Simmi and Sonu are partners in a firm, sharing profits and losses in the ratio of 3 : 1

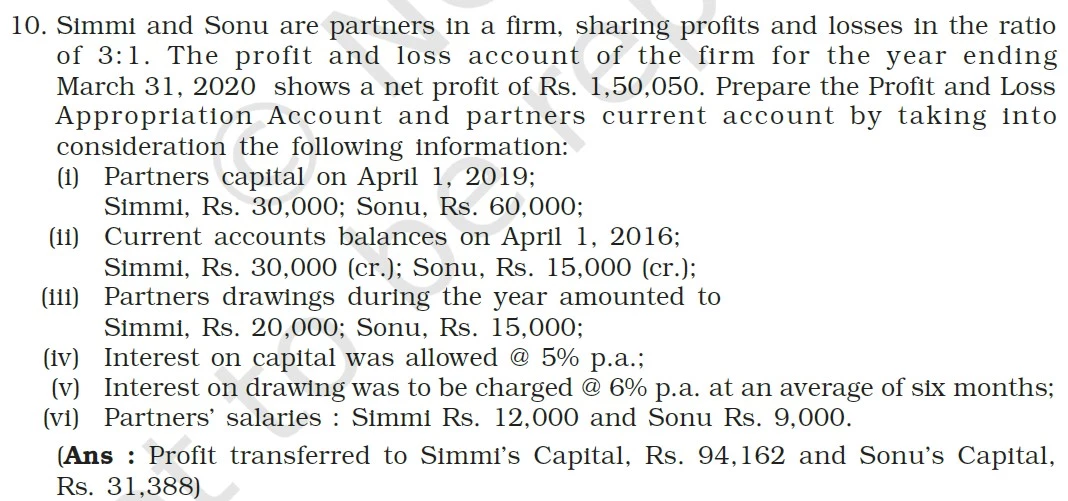

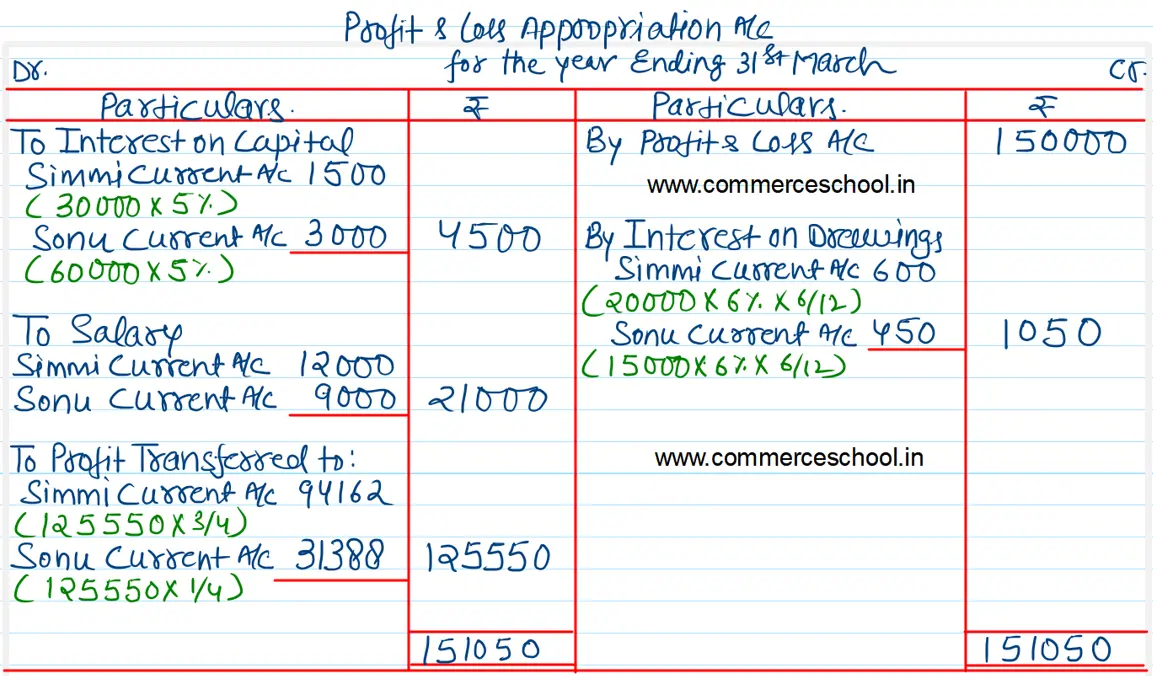

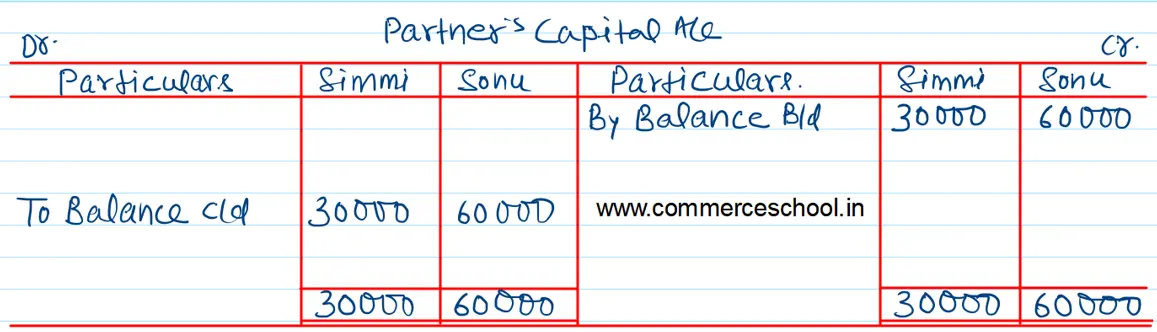

Simmi and Sonu are partners in a firm, sharing profits and losses in the ratio of 3 : 1. The profit and loss account of the firm for the year ending March 31, 2020, shows a net profit of ₹ 1,50,050. Prepare the Profit and Loss Appropriation Account and Partners current account by taking into consideration the following information:

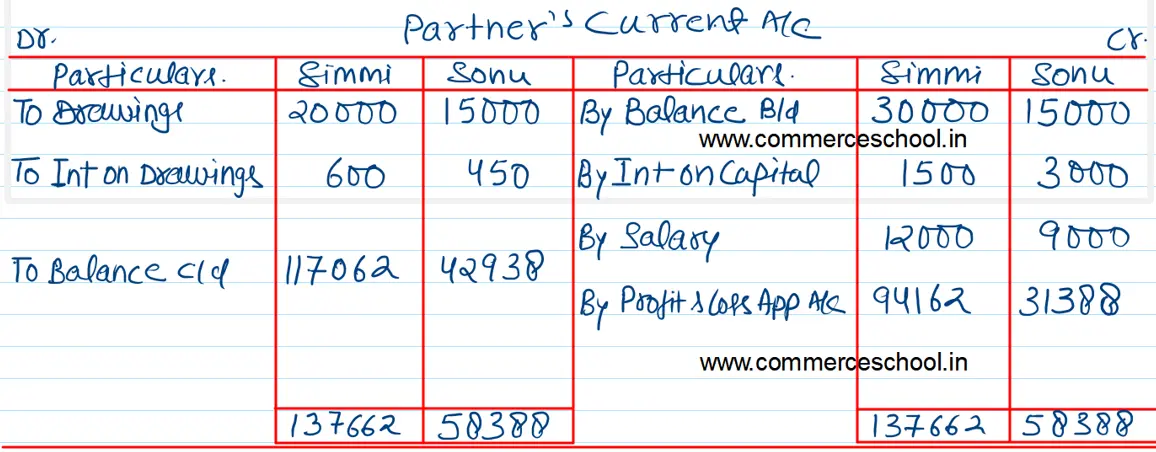

(i) Partners capital on April 1, 2019; Simmi, ₹ 30,000; Sonu, ₹ 60,000;

(ii) Current accounts balances on April 1, 2016; Simmi, ₹ 30,000 (cr.); Sonu, ₹ 15,000 (cr.);

(iii) Partners drawings during the year amounted to Simmi, ₹ 20,000; Sonu, ₹ 15,000;

(iv) Interest on capital was allowed @ 5% p.a.,:

(v) Interest on drawings was to be charged @ 5% p.a. at an average of six months;

(vi) Partner’s salaries: Simmi ₹ 12,000 and Sonu ₹ 9,000.

[Ans. Profit transferred to simmi’s Capital, ₹ 94,162 and Sonu’s Capital, ₹ 31,388]