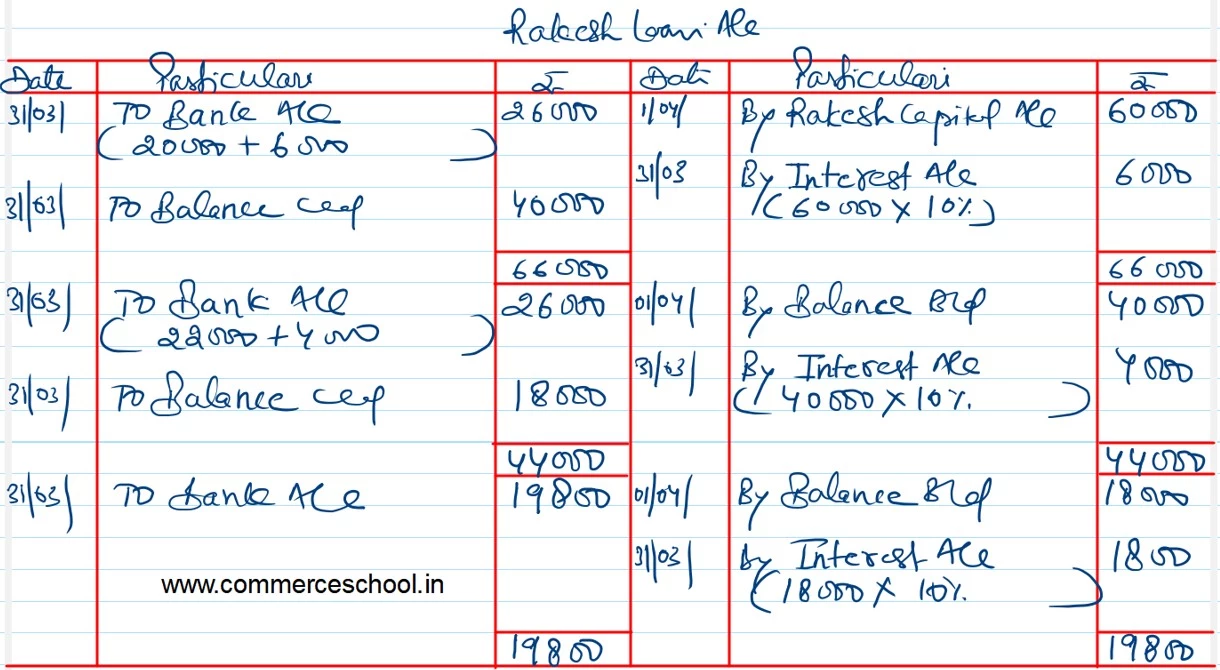

Rakesh retired from the firm. The amount due to his was determined at ₹ 90,000. It was decided to pay the due amount as follows: On the date of retirement – ₹ 30,000 Balance in three yearly instalments – First two instalments being of ₹ 26,000, including interest; and Balance amount as last instalment. Interest was payable @ 10% p.a. Prepare Retiring Partner’s Loan Account. [Ans.: Interest payable at the end ofyear 1 – ₹ 6,000; Year 2 – ₹ 4,000; Year 3 – ₹ 1,800; Last instalment – ₹ 19,800.]

Rakesh retired from the firm. The amount due to his was determined at ₹ 90,000. It was decided to pay the due amount as follows:

On the date of retirement – ₹ 30,000

Balance in three yearly instalments – First two instalments being of ₹ 26,000, including interest; and Balance amount as last instalment.

Interest was payable @ 10% p.a. Prepare Retiring Partner’s Loan Account.

[Ans.: Interest payable at the end ofyear 1 – ₹ 6,000; Year 2 – ₹ 4,000; Year 3 – ₹ 1,800; Last instalment – ₹ 19,800.]

Anurag Pathak Changed status to publish