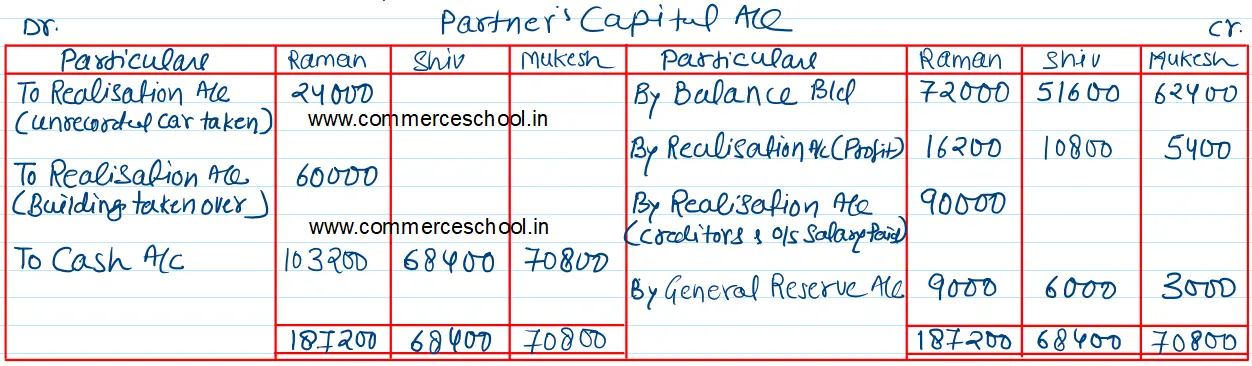

Raman, Shiv and Mukesh were in partnership sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 was as follows:

Raman, Shiv and Mukesh were in partnership sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

|

Capital A/cs: Raman Shiv Mukesh General Reserve Employee’s Provident Fund Provision for Depreciation Creditors |

72,000 51,600 62,400 18,000 18,000 30,000 66,000 |

Building Plant Stock Computers Debtors Accrued Commission Cash |

60,000 1,32,000 36,000 37,200 30,000 6,000 16,800 |

| 3,18,000 | 3,18,000 |

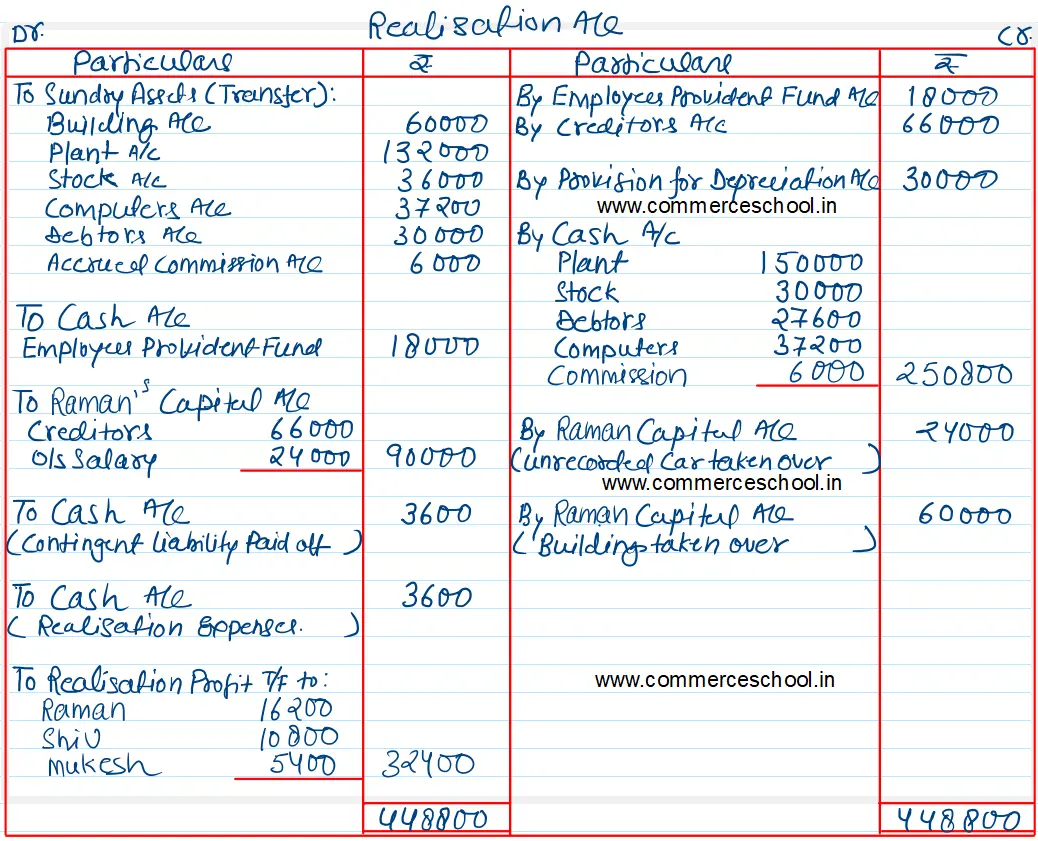

The firm was dissolved on the above date. The terms of the dissolution were:

(i) Raman took building at book value and agreed to pay the creditors.

(ii) Contingent liability of ₹ 3,600 was paid.

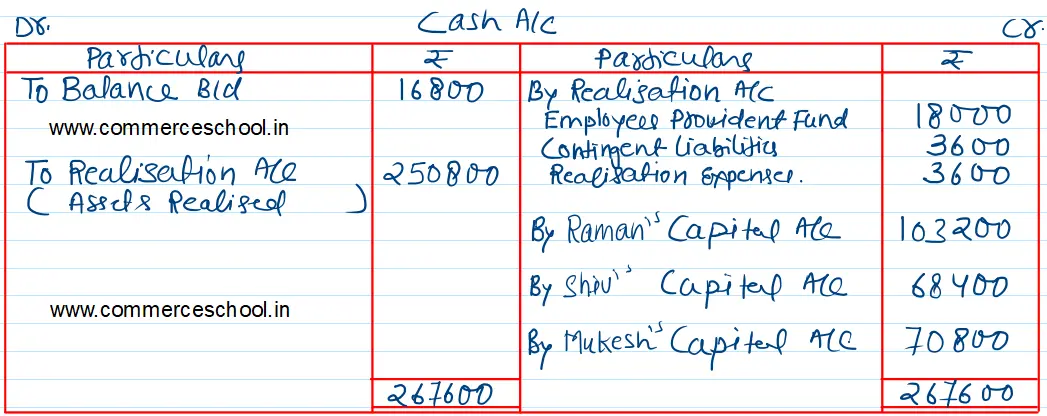

(iii) Other assets realised: Plant ₹ 1,50,000; Stock ₹ 30,000; Debtors ₹ 27,600; Computer ₹ 37,200.

(iv) Realisation Expenses were ₹ 3,600.

(v) A car which was written off from the books was taken by Raman for ₹ 24,000. He also agreed to pay Outstanding Salary of ₹ 24,000 which was not provided in the books.

Prepare Realisation Account, Capital Accounts of Partners and Cash Account.