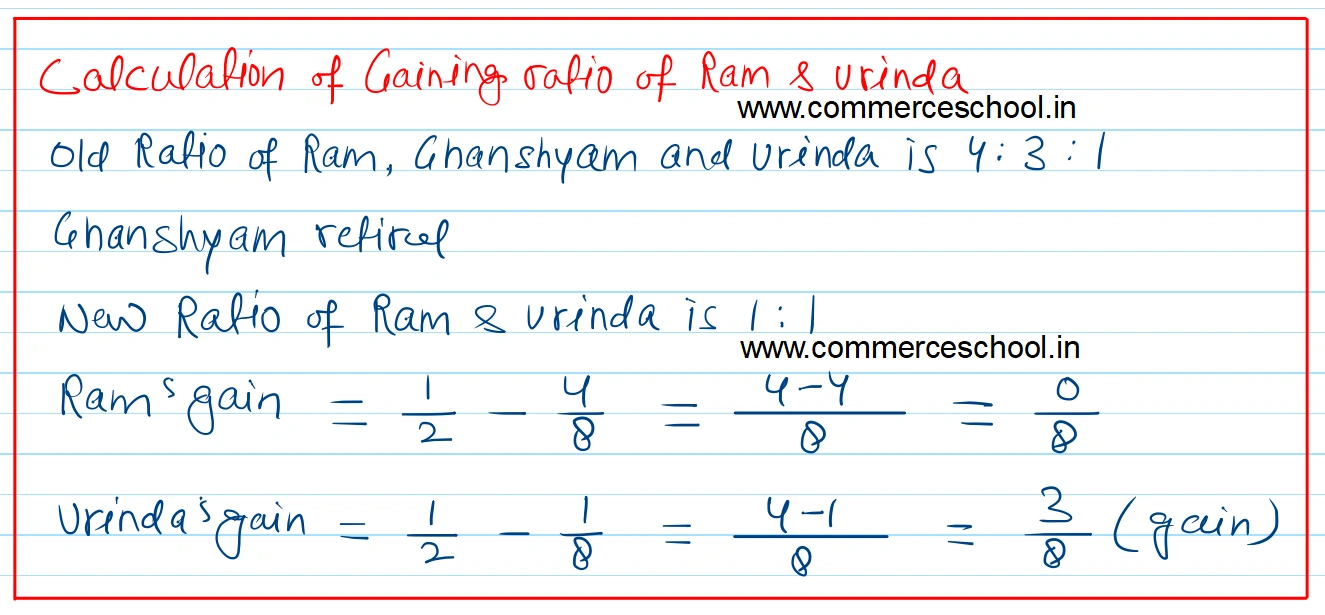

Ram, Ghanshyam and Vrinda were partners in a firm sharing profits in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. On 1st February, 2023 Ghanshyam died

Ram, Ghanshyam and Vrinda were partners in a firm sharing profits in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. On 1st February, 2023 Ghanshyam died and it was decided that the new profit sharing ratio between Ram and Vrinda will be equal. The Partnership Deed provided for the following on the death of a partner:

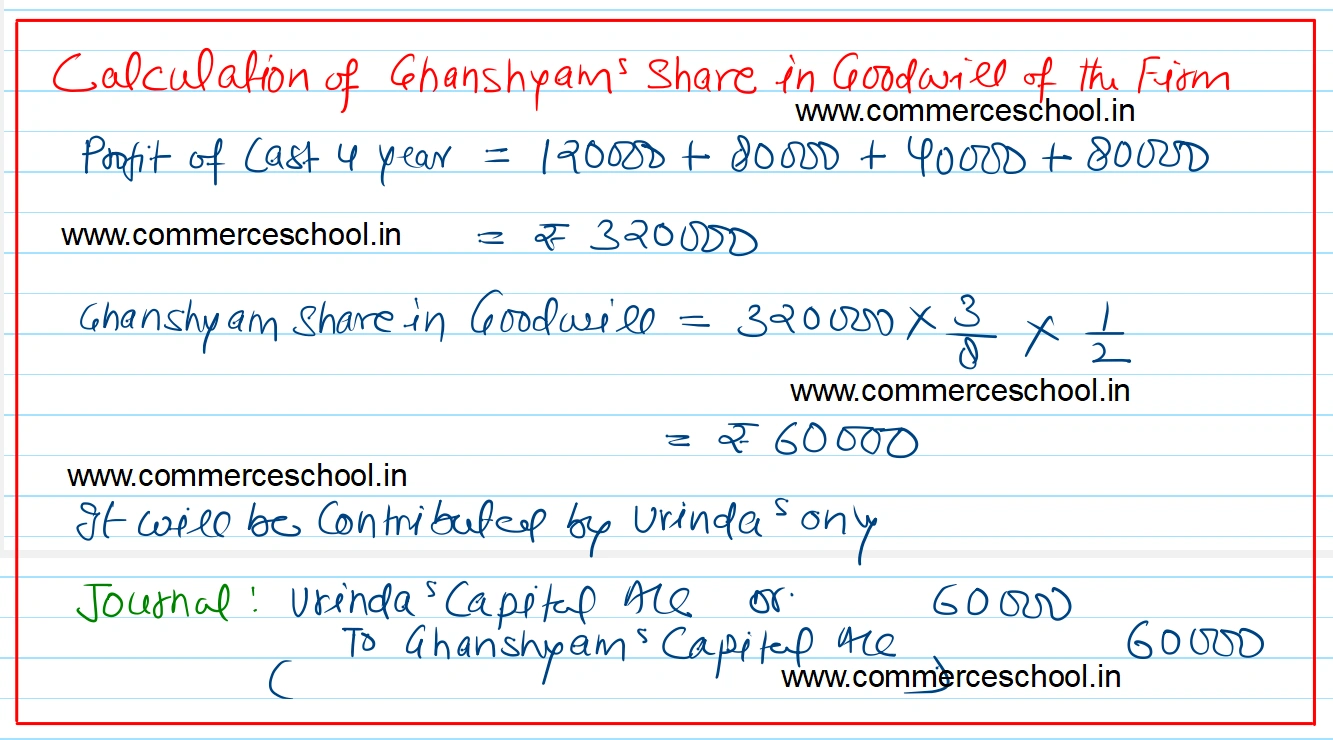

(a) His share of goodwill be calculated on the basis of half of the profits credited to his account during the previous four completed years:

The firm’s profits for the last four years were.

2018-19 – ₹ 1,20,000, 2019-20 – ₹ 80,000, 2020-21 – ₹ 40,000, and 2021-22 – ₹ 80,000.

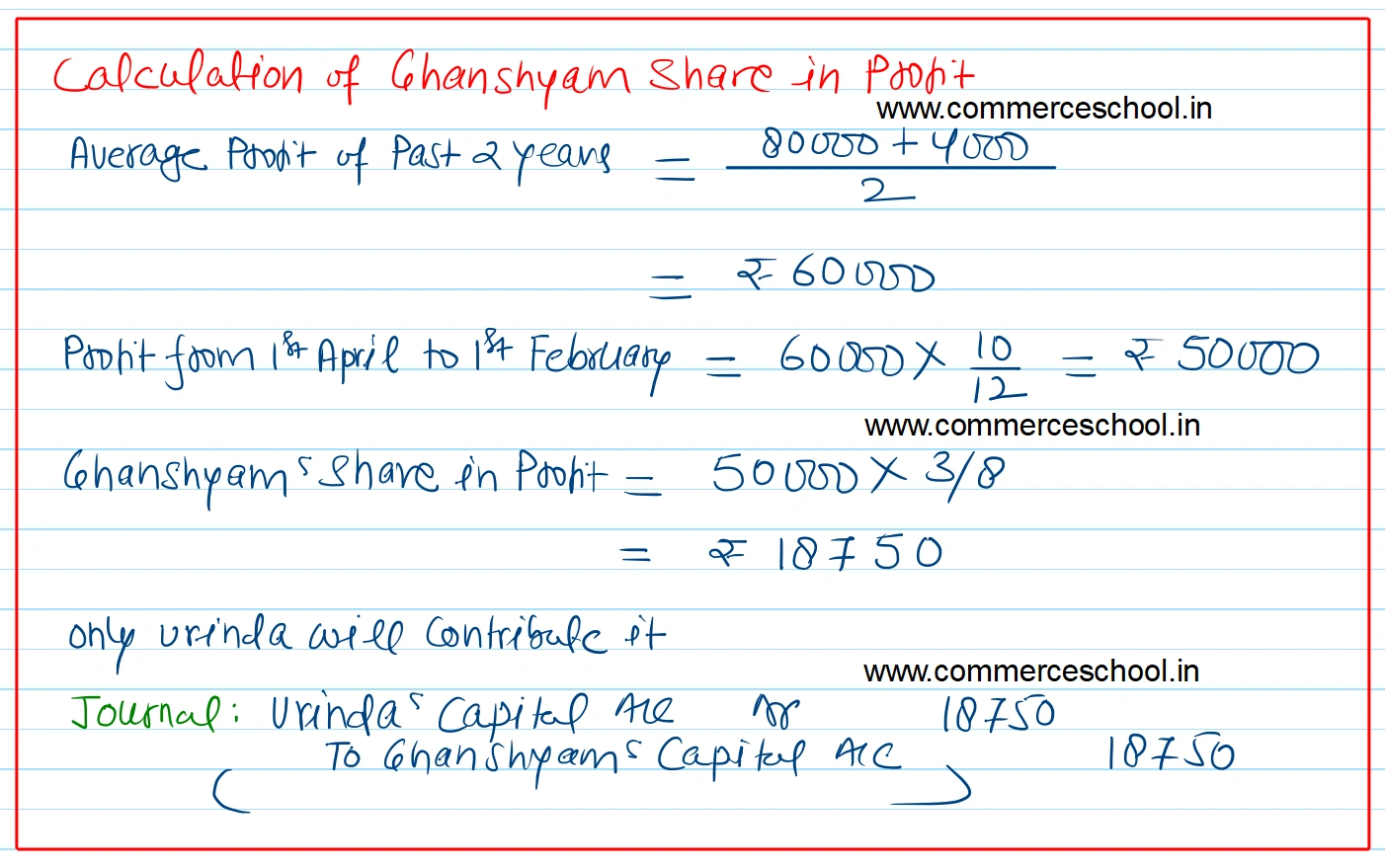

(b) His share of profit in the year of his death was to be computed on the basis of average profits of past two years.

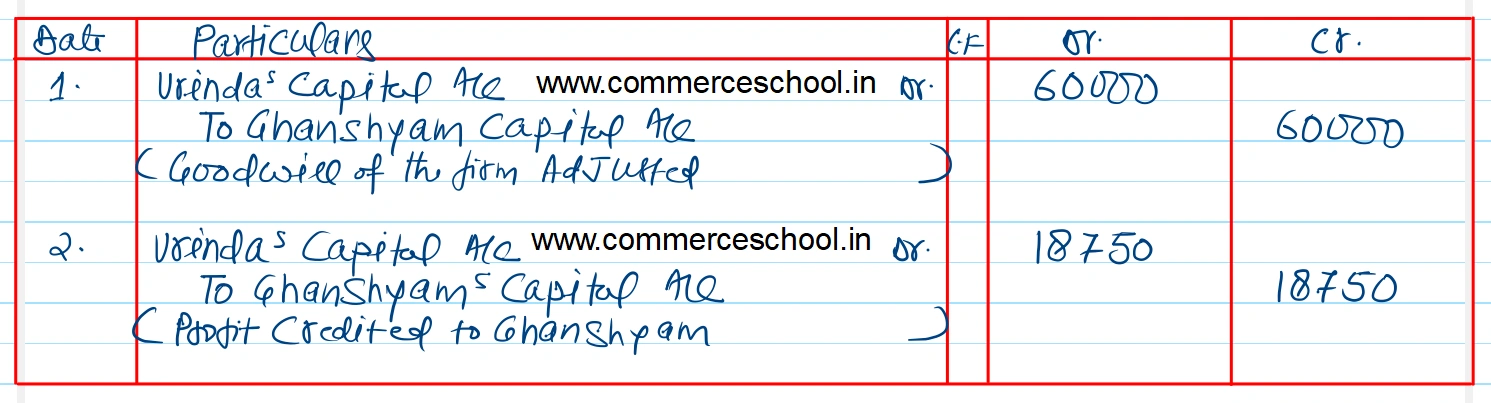

Pass necessary Journal entries relating to goodwill and profit to be transferred to Ghanshyam’s Capital Account. Also show your workings clearly.

[Ans. Ghanshyam’s share of Goodwill ₹ 60,000, which will be debited entirely to Vrinda’s Capital A/c. Ghanshyam’s share of profit till the date of death ₹ 18,750 will also be debited entirely to Vrinda’s Capital A/c.]