Rajesh and Ravi are partners sharing profits in the ratio of 3 : 2. Their Balance Sheet at 31st March, 2023 stood as:

Rajesh and Ravi are partners sharing profits in the ratio of 3 : 2. Their Balance Sheet at 31st March, 2023 stood as:

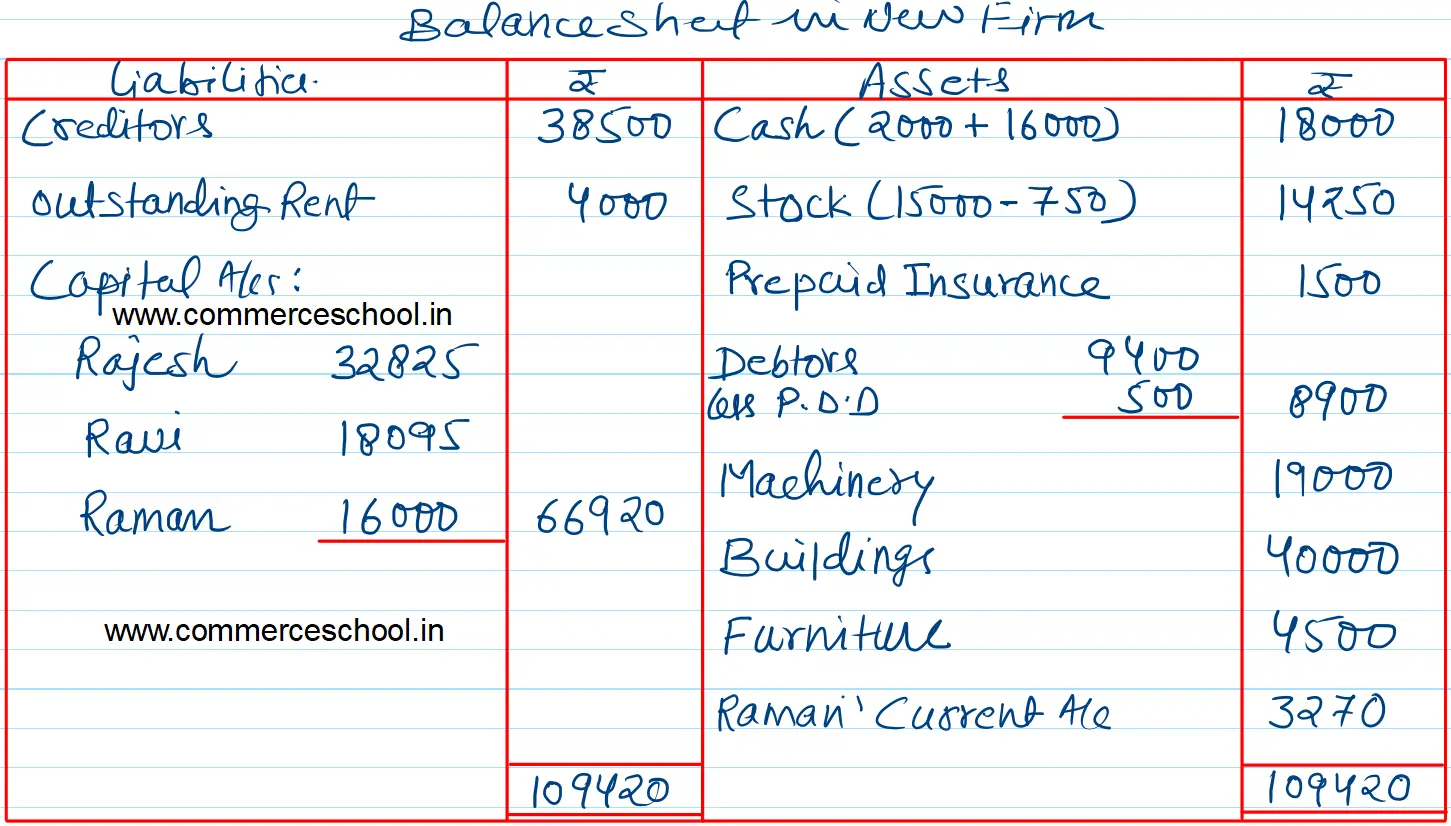

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Outstanding Rent Capital A/cs: Rajesh Ravi |

38,500 44,000 29,000 15,000 |

Cash

Stock Prepaid Insurance Debtors Machinery Building Furniture |

9,400

|

2,000 15,000 1,500 9,000 19,000 35,000 5,000 |

| 86,500 | 86,500 |

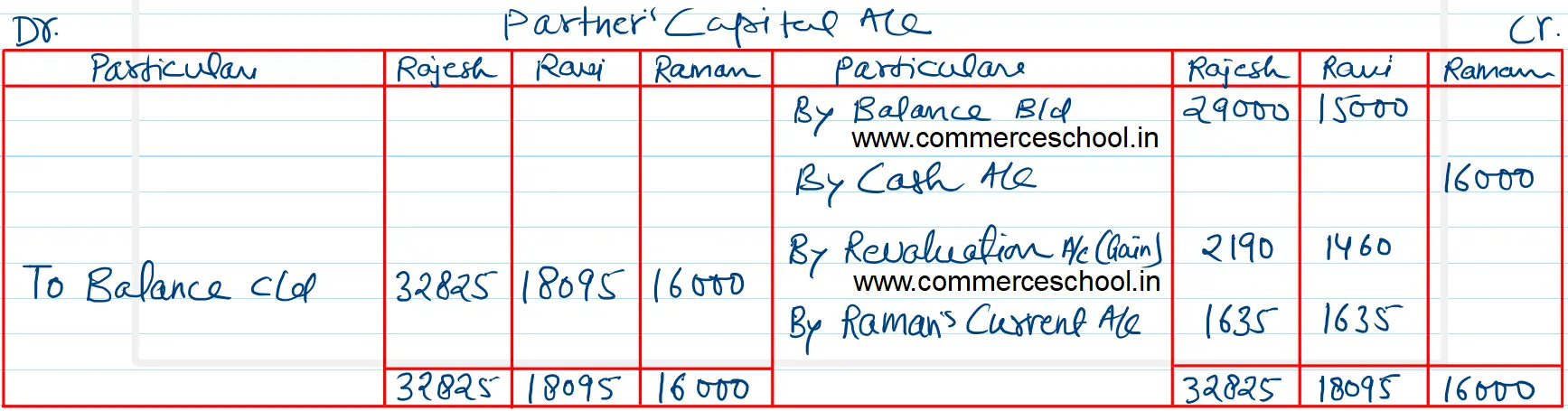

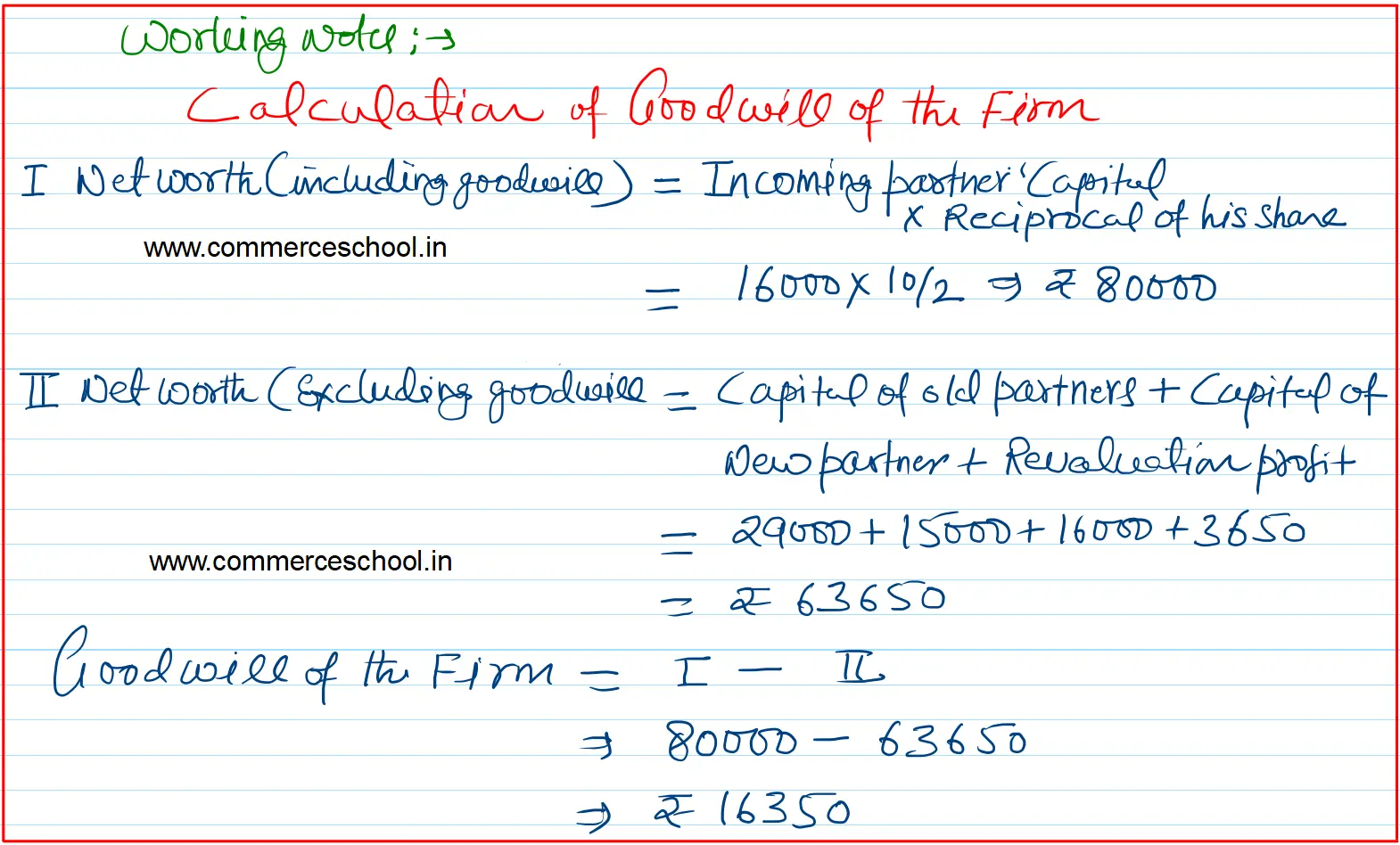

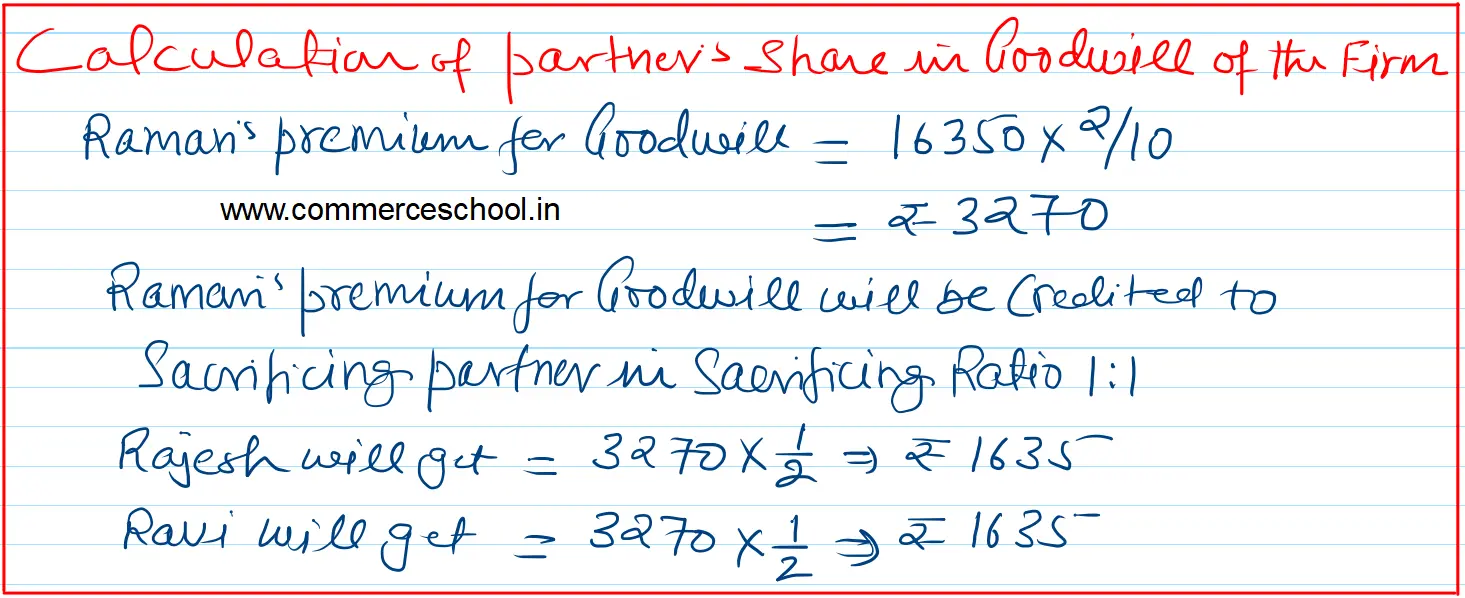

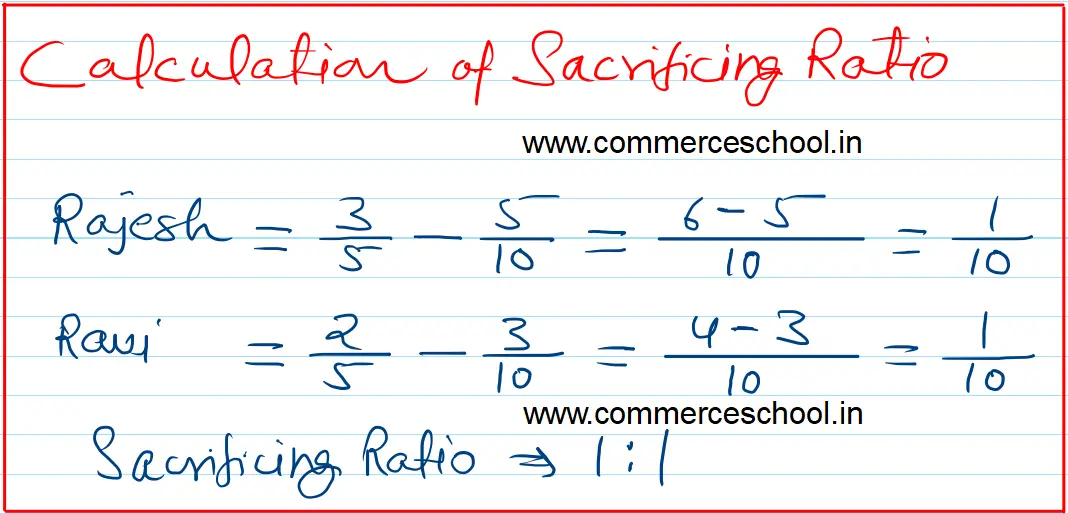

Raman is admitted as a new partner introducing a capital of ₹ 16,000. The new profit sharing ratio is decided as 5 : 3 : 2. Raman is unable to bring in any cash for goodwill. So, it is decided to value the goodwill on the basis of Raman’s share in the profits and the capital contributed by him. Following revaluation are made:

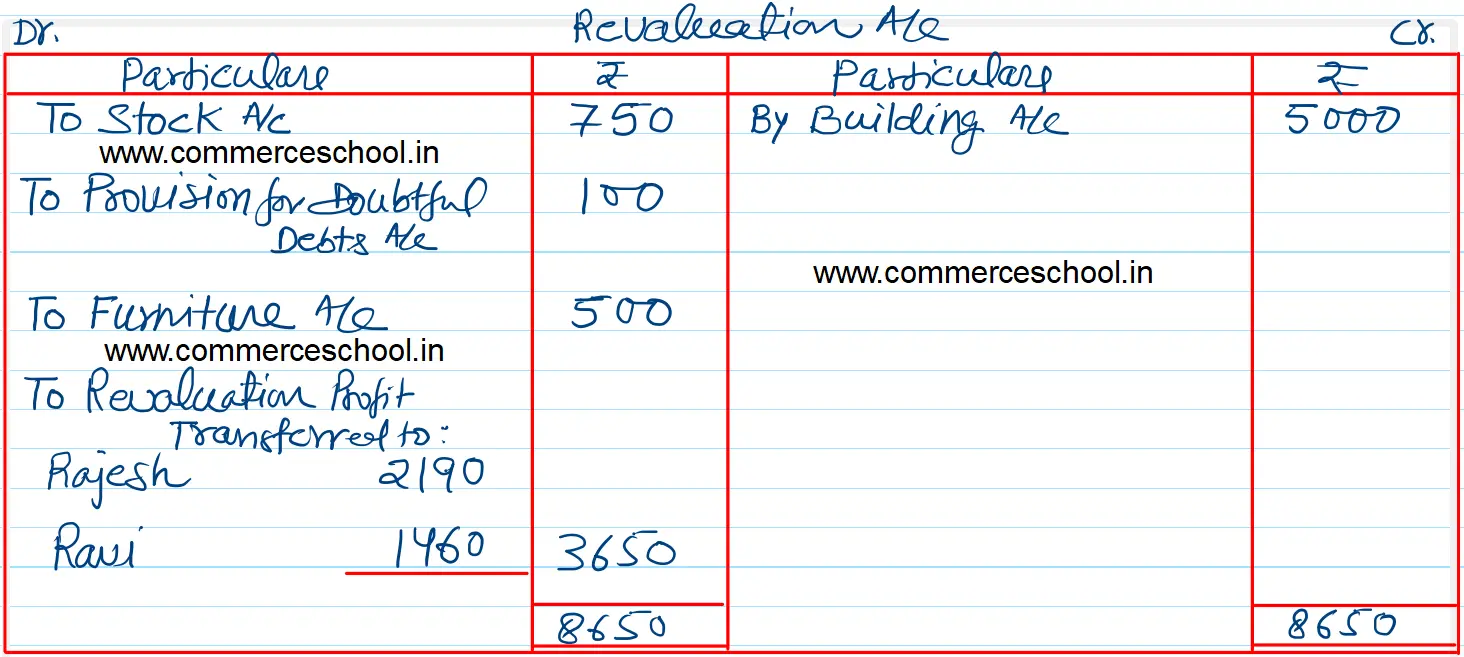

a) Stock to decrease by 5%.

b) Provision for Doubtful Debts is to be ₹ 500.

c) Furniture to decrease by 10%

d) Building is valued at ₹ 40,000.

Show necessary Ledger Account and Balance Sheet of new firm.