Raman and Rohit were partners in a firm sharing profits and losses in the ratio 0f 2 : 1. On 31st March, 2018, their Balance Sheet was as follows:

Raman and Rohit were partners in a firm sharing profits and losses in the ratio 0f 2 : 1. On 31st March, 2018, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capitals:

Raman Rohit Workmen Compensation Fund Creditors |

1,40,000 1,00,000 40,000 1,60,000 |

Plant and Machinery

Furniture and Fixtures stock Debtors Bank Balance |

1,10,000

|

1,75,000 65,000 47,000 1,03,000 50,000 |

| 4,40,000 | 4,40,000 |

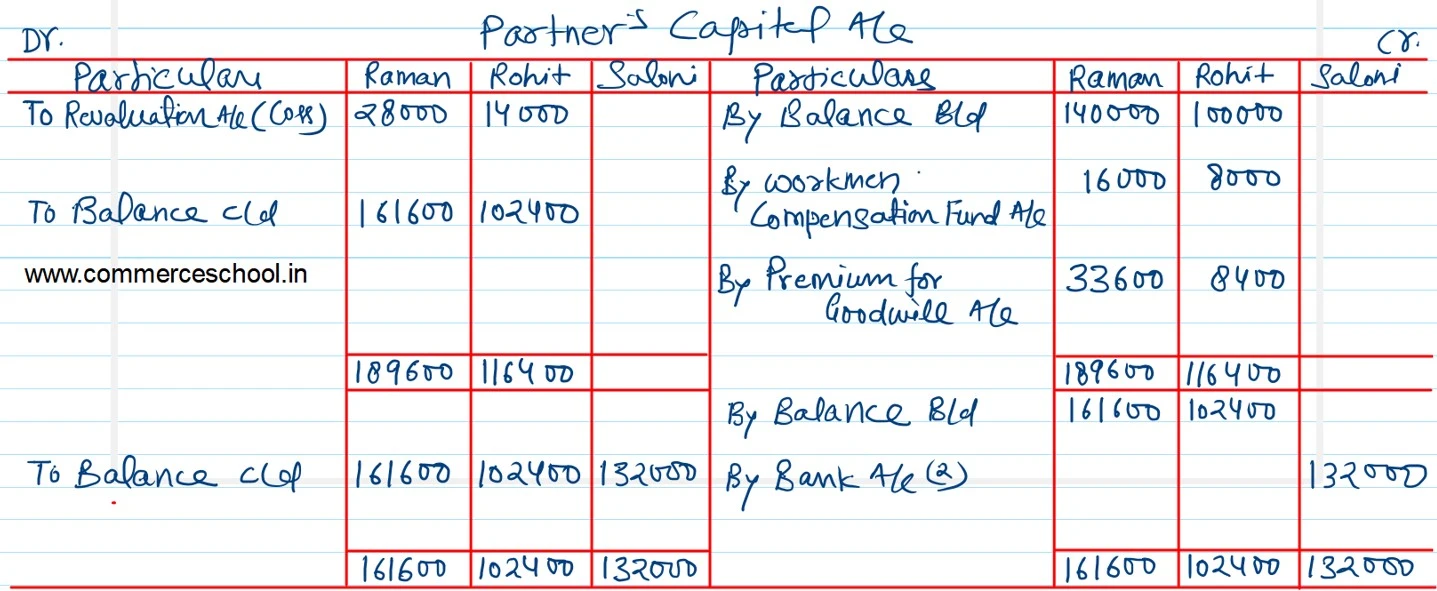

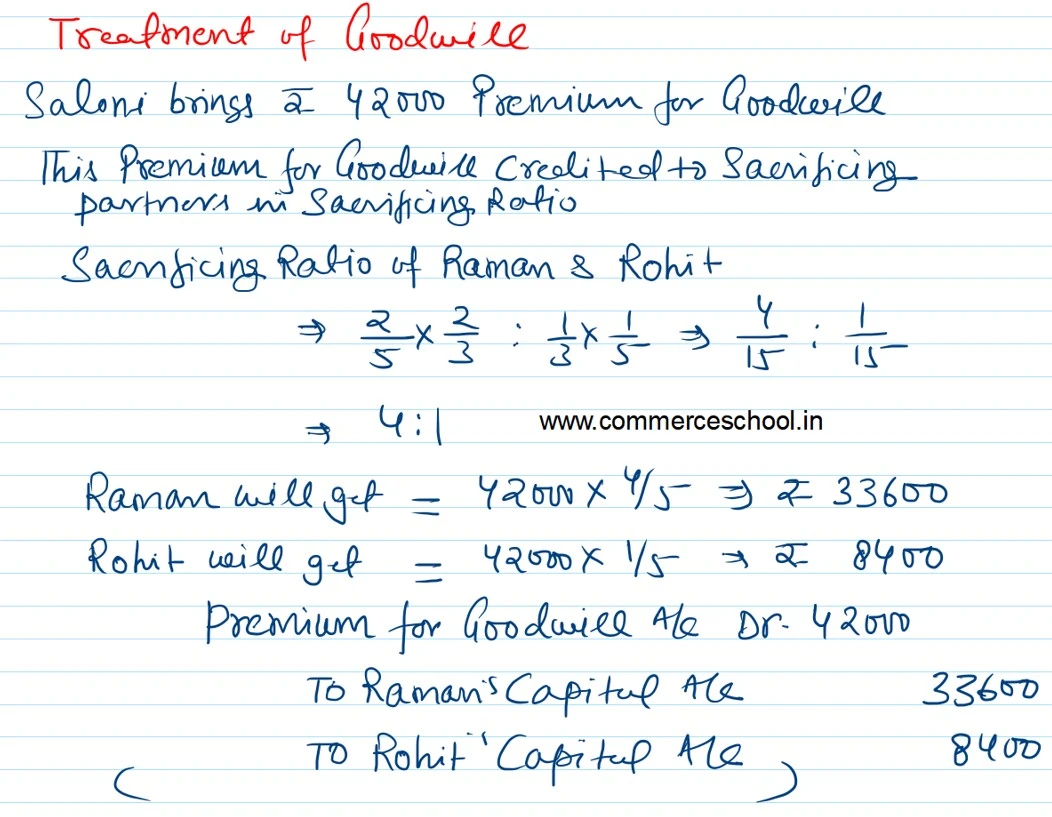

On the above date, Saloni was admitted in the partnership firm. Raman surrendered 2//5th of his share and Rohit surrendered 1/5th of his share in favour of saloni. It was agreed that:

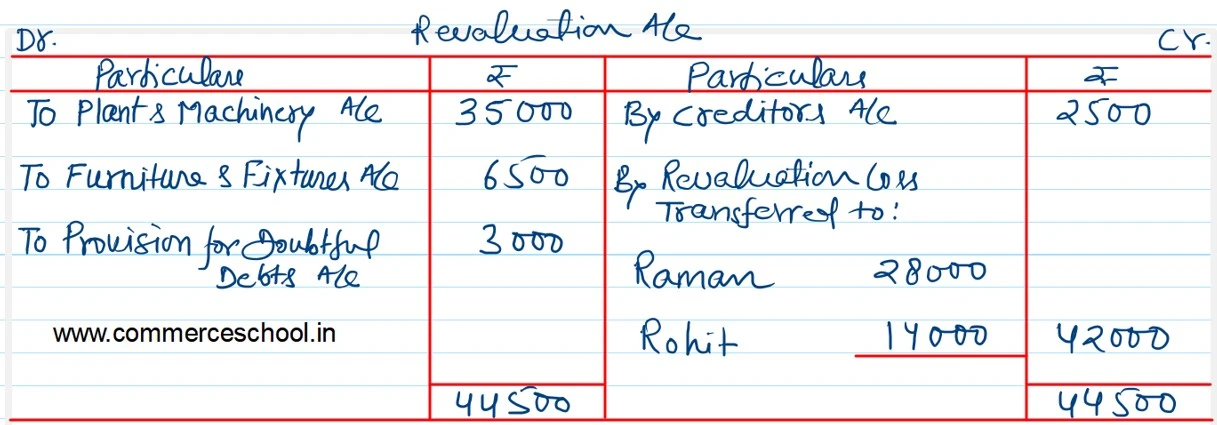

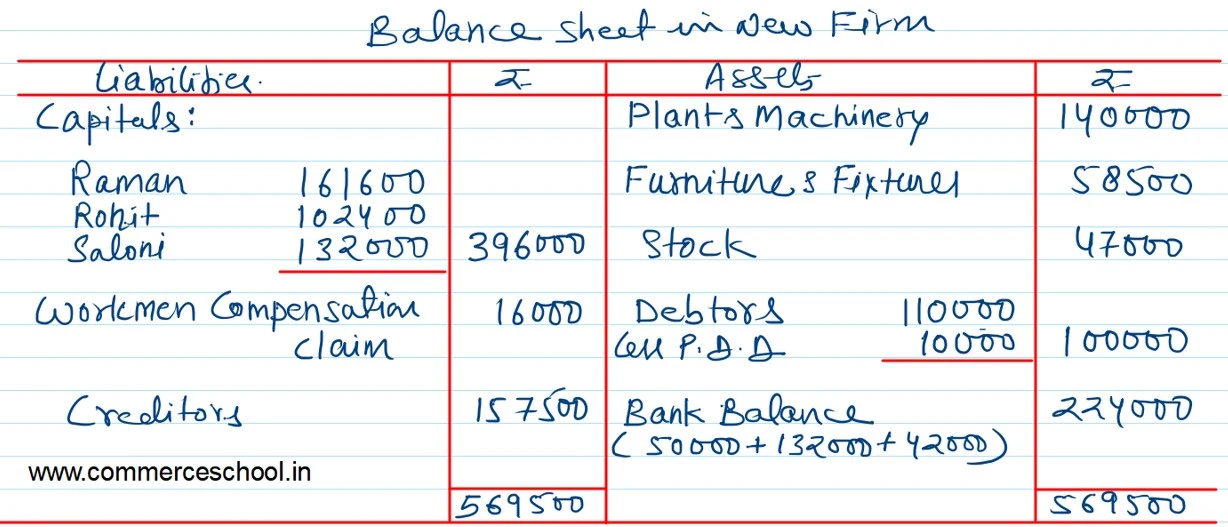

i) Plant and machinery will be reduced by ₹ 35,000 and furniture and fixtures will be reduced to ₹ 58,500.

ii) Provision for bad and doubtful debts will be increased by ₹ 3,000.

iii) A claim for ₹ 16,000 for workmen’s Compensation was admitted.

iv) A liability of ₹ 2,500 included in creditors is not likely to arise.

v) Saloni will bring ₹ 42,000 as her share of goodwill premium and proportionate capital.

Prepare Revaluation Account, partner’s Capital Accounts and Balance Sheet of the reconstituted firm.

[Ans: Loss on Revaluation = ₹ 42,000; Partner’s Capital Accounts: Raman – ₹ 1,61,600; Rohit – ₹ 1,02,400; Saloni – ₹ 1,32,000; Balance Sheet total – ₹ 5,69,500.]