Simrat and Bir are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March 2023 after closing the books of account

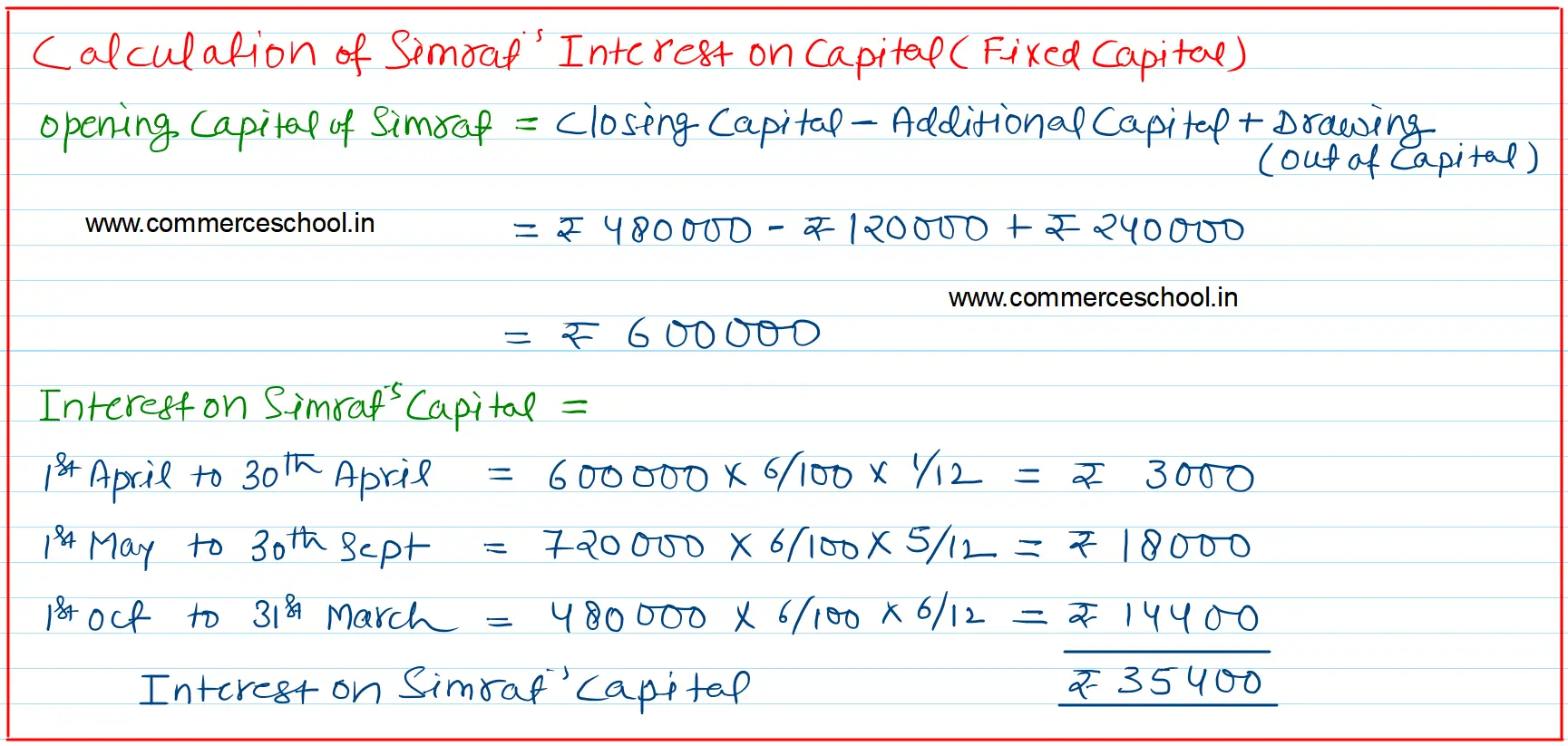

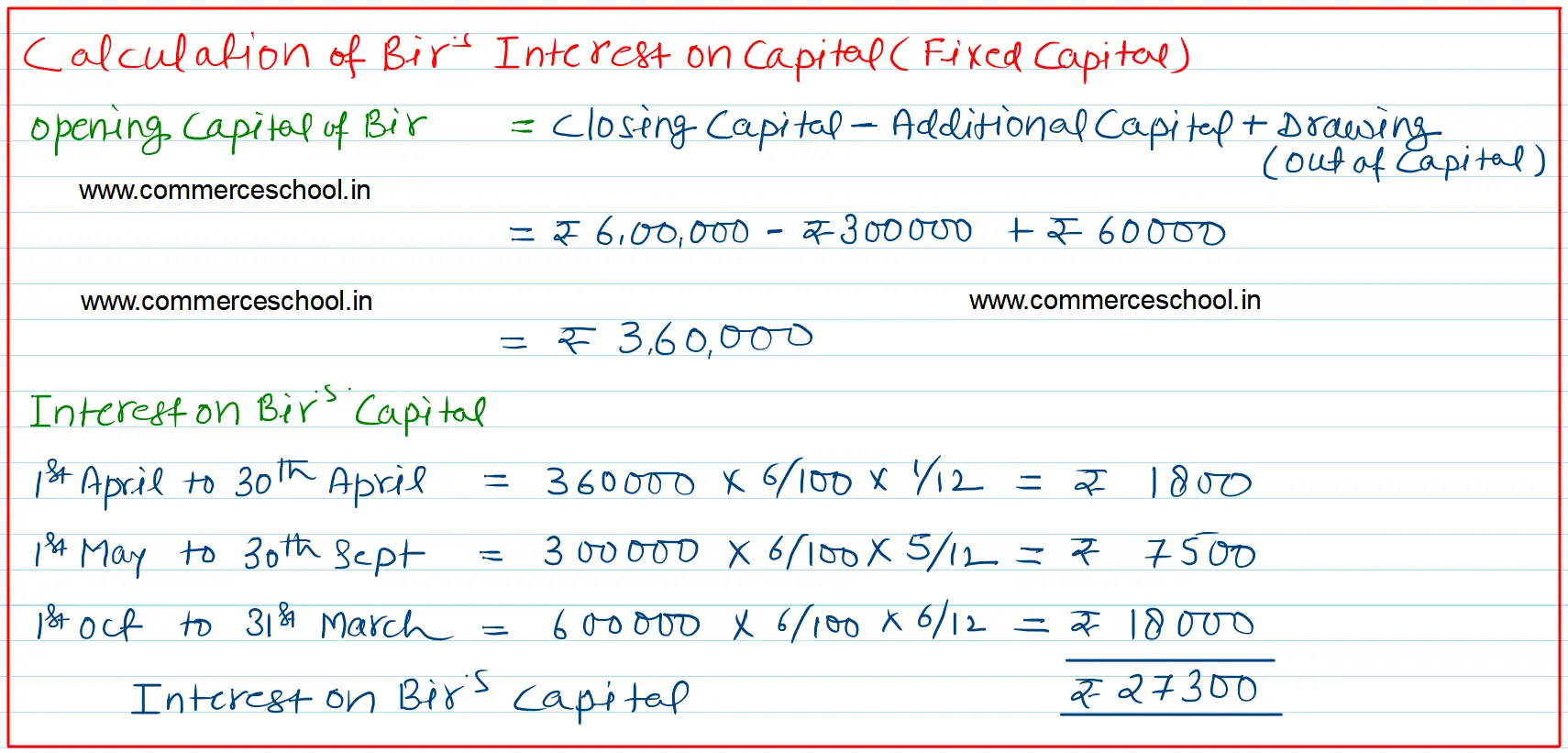

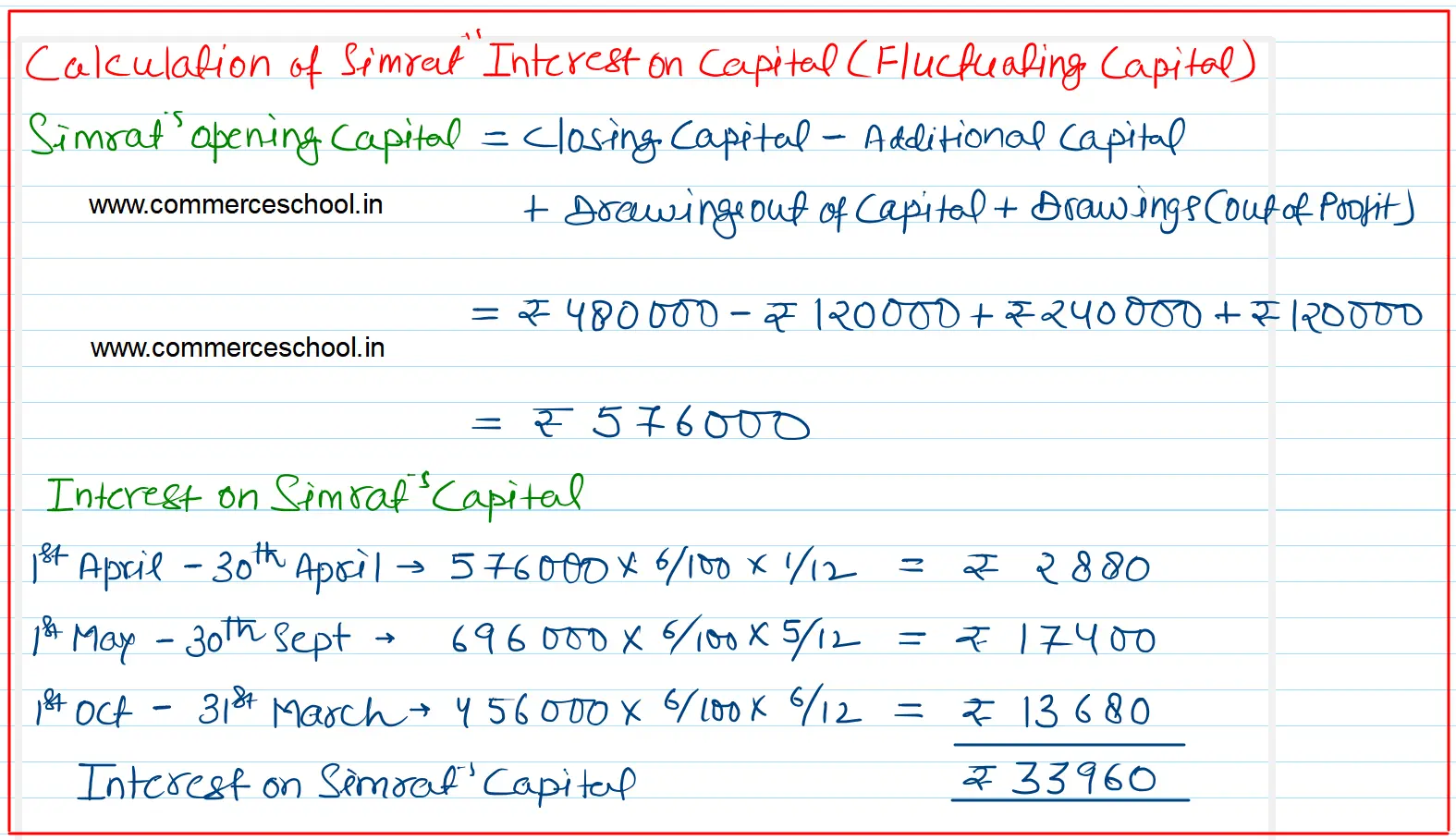

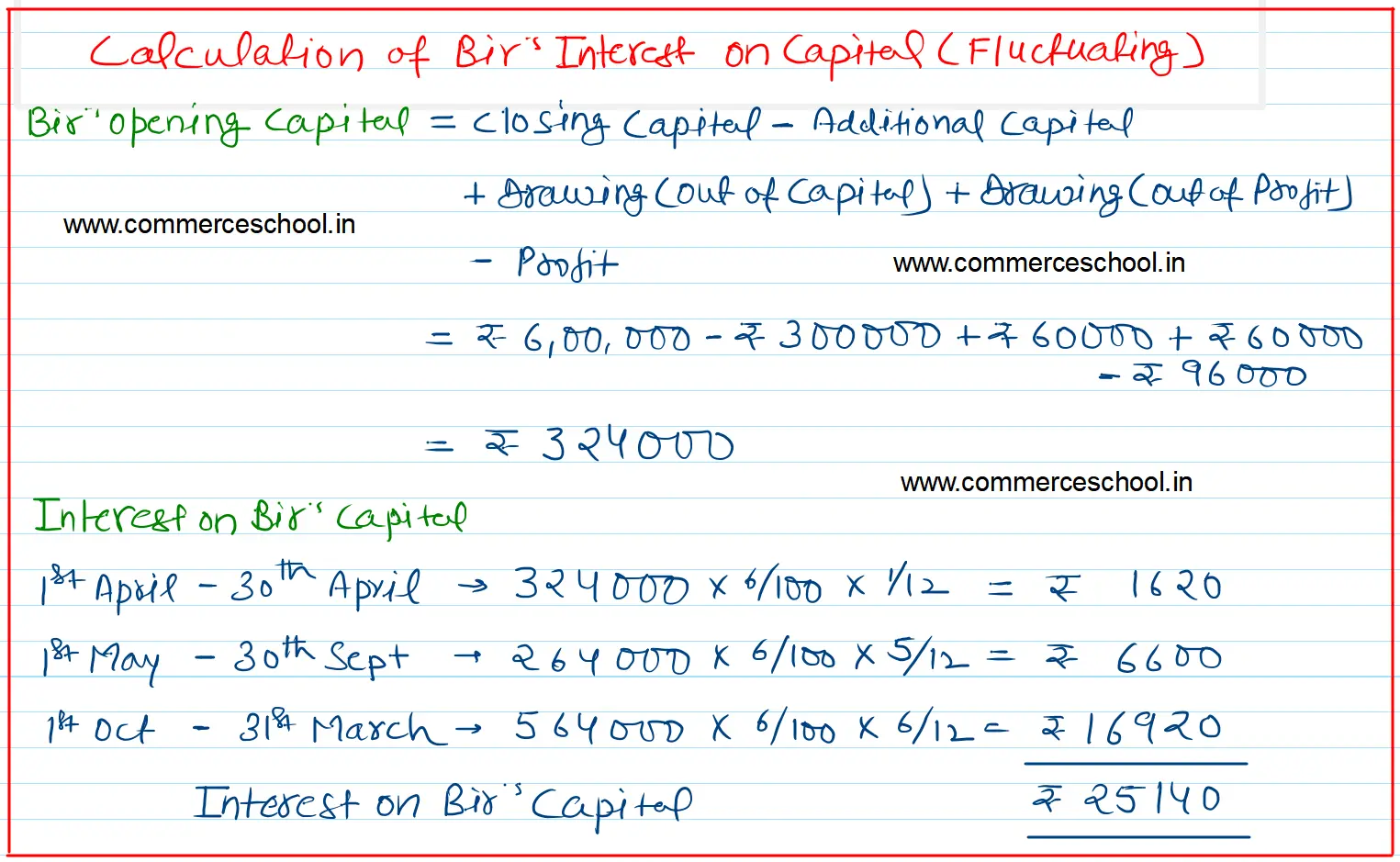

Simrat and Bir are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March 2023 after closing the books of account, their capital Accounts stood at ₹ 4,80,000 and ₹ 6,00,000 respectively. on 1st May 2022, Simrat introduced an additional capital of ₹ 1,20,000 and Bir withdrew ₹ 60,000 from his capital. On 1st October 2022, Simrat withdrew ₹ 2,40,000 from her capital and Bir introduced ₹ 3,00,000. Interest on capital is allowed at 6% p.a. Subsequently, it was noticed that interest on capital @ 6% p.a. had been omitted. Profit for the year ended 31st March 2023 amounted to ₹ 2,40,000 and the partner’s drawings had been: Simrat – ₹ 1,20,000 and Bir – ₹ 60,000.

Compute the interest on capital if the capitals are (a) fixed, and (b) fluctuating.

[Ans: Interest on Capital: (a) Simrat – ₹ 35,400; Bir – ₹27,300; (b) Simrat – ₹ 33,960; Bir – ₹ 25140.]