Simrat and Nimrat are partners since 1st April 2022 without a Partnership Deed and they introduced capitals of ₹ 1,00,000 and ₹ 80,000 respectively.

Simrat and Nimrat are partners since 1st April 2022 without a Partnership Deed and they introduced capitals of ₹ 1,00,000 and ₹ 80,000 respectively.

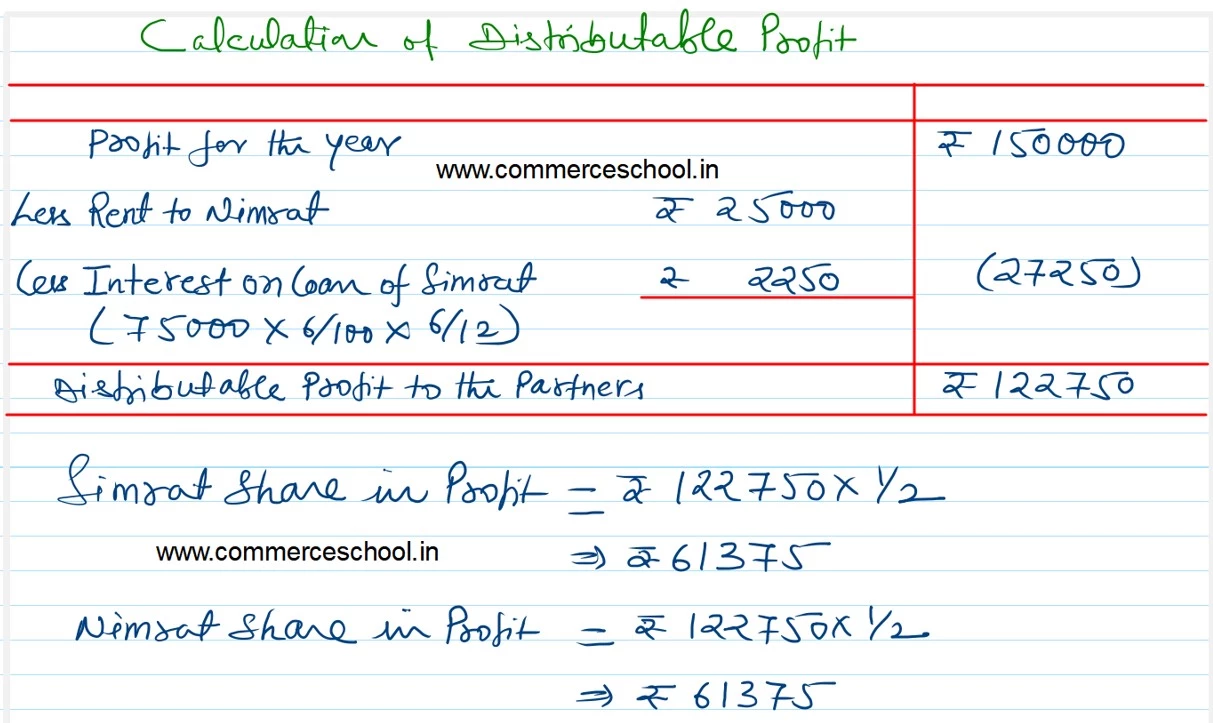

On 1st October 2022, Simrat also gave a loan of ₹ 75,000 to the firm without any agreement as to interest.

Nimrat allows the firm to carry on business from premises owned by her for a yearly rent of ₹ 25,000.

Profit as per the Profit and Loss Account for the year ended 31st March 2023 was ₹ 1,50,000 before charging interest on loan and rent.

The partners do not agree on allowing of interest and the basis of division of profits.

You are required to divide the profits giving reasons for your method.

Anurag Pathak Changed status to publish April 14, 2023