Sanjana and Alok were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as follows:

Sanjana and Alok were partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as follows:

Balance Sheet of Sanjana and Alok as at 31.3.2018

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 60,000 | Cash at Bank | 1,66,000 |

| Workmen’s Compensation Reserve | 60,000 |

Debtors 1,46,000 Less: PDD 2,000 |

1,44,000 |

|

Capitals: Sanjana 5,00,000 Alok 4,00,000 |

9,00,000 | Stock | 1,50,000 |

| Investments | 2,60,000 | ||

| Furniture | 3,00,000 | ||

| 10,20,0000 | 10,20,000 |

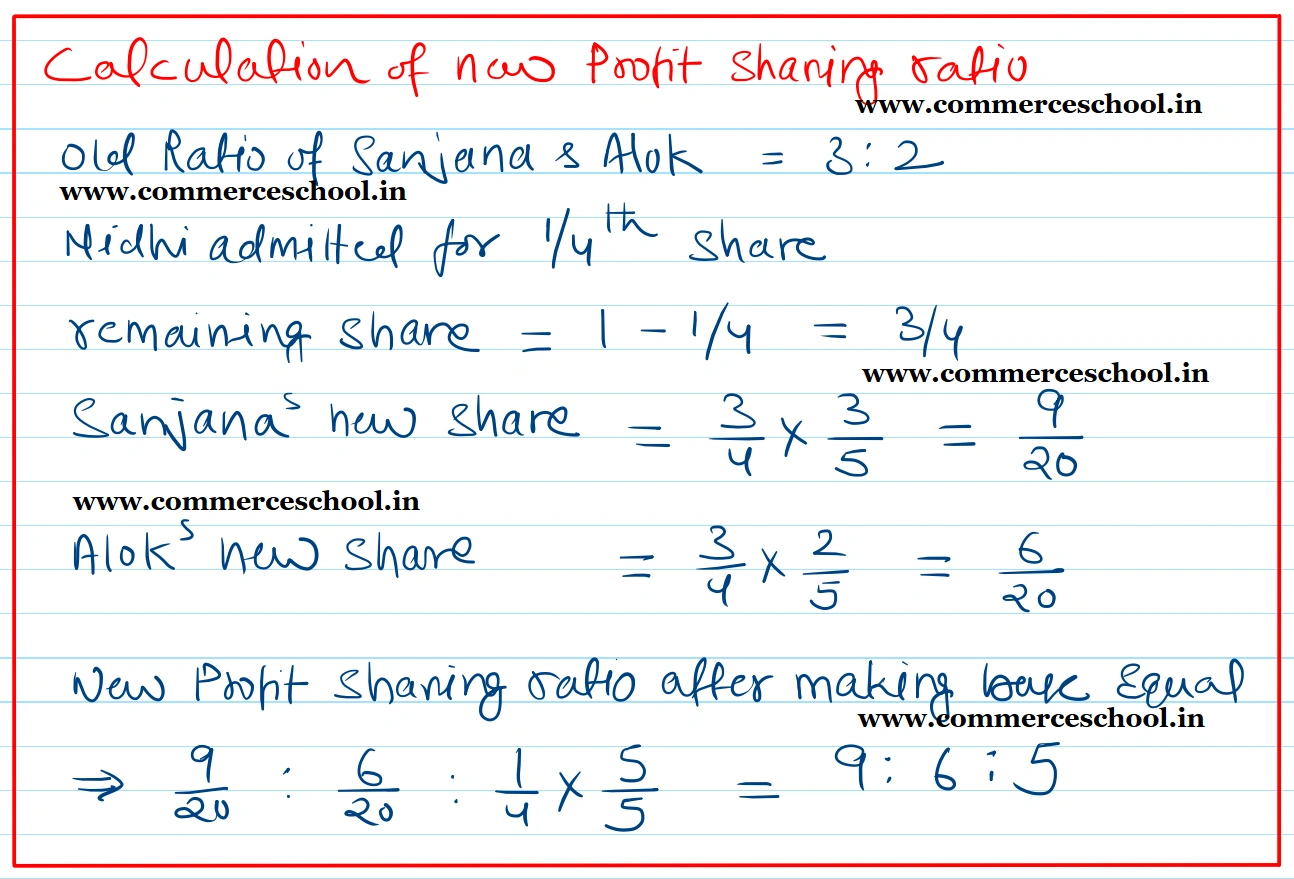

On 1st April, 2018, they admitted Nidhi as a new partner for 1/4th share in the profits on the following terms:

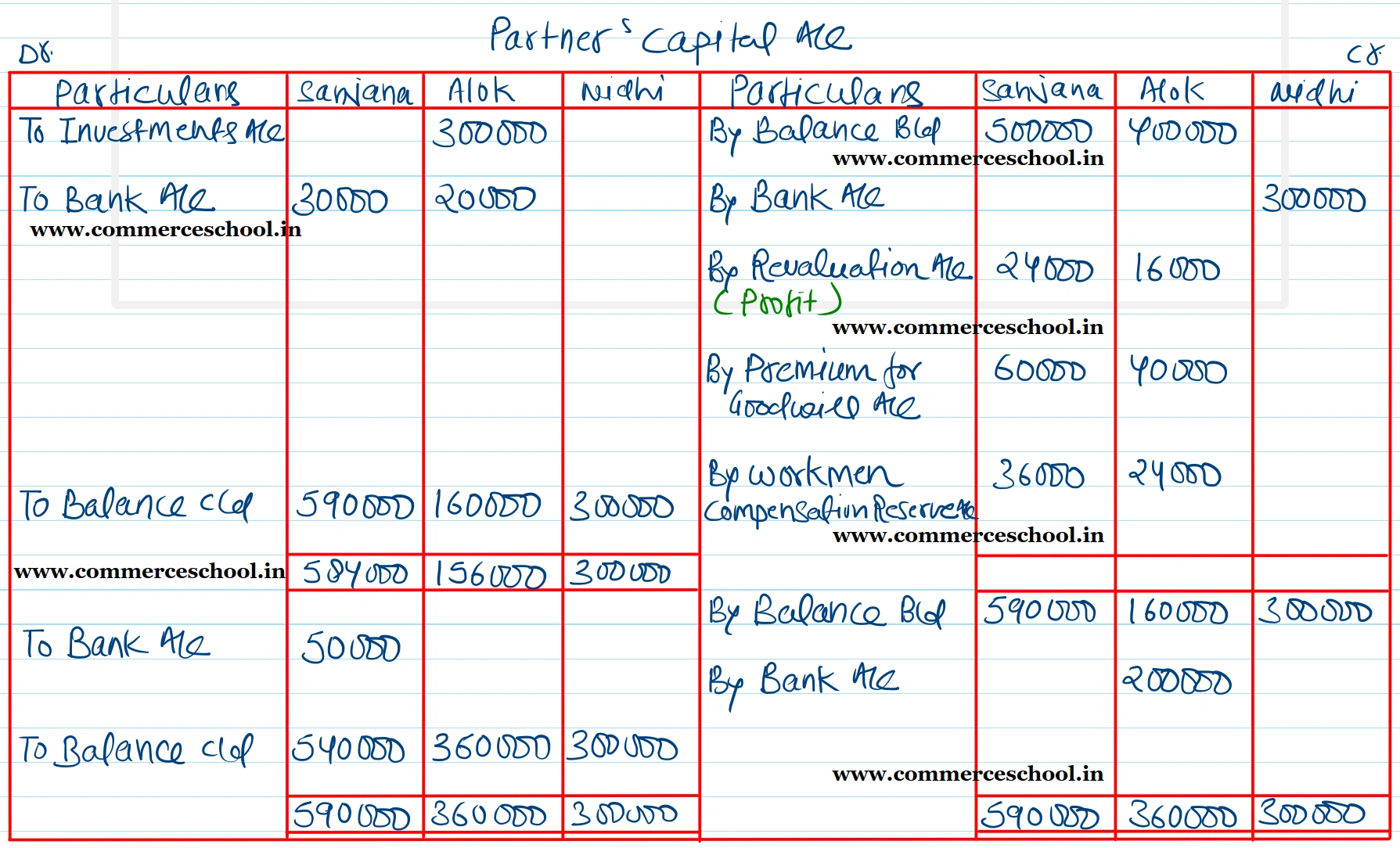

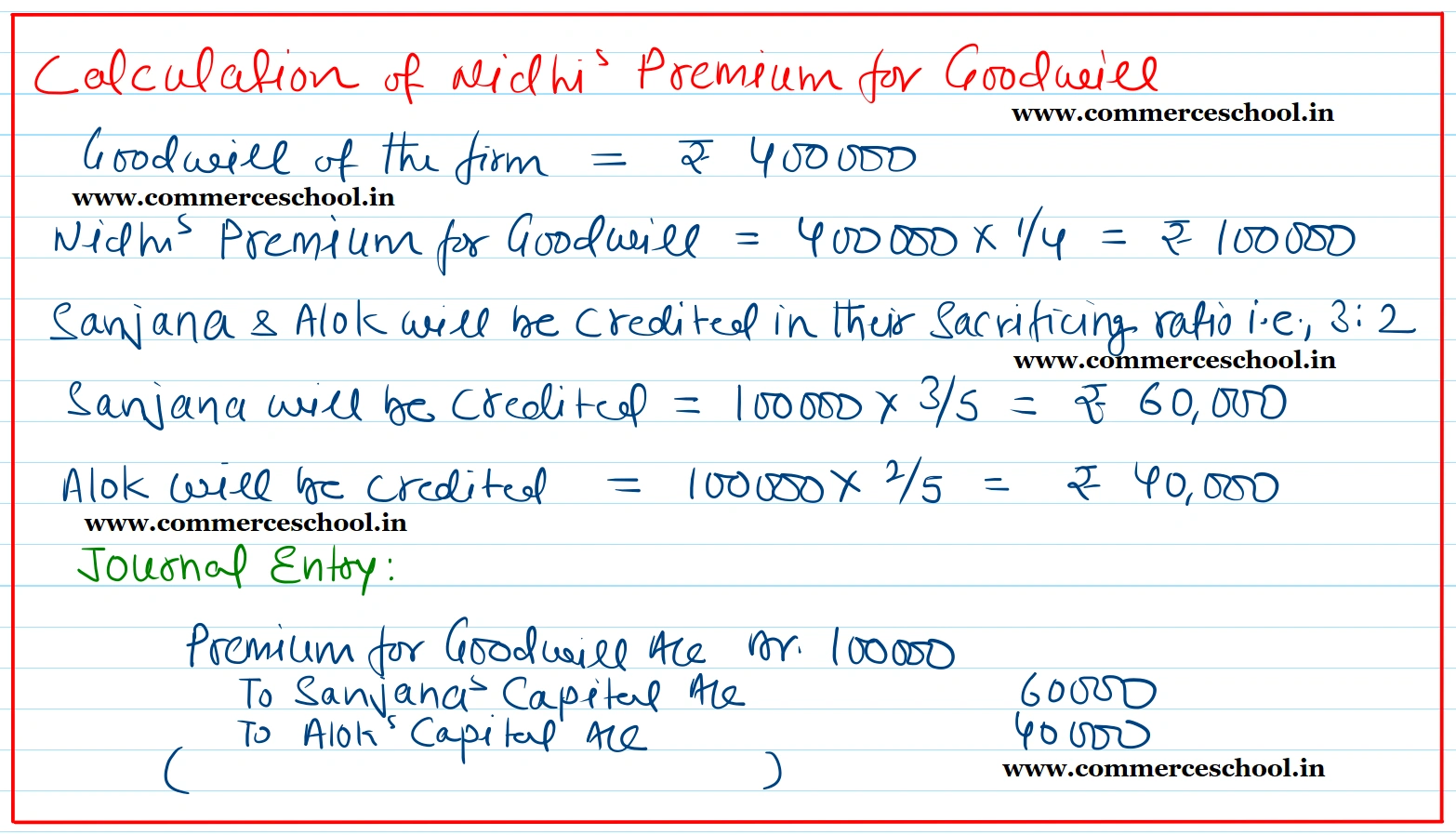

(a) Goodwill of the firm was valued at ₹ 4,00,000 and Nidhi brought the necessary amount in cash for her share of goodwill premium, half of which was withdrawn by the old partners.

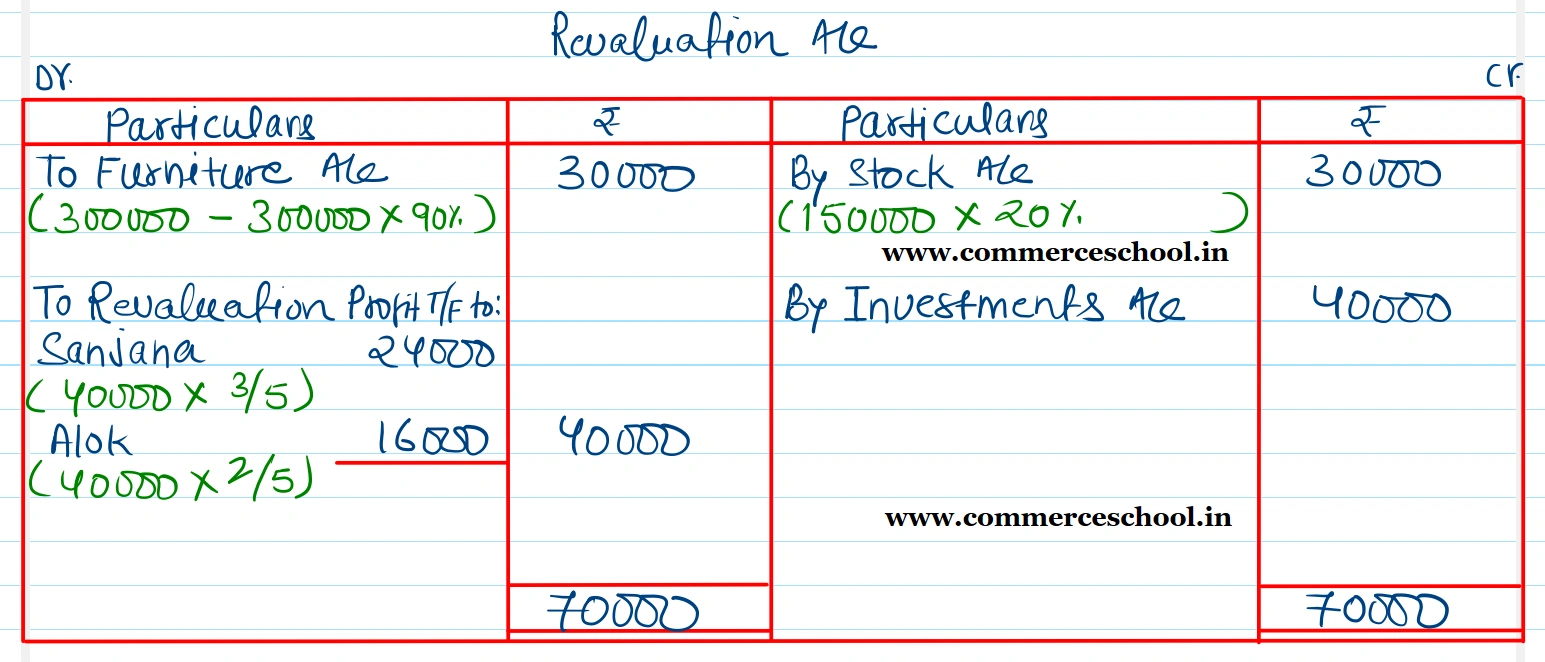

(b) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(c) Investments were to be valued at ₹ 3,00,000. Alok took over investments at this value.

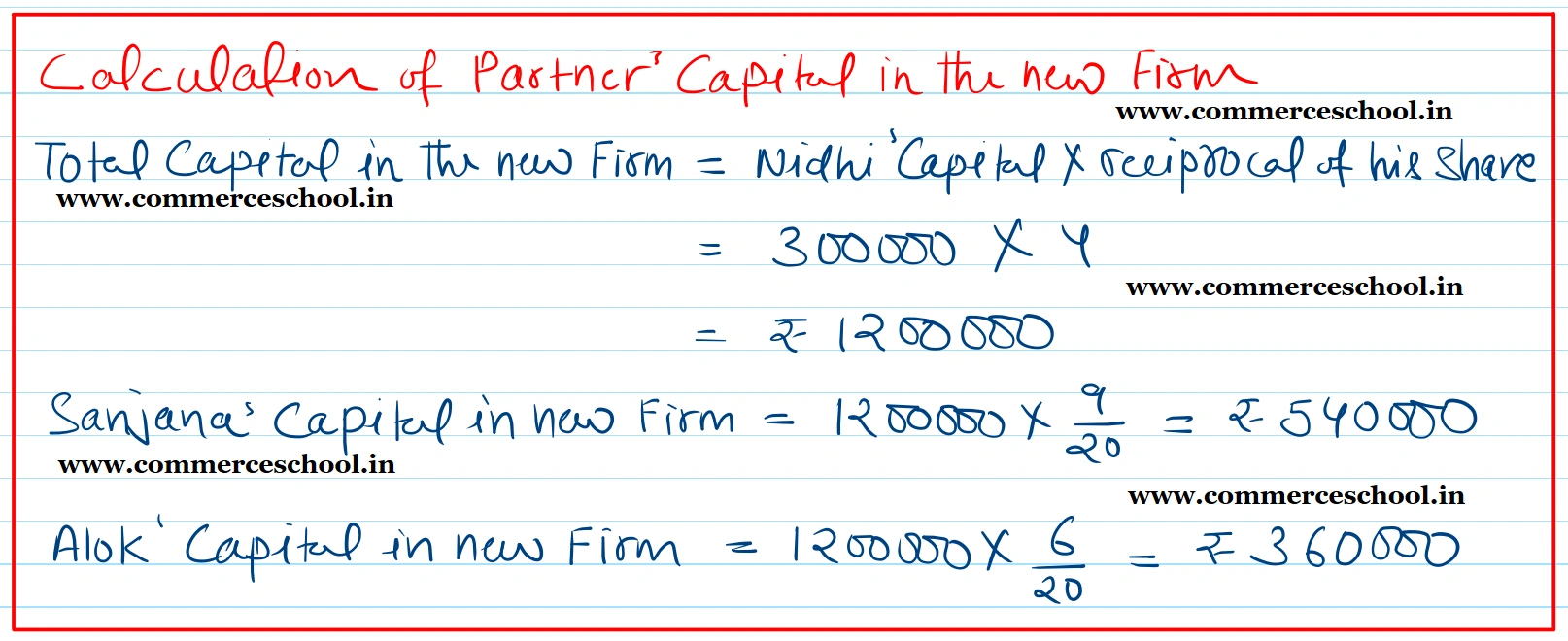

(d) Nidhi brought ₹ 3,00,000 as her capitl and the capitals of Sanjana and Alok were adjusted in the new profit sharing ratio.

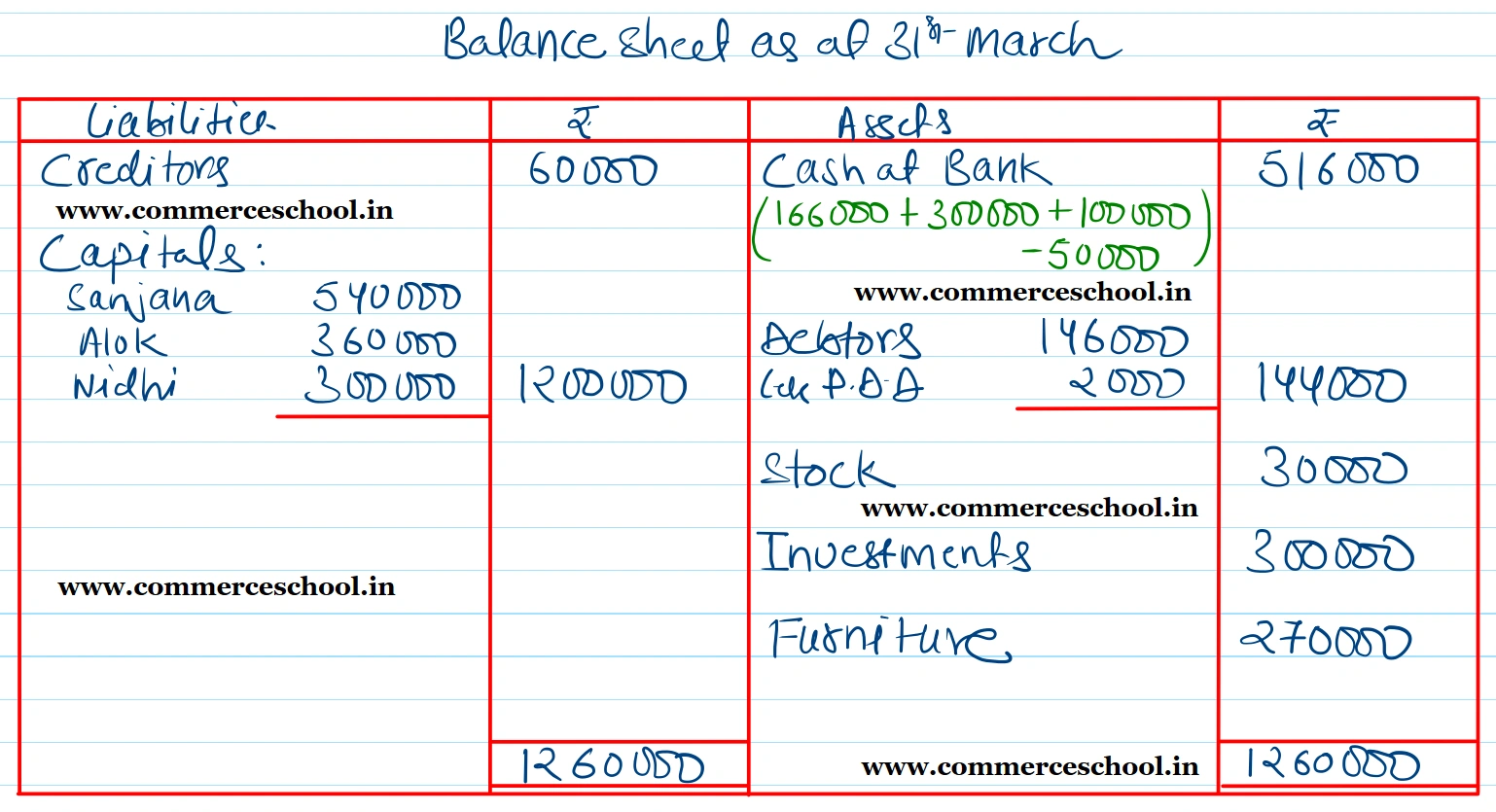

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm on Nidhi’s admission.

[Ans. Gain on Revvaluation ₹ 40,000; Capital A/cs : Sanjana ₹ 5,40,000; Alok ₹ 3,60,000 and Nidhi ₹ 3,00,000; Sanjana withdraws ₹ 50,000 and Alok brings in ₹ 2,00,000; Balance Sheet Total ₹ 12,60,000.]