Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 3. On 31.3.2016, their Balance Sheet was as follows:

Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 3. On 31.3.2016, their Balance Sheet was as follows:

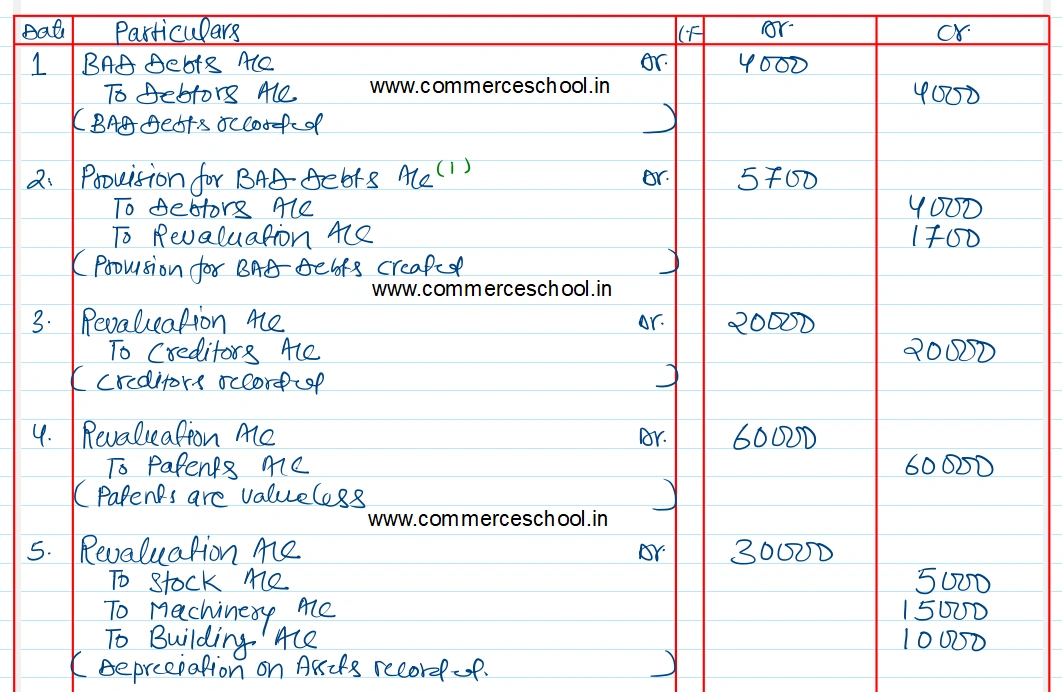

On the above date, Sameer retired and it was agreed that:

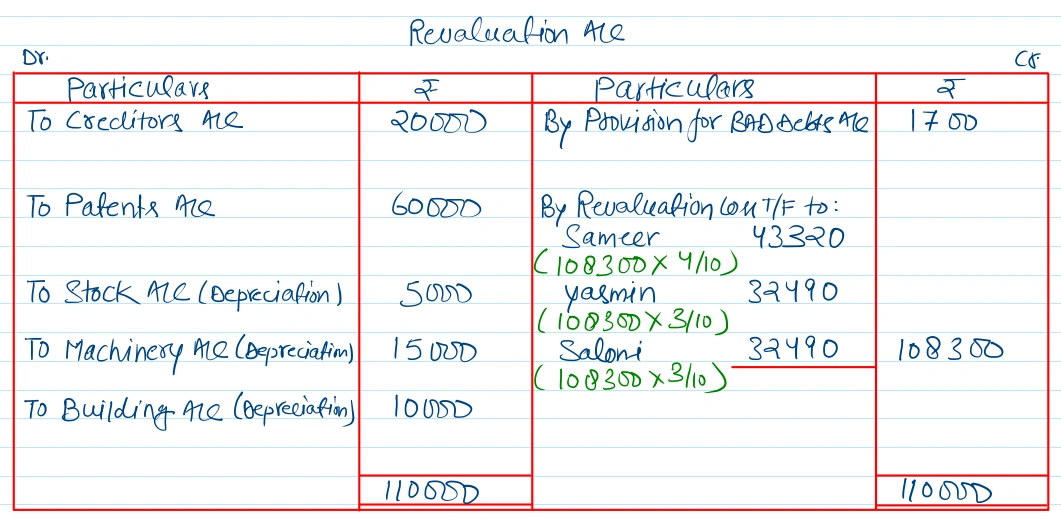

(i) Debtors of ₹ 4,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) An unrecorded creditor of ₹ 20,000 will be recorded.

(iii) Patents will be completely written off and 5% depreciation will be charged on stock, machinery and building.

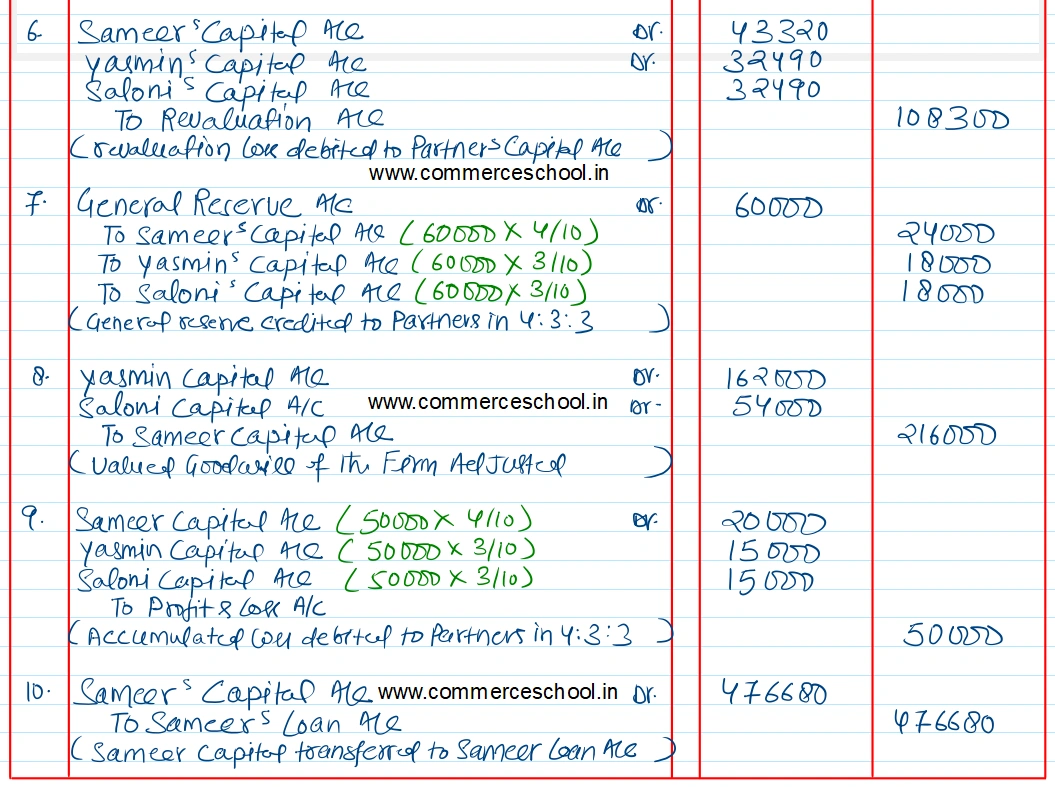

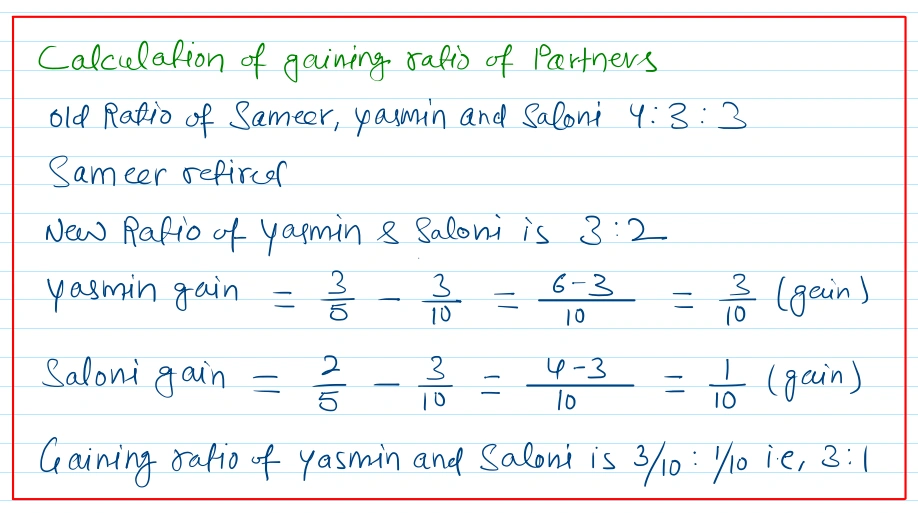

(iv) Yasmin and Saloni will share profits in the ratio of 3 : 2.

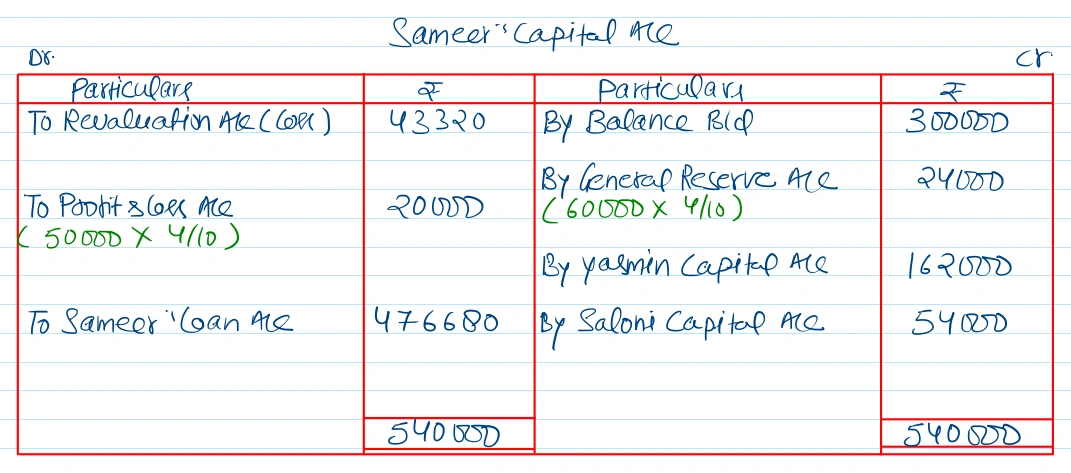

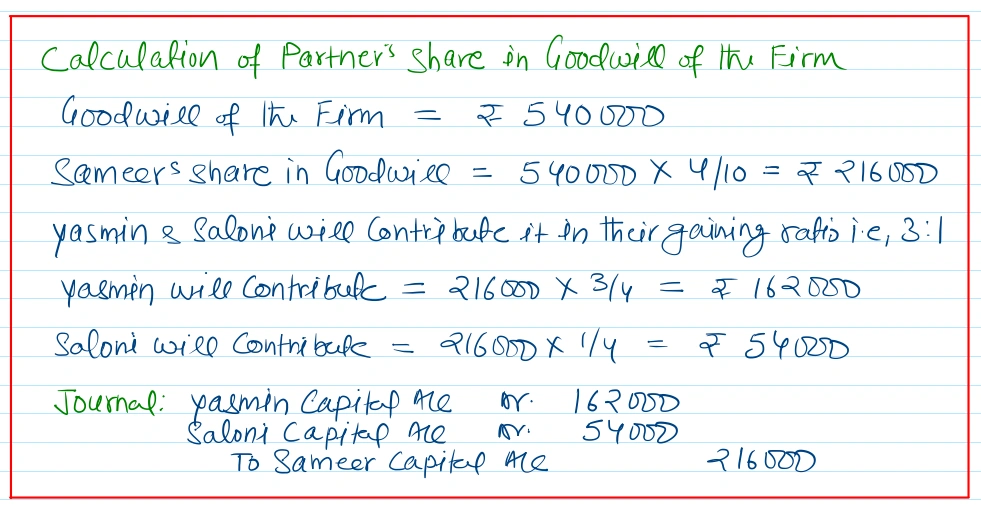

(v) Goodwill of the firm on Sameer’s retirement was valued at ₹ 5,40,000.

Pass necessary journal entries for the above transactions in the books of the firm on Sameer’s retirement.

[Ans. Loss on Revaluation ₹ 1,08,300; Amount transferred to Sameer’s Loan A/c ₹ 4,76,680.]

Balance Sheet of Sameer, Yasmin and Saloni as at 31st Marc

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,10,000 | Cash | 80,000 |

| General Reserve | 60,000 | Debtors 90,000 Less: 10,000 | 80,000 |

| Capitals: Sameer Yasmin Saloni | 3,00,000 2,50,000 1,50,000 | Stock | 1,00,000 |

| Machinery | 3,00,000 | ||

| Building | 2,00,000 | ||

| Patents | 60,000 | ||

| Profit and Loss Account | 50,000 | ||

| 8,70,000 | 8,70,000 |

Anurag Pathak Answered question