Sam and Akhil are partners sharing profits and losses in proportion to their capitals, which on 31st March

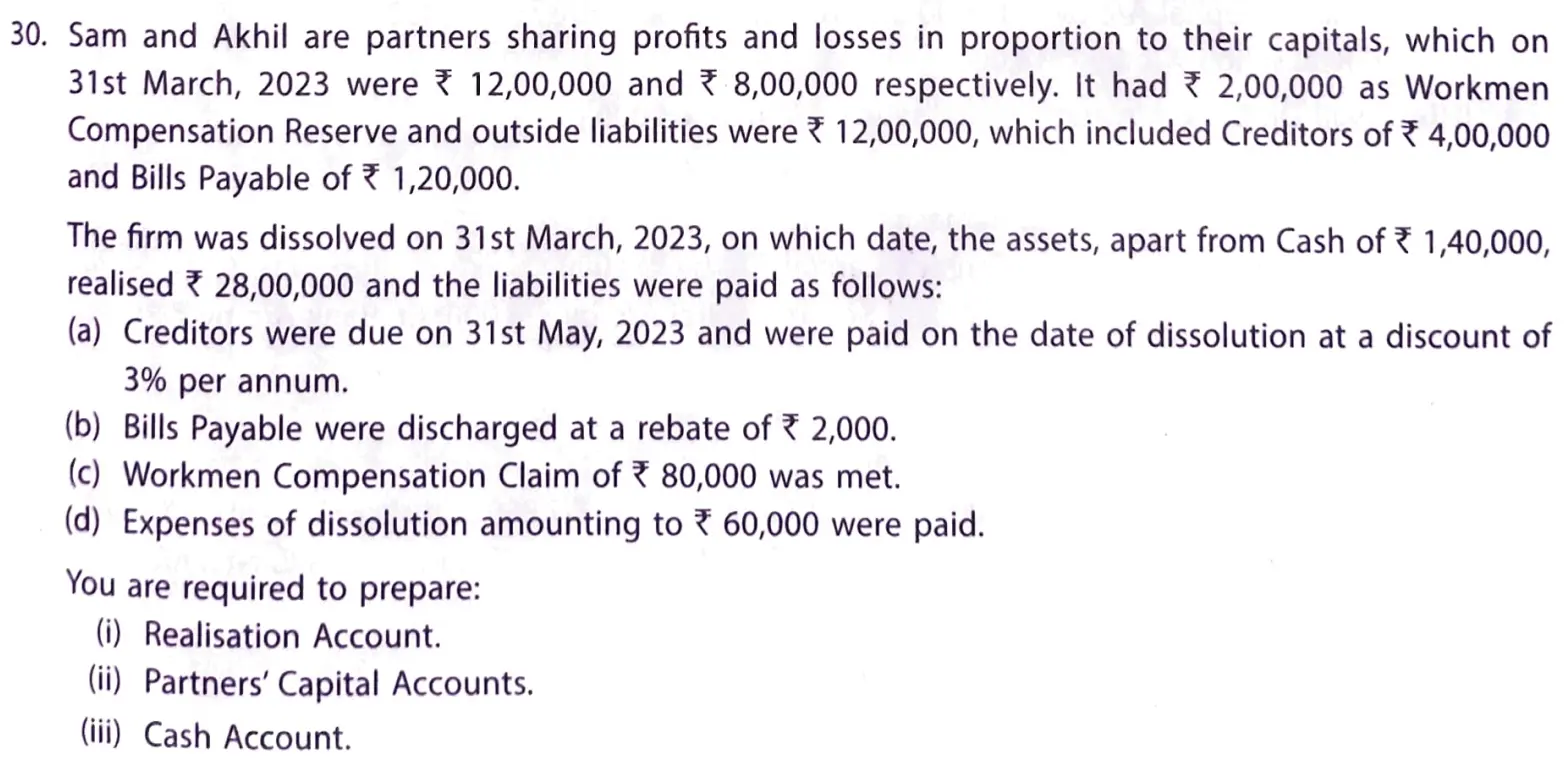

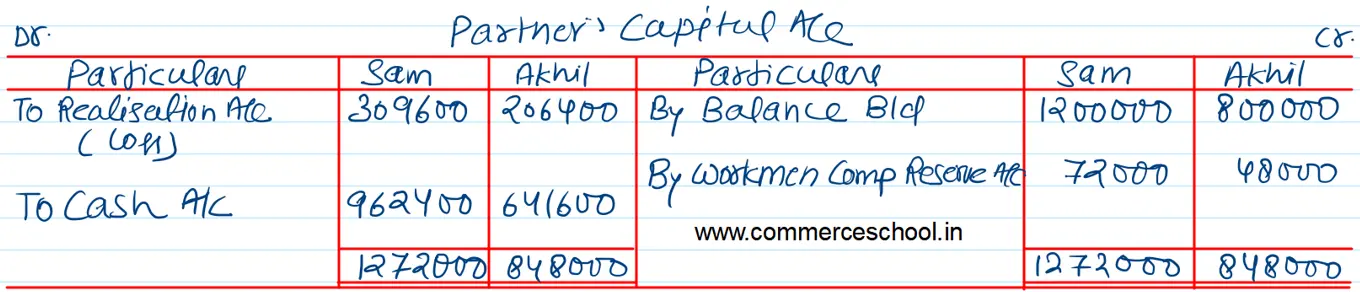

Sam and Akhil are partners sharing profits and losses in proportion to their capitals, which on 31st March, 2023 were ₹ 12,00,000 and ₹ 8,00,000 respectively. It had ₹ 2,00,000 as Workmen Compensation Reserve and outside liabilities were ₹ 12,00,000, which included Creditors of ₹ 4,00,000 and Bills Payable of ₹ 1,20,000.

The firm was dissolved on 31st March, 2023, on which date, the assets, aprt from cash of ₹ 1,40,000, realised ₹ 28,00,000 and the liabilities were paid as follows:

(a) Creditors were due on 31st May, 2023 and were paid on the date of dissolution at a discount of 3% per annum.

(b) Bills Payable were discharged at a rebate of ₹ 2,000.

(c) Workmen Compensation Claim of ₹ 80,000 was met.

(d) Expenses of dissolution amounting to ₹ 60,000 were paid.

You are required to prepare:

(i) Realisation Account.

(ii) Partner’s Capital Accounts.

(iii) Cash Account.