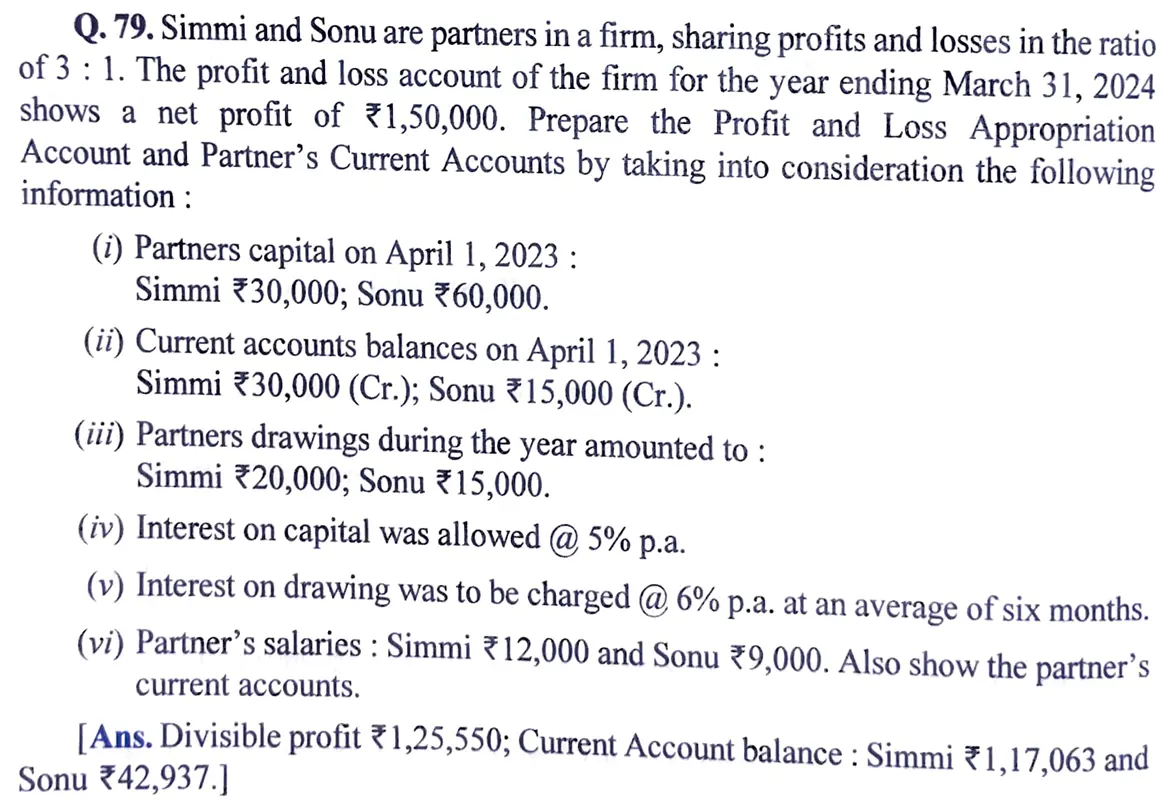

Simmi and Sonu are partners in a firm, sharing profits and losses in the ratio of 3 : 1. The profit and loss account of the firm for the year ending March 31, 2024 shows a net profit of ₹ 1,50,000

Simmi and Sonu are partners in a firm, sharing profits and losses in the ratio of 3 : 1. The profit and loss account of the firm for the year ending March 31, 2024 shows a net profit of ₹ 1,50,000. Prepare the Profit and Loss Appropriation Account and Partner’s Current Accounts by taking into consideration the following information:

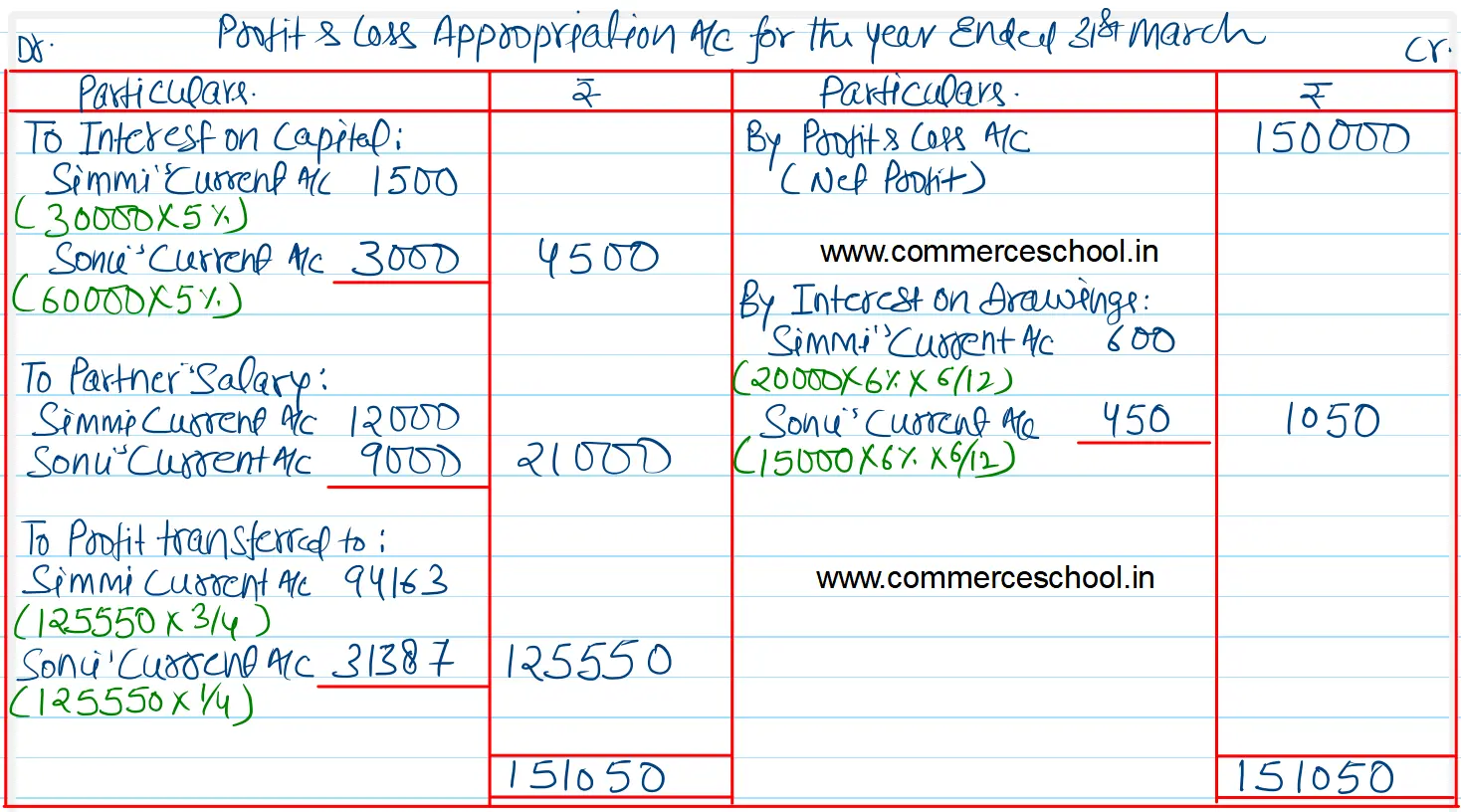

(i) Partner’s Capital on April 1, 2023:

Simmi ₹ 30,000; Sonu ₹ 60,000.

(ii) Current accounts balances on April 1, 2023:

Simmi ₹ 30,000 (Cr.); Sonu ₹ 15,000 (Cr.)

(iii) Partners drawings during the year amounted to:

Simmi ₹ 20,000; Sonu ₹ 15,000.

(iv) Interest on capital was allowed @ 5% p.a.

(v) Interest on drawing was to be charged @ 6% p.a. at an average of six months.

(vi) Partner’s Salaries: Simmi ₹ 12,000 and Sonu ₹ 9,000. Also show the partner’s current accounts.

[Ans. Divisible Profit ₹ 1,25,550; Current Account balance : Simmi ₹ 1,17,063 and Sonu ₹ 42,937.]