Saraswati Ltd. has an authorised capital of ₹ 10,00,000 divided into equity shares of ₹ 10 each. Subscribed and fully paid up share capital of the company was ₹ 4,00,000

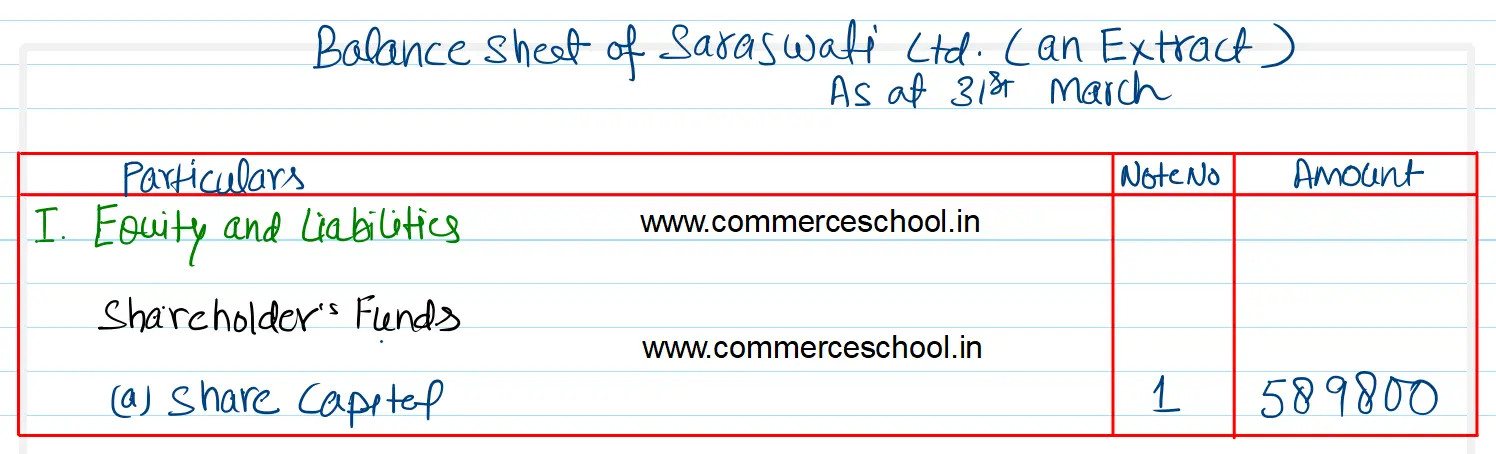

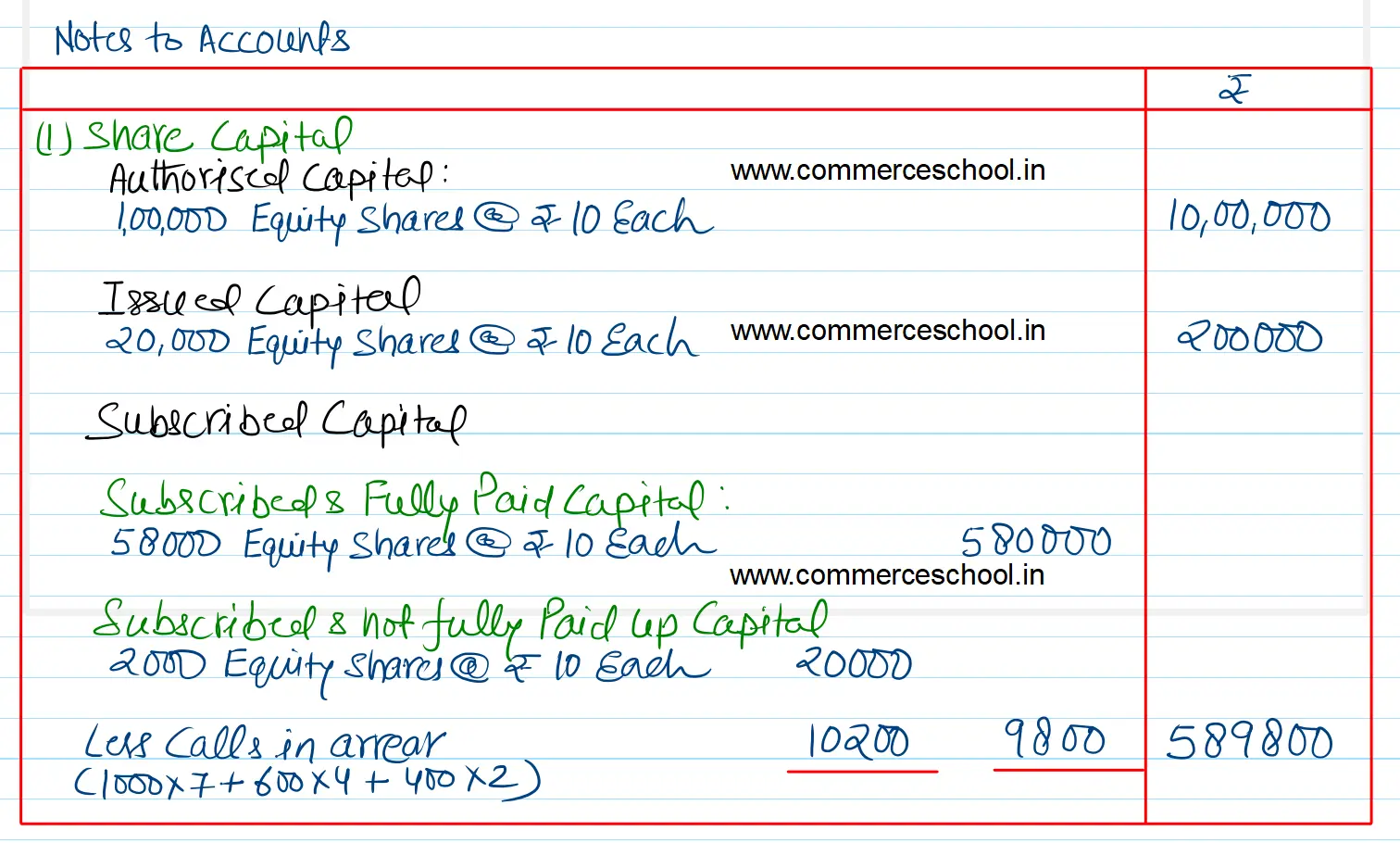

Saraswati Ltd. has an authorised capital of ₹ 10,00,000 divided into equity shares of ₹ 10 each. Subscribed and fully paid up share capital of the company was ₹ 4,00,000. To meet its new financial requirements, the company issued 20,000 equity shares of ₹ 10 each which were payable as follows : ₹ 3 on application; ₹ 3 on allotment, ₹ 2 on first call and ₹ 2 on second and final call. The issue was fully subscribed. X to whom 1,000 shares were allotted, did not pay the allotment and call money; Y an allotee of 600 shares, did not pay the two calls; and Z to whom 400 shares were allotted, did not pay the final call. Present the share capital in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013. Also prepare Notes to Accounts for the same.

[Ans. Subscribed and Fully Paid Capital ₹ 5,80,000; Subscribed but not Fully Paid Capital ₹ 9,800.]