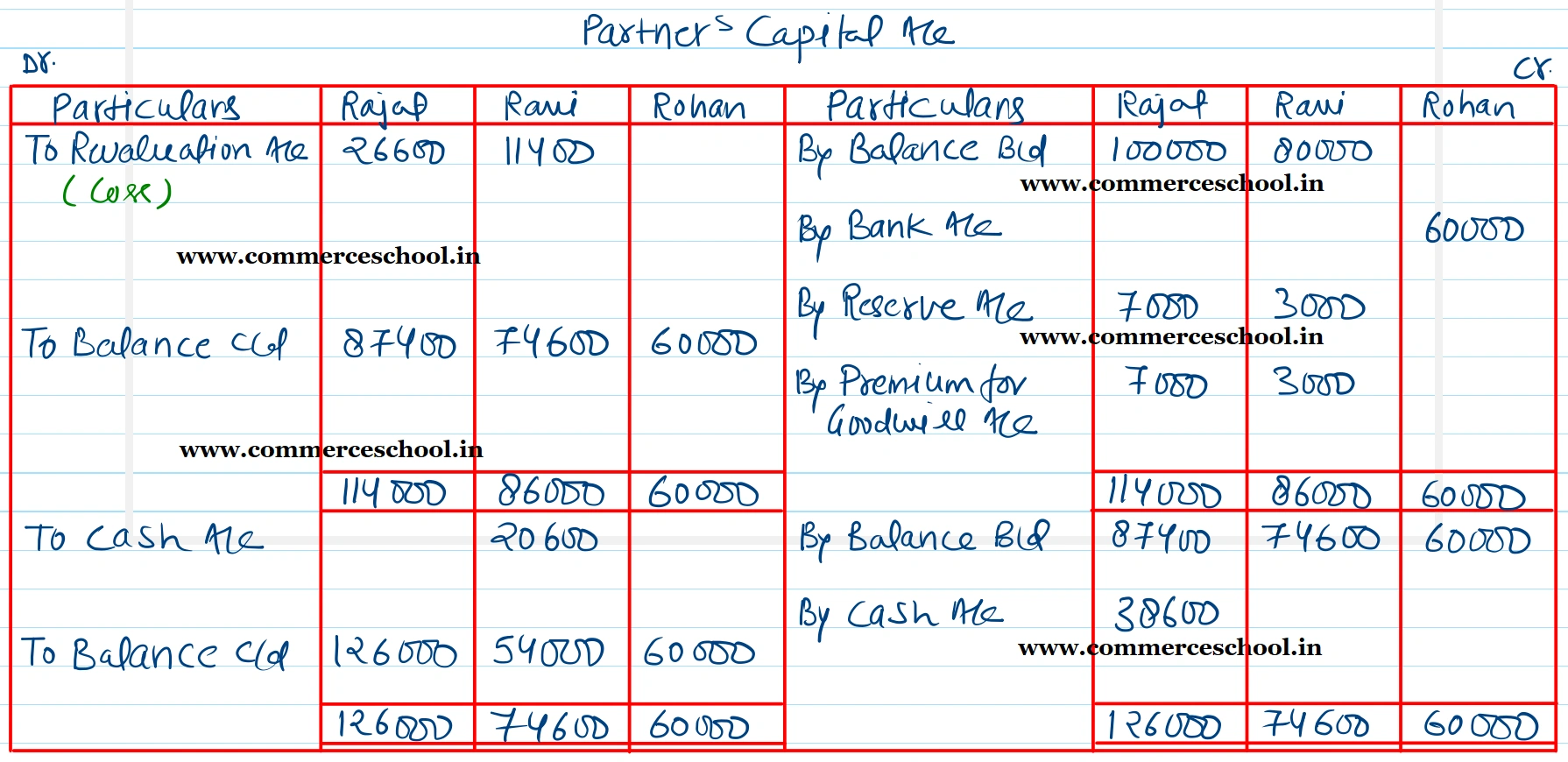

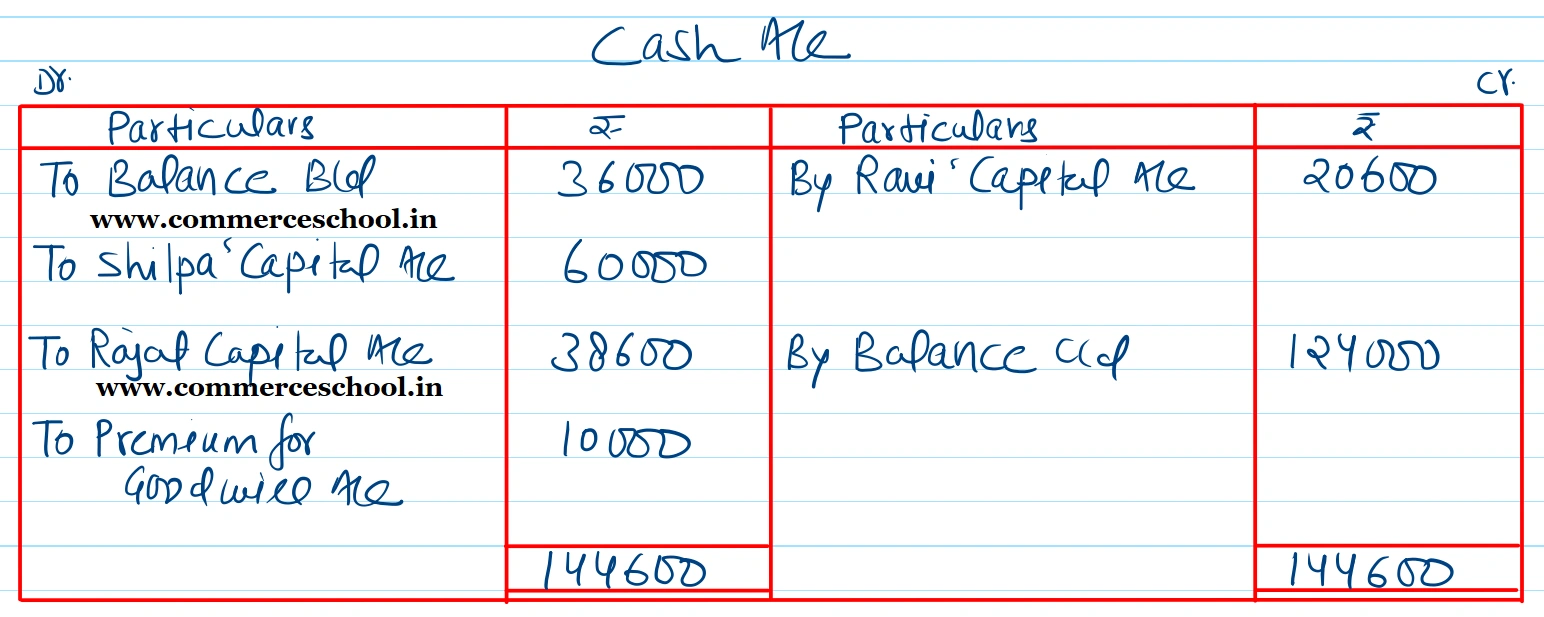

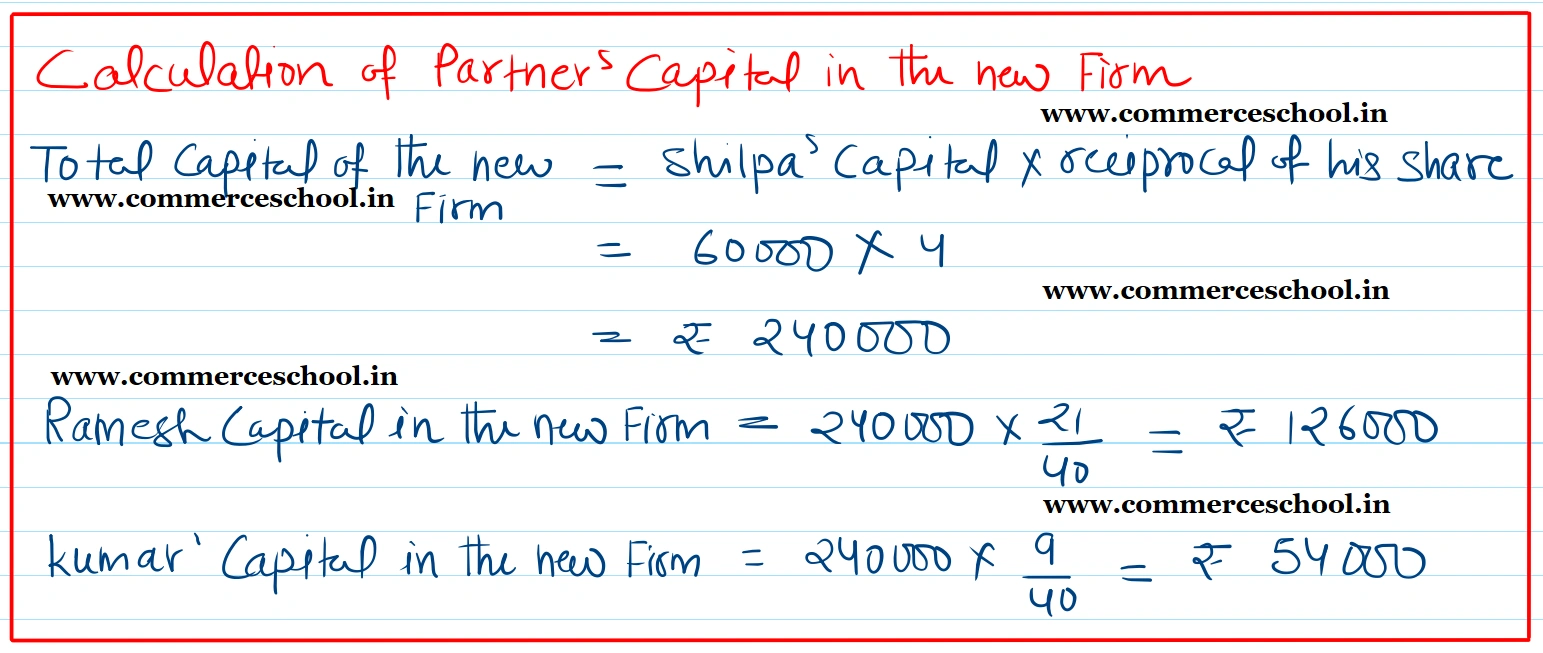

(i) Goodwill is valued at ₹ 40,000 and Rohan is to bring in the necessary amount in cash as premium for goodwill and ₹ 60,000 as Capital for 1/4 share in profits.

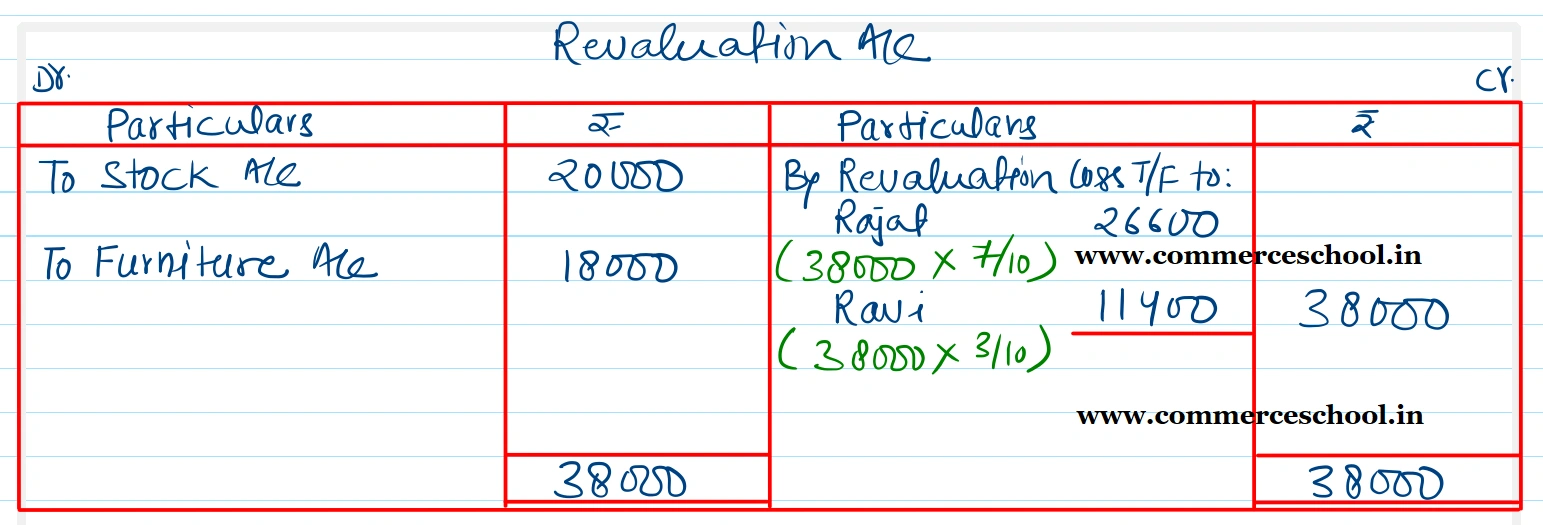

(ii) Stock is to be reduced by 40% and furniture is to be reduced to 40%.

(iii) Capitals of the partners shall be proportionate to their Profit Sharing Ratio taking Rohan’s Capital as base. Adjsutments of Capitals to be made by cash.

Requirements: Prepare Revaluation Account, Partner’s Capital Accounts and Cash Account.

[Ans. Loss on Revaluation ₹ 38,000; New Ratio 21 : 9 : 10; Capital Accounts Rajat ₹ 1,26,000; Ravi ₹ 54,000 and Rohan ₹ 60,000; Deficit Capital brought in by Rajat in Cash ₹ 38,600; Surplus Capital returned to Ravi in Cash ₹ 20,600. Balance of Cash A/c ₹ 1,24,000.]