Shilpa, Meena and Nanda decided to dissolve their partnership on 31st March, 2023. Their Profit sharing ratio was 3 : 2 : 1 and their Balance Sheet was as under:

Shilpa, Meena and Nanda decided to dissolve their partnership on 31st March, 2023. Their Profit sharing ratio was 3 : 2 : 1 and their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Shilpa Meena Bank Loan Creditors Provision for Doubtful Debts General Reserve |

80,000

40,000 20,000 37,000 1,200 12,000 |

Land

Stock Debtors Nanda’s Capital Cash |

81,000

56,760 18,600 23,000 10,840 |

| 1,90,200 | 1,90,200 |

It is agreed as follows:

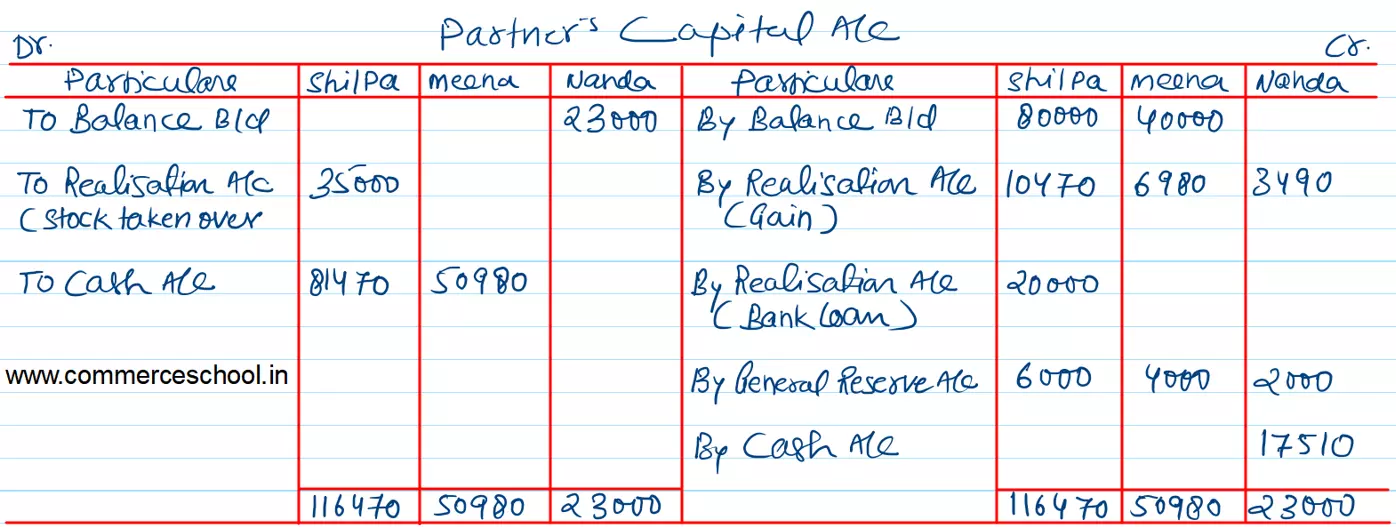

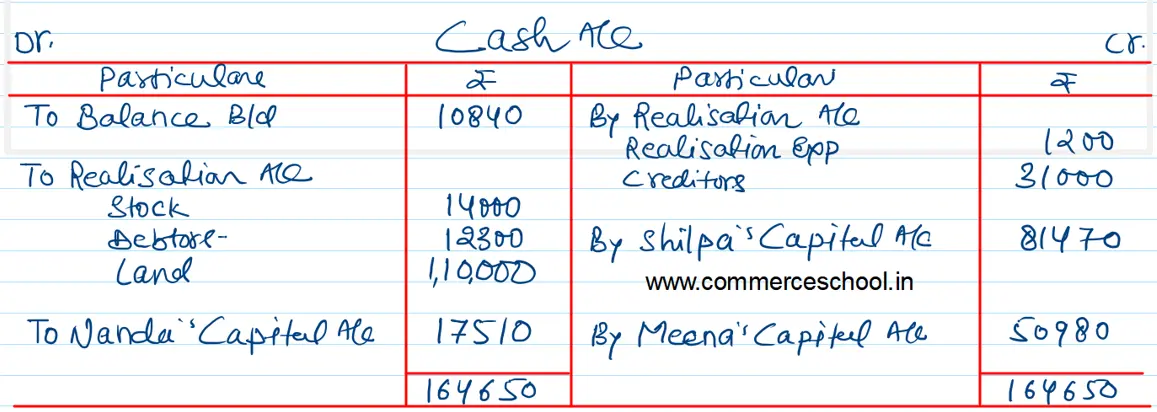

The stock of value of ₹ 41,660 are taken over by Shilpa for ₹ 35,000 and she agreed to pay bank loan. The remaining stock was sold at ₹ 14,000 and debtors amounting to ₹ 10,000 realised ₹ 8,000. Land is sold for ₹ 1,10,000. The remaining debtors realised 50% at their book value. Cost of realisation amounted to ₹ 1,200. There was a typewriter not recorded in the books worth of ₹ 6,000 which were taken over by one of the creditors at this value. Prepare Realisation Account, Partner’s Capital Accounts, and Cash Account to close the books fo the firm.

[Ans.: Gain (profit) on Realisation – ₹ 20,940; Final Payments: Shilpa – ₹ 81,470; Meena – ₹ 50,980; Amount brought in by Nanda – ₹ 17,510; Total of Cash Account – ₹ 1,64,650.]